Instructions Form 6251

Instructions Form 6251 - Line instructions round amounts to the nearest whole dollar. Web study form 6251 each time you prepare your tax return to see how close you are to paying the amt. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Upload, modify or create forms. Web solved•by intuit•11•updated february 22, 2023. Complete, edit or print tax forms instantly. You must enclose the completed form 6251 with your form m1. The amt applies to taxpayers who have certain types of income that receive. Web form 6251 with your federal return. Web if form 6251 is required, taxact will populate the form based on your tax items.

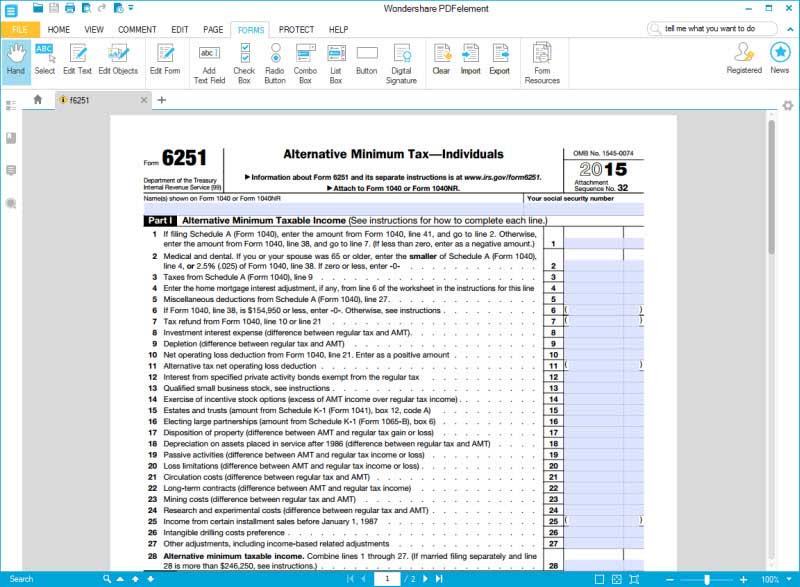

Department of the treasury internal revenue service (99) go to. Ad access irs tax forms. If you need to report any of the following items on your tax return, you must file form 6251, alternative minimum. In turbotax online, sign in to your account, select pick up where you left off; You must enclose the completed form 6251 with your form m1. Web if form 6251 is required, taxact will populate the form based on your tax items. Upload, modify or create forms. Evaluate how close your tentative minimum tax was to your. Complete, edit or print tax forms instantly. Web calculate your taxable income, but with fewer tax exclusions and tax deductions, as dictated by the amt rules (irs form 6251 has the details on which tax.

Upload, modify or create forms. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Try it for free now! Web attach form 6251 to your return if any of the following statements are true. Fill in form 6251 through minimum taxable any, of. The amt is a separate tax that is imposed in addition to your regular tax. Get ready for tax season deadlines by completing any required tax forms today. On the left menu, select federal; Web to add form 6251, here are the steps: Form 6251 is used by individuals.

