International Contractor Tax Form

International Contractor Tax Form - File 1099 online for the current tax year. Sign in to your account. Pay independent contractors anywhere in the world in one click. Name (as shown on your income tax return). Web international taxpayers federal income tax withholding for persons employed abroad by a u.s. Companies to file an irs 1099 form to pay a foreign contractor. Tax information for foreign persons with income in the u.s. Efile 1099 for instant filing for 2021 Web tax forms needed for foreign independent contractors try bench. Citizens and resident aliens abroad.

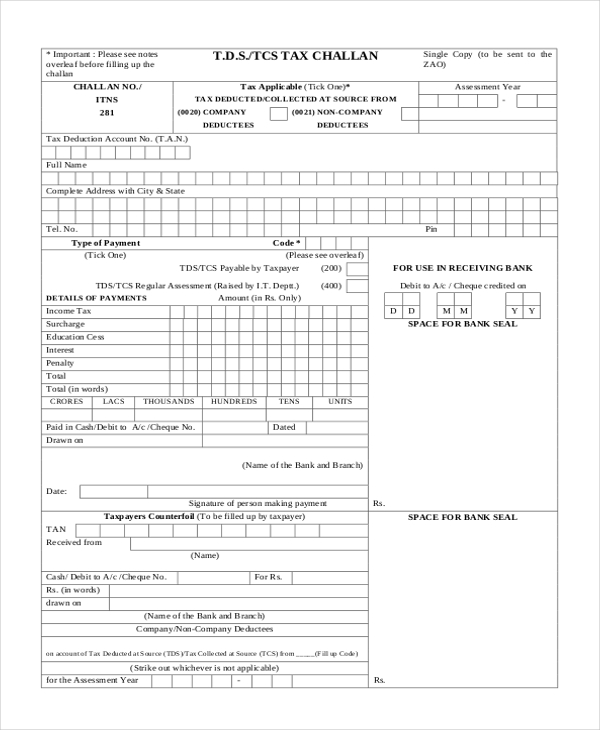

Ad hire independent contractors in 190 countries without worry over payroll and compliance. Companies to file an irs 1099 form to pay a foreign contractor. Web international taxpayers federal income tax withholding for persons employed abroad by a u.s. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web there is no requirement for u.s. October 2018) department of the treasury. Tax information for foreign persons with income in the u.s. Citizens and resident aliens with income outside the u.s. Web federal 1099 tax form for international contractors. Web common tax forms for freelancers & independent contractors living overseas irs form 1040:

Web when hiring internationally, you’ll need to file specific tax forms for any contractor you employ. Pay independent contractors anywhere in the world in one click. Web file your taxes for free. But as noted above, the company should require the contractor. Hiring foreign independent contractors when your business is based in the u.s. Web there is no requirement for u.s. Tax information for foreign persons with income in the u.s. Efile 1099 for instant filing for 2021 Web tax for international contracts before signing an international contract if you are signing a contract that is either being funded by a foreign organization or that includes any activity. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia.

