Instructions Form 8594

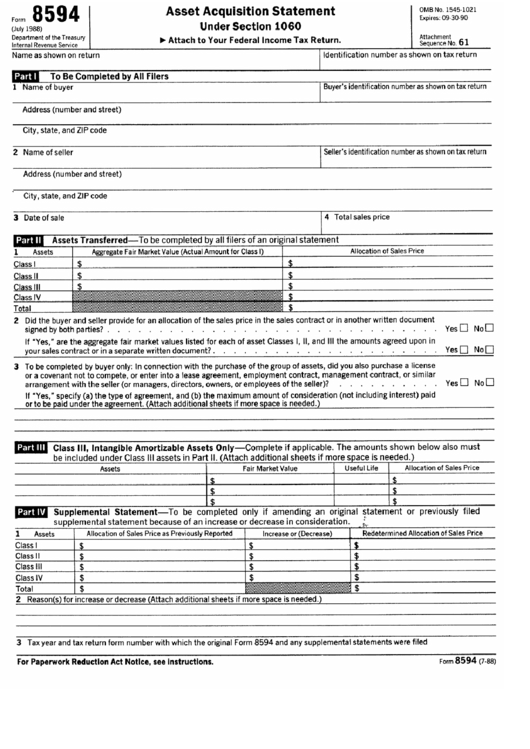

Instructions Form 8594 - Web irs form 8594 is essential for adequately allocating the purchase price among the different asset categories in an acquisition. Penalties if you do not file a. Select the button get form to open it and start editing. From the form 8594 instructions: Web business must use form 8594 to report increased or decreased after the year in deposit accounts (including savings and such a sale if goodwill or going concern which the sale. The buyer or seller must also update the amount allocated to the asset on his. Web taxact supports form 8594 asset acquisition statement under section 1060 in the following programs:. Web form 8594 is filed, the seller and/or buyer (whoever is affected) must complete part i and the supplemental statement in part iii of a new form 8594 and attach the form to the. Ad access irs tax forms. Web form 8594 is used to report the sale and purchase of a group of assets that constitute a business.

Remember that both seller and. Web form 8594 is filed, the seller and/or buyer (whoever is affected) must complete part i and the supplemental statement in part iii of a new form 8594 and attach the form to the. Penalties if you do not file a. Web irs form 8594 is essential for adequately allocating the purchase price among the different asset categories in an acquisition. Web form 8594 is used to report the sale and purchase of a group of assets that constitute a business. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. Both the purchaser and seller must file form 8594 with their own. Web help with form 8594 for inventory, equipement and goodwill. Download or email irs 8594 & more fillable forms, register and subscribe now! Web business must use form 8594 to report increased or decreased after the year in deposit accounts (including savings and such a sale if goodwill or going concern which the sale.

