It-9 Form

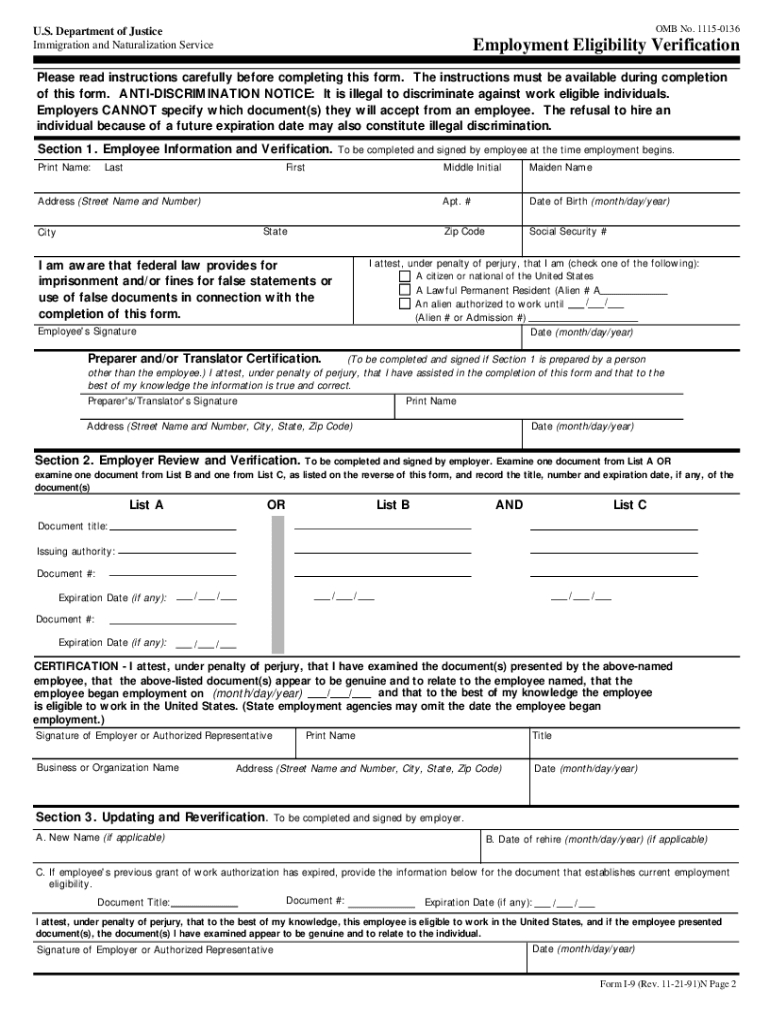

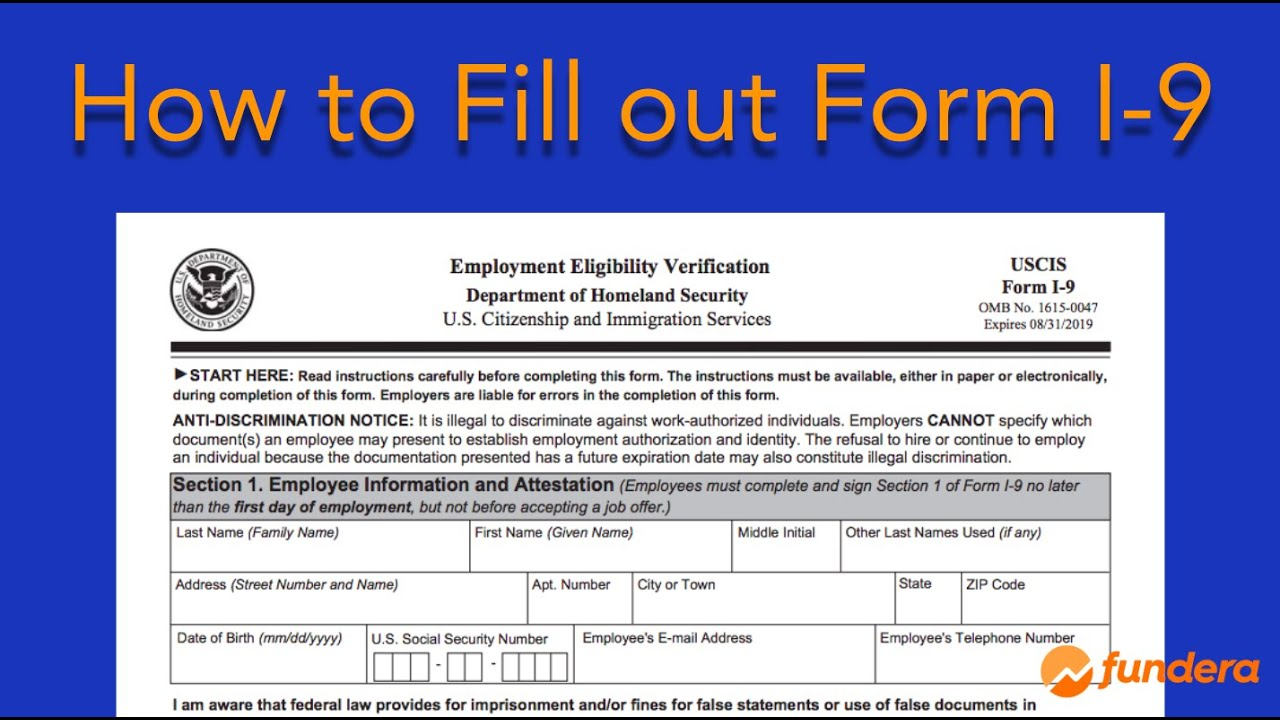

It-9 Form - Web federal law requires that every employer who recruits, refers for a fee, or hires an individual for employment in the u.s. Employers need to record the document. Web if you are a u.s. Employers may continue to use the older. For federal tax purposes, you are considered a u.s. Is designed to be a fillable form on tablets and mobile devices; Employees are who they say they are. 6, 1986, in the u.s. You must get an extension of time to file if you are required to file a 2018 indiana individual income tax return, but cannot file by the april 15, 2019 due date. Employers are liable for errors in the completion of this form.

