Irs Form To Convert S Corp To Llc

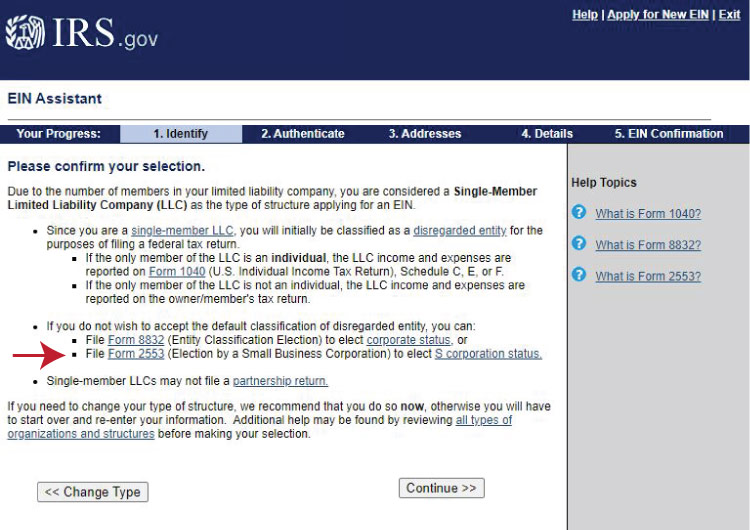

Irs Form To Convert S Corp To Llc - Web to convert s corp to single member llc involves the conversion of a state law corporation to a limited liability company with only one owner. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and elects to be. Depending on elections made by the llc and the number of members, the irs will treat an llc either. The ability to contribute to retirement accounts does not change. Web a corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362 (a) to be an s corporation. There are no filing fees. Web you can change your limited liability company (llc) to an s corporation (s corp) by filing form 2553 with the internal revenue service (irs). Web a limited liability company (llc) is an entity created by state statute. To make an llc to s corp. How to change from llc to s corp.