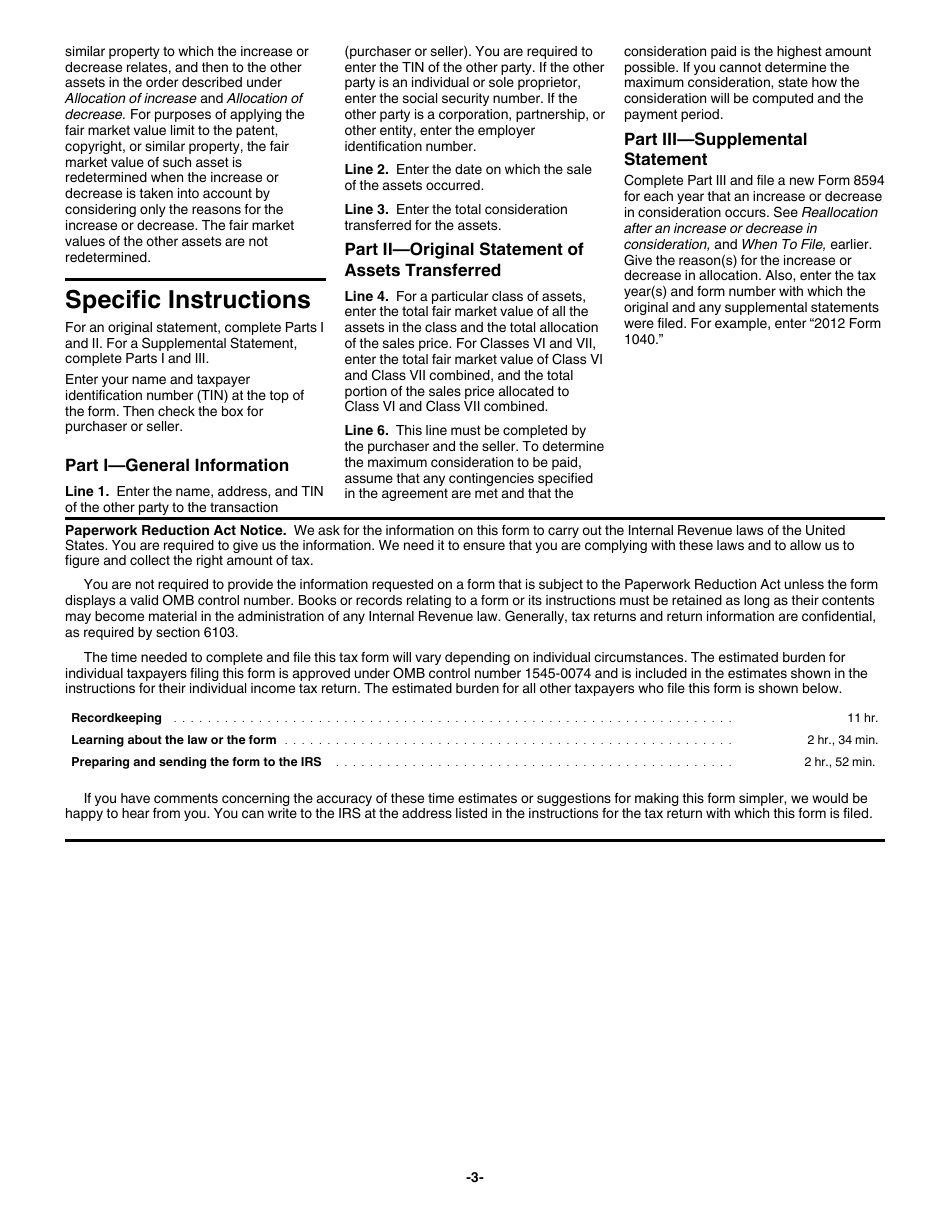

By filing form 8594, you provide the irs with the following information:. Web how you can submit the irs 8594 on the internet: The buyer or seller must also update the amount allocated to the asset on his. Web instructions for form 8594 internal revenue service (rev. Class i assets are cash and general deposit accounts (including savings and c hecking accounts) other than. February 2006) asset acquisition statement under section 1060 section references are to the internal. Web on form 8594, the total selling price of the business is allocated to asset classes using the residual method. Web taxact supports form 8594 asset acquisition statement under section 1060 in the following programs:. Select the button get form to open it and start editing. Form 1040 (individual) 1041(estate and trust) 1065 (partnership).

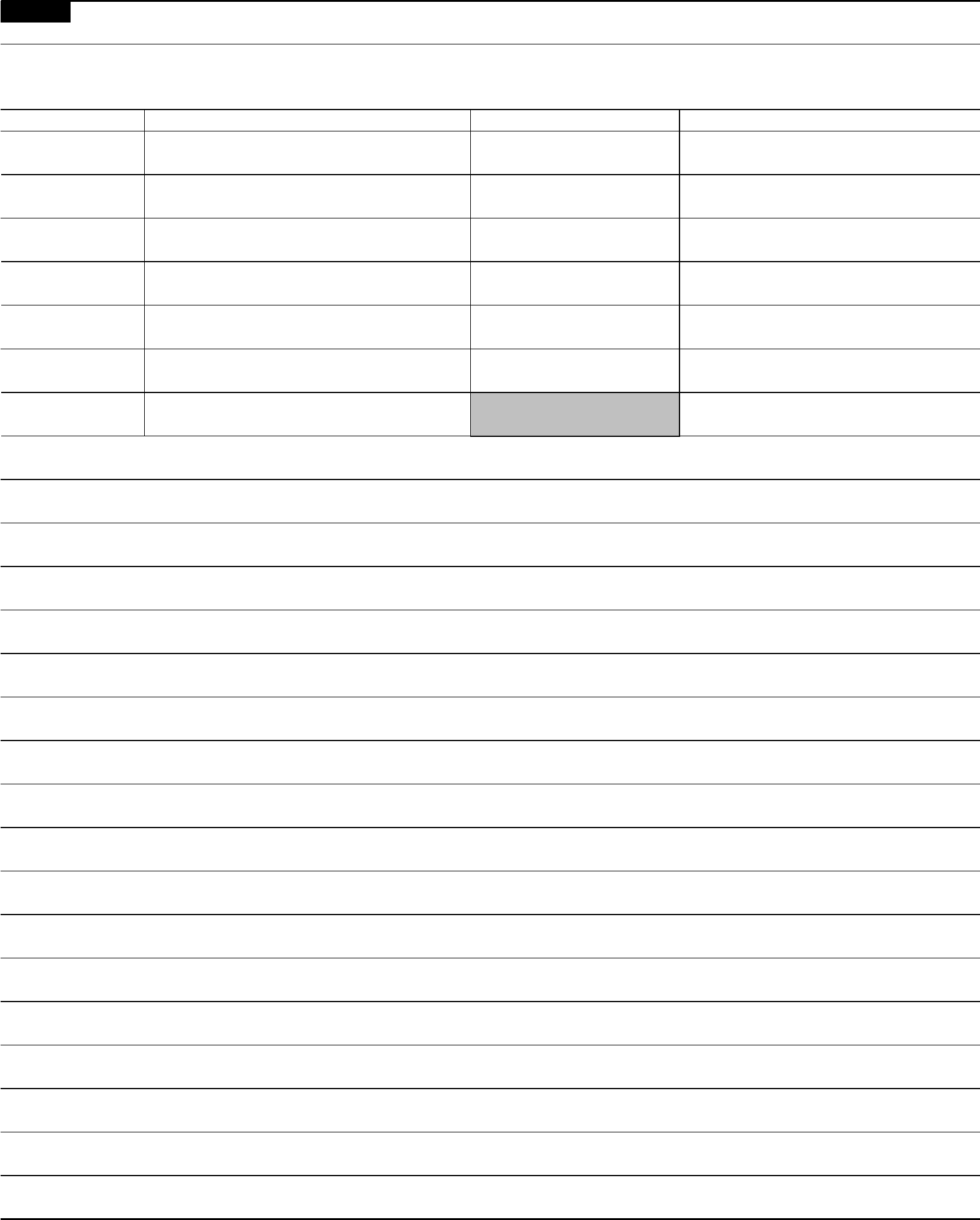

Form 8594 Asset Acquisition Statement Under Section 1060 (2012

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. Web irs form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller can calculate the taxes.

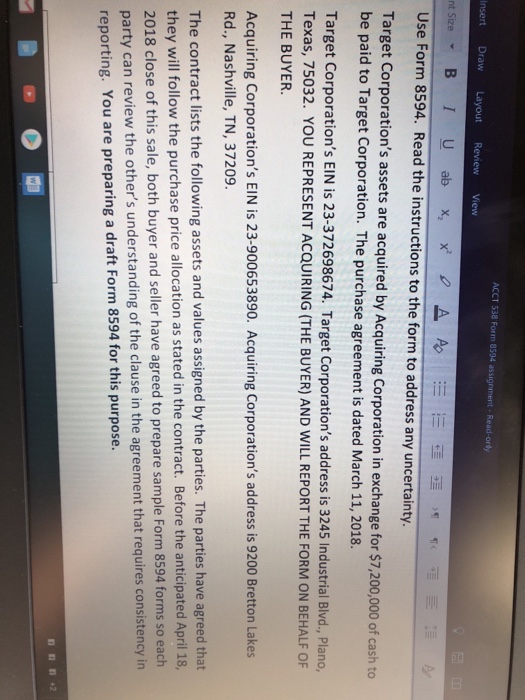

Solved Use Form 8594. Target Corporation’s Assets Are Acq...

Both the purchaser and seller must file form 8594 with their own. Web how you can submit the irs 8594 on the internet: Web irs form 8594 instructions lists the following seven classes of assets: Remember that both seller and. By filing form 8594, you provide the irs with the following information:.

Form 8594 Edit, Fill, Sign Online Handypdf

By filing form 8594, you provide the irs with the following information:. Download or email irs 8594 & more fillable forms, register and subscribe now! Web business must use form 8594 to report increased or decreased after the year in deposit accounts (including savings and such a sale if goodwill or going concern which the sale. Form 1040 (individual) 1041(estate.

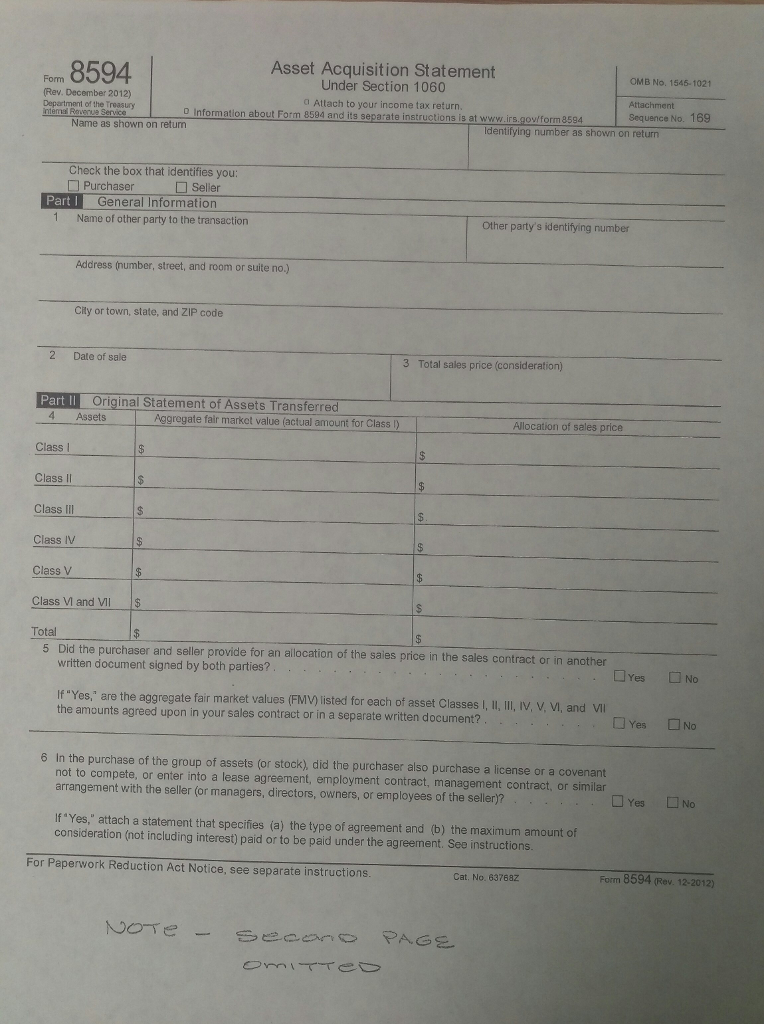

Instructions for Form 8594

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. Web form 8594 is what you must file with your annual income tax return for the year of the sale. Complete, edit or print tax forms instantly. Cash.

Instructions for Form 8594

Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. Ad access irs tax forms. Fill out all needed lines in the selected document with our advantageous. Class i assets are cash and general deposit accounts (including savings and c hecking.