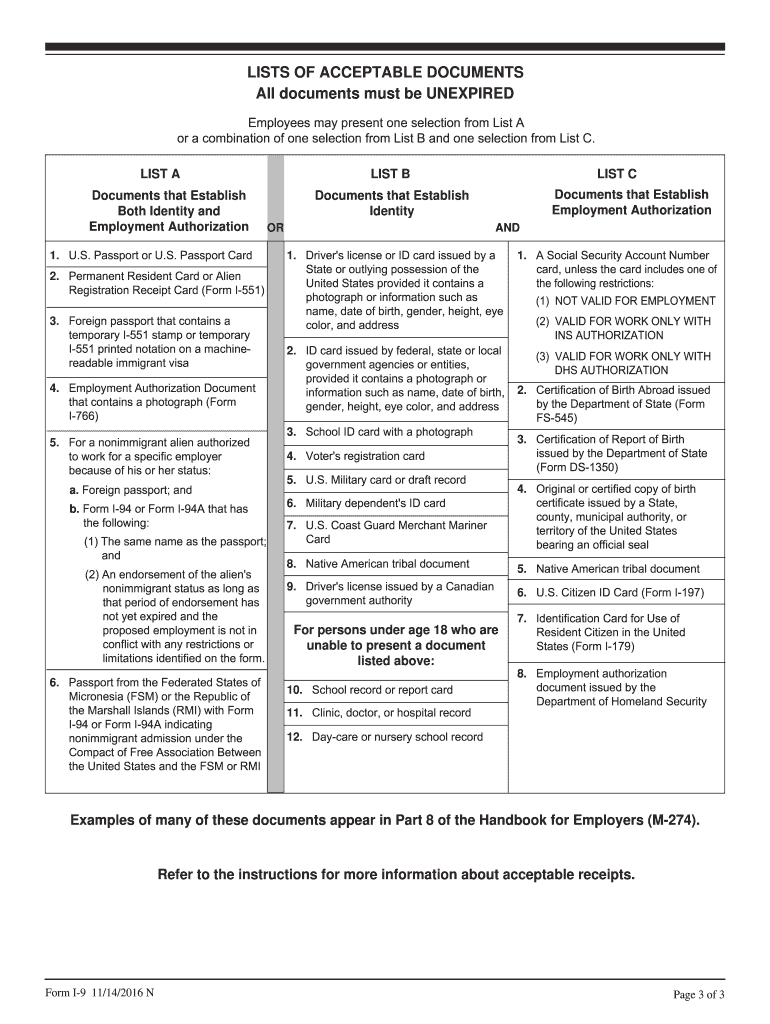

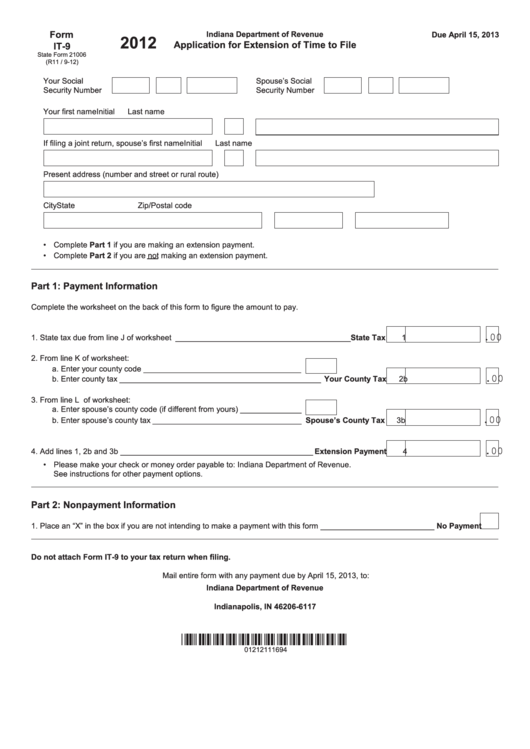

Employers must then evaluate whether the documents presented to them appear genuine and relate to the employee. • an individual who is a u.s. Employers need to record the document. Employers may continue to use the older. You must get an extension of time to file if you are required to file a 2018 indiana individual income tax return, but cannot file by the april 15, 2019 due date. Government requires for each employee. Web if you are a u.s. The instructions must be available, either in paper or electronically, during completion of this form. Application for extension of time to file instructions who should get an extension of time to file? This form is for income earned in tax year 2022, with tax returns due in april 2023.

Employees are authorized to work in the u.s. Government requires for each employee. For federal tax purposes, you are considered a u.s. It was created by the united states citizenship and immigration services (uscis) sector of the department of homeland security (dhs) and must be completed for every employee hired in the u.s. 6, 1986, in the u.s. The instructions must be available, either in paper or electronically, during completion of this form. Read instructions carefully before completing this form. Employers must then evaluate whether the documents presented to them appear genuine and relate to the employee. For the employee, establishing identity. Application for extension of time to file instructions who should get an extension of time to file?

