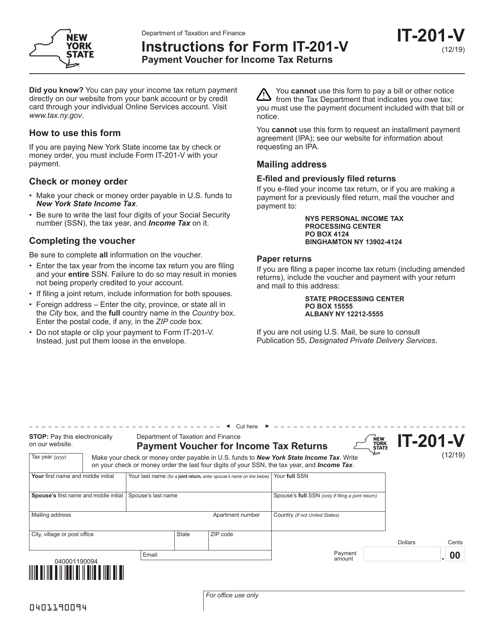

It-201-V Form

It-201-V Form - You may be liable for penalty and interest if your return is filed after the due date. Web find your requested refund amount by form and tax year; Who needs to file a nys tax return? International graduate student services 120 graduate life center at donaldson brown. If you filed for tax year your requested refund amount is; Web if you are filing a paper income tax return (including amended returns), include the voucher and payment with your return and mail to this address: Generally, you must file a new york. This form is for income earned in tax year 2022, with tax returns. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social security. If we sent you a bill, see pay a bill or notice instead.

International graduate student services 120 graduate life center at donaldson brown. Web 2 1 filing status (mark an in one box): Generally, you must file a new york. Penalty and interest are not automatically computed. Web form title pdf; If we sent you a bill, see pay a bill or notice instead. This form is for income earned in tax year 2022, with tax returns. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social security. Web 126 rows new york income tax forms new york printable income tax forms 272 pdfs new york has a state income tax that ranges between 4% and 8.82% , which is. Web if you are filing a paper income tax return (including amended returns), include the voucher and payment with your return and mail to this address:

Web if you are filing a paper income tax return (including amended returns), include the voucher and payment with your return and mail to this address: You may be liable for penalty and interest if your return is filed after the due date. If we sent you a bill, see pay a bill or notice instead. Web form title pdf; Download your adjusted document, export it to the cloud, print it from. Web 126 rows new york income tax forms new york printable income tax forms 272 pdfs new york has a state income tax that ranges between 4% and 8.82% , which is. Web find your requested refund amount by form and tax year; Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social security. You can pay your income tax return payment directly on our website from. If you filed for tax year your requested refund amount is;