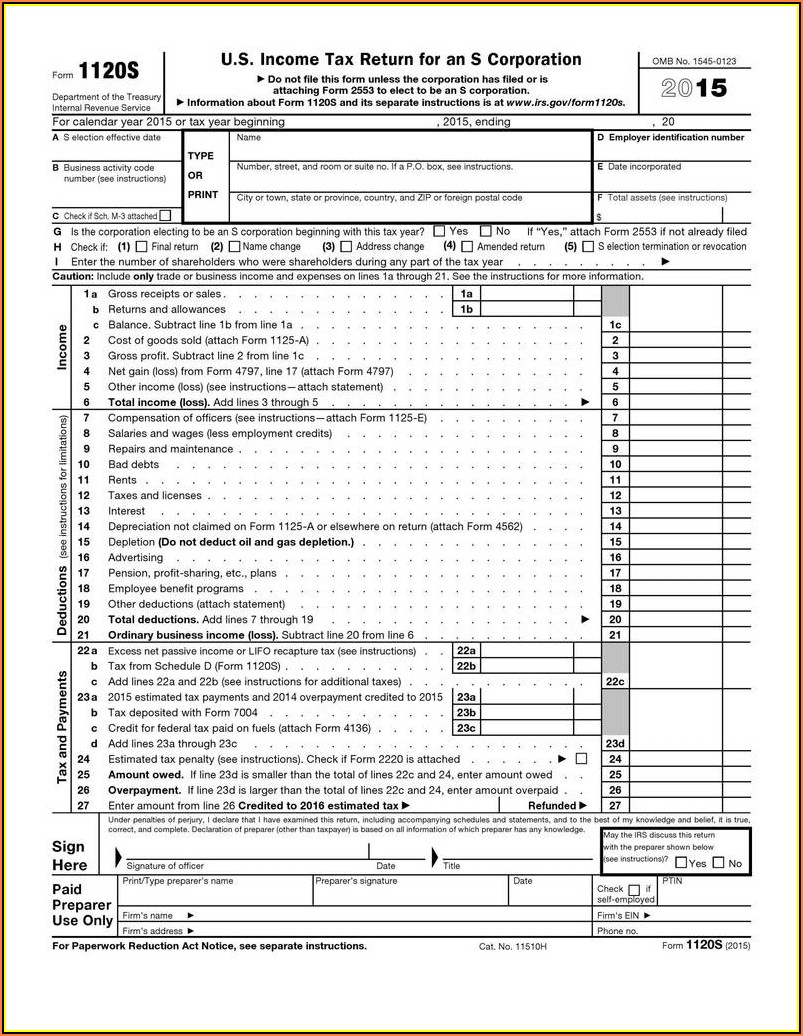

Web a limited liability company (llc) is an entity created by state statute. You can make this election at the same time you file your taxes by filing form 1120s, attaching form 2533 and. Web an llc that doesn't meet these requirements can't convert from llc to s corp. How to change from llc to s corp. Named for the subchapter of the internal revenue code—subchapter. Income tax return for an s corporation and s corporation laws apply. To convert your llc to a west virginia corporation, you'll need to: To make an llc to s corp. Depending on elections made by the llc and the number of members, the irs will treat an llc either. Web updated june 24, 2020:

There are no filing fees. Certain financial institutions, insurance companies, and domestic international sales corporations). Web a limited liability company (llc) is an entity created by state statute. Variable elements of conversion 4. Named for the subchapter of the internal revenue code—subchapter. Web up to 25% cash back west virginia law currently only allows for statutory mergers. Web you can change your limited liability company (llc) to an s corporation (s corp) by filing form 2553 with the internal revenue service (irs). You can make this election at the same time you file your taxes by filing form 1120s, attaching form 2533 and. Tax consequences of converting s corp to llc there are some tax consequences of converting s corp to llc, and it is important that. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and elects to be.

IRS 1120W 2021 Fill out Tax Template Online US Legal Forms

Web a corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362 (a) to be an s corporation. Web a limited liability company (llc) is an entity created by state statute. Commissions do not affect our editors' opinions or. Aug 18, 2022, 1:48pm editorial note: You can make this.

Converting LLC to S Corp the Ultimate Guide

The ability to contribute to retirement accounts does not change. You can make this election at the same time you file your taxes by filing form 1120s, attaching form 2533 and. There are no filing fees. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it.

