Is Depreciation On Balance Sheet

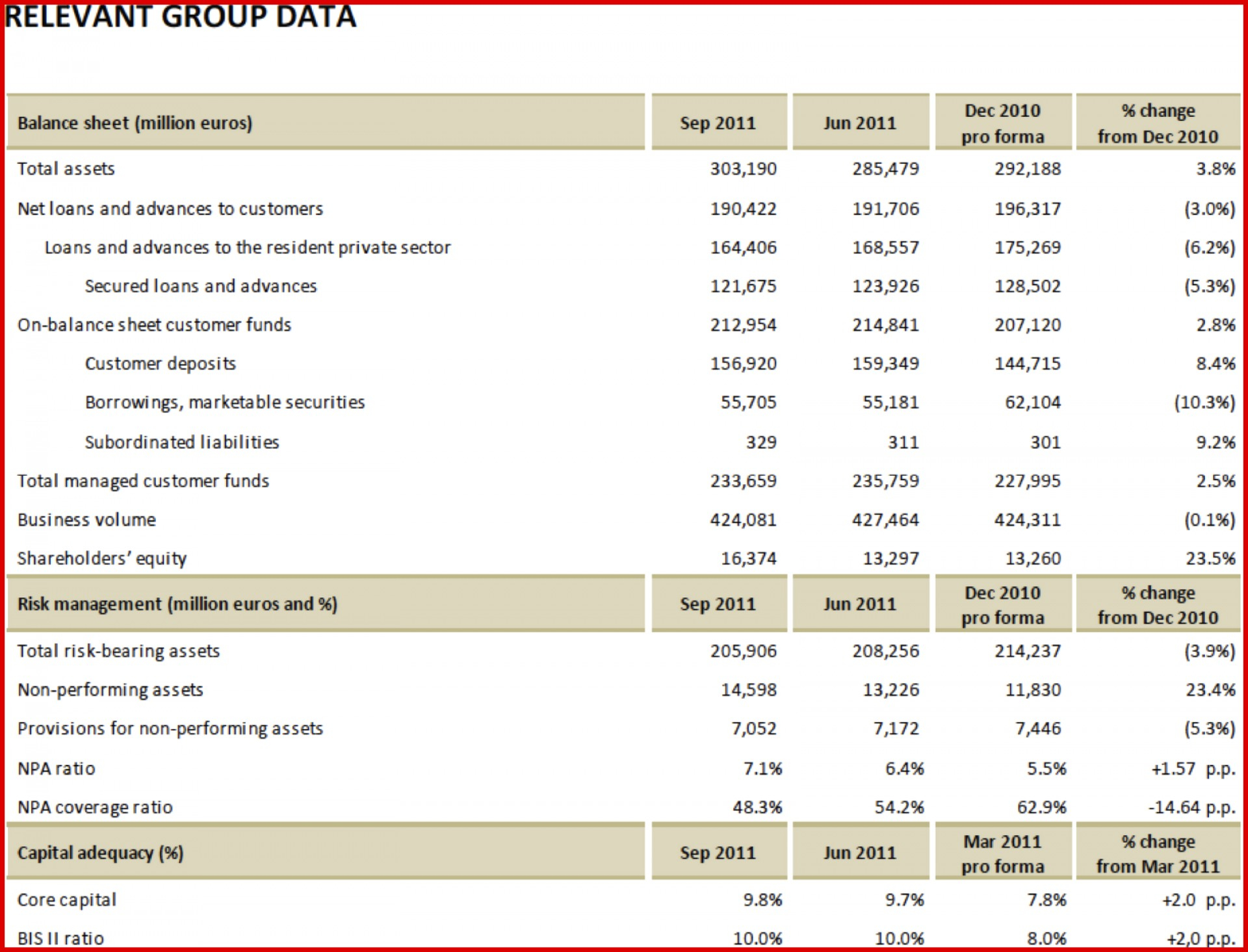

Is Depreciation On Balance Sheet - It's expressed in both the balance sheet and income statement of a business. Web depreciation is typically tracked one of two places: Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. Web it represents the decrease in the value of an asset over time. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. For income statements, depreciation is listed as an expense. On an income statement or balance sheet. Also, fixed assets are recorded on the balance sheet, and since accumulated. Depreciation also affects your business.

Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. For income statements, depreciation is listed as an expense. Web it represents the decrease in the value of an asset over time. Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. It's expressed in both the balance sheet and income statement of a business. Depreciation also affects your business. It accounts for depreciation charged to expense for the. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web depreciation is typically tracked one of two places:

Web it represents the decrease in the value of an asset over time. Web depreciation is typically tracked one of two places: It accounts for depreciation charged to expense for the. Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. For income statements, depreciation is listed as an expense. Depreciation also affects your business. Also, fixed assets are recorded on the balance sheet, and since accumulated. On an income statement or balance sheet. It's expressed in both the balance sheet and income statement of a business. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time.

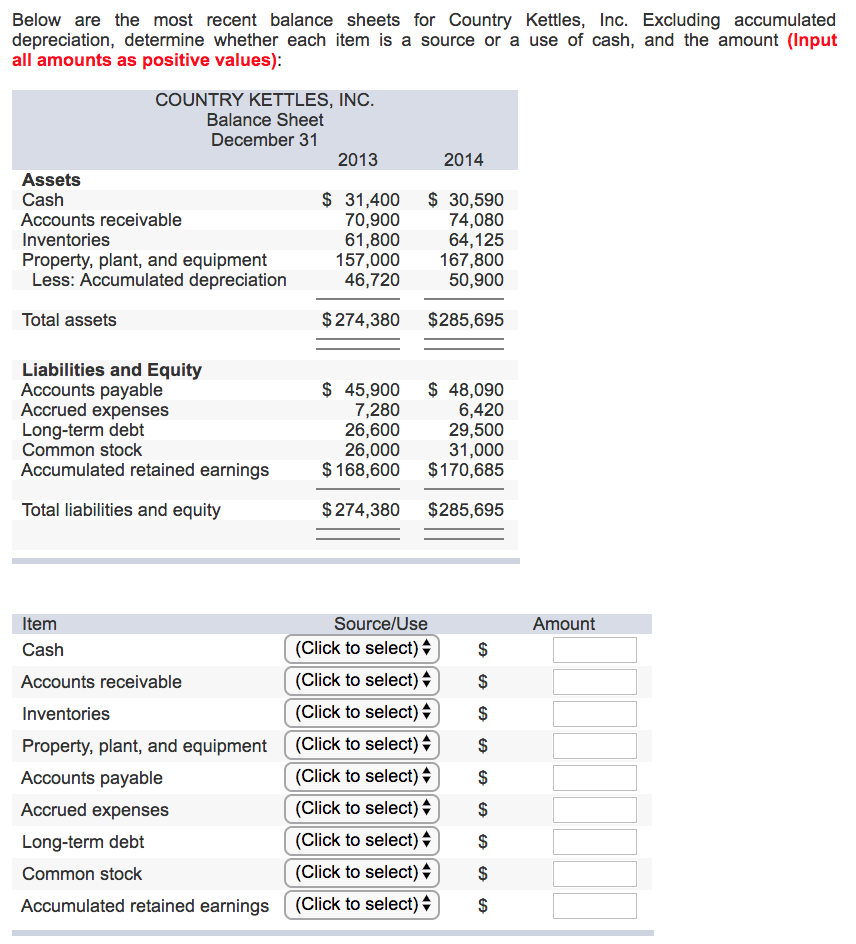

template for depreciation worksheet

It's expressed in both the balance sheet and income statement of a business. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. It accounts for depreciation charged to expense for the. For income statements, depreciation is listed as an expense. Depreciation also affects your business.

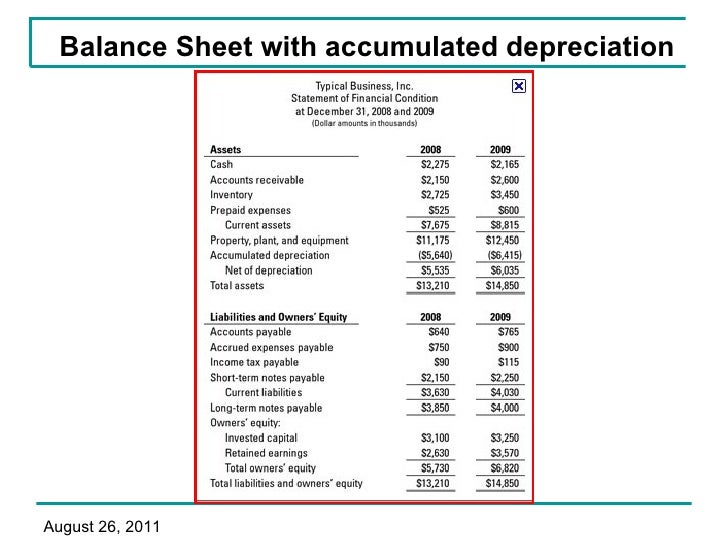

What is Accumulated Depreciation? Formula + Calculator

On an income statement or balance sheet. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. Depreciation also affects your business. It accounts for depreciation charged to expense for the. Web it represents the decrease in the value of an asset.

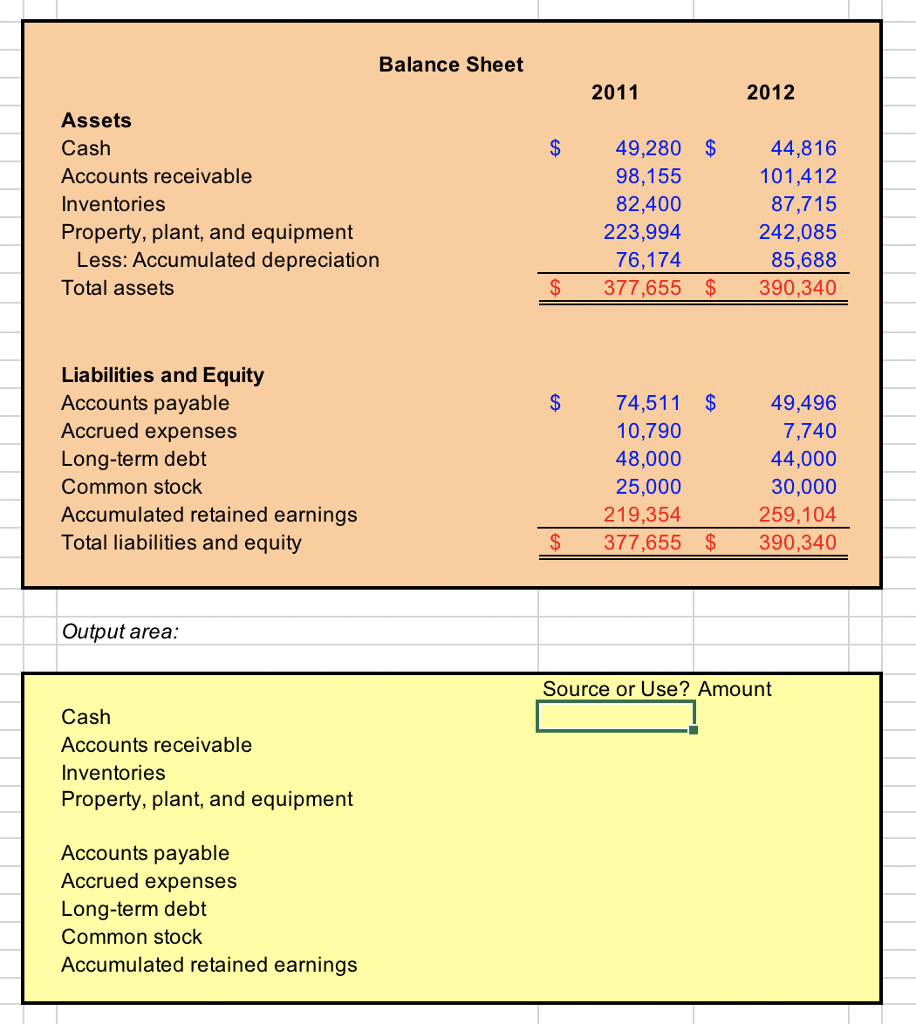

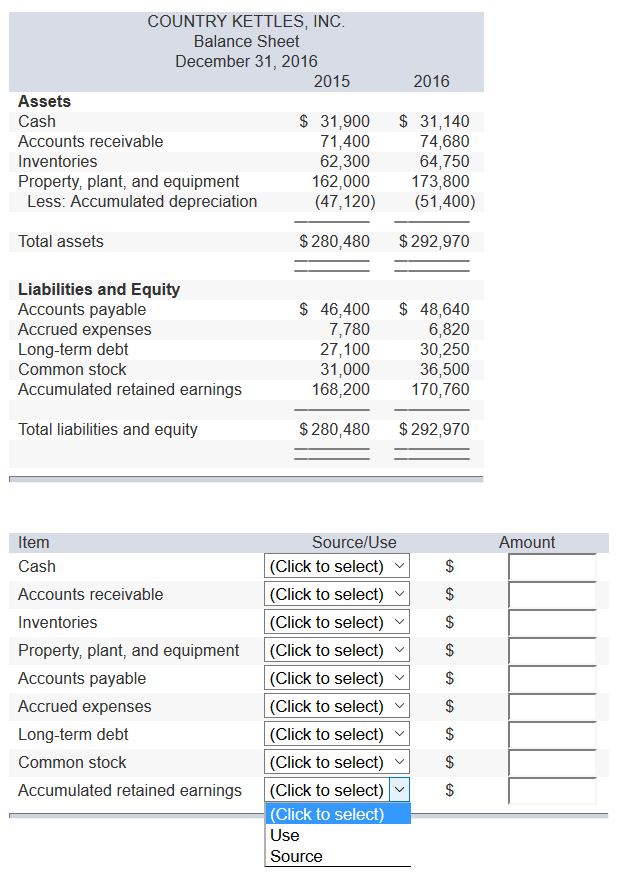

How To Calculate Depreciation Balance Sheet Haiper

Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. On an income statement or balance sheet. Depreciation also affects your business. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web depreciation expense is reported on the income statement.

Balance Sheet Depreciation Understanding Depreciation

Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. It accounts for depreciation charged to expense for the. Web it represents the decrease in the value of an asset over time. Web credit to accumulated depreciation, which is reported on the.

What Is Accumulated Depreciation / Why Is Accumulated Depreciation A

Web depreciation is typically tracked one of two places: Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. For income statements, depreciation is listed as.

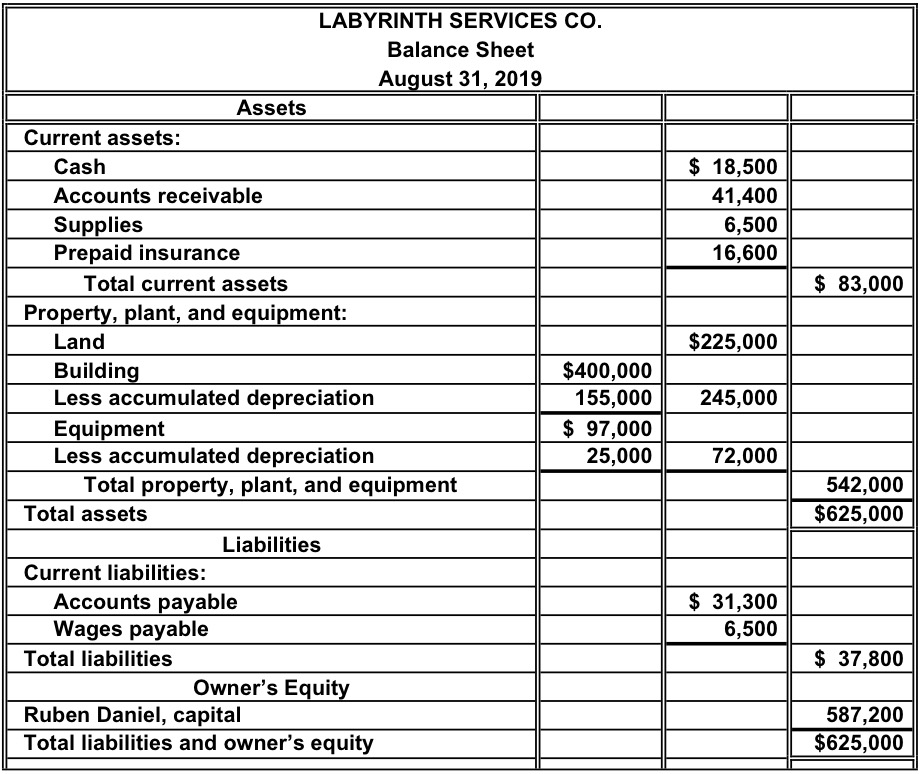

balance sheet Expense Depreciation

Also, fixed assets are recorded on the balance sheet, and since accumulated. Depreciation also affects your business. Web it represents the decrease in the value of an asset over time. It's expressed in both the balance sheet and income statement of a business. Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted.

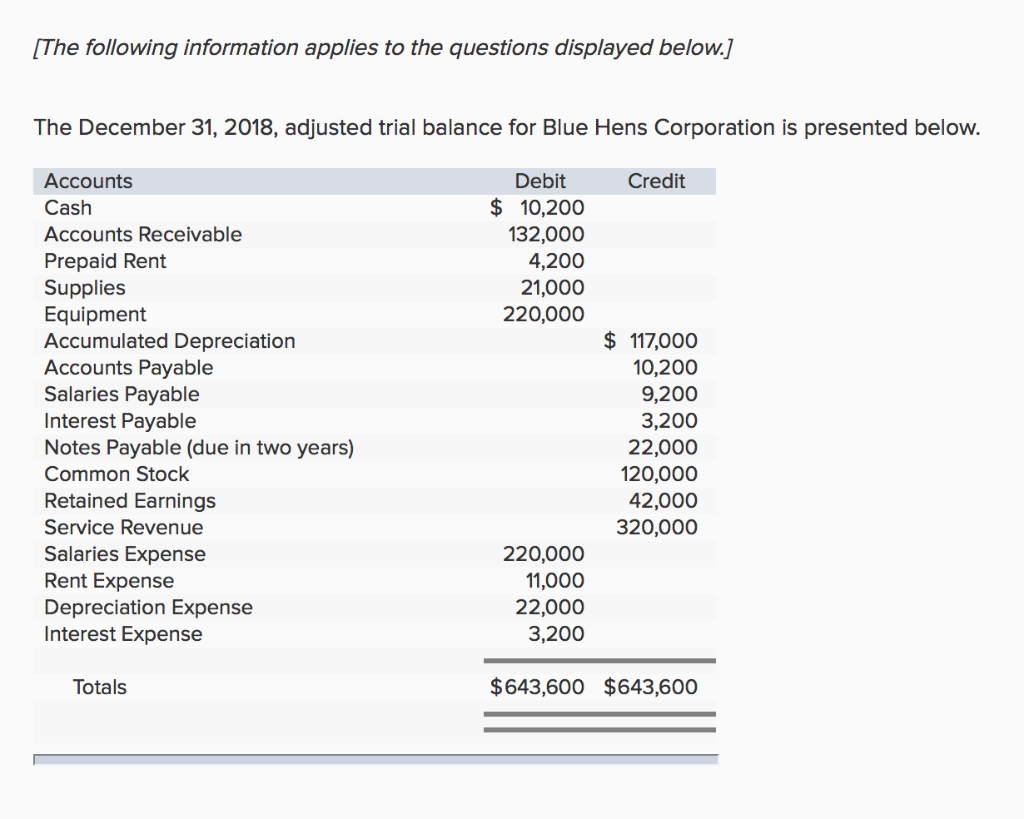

Accounting Questions and Answers EX 413 Balance sheet

It's expressed in both the balance sheet and income statement of a business. Web depreciation is typically tracked one of two places: Depreciation also affects your business. Web it represents the decrease in the value of an asset over time. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time.

How To Calculate Depreciation Balance Sheet Haiper

Depreciation also affects your business. Also, fixed assets are recorded on the balance sheet, and since accumulated. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web it represents the decrease in the value of an asset over time. Web depreciation expense is reported on the income statement as any other normal.

Depreciation

Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. Web it represents the decrease.

Accumulated Depreciation Balance Sheet / Why do we show an asset at

It's expressed in both the balance sheet and income statement of a business. Web depreciation is typically tracked one of two places: Depreciation also affects your business. Web it represents the decrease in the value of an asset over time. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a.

Web Depreciation Expense Is Reported On The Income Statement As Any Other Normal Business Expense, While Accumulated Depreciation Is A Running Total Of Depreciation Expense Reported On The.

Web it represents the decrease in the value of an asset over time. Web depreciation is typically tracked one of two places: It's expressed in both the balance sheet and income statement of a business. It accounts for depreciation charged to expense for the.

Web Credit To Accumulated Depreciation, Which Is Reported On The Balance Sheet Depreciation And Taxes As Noted Above, Businesses Use Depreciation For Both Tax And Accounting Purposes.

Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Also, fixed assets are recorded on the balance sheet, and since accumulated. On an income statement or balance sheet. Depreciation also affects your business.