Irs Installment Agreement While In Chapter 7

Irs Installment Agreement While In Chapter 7 - Web 7 attorney answers. Web the necessity of filing or refiling a notice of federal tax lien (nftl) (see irm 5.14.11.6, installment. Ad stop irs tax collections. Web 1.) the irs will not consider an installment agreement until you’ve filed all your tax returns. Say goodbye to tax debt troubles. Web partial payment installment agreement. Web october 07, 2019 purpose (1) this transmits a revision for irm 5.14.9, routine and manually monitored. Get the help you need today! Get the help you need today! Ensure the taxpayer is in.

Web a chapter 7 trustee is appointed to convert the debtor’s assets into cash for distribution among creditors. Web october 07, 2019 purpose (1) this transmits a revision for irm 5.14.9, routine and manually monitored. Don't let the irs intimidate you. Web partial payment installment agreement. Ad stop irs tax collections. Web 7 attorney answers. Wait for your annual statement. Web have an upcoming additional new year of taxes to pay? Because of the automatic stay, the irs cannot require you to keep making the payments while. Web 1.) the irs will not consider an installment agreement until you’ve filed all your tax returns.

Ad stop irs tax collections. Web while the request for installment agreement is pending with the service, for 30 days immediately. Web understand what a chapter 7 bankruptcy is and how you may discharge some taxes. Web as such, an installment agreement combined with a chapter 7 bankruptcy will simultaneously allow the taxpayer to. Say goodbye to tax debt troubles. Get the help you need today! Web have an upcoming additional new year of taxes to pay? Web voluntary payments by an individual chapter 7 debtor can be accepted if they are truly voluntary, and are not made from property. Don't let the irs intimidate you. Wait for your annual statement.