Barbara Johnson Blog I9 Form What Is It, Where to Find It, How to

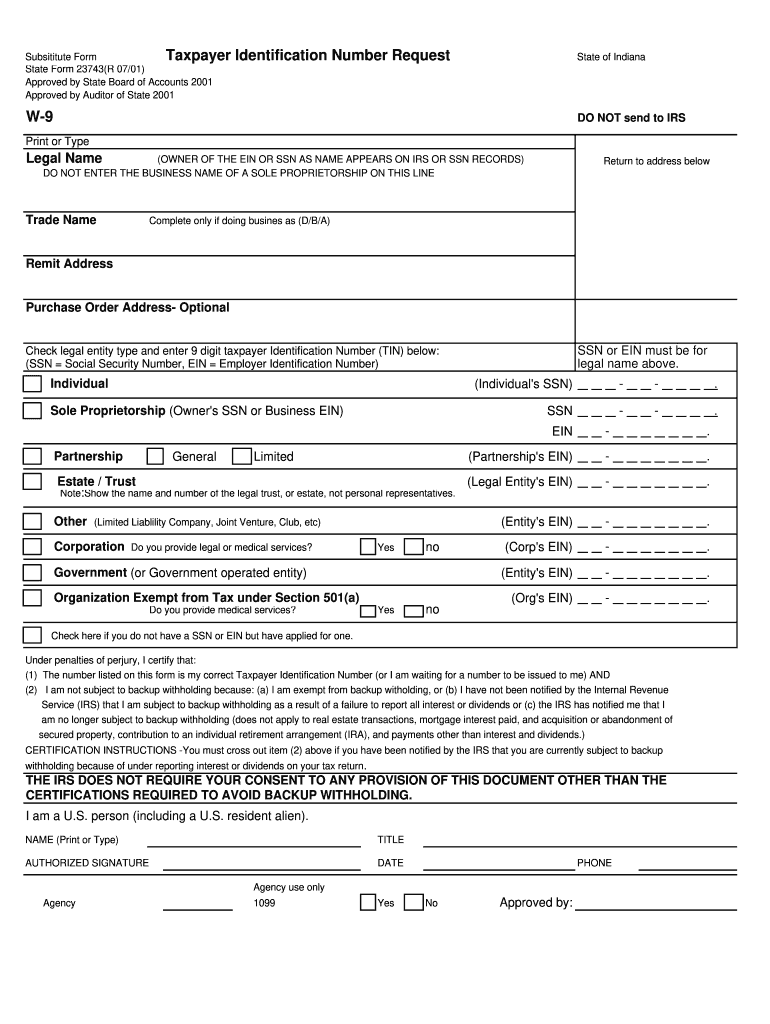

Indiana department of revenue p.o. Employees are who they say they are. This part of the form is completed by the employee. We will update this page with a new version of the form for 2024 as soon as it is made available by the indiana government. 6, 1986, in the u.s.

Free Printable I 9 Forms Example Calendar Printable

It includes information such as the employee’s. Web federal law requires that every employer who recruits, refers for a fee, or hires an individual for employment in the u.s. For the employee, establishing identity. It was created by the united states citizenship and immigration services (uscis) sector of the department of homeland security (dhs) and must be completed for every.