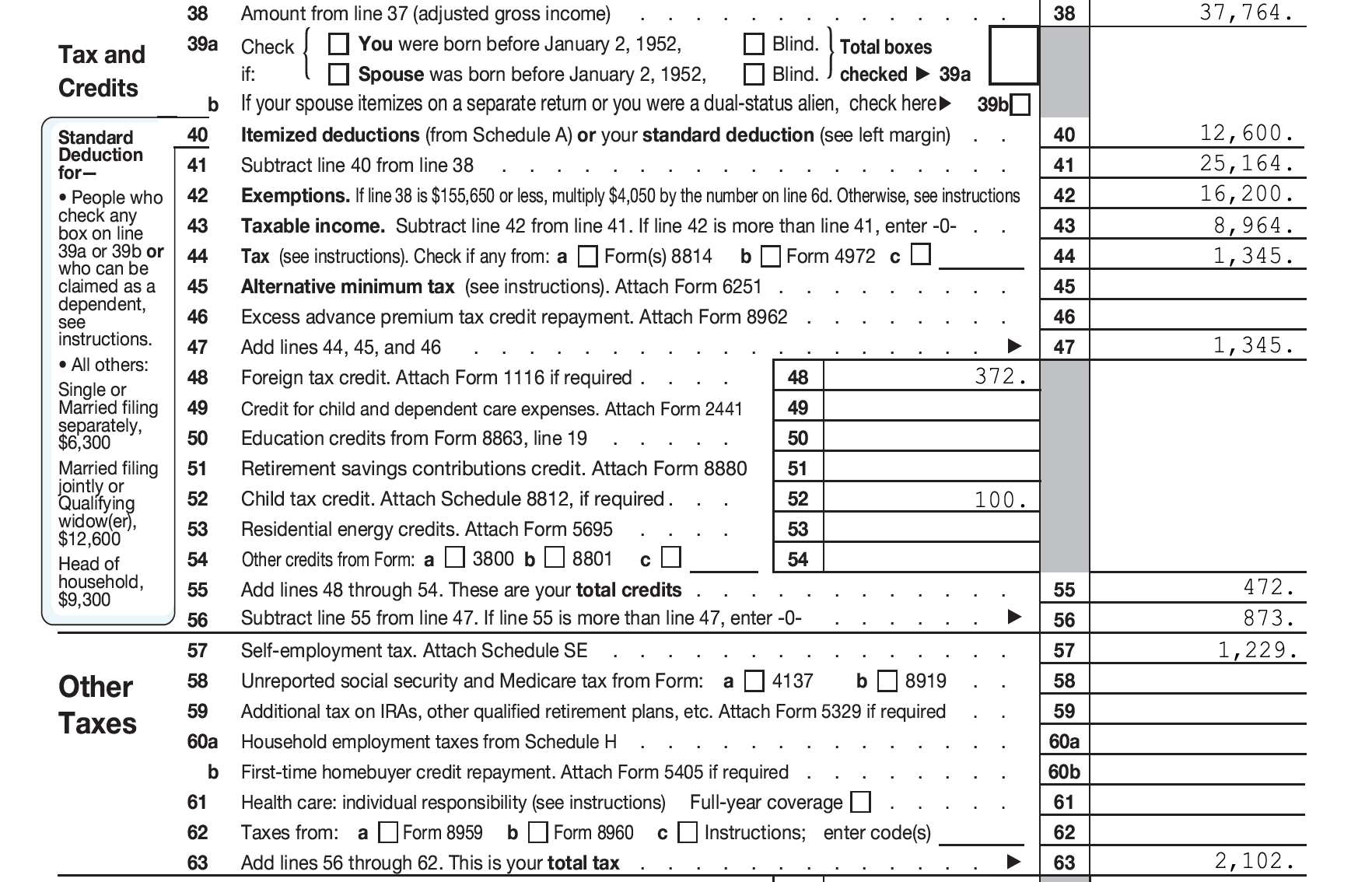

Worksheet to See if You Should Fill in Form 6251 Line 41

Web if form 6251 is required, taxact will populate the form based on your tax items. Fill in form 6251 through minimum taxable any, of. In turbotax online, sign in to your account, select pick up where you left off; Web you may need to file form 6251 if you have specific amt items. On the left menu, select federal;

form 6251 instructions 2020 2021 Fill Online, Printable, Fillable

The amt applies to taxpayers who have certain types of income that receive. Web to add form 6251, here are the steps: Ad access irs tax forms. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount, if computation. Line instructions round amounts to the nearest whole dollar.

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

You must enclose the completed form 6251 with your form m1. Get ready for tax season deadlines by completing any required tax forms today. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to. In order for wealthy individuals to. Web developments related to form 6251 and its.

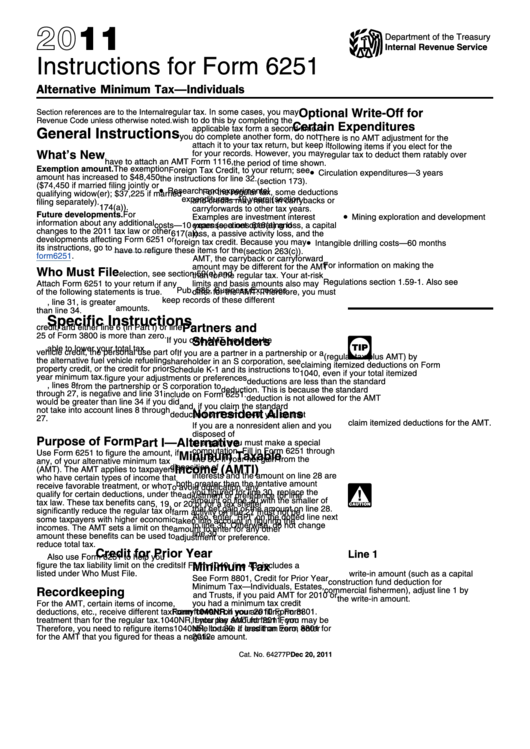

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2011

Ad access irs tax forms. Form 6251, line 7, is greater than line 10. In turbotax online, sign in to your account, select pick up where you left off; Complete, edit or print tax forms instantly. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount, if computation.