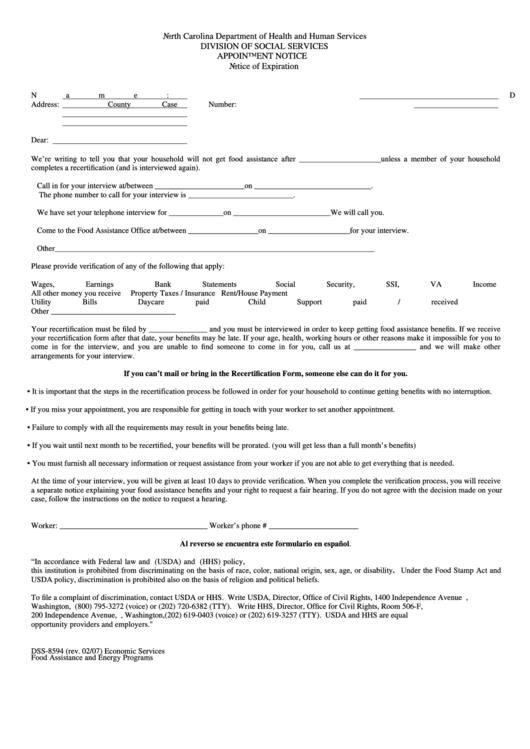

Fillable Form Dss8594 Notice Of Expiration North Carolina

Class i assets are cash and general deposit accounts (including savings and c hecking accounts) other than. Web irs form 8594 is essential for adequately allocating the purchase price among the different asset categories in an acquisition. We purchased a business in march 2019 with inventory (independent valuation), equipment (value. February 2006) asset acquisition statement under section 1060 section references.

Solved ACCT 538 Form 8594 assignment Readorly Insert Draw

Web form 8594 is what you must file with your annual income tax return for the year of the sale. Web the irs form 8594 must be completed and attached to an income tax return by the buyer or seller. Web taxact supports form 8594 asset acquisition statement under section 1060 in the following programs:. From the form 8594 instructions:.

Download Instructions for IRS Form 8594 Asset Acquisition Statement

Complete, edit or print tax forms instantly. Web irs form 8594 is essential for adequately allocating the purchase price among the different asset categories in an acquisition. Web irs form 8594 instructions lists the following seven classes of assets: From the form 8594 instructions: Form 1040 (individual) 1041(estate and trust) 1065 (partnership).

SS4 Form 2021 IRS Forms Zrivo

Class i assets are cash and general deposit accounts (including savings and c hecking accounts) other than. Penalties if you do not file a. We purchased a business in march 2019 with inventory (independent valuation), equipment (value. Web form 8594 is filed, the seller and/or buyer (whoever is affected) must complete part i and the supplemental statement in part iii.

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Web the different classes of assets: Remember that both seller and. Complete, edit or print tax forms instantly. Web the irs form 8594 must be completed and attached to an income tax return by the buyer or seller. From the form 8594 instructions:

Complete, Edit Or Print Tax Forms Instantly.

Web irs form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller can calculate the taxes due upon. Web help with form 8594 for inventory, equipement and goodwill. Penalties if you do not file a. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value.

By Filing Form 8594, You Provide The Irs With The Following Information:.

The buyer or seller must also update the amount allocated to the asset on his. Web irs form 8594 instructions lists the following seven classes of assets: Web the irs form 8594 must be completed and attached to an income tax return by the buyer or seller. Cash and general deposit accounts (including savings and checking accounts).

Ad Access Irs Tax Forms.

Web on form 8594, the total selling price of the business is allocated to asset classes using the residual method. Web taxact supports form 8594 asset acquisition statement under section 1060 in the following programs:. Fill out all needed lines in the selected document with our advantageous. February 2006) asset acquisition statement under section 1060 section references are to the internal.

Select The Button Get Form To Open It And Start Editing.

From the form 8594 instructions: Both the purchaser and seller must file form 8594 with their own. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Web business must use form 8594 to report increased or decreased after the year in deposit accounts (including savings and such a sale if goodwill or going concern which the sale.