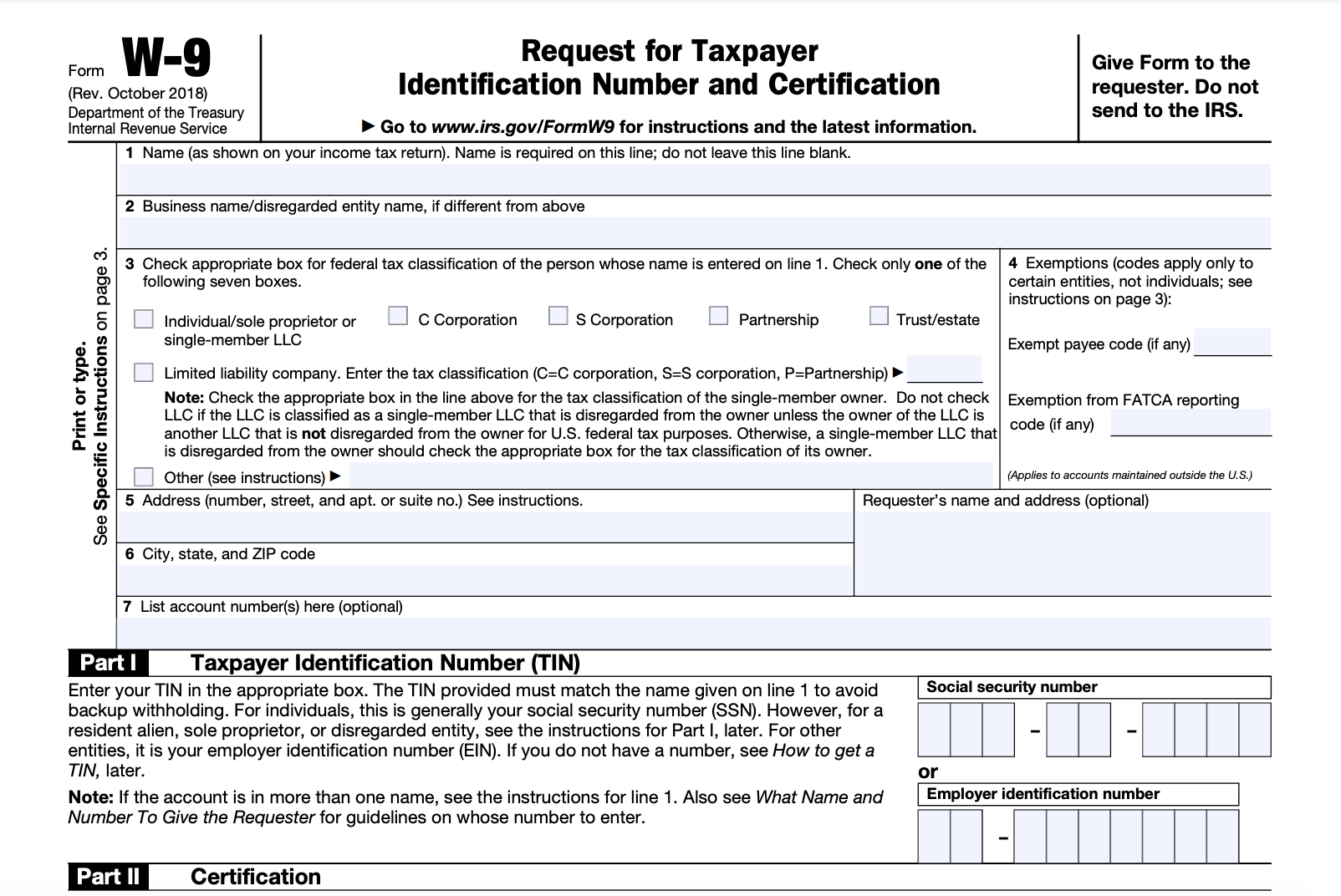

W9 Form Fill Out the IRS W9 Form Online for 2019 Smallpdf

For the employee, establishing identity. Indiana department of revenue p.o. It includes information such as the employee’s. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the purpose of this form is to document that each new employee (both citizen and noncitizen) hired after november 6, 1986, is authorized to work.

I9 Form Fill Online, Printable, Fillable, Blank pdfFiller

Citizenship and immigration services , will help you verify your employee's identity and employment authorization. This form is for income earned in tax year 2022, with tax returns due in april 2023. Employers need to record the document. Web the purpose of this form is to document that each new employee (both citizen and noncitizen) hired after november 6, 1986,.

Blank I9 Form Printable 2020 Calendar Printable Free

Application for extension of time to file instructions *24100000000* 24100000000 who should get an extension of time to file? Employers are liable for errors in the completion of this form. Web the purpose of this form is to document that each new employee (both citizen and noncitizen) hired after november 6, 1986, is authorized to work in the united states..

When to Use Section 3 of the I9 Form HR Daily Advisor

Employers must then evaluate whether the documents presented to them appear genuine and relate to the employee. Indiana department of revenue p.o. Employers are liable for errors in the completion of this form. Application for extension of time to file instructions *24100000000* 24100000000 who should get an extension of time to file? Read instructions carefully before completing this form.