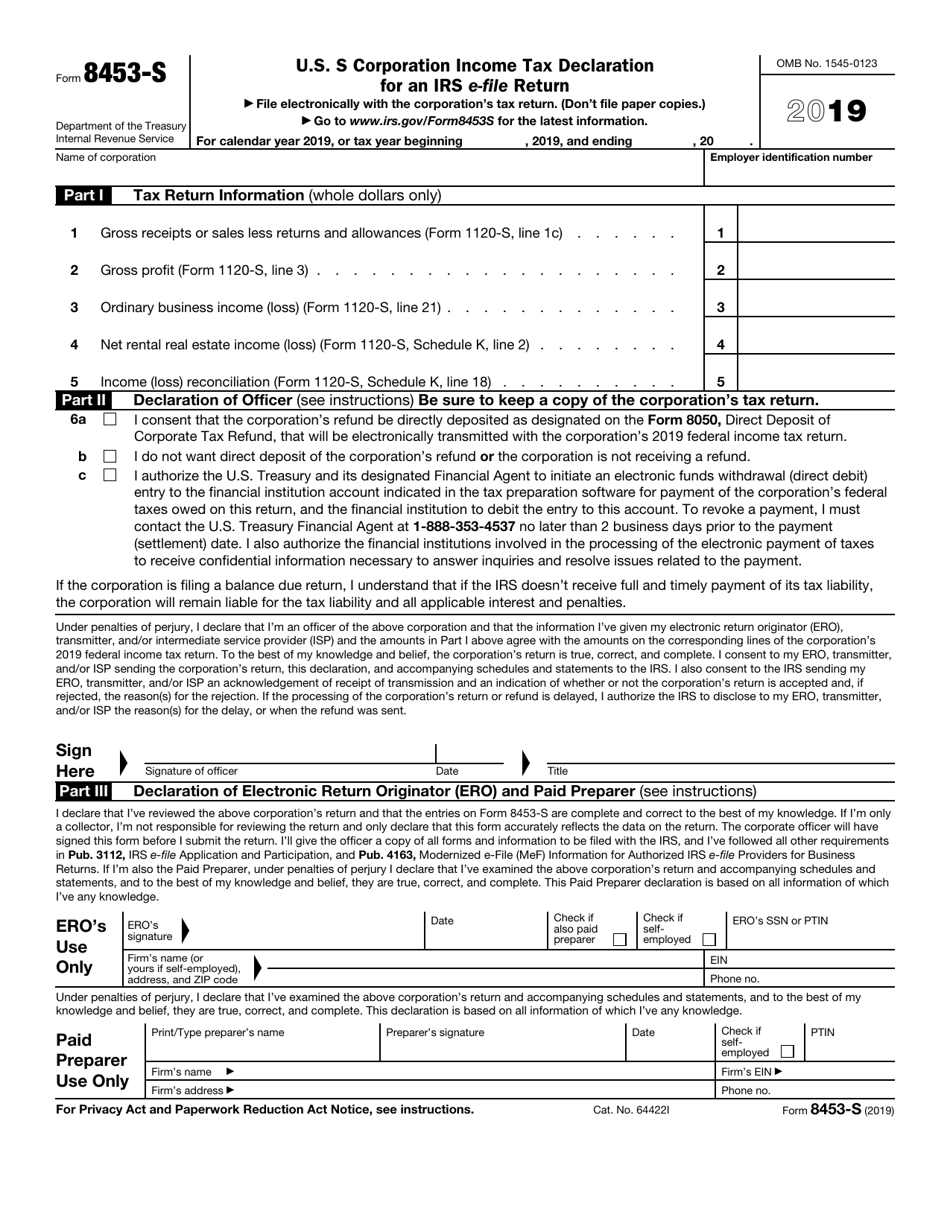

IRS Form 8453S Download Fillable PDF or Fill Online U.S. S Corporation

Web up to 25% cash back west virginia law currently only allows for statutory mergers. There are no filing fees. Variable elements of conversion 4. Tax consequences of converting s corp to llc there are some tax consequences of converting s corp to llc, and it is important that. Web a limited liability company (llc) is an entity created by.

When Should Business Owners Convert From LLC To S Corp

To convert your llc to a west virginia corporation, you'll need to: Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and elects to be. How to change from llc to s corp. Web have only one class of stock not be.

Irs Tax Form 1040ez 2020 Form Resume Examples qeYzgN5V8X

Certain financial institutions, insurance companies, and domestic international sales corporations). Named for the subchapter of the internal revenue code—subchapter. We earn a commission from partner links on forbes advisor. Income tax return for an s corporation and s corporation laws apply. Depending on elections made by the llc and the number of members, the irs will treat an llc either.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Web up to 25% cash back west virginia law currently only allows for statutory mergers. There are no filing fees. How to change from llc to s corp. We earn a commission from partner links on forbes advisor. Named for the subchapter of the internal revenue code—subchapter.

How to Start an S Corp Everything You Need to Know

Web to convert s corp to single member llc involves the conversion of a state law corporation to a limited liability company with only one owner. Web a limited liability company (llc) is an entity created by state statute. Web in order for the entity to be changed from an llc to a corporation, the business will need to file.

How To Complete Form 1120s S Corporation Tax Return Bench Accounting

Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and elects to be. Web up to 25% cash back west virginia law currently only allows for statutory mergers. You can make this election at the same time you file your taxes by.

Irs 2553 Form S Corporation Irs Tax Forms

Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and elects to be. Income tax return for an s corporation and s corporation laws apply. Web a limited liability company (llc) is an entity created by state statute. Web an llc that.

Massachusetts S Corp Start an S Corp in MA TRUiC

The ability to contribute to retirement accounts does not change. Web to convert s corp to single member llc involves the conversion of a state law corporation to a limited liability company with only one owner. It doesn't mean that your. Web a limited liability company (llc) is an entity created by state statute. Web an llc that doesn't meet.

The Ability To Contribute To Retirement Accounts Does Not Change.

Web have only one class of stock not be an ineligible corporation (i.e. Depending on elections made by the llc and the number of members, the irs will treat an llc either. Web up to 25% cash back west virginia law currently only allows for statutory mergers. Web updated june 24, 2020:

Web The Fee To Convert Is $150.

We earn a commission from partner links on forbes advisor. Tax consequences of converting s corp to llc there are some tax consequences of converting s corp to llc, and it is important that. Commissions do not affect our editors' opinions or. Aug 18, 2022, 1:48pm editorial note:

To Convert Your Llc To A West Virginia Corporation, You'll Need To:

Web an llc that doesn't meet these requirements can't convert from llc to s corp. Web a limited liability company (llc) is an entity created by state statute. You can make this election at the same time you file your taxes by filing form 1120s, attaching form 2533 and. Named for the subchapter of the internal revenue code—subchapter.

Income Tax Return For An S Corporation And S Corporation Laws Apply.

To make an llc to s corp. Web a corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362 (a) to be an s corporation. It doesn't mean that your. Web in order for the entity to be changed from an llc to a corporation, the business will need to file with the state agency who is in charge of corporate filings.