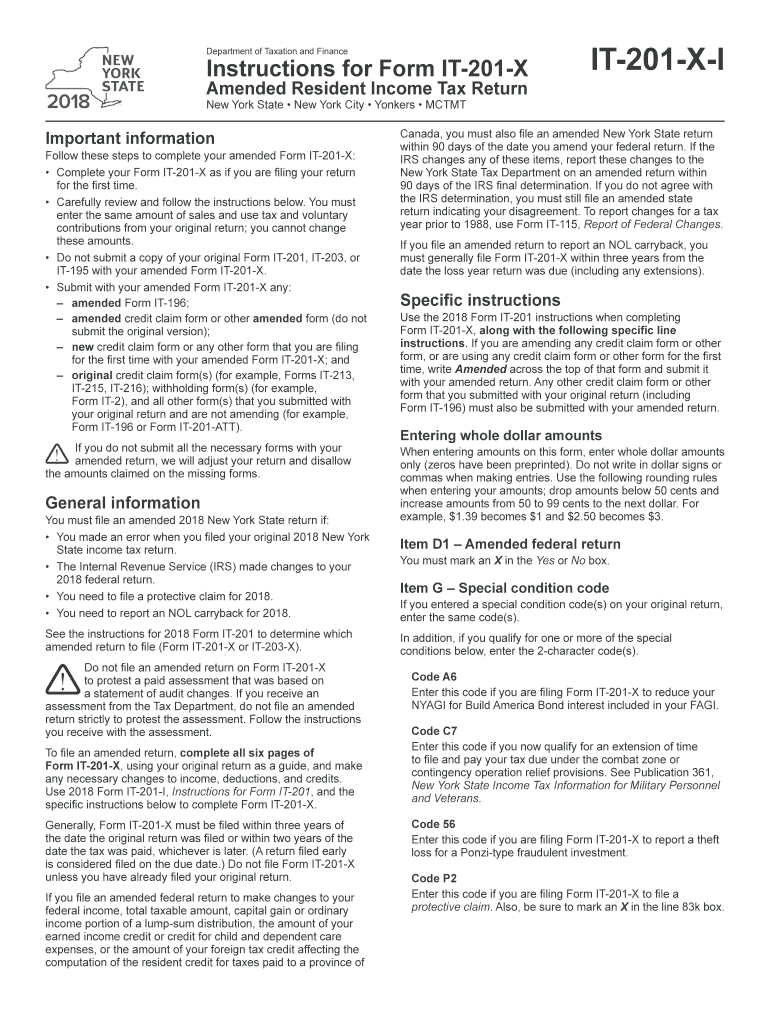

2018 Form NY DTF IT201XI Fill Online, Printable, Fillable, Blank

Generally, you must file a new york. This form is for income earned in tax year 2022, with tax returns. You can pay your income tax return payment directly on our website from. Web 126 rows new york income tax forms new york printable income tax forms 272 pdfs new york has a state income tax that ranges between 4%.

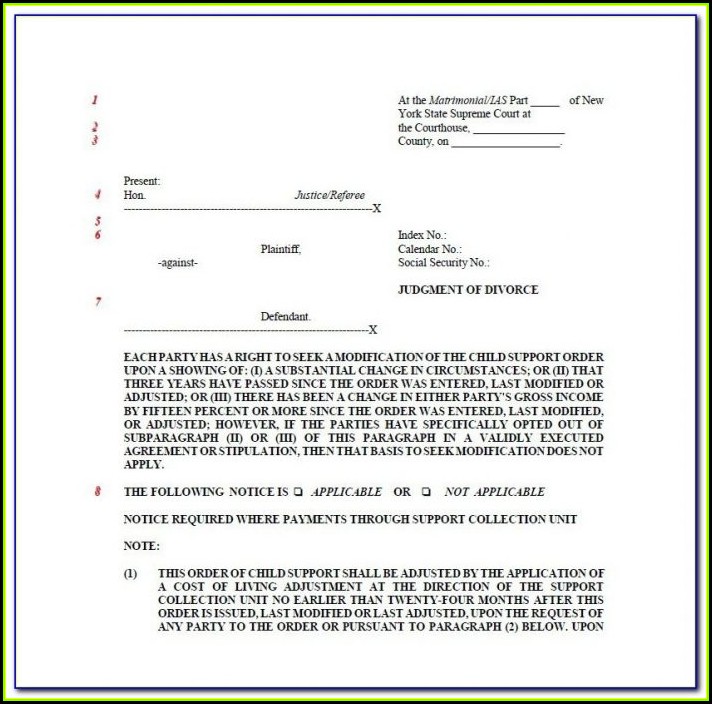

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

If you filed for tax year your requested refund amount is; Web form title pdf; Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social security. Web submit form and all relevant attachments to international graduate student services. Web 2 1 filing status (mark an in one box):