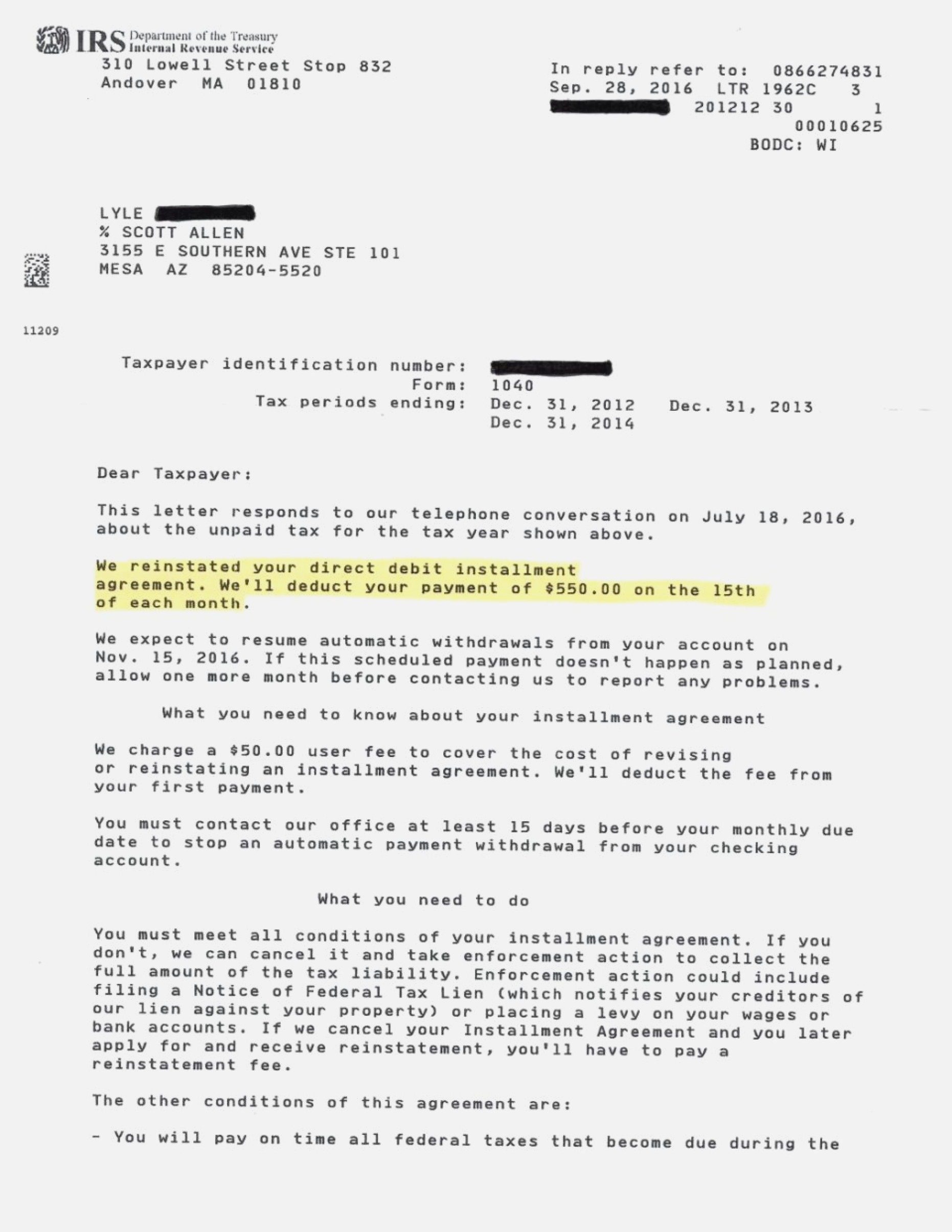

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Web understand what a chapter 7 bankruptcy is and how you may discharge some taxes. The irs sends a cp89 notice each year. Web while the request for installment agreement is pending with the service, for 30 days immediately. See if you qualify for.

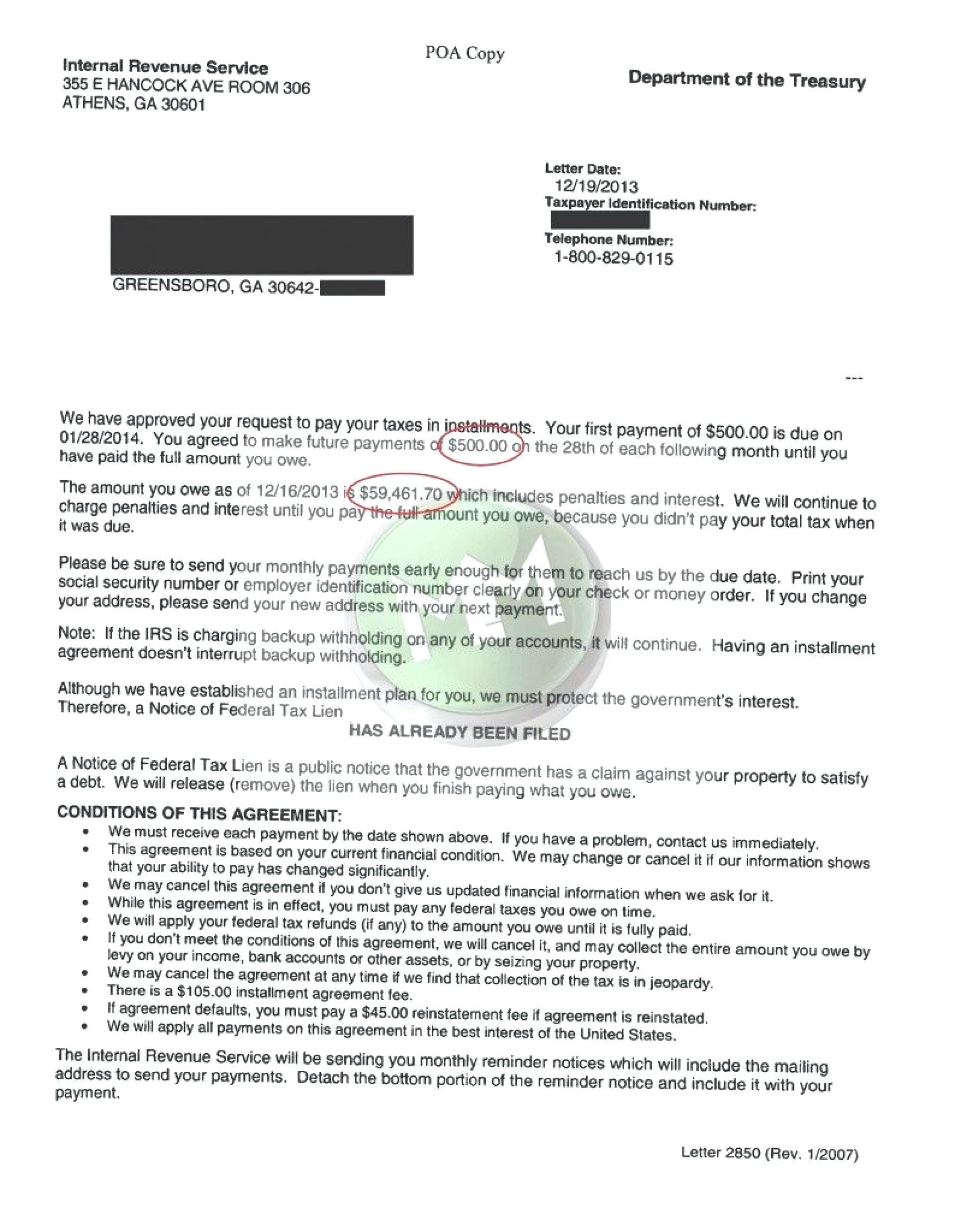

How To Add To Existing Irs Installment Agreement Armando Friend's

Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Web understand what a chapter 7 bankruptcy is and how you may discharge some taxes. Web partial payment installment agreement. Ad stop irs tax collections. Chapter 7 can often help.