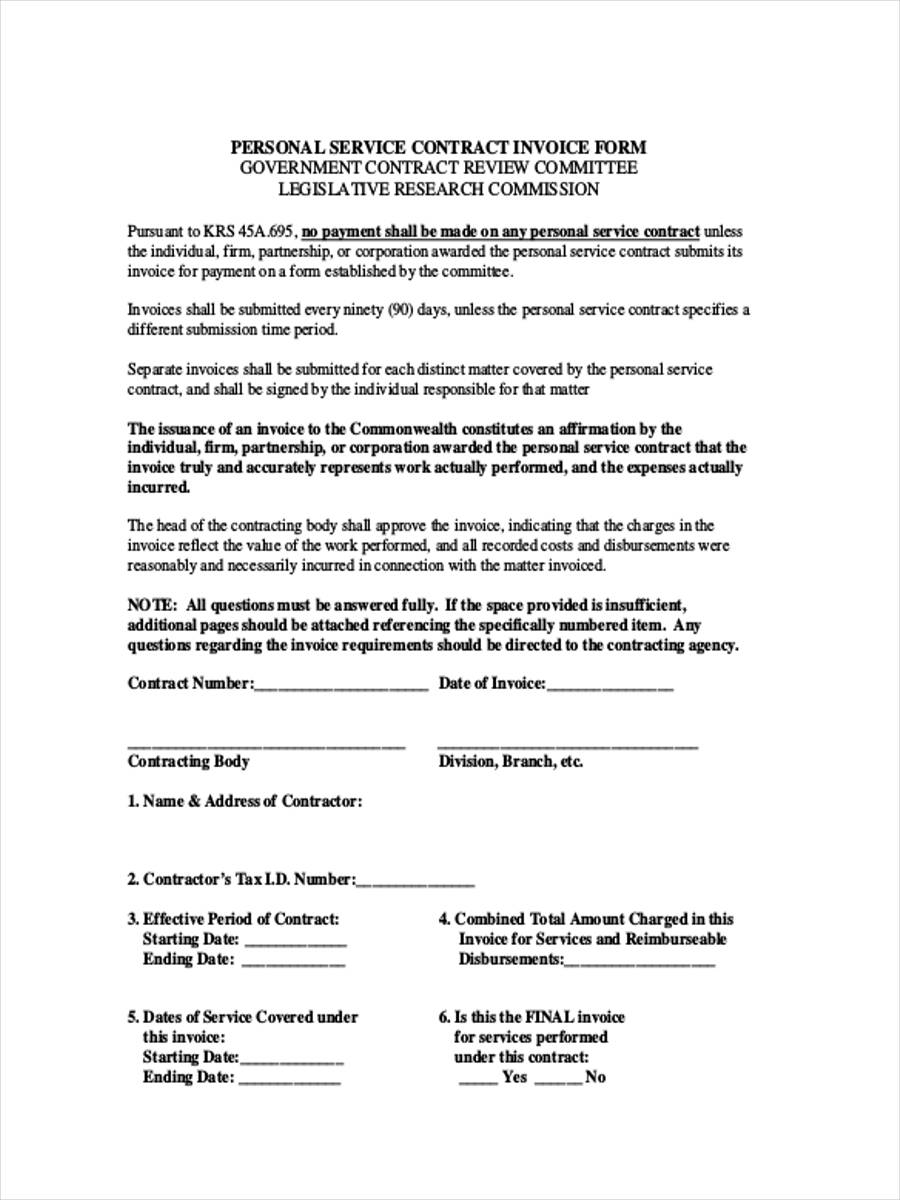

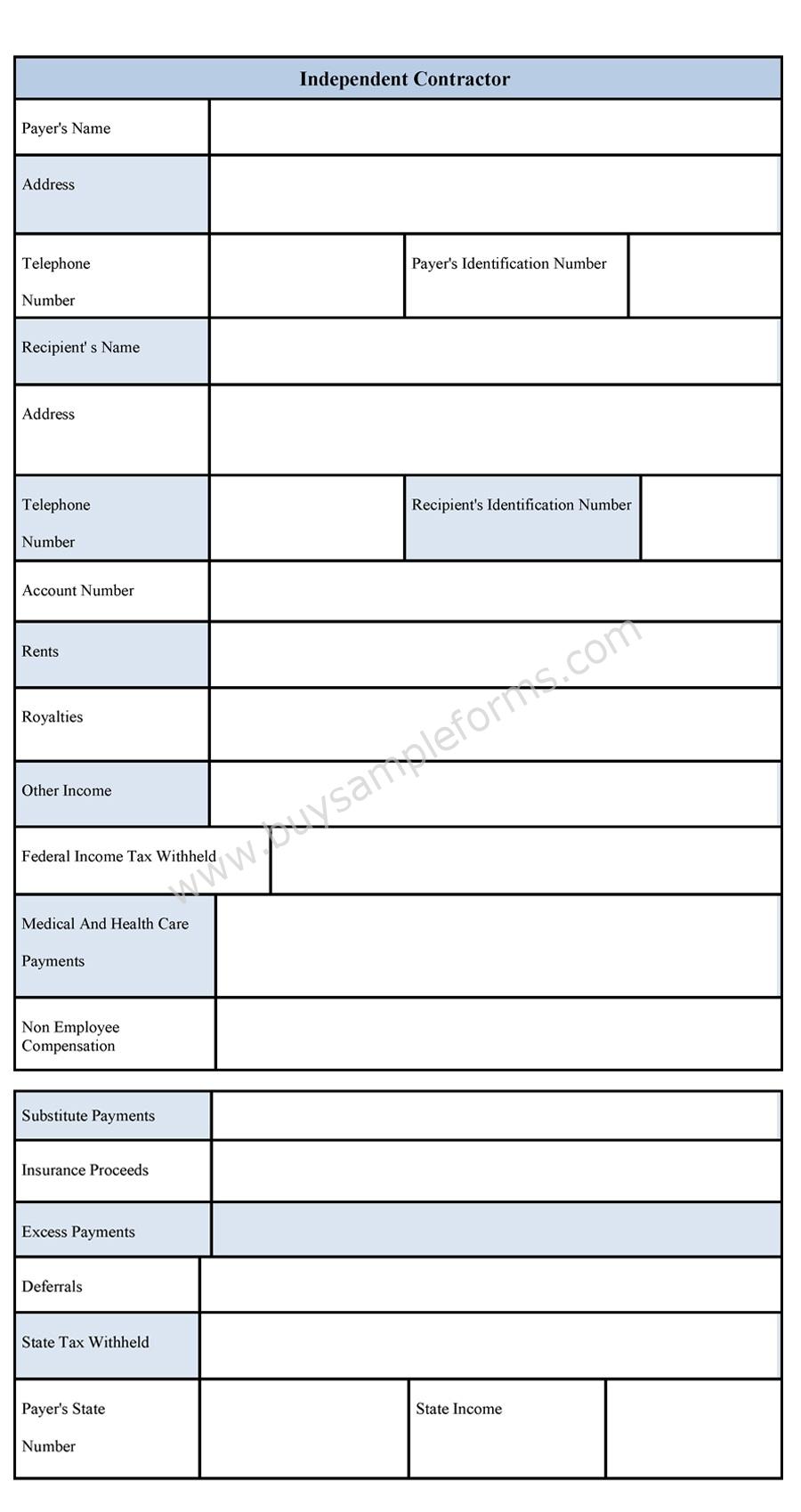

1099 Form Independent Contractor Pdf 1099 Form Independent Contractor

File 1099 online for the current tax year. Ad hire independent contractors in 190 countries without worry over payroll and compliance. Web file your taxes for free. Web common tax forms for freelancers & independent contractors living overseas irs form 1040: Web when hiring internationally, you’ll need to file specific tax forms for any contractor you employ.