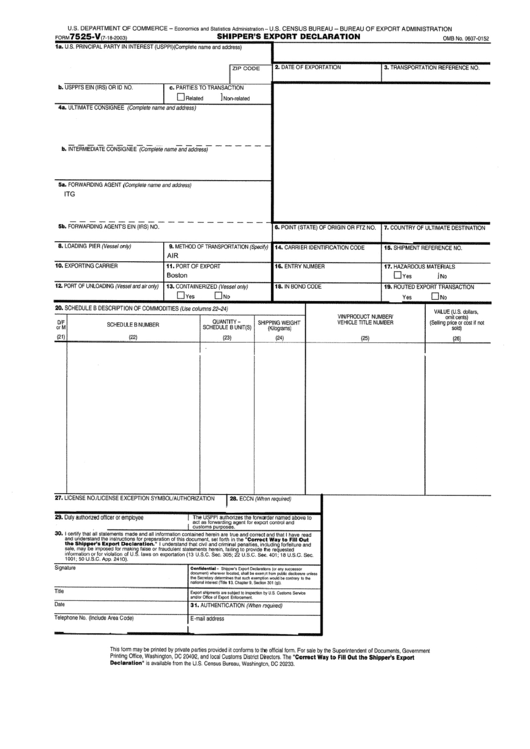

Form 7525V Shipper'S Export Declaration printable pdf download

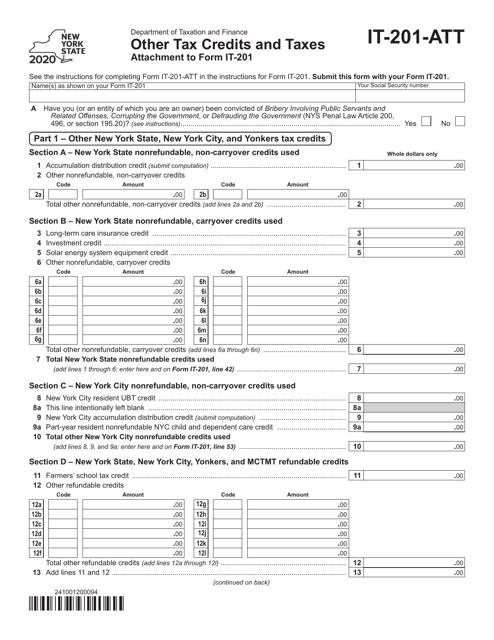

You may be liable for penalty and interest if your return is filed after the due date. Nys other tax credits and taxes. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social security. Penalty and interest are not automatically computed. If we sent you a bill, see pay a bill or.

