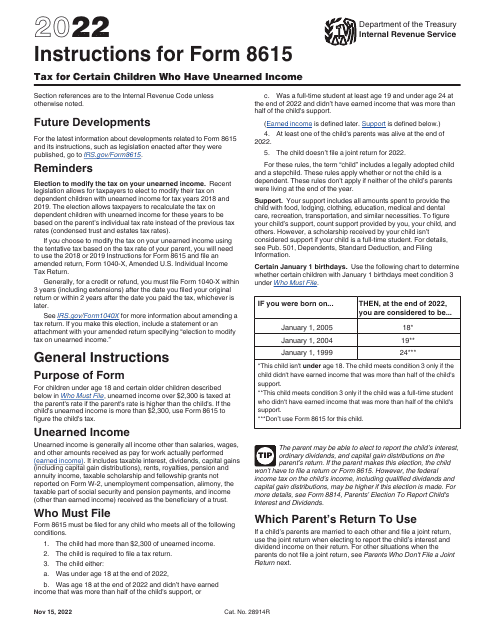

Instructions For Form 8615

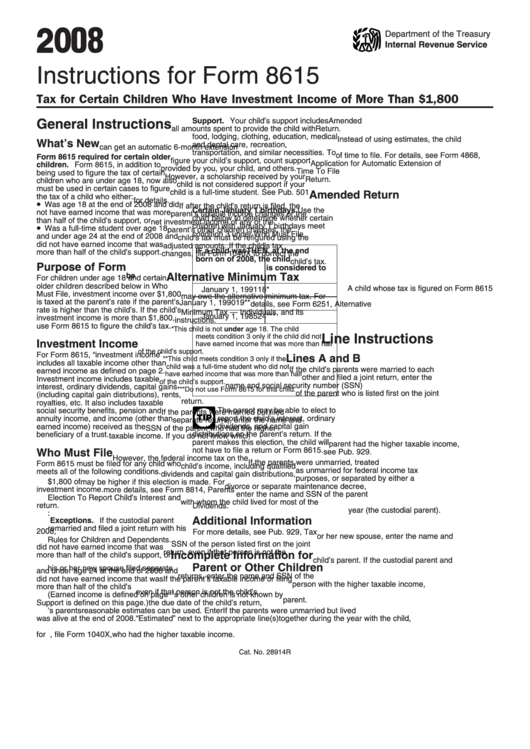

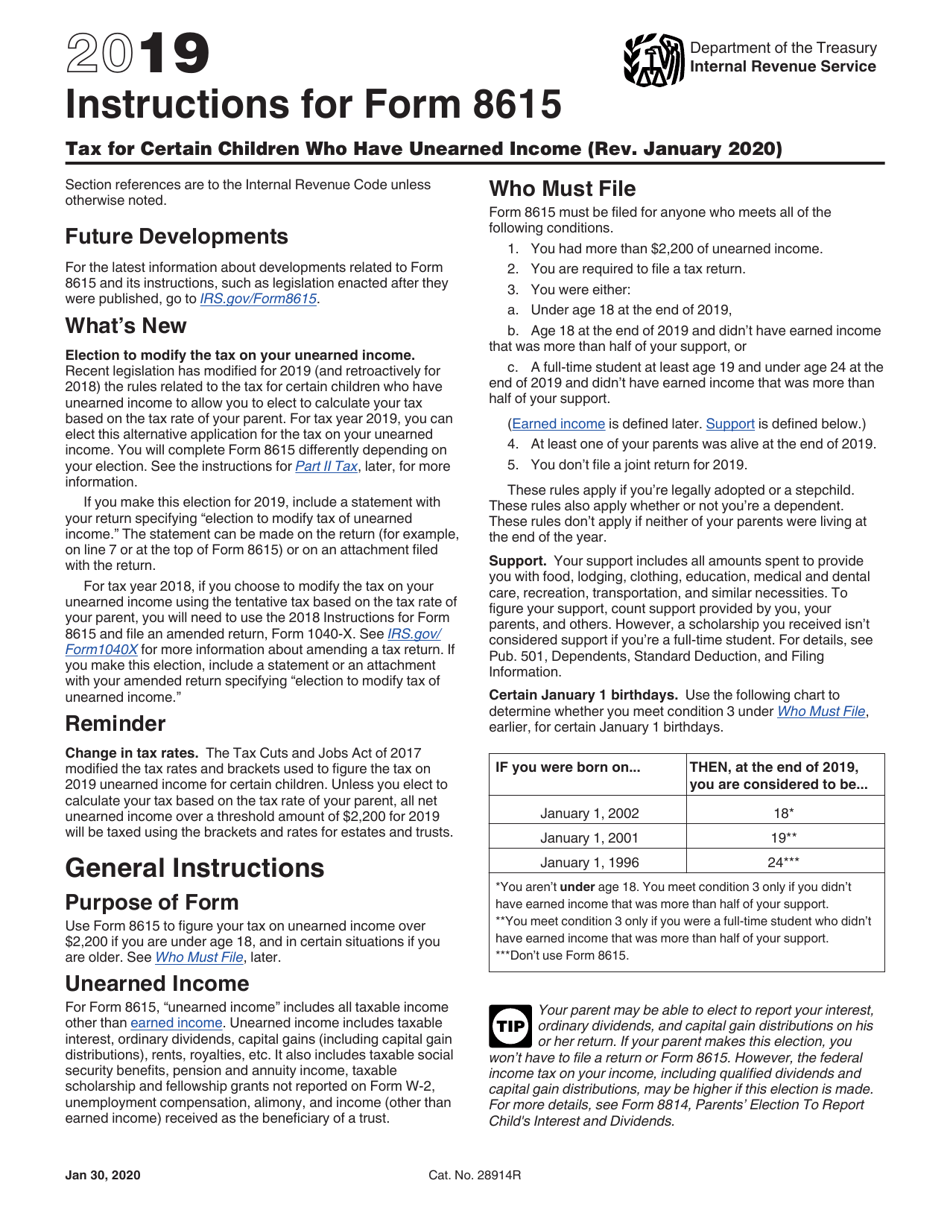

Instructions For Form 8615 - The child is required to file a tax return. Below are answers to frequently asked questions about. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. See who must file, later. Register and subscribe now to work on your irs form 8615 & more fillable forms. The child is required to file a tax return. Web enter the parent’s tax from form 1040, line 44; Web form 8615, tax for certain children who have unearned income. Solved•by intuit•15•updated july 12, 2022. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are.

Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,000 of unearned income. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 must be filed if the child meets all of the following conditions: Below are answers to frequently asked questions about. Register and subscribe now to work on your irs form 8615 & more fillable forms. The child is required to file a tax return. Try it for free now! You are required to file a tax return.

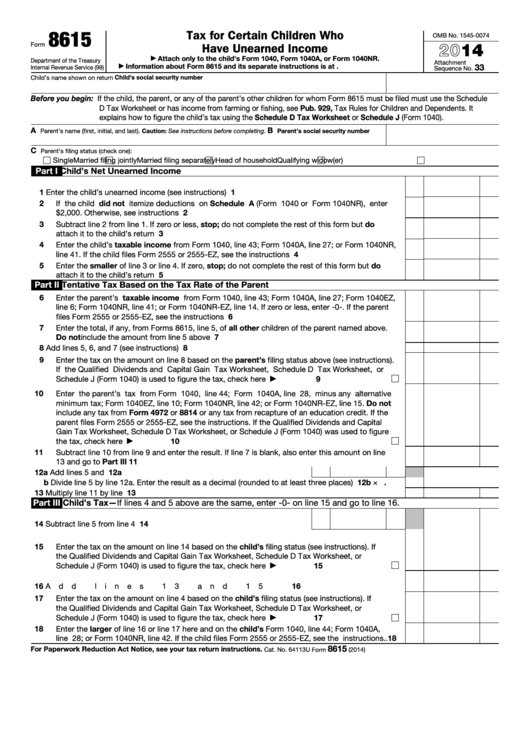

Form 1040a, line 28, minus any alternative minimum tax; The child had more than $2,000 of unearned income. Try it for free now! Web form 8615 must be filed for any child who meets all of the following conditions. Web common questions about form 8615 and form 8814. The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Ad upload, modify or create forms. Do not file draft forms. The child is required to file a tax return.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Web the amount on line 13 of form 1040, line 10 of form 1040a, or line 14 of form 1040nr. Web common questions about form 8615 and form 8814. The child is required to file a tax return. Web form 8615 must be filed with the child’s tax return if all of the following apply: Solved•by intuit•15•updated july 12, 2022.

Fill Free fillable Form 8615 Tax for Children Who Have Unearned

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Try it for free now! Form 1040a, line 28, minus any alternative minimum tax; The child had more than $1,100 in unearned income. Solved•by intuit•15•updated july 12, 2022.

Form 568 instructions 2012

Try it for free now! The service delivery logs are available for the documentation of a service event for individualized skills and socialization. The child is required to file a tax return. Form 1040a, line 28, minus any alternative minimum tax; If you must use the schedule d tax worksheet or have income from farming or fishing, see the instructions.

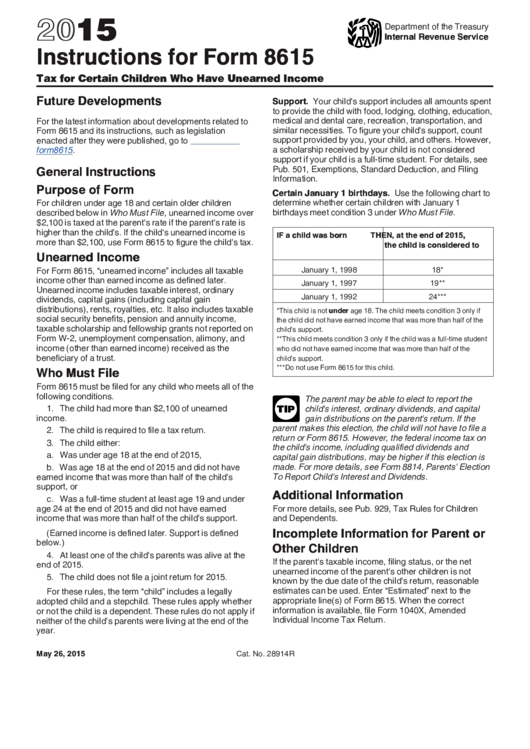

Form 8615 Instructions (2015) printable pdf download

See who must file, later. Qualified dividends are those use this worksheet only if line 2 of the. Form 1040a, line 28, minus any alternative minimum tax; The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web general instructions purpose of form use form 8615 to figure your tax on unearned.

Fillable Form 8615 Tax For Certain Children Who Have Unearned

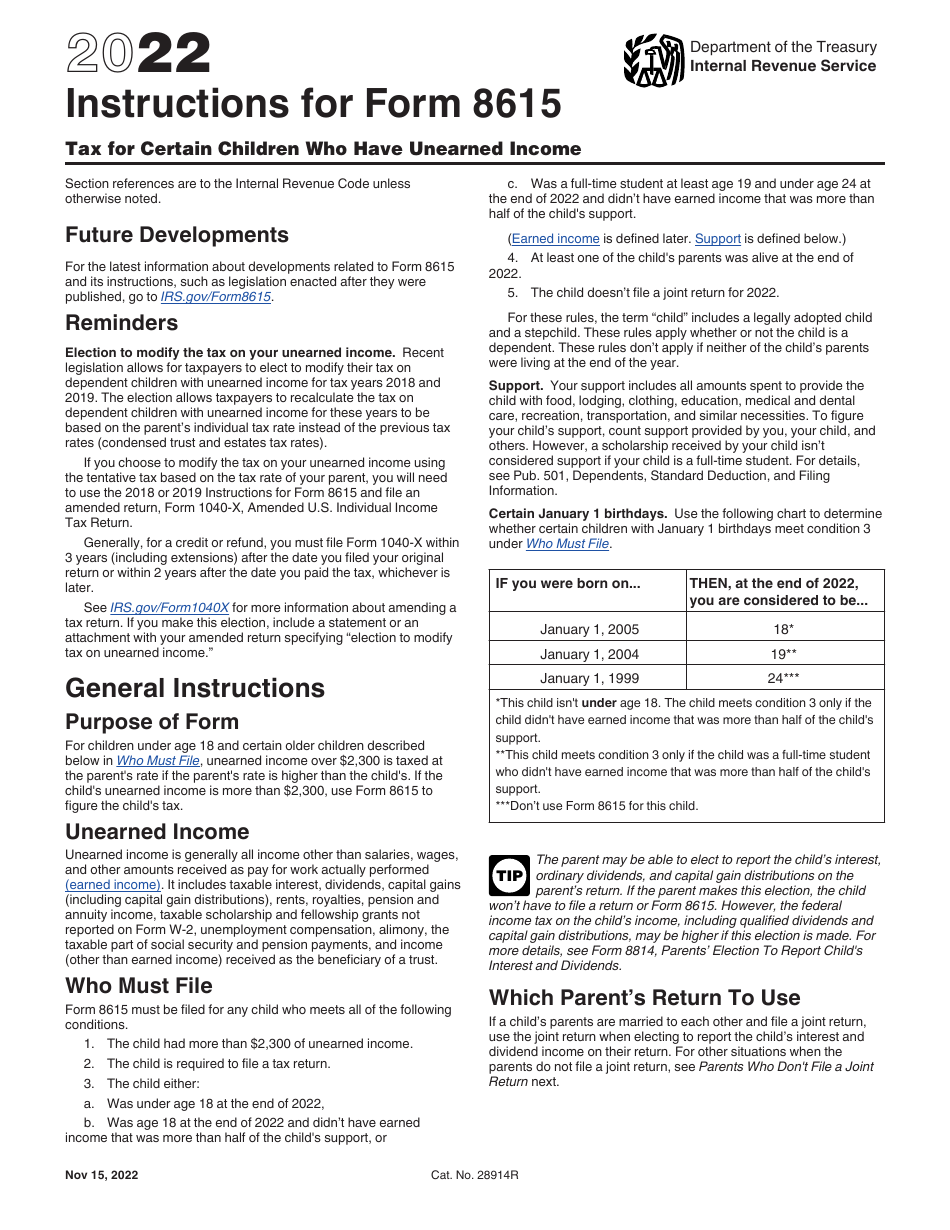

Web the amount on line 13 of form 1040, line 10 of form 1040a, or line 14 of form 1040nr. You had more than $2,300 of unearned income. Below are answers to frequently asked questions about. Web enter the parent’s tax from form 1040, line 44; Web form 8615 must be filed with the child’s tax return if all of.

Instructions For Form 8615 Tax For Certain Children Who Have

The child is required to file a tax return. Web common questions about form 8615 and form 8814. Solved•by intuit•15•updated july 12, 2022. The child had more than $1,100 in unearned income. The child had more than $2,300 of unearned income.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Register and subscribe now to work on your irs form 8615 & more fillable forms. The child had more than $2,300 of unearned income. Web form 8615 must be filed if the child meets all of the following conditions: The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web this is.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Do not file draft forms. Form 1040a, line 28, minus any alternative minimum tax; The child is required to file a tax return. Web form 8615 must be filed if the child meets all of the following conditions: Qualified dividends are those use this worksheet only if line 2 of the.

DSC_8615 Gundersons Bookkeeping

The child had more than $2,200 of unearned income. Do not file draft forms. The child is required to file a tax return. Ad upload, modify or create forms. Web enter the parent’s tax from form 1040, line 44;

Form 8615 Tax Pro Community

Web form 8615 must be filed with the child’s tax return if all of the following apply: The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web form 8615, tax for certain children who have unearned income. Solved•by intuit•15•updated july 12, 2022. Web this is an early release draft of an.

Web Enter The Parent’s Tax From Form 1040, Line 44;

The child had more than $2,200 of unearned income. The child is required to file a tax return. Web the amount on line 13 of form 1040, line 10 of form 1040a, or line 14 of form 1040nr. You are required to file a tax return.

Refer To This Article For Instructions On Using Family Link To Connect Parents’ And Children’s.

If you must use the schedule d tax worksheet or have income from farming or fishing, see the instructions. Solved•by intuit•15•updated july 12, 2022. Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 must be filed for any child who meets all of the following conditions.

Web Form 8615 Must Be Filed With The Child’s Tax Return If All Of The Following Apply:

The service delivery logs are available for the documentation of a service event for individualized skills and socialization. The child is required to file a tax return. Web form 8615 must be filed for any child who meets all of the following conditions. Web common questions about form 8615 and form 8814.

Web Form 8615, Tax For Certain Children Who Have Unearned Income.

You had more than $2,300 of unearned income. The child is required to file a tax return. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. See who must file, later.