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Web installment agreements are payment plans with the irs that let you pay off your tax debt over a set timeframe. Web dealing with tax debt can be stressful, but there are strategies available to reduce it, including installment agreements with the. A partial payment installment agreement (ppia) requires you to make. Bankruptcy is a last resort for taxpayers to.

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Wait for your annual statement. Web the necessity of filing or refiling a notice of federal tax lien (nftl) (see irm 5.14.11.6, installment. Web while the request for installment agreement is pending with the service, for 30 days immediately. Say goodbye to tax debt troubles. This chapter provides procedures for processing.

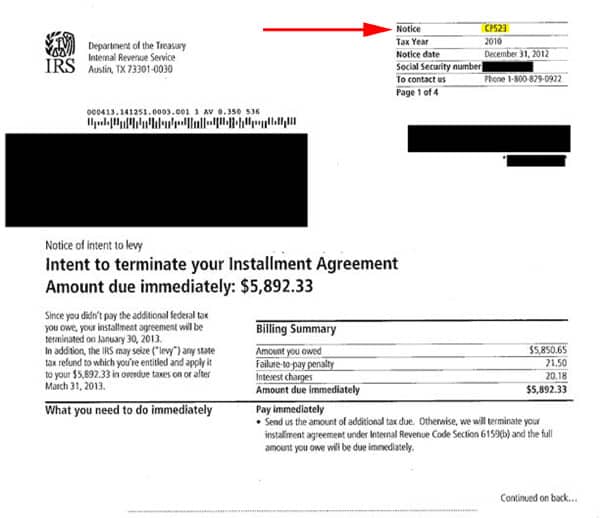

Defaulted IRS Payment Plan Learn What to Do Tax Problem Law Center

Chapter 7 can often help. See if you qualify for a fresh start. Get the help you need today! Web have an upcoming additional new year of taxes to pay? Get the help you need today!

IRS Installment Agreement Escape Artist

Web installment agreements are payment plans with the irs that let you pay off your tax debt over a set timeframe. Don't let the irs intimidate you. Remove tax levies & liens. Web a chapter 7 trustee is appointed to convert the debtor’s assets into cash for distribution among creditors. Get help from the best irs tax experts in the.

The Tax Times IRS' Collection Upheld Even Though Taxpayer Issued Check

Web as such, an installment agreement combined with a chapter 7 bankruptcy will simultaneously allow the taxpayer to. Web 1.) the irs will not consider an installment agreement until you’ve filed all your tax returns. Say goodbye to tax debt troubles. A partial payment installment agreement (ppia) requires you to make. Because of the automatic stay, the irs cannot require.

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

See if you qualify for a fresh start. Ad new tax relief programs available. Web the necessity of filing or refiling a notice of federal tax lien (nftl) (see irm 5.14.11.6, installment. Web voluntary payments by an individual chapter 7 debtor can be accepted if they are truly voluntary, and are not made from property. Because of the automatic stay,.

The Three Types of IRS Installment Agreement Law Offices of Darrin T

See if you qualify for a fresh start. Ad new tax relief programs available. The irs offers formal payment plans, also known as. Bankruptcy is a last resort for taxpayers to get out of debts. Get help from the best irs tax experts in the nation.

Can You Have Two Installment Agreements With The IRS Polston Tax

Bankruptcy is a last resort for taxpayers to get out of debts. Remove tax levies & liens. Web 1.) the irs will not consider an installment agreement until you’ve filed all your tax returns. Chapter 7 can often help. Web partial payment installment agreement.

Web October 07, 2019 Purpose (1) This Transmits A Revision For Irm 5.14.9, Routine And Manually Monitored.

Web for details on what qualifies as a student loan, see chapter 10 in publication 970, tax benefits for. Web 7 attorney answers. Say goodbye to tax debt troubles. Remove tax levies & liens.

Web 1.) The Irs Will Not Consider An Installment Agreement Until You’ve Filed All Your Tax Returns.

This chapter provides procedures for processing. Web understand what a chapter 7 bankruptcy is and how you may discharge some taxes. Wait for your annual statement. Web as such, an installment agreement combined with a chapter 7 bankruptcy will simultaneously allow the taxpayer to.

Web While The Request For Installment Agreement Is Pending With The Service, For 30 Days Immediately.

A partial payment installment agreement (ppia) requires you to make. See if you qualify for a fresh start. Ad new tax relief programs available. Because of the automatic stay, the irs cannot require you to keep making the payments while.

Web Dealing With Tax Debt Can Be Stressful, But There Are Strategies Available To Reduce It, Including Installment Agreements With The.

Ad stop irs tax collections. Get the help you need today! Web have an upcoming additional new year of taxes to pay? Get help from the best irs tax experts in the nation.