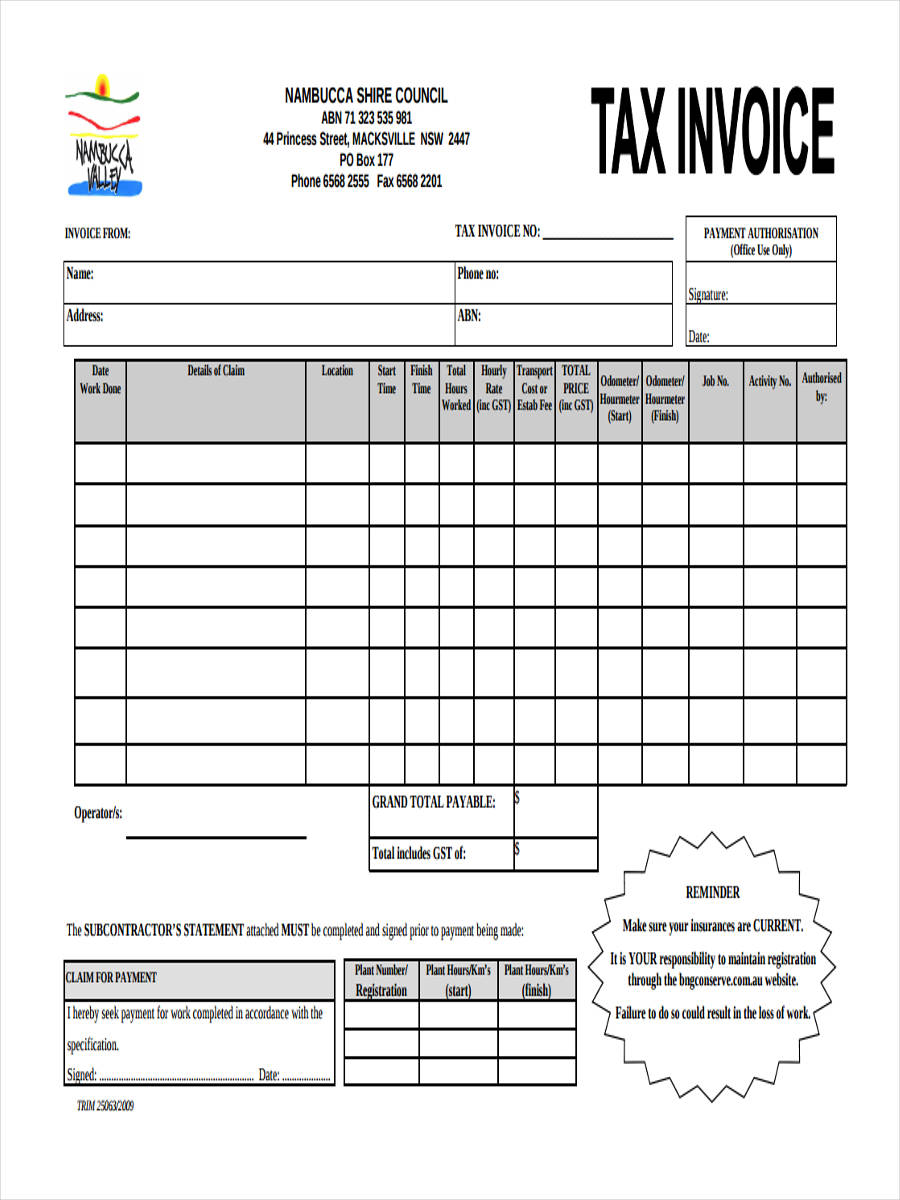

FREE 21+ Sample Contractor Forms in PDF MS Word Excel

Hiring foreign independent contractors when your business is based in the u.s. Citizens and resident aliens with income outside the u.s. October 2018) department of the treasury. Web tax for international contracts before signing an international contract if you are signing a contract that is either being funded by a foreign organization or that includes any activity. A citizen or.

The Independent Contractor Tax Rate Breaking It Down • Benzinga

Citizens and resident aliens with income outside the u.s. Web file your taxes for free. Web information for international individual taxpayers: Web common tax forms for freelancers & independent contractors living overseas irs form 1040: Form 1040 is the standard us individual.

FREE 23+ Sample Contractor Invoices in MS Word PDF Excel

October 2018) department of the treasury. But as noted above, the company should require the contractor. A citizen or resident of the united states,. Web information for international individual taxpayers: Web when hiring internationally, you’ll need to file specific tax forms for any contractor you employ.

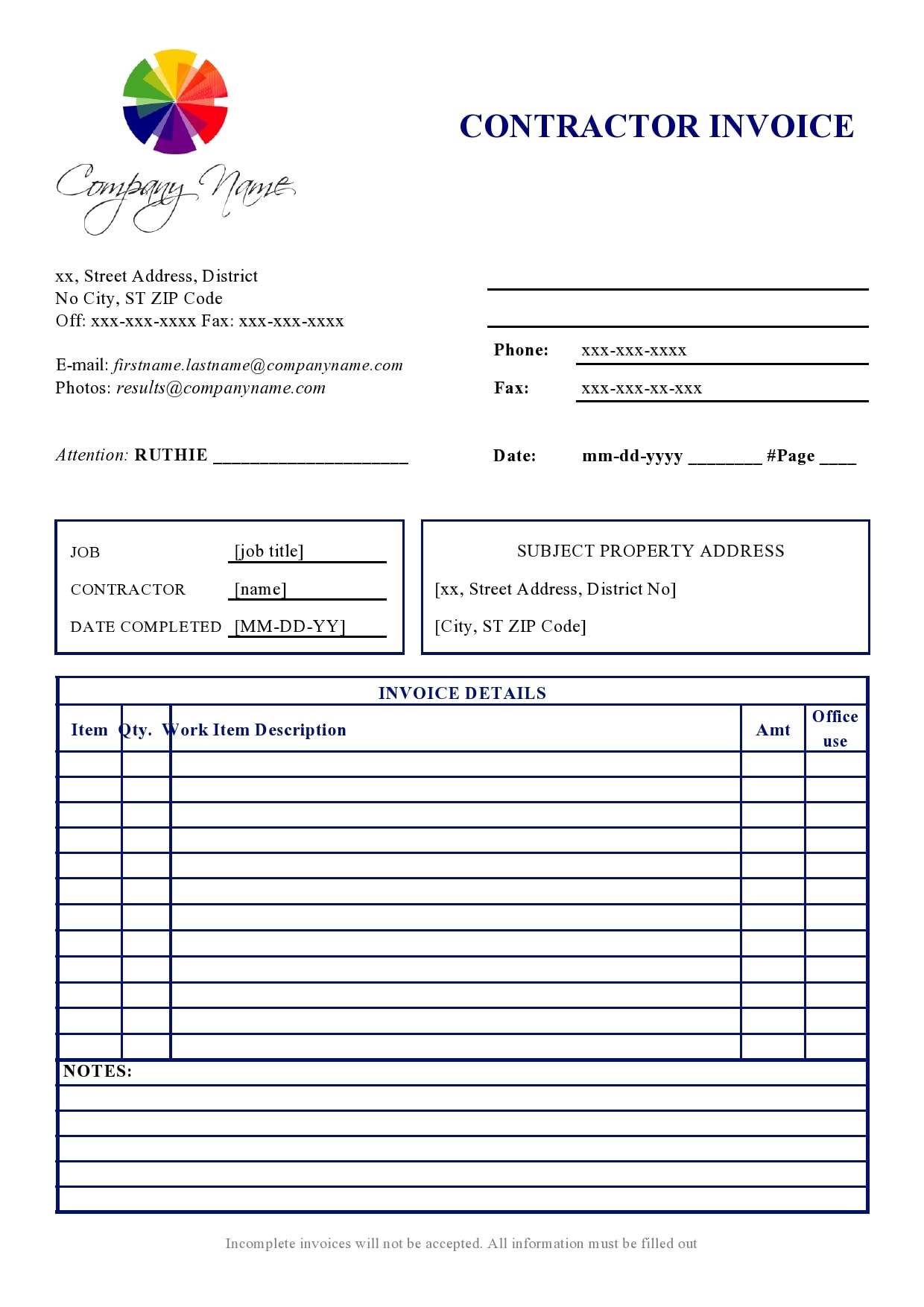

28 Independent Contractor Invoice Templates (FREE)

File 1099 online for the current tax year. Companies to file an irs 1099 form to pay a foreign contractor. Citizens and resident aliens with income outside the u.s. October 2018) department of the treasury. But as noted above, the company should require the contractor.