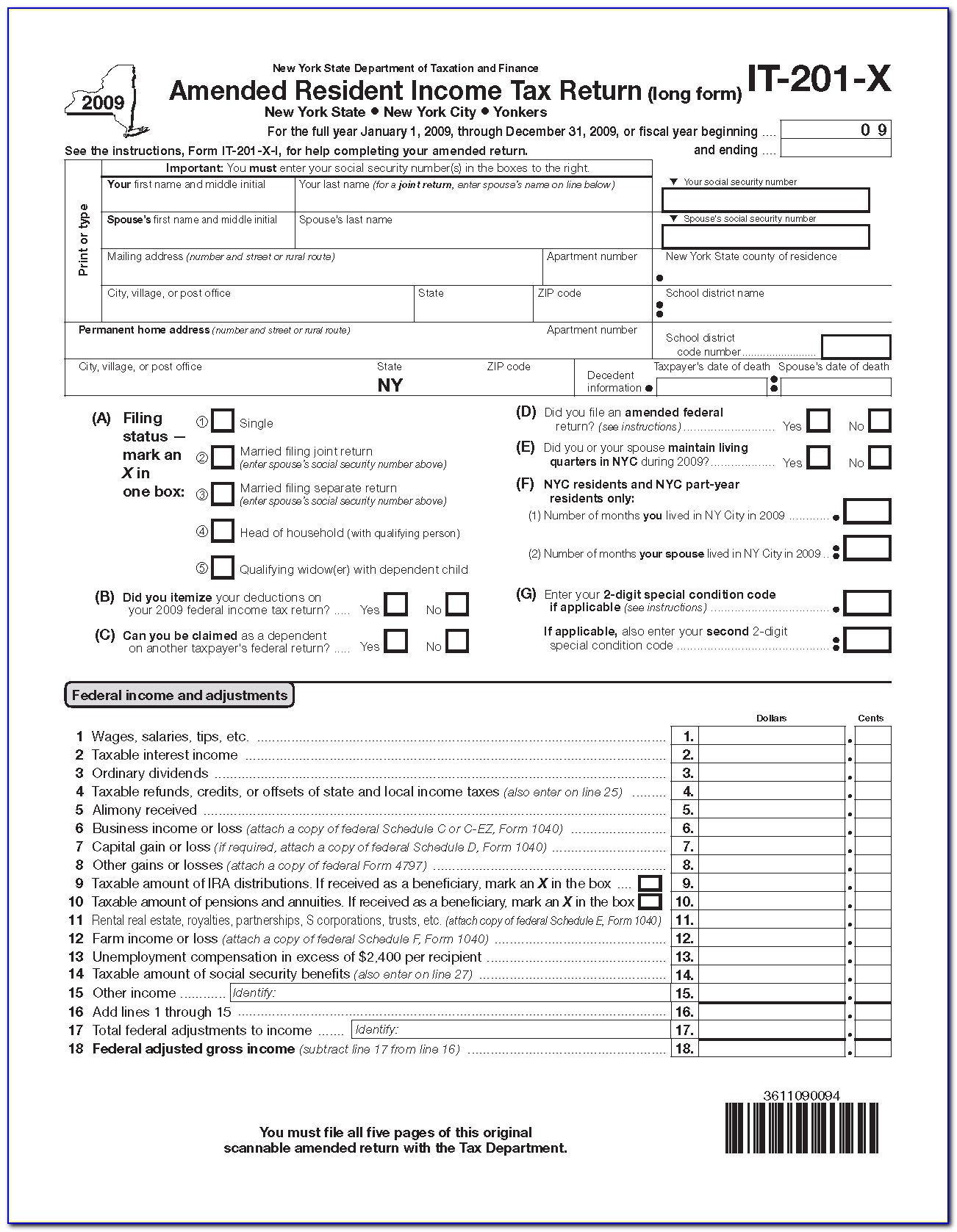

Printable Ny State Tax Form It 201 Form Resume Examples VEk19Rmk8p

If we sent you a bill, see pay a bill or notice instead. Web 126 rows new york income tax forms new york printable income tax forms 272 pdfs new york has a state income tax that ranges between 4% and 8.82% , which is. Penalty and interest are not automatically computed. This form is for income earned in tax.

Pay Nys Tax Online

You can pay your income tax return payment directly on our website from. This form is for income earned in tax year 2022, with tax returns. You may be liable for penalty and interest if your return is filed after the due date. Who needs to file a nys tax return? International graduate student services 120 graduate life center at.

Form IT203C Nonresident or PartYear Resident Spouse's Certification,

You can pay your income tax return payment directly on our website from. Generally, you must file a new york. International graduate student services 120 graduate life center at donaldson brown. If we sent you a bill, see pay a bill or notice instead. You may be liable for penalty and interest if your return is filed after the due.

Printable Ny State Tax Form It 201 Form Resume Examples Xk87wz28ZW

Generally, you must file a new york. This form is for income earned in tax year 2022, with tax returns. Web submit form and all relevant attachments to international graduate student services. International graduate student services 120 graduate life center at donaldson brown. Web if you are filing a paper income tax return (including amended returns), include the voucher and.

Form IT201ATT Download Fillable PDF or Fill Online Other Tax Credits

Web find your requested refund amount by form and tax year; Nys other tax credits and taxes. Web form title pdf; Web 126 rows new york income tax forms new york printable income tax forms 272 pdfs new york has a state income tax that ranges between 4% and 8.82% , which is. Web if you are filing a paper.

Form IT201V Download Fillable PDF or Fill Online Payment Voucher for

Web 2 1 filing status (mark an in one box): Web form title pdf; This form is for income earned in tax year 2022, with tax returns. You may be liable for penalty and interest if your return is filed after the due date. If we sent you a bill, see pay a bill or notice instead.

Fill Free fillable IT201V Instructions for Form IT201V (New York

Who needs to file a nys tax return? Generally, you must file a new york. International graduate student services 120 graduate life center at donaldson brown. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social security. If we sent you a bill, see pay a bill or notice instead.

Web Submit Form And All Relevant Attachments To International Graduate Student Services.

Generally, you must file a new york. Web form title pdf; Who needs to file a nys tax return? Penalty and interest are not automatically computed.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns.

Web 126 rows new york income tax forms new york printable income tax forms 272 pdfs new york has a state income tax that ranges between 4% and 8.82% , which is. You may be liable for penalty and interest if your return is filed after the due date. You can pay your income tax return payment directly on our website from. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social security.

Nys Other Tax Credits And Taxes.

International graduate student services 120 graduate life center at donaldson brown. Download your adjusted document, export it to the cloud, print it from. If we sent you a bill, see pay a bill or notice instead. If you filed for tax year your requested refund amount is;

Web Find Your Requested Refund Amount By Form And Tax Year;

Web 2 1 filing status (mark an in one box): Web if you are filing a paper income tax return (including amended returns), include the voucher and payment with your return and mail to this address: