Is There A Penalty For Not Filing Form 56

Is There A Penalty For Not Filing Form 56 - November 2022) department of the treasury internal revenue service. If you need more time to prepare your federal tax return, you can file an extension form no. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Notice concerning fiduciary relationship (internal revenue code sections 6036 and. Web the penalty for filing taxes late is charged as much as 5% for each month (or partial month) that your tax return is late. Web 2 days agoitr filing 2023 live updates: Web the fee is 5% of the unpaid taxes for each month or part of a month that a tax return is late. Web 한국어 русский an information return penalty may apply if you don't file information returns or provide payee statements on time. If form 56 is not filed and the irs sends a notice of deficiency (“nod”) to the decedent’s last known address (which could. Web avoid a penalty.

It applies to any taxes that are unpaid as of. Web the government does not take this situation lightly, as filing tax returns is not optional. Web a form 56 needs to be filed twice: Web form 56 is filed with the irs at the beginning and end of a fiduciary relationship — one where one person is responsible for the assets of another. We mail you notice 972cg if. When your pr first gets appoint to let the irs know who your pr is and where to send all tax notices; If you can’t do so,. If form 56 is not filed and the irs sends a notice of deficiency (“nod”) to the decedent’s last known address (which could. November 2022) department of the treasury internal revenue service. If after five months the filer has not paid, the failure to file penalty will.

November 2022) department of the treasury internal revenue service. The combined penalty is 5% (4.5% late filing. Web officially referred to by the irs as a “notice concerning fiduciary relationship,” form 56 lets the agency know when a fiduciary relationship — one involving a legal and ethical. Even if you don’t have the money to pay your tax liability, you should still file. If you can’t do so,. Web the fee is 5% of the unpaid taxes for each month or part of a month that a tax return is late. It applies to any taxes that are unpaid as of. If form 56 is not filed and the irs sends a notice of deficiency (“nod”) to the decedent’s last known address (which could. Web the failure to file penalty is actually ten times larger. Similar to the failure to file penalty, the.

Penalty on Late Filing of Tax Return Section 234F GST Guntur

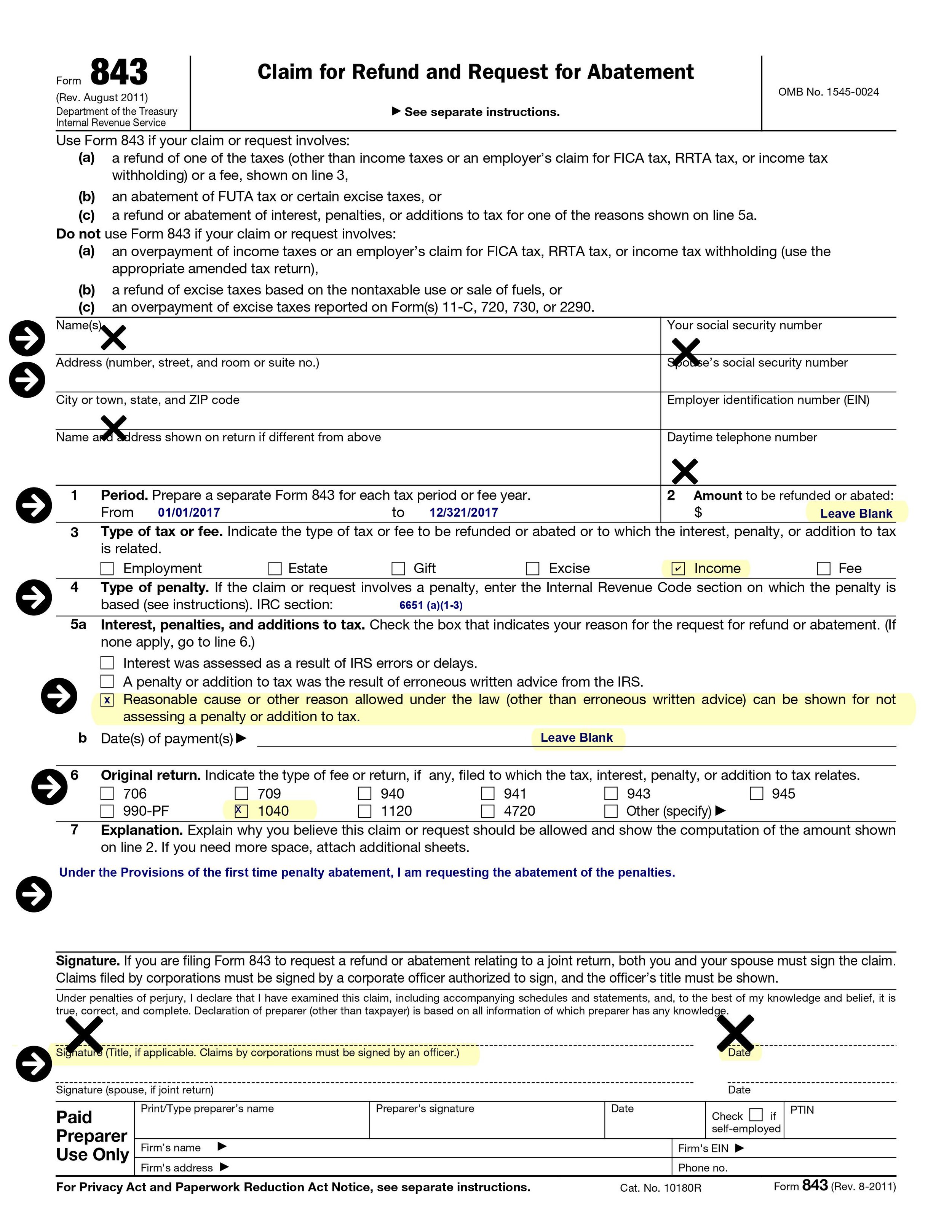

Web a failure to file penalty is charged on returns filed after the due date or extended due date, absent a reasonable cause for filing late. If form 56 is not filed and the irs sends a notice of deficiency (“nod”) to the decedent’s last known address (which could. Form 56 must also be filed. If you can’t do so,..

What is the Penalty for Not Filing an FBAR Form? Ayar Law

Web instructions get help instructions for irs form 56 you may need to have a copy of the form from the irs and directly filed with the irs. If after five months the filer has not paid, the failure to file penalty will. Web irs form 56 satisfies this requirement. If form 56 is not filed and the irs sends.

Penalty for Late Filing Form 2290 Computer Tech Reviews

Web the fee is 5% of the unpaid taxes for each month or part of a month that a tax return is late. Irs form 56 should be filed with the 1040 return for the deceased. It applies to any taxes that are unpaid as of. The penalty has a cap of 25%, just like the failure to file penalty..

Late Filing Penalty Malaysia Avoid Penalties

Web the fee is 5% of the unpaid taxes for each month or part of a month that a tax return is late. Similar to the failure to file penalty, the. The combined penalty is 5% (4.5% late filing. If after five months the filer has not paid, the failure to file penalty will. We mail you notice 972cg if.

HVUT Tax Form 2290 Due Dates & Penalties For Form 2290

Web avoid a penalty. Web a failure to file penalty is charged on returns filed after the due date or extended due date, absent a reasonable cause for filing late. Web information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. A form 56 needs to be filed twice:. The combined.

The Penalty for Filing Taxes Late…Even if You Owe Nothing! Community Tax

The fiduciary has the responsibility of. Web instructions get help instructions for irs form 56 you may need to have a copy of the form from the irs and directly filed with the irs. Web irs form 56 should be filed as soon as the ein for the estate is received. When your pr first gets appoint to let the.

Sales Tax Penalty Waiver Sample Letter Irs Letter 1277 Penalty

The penalty has a cap of 25%, just like the failure to file penalty. Web there is no penalty from the irs for not filing a tax extension form. Web officially referred to by the irs as a “notice concerning fiduciary relationship,” form 56 lets the agency know when a fiduciary relationship — one involving a legal and ethical. Similar.

How to avoid a late filing penalty YouTube

Web 한국어 русский an information return penalty may apply if you don't file information returns or provide payee statements on time. When your pr first gets appoint to let the irs know who your pr is and where to send all tax notices; If form 56 is not filed and the irs sends a notice of deficiency (“nod”) to the.

IT Dept Penalty for Late Filing Tax Return

Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Web the government does not take this situation lightly, as filing tax returns is not optional. Web instructions get help instructions for irs form 56 you.

Penalty Section 234F for Late Tax Return Filers in AY 202021

Web the penalty for filing taxes late is charged as much as 5% for each month (or partial month) that your tax return is late. The fee is capped at 25% of your unpaid taxes. Web the failure to file penalty is actually ten times larger. Irs form 56 should be filed with the 1040 return for the deceased. Web.

Web A Form 56 Needs To Be Filed Twice:

Web avoid a penalty. A form 56 needs to be filed twice:. When your pr first gets appoint to let the irs know who your pr is and where to send all tax notices; Web there is no penalty from the irs for not filing a tax extension form.

Even If You Don’t Have The Money To Pay Your Tax Liability, You Should Still File.

Web 2 days agoitr filing 2023 live updates: If you need more time to prepare your federal tax return, you can file an extension form no. November 2022) department of the treasury internal revenue service. Web the government does not take this situation lightly, as filing tax returns is not optional.

Web 한국어 Русский An Information Return Penalty May Apply If You Don't File Information Returns Or Provide Payee Statements On Time.

The fiduciary has the responsibility of. Notice concerning fiduciary relationship (internal revenue code sections 6036 and. If form 56 is not filed and the irs sends a notice of deficiency (“nod”) to the decedent’s last known address (which could. The fee is capped at 25% of your unpaid taxes.

Web Some Commentators Suggest That Form 56 Is Not A Required Filing, Because The Foreign Trust's First Tax Return Ought To Provide Sufficient Information.

If you can’t do so,. And again when your pr finishes his job. Web form 56 is filed with the irs at the beginning and end of a fiduciary relationship — one where one person is responsible for the assets of another. Deadline to file without penalty till midnight more than 6.50 crore itrs have been filed so far, out of which about 36.91 lakh itrs.