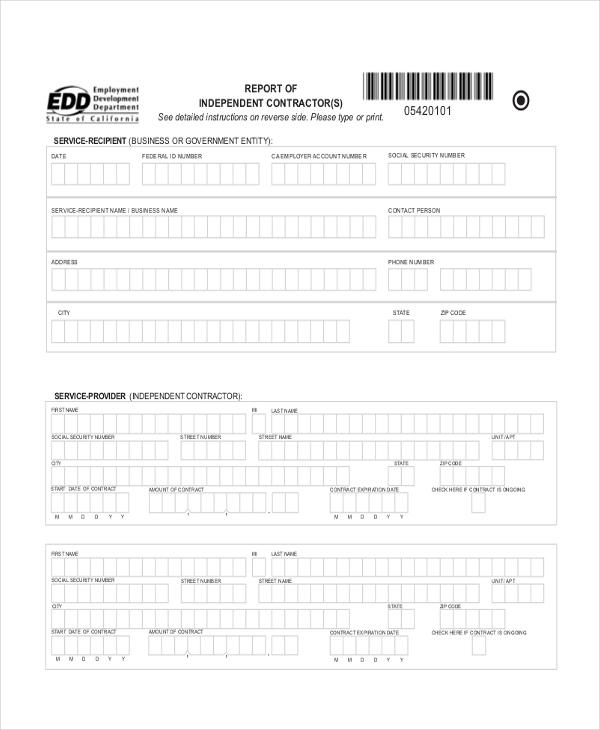

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

Ad hire independent contractors in 190 countries without worry over payroll and compliance. Web when hiring internationally, you’ll need to file specific tax forms for any contractor you employ. Name (as shown on your income tax return). A citizen or resident of the united states,. Tax information for foreign persons with income in the u.s.

Six Easy Steps to Filing Your SelfEmployment Tax Return

Form 1040 is the standard us individual. Ad hire independent contractors in 190 countries without worry over payroll and compliance. Ad hire independent contractors in 190 countries without worry over payroll and compliance. File 1099 online for the current tax year. Web tax for international contracts before signing an international contract if you are signing a contract that is either.

FREE 8+ Contractor Invoice Forms in PDF Ms Word

Ad hire independent contractors in 190 countries without worry over payroll and compliance. But as noted above, the company should require the contractor. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. October 2018) department of the treasury. Web tax forms needed for foreign independent contractors try bench.

FREE 8+ Contractor Invoice Forms in PDF Ms Word

Web tax forms needed for foreign independent contractors try bench. Tax information for foreign persons with income in the u.s. Pay independent contractors anywhere in the world in one click. Ad hire independent contractors in 190 countries without worry over payroll and compliance. But as noted above, the company should require the contractor.

Independent Contractor Form Sample Forms

Companies to file an irs 1099 form to pay a foreign contractor. Efile 1099 for instant filing for 2021 Hiring foreign independent contractors when your business is based in the u.s. File 1099 online for the current tax year. Web however, the irs doesn’t require a company to withhold taxes or report any income from an international contractor if the.

Web When Hiring Internationally, You’ll Need To File Specific Tax Forms For Any Contractor You Employ.

Web however, the irs doesn’t require a company to withhold taxes or report any income from an international contractor if the contractor is not a u.s. Pay independent contractors anywhere in the world in one click. Efile 1099 for instant filing for 2021 Web tax for international contracts before signing an international contract if you are signing a contract that is either being funded by a foreign organization or that includes any activity.

Form 1040 Is The Standard Us Individual.

Sign in to your account. Web international taxpayers federal income tax withholding for persons employed abroad by a u.s. Web common tax forms for freelancers & independent contractors living overseas irs form 1040: Citizens and resident aliens with income outside the u.s.

Web Tax Forms Needed For Foreign Independent Contractors Try Bench.

Citizens and resident aliens abroad. Ad hire independent contractors in 190 countries without worry over payroll and compliance. File 1099 online for the current tax year. Ad hire independent contractors in 190 countries without worry over payroll and compliance.

Web File Your Taxes For Free.

A citizen or resident of the united states,. But as noted above, the company should require the contractor. Web information for international individual taxpayers: Tax information for foreign persons with income in the u.s.