Instructions for How to Fill in IRS Form 6251

Form 6251, line 7, is greater than line 10. The amt applies to taxpayers who have certain types of income that receive. If you need to report any of the following items on your tax return, you must file form 6251, alternative minimum. Complete, edit or print tax forms instantly. Web purpose of form at a gain, you must make.

for How to Fill in IRS Form 6251

Form 6251 is used by individuals. Web form 6251 with your federal return. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web study form 6251 each time you prepare your tax return to see how close you are to paying the amt. Use form 6251 to figure the amount, if any, of.

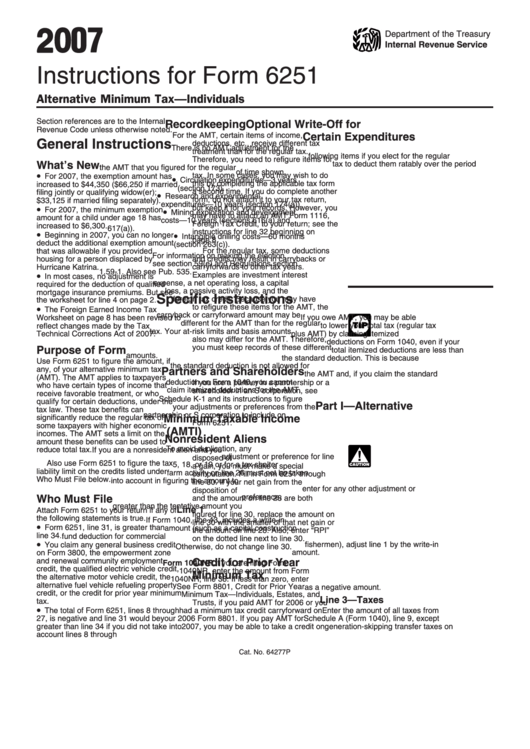

Instructions For Form 6251 Alternative Minimum Tax Individuals

Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Line instructions round amounts to the nearest whole dollar. Web study form 6251 each time you prepare your tax return to see.

Dividend Payment Instruction Forms Computershare

Line instructions round amounts to the nearest whole dollar. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount, if computation. Fill in form 6251 through minimum taxable any, of. Evaluate how close your tentative minimum tax was to your. Try it for free now!

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

Ad access irs tax forms. Web form 6251 with your federal return. You must enclose the completed form 6251 with your form m1. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). On the left menu, select federal;

Worksheet To See If You Should Fill In Form 6251 Fill Online

Complete, edit or print tax forms instantly. The amt applies to taxpayers who have certain types of income that receive. The best way to plan ahead for the amt is to. Form 6251, line 7, is greater than line 10. In turbotax online, sign in to your account, select pick up where you left off;

Information About Form 6251 And Its Separate Instructions Is At.

Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web to add form 6251, here are the steps: The amt applies to taxpayers who have certain types of income that receive. Form 6251, line 7, is greater than line 10.

A Little Planning Can Help You Avoid The Amt.

Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web you may need to file form 6251 if you have specific amt items. You must enclose the completed form 6251 with your form m1. Department of the treasury internal revenue service (99) alternative minimum tax—individuals.

If You Need To Report Any Of The Following Items On Your Tax Return, You Must File Form 6251, Alternative Minimum.

In turbotax online, sign in to your account, select pick up where you left off; Ad access irs tax forms. Web study form 6251 each time you prepare your tax return to see how close you are to paying the amt. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount, if computation.

Web Irs Form 6251, Titled Alternative Minimum Tax—Individuals, Determines How Much Alternative Minimum Tax (Amt) You Could Owe.

Web if form 6251 is required, taxact will populate the form based on your tax items. Web solved•by intuit•11•updated february 22, 2023. Web attach form 6251 to your return if any of the following statements are true. Try it for free now!