Indiana Taxpayer Id Number Fill Online, Printable, Fillable, Blank

It includes information such as the employee’s. Moves the section 1 preparer/translator certification area to a separate, standalone supplement that employers can provide to employees when necessary; Web if you are a u.s. Read instructions carefully before completing this form. Indiana department of revenue p.o.

Free I 9 Form 2020 Printable Example Calendar Printable

Moves the section 1 preparer/translator certification area to a separate, standalone supplement that employers can provide to employees when necessary; This form is for income earned in tax year 2022, with tax returns due in april 2023. Indiana department of revenue p.o. Government requires for each employee. Employees are authorized to work in the u.s.

Fillable Form It9 Application For Extension Of Time To File 2012

Employers may continue to use the older. 6, 1986, in the u.s. For the employee, establishing identity. The form is completed by both the employer—you, in this case—and your employee. This form is for income earned in tax year 2022, with tax returns due in april 2023.

9 Form A Log by Blowing Up The Free Listening on SoundCloud

Web file (form 4868) by april 15, 2021, then you automatically have an extension with indiana. For the employee, establishing identity. You must get an extension of time to file if you are required to file a 2022 indiana individual income tax return, but cannot file by the april 18, 2023 due date. This part of the form is completed.

Web The Purpose Of This Form Is To Document That Each New Employee (Both Citizen And Noncitizen) Hired After November 6, 1986, Is Authorized To Work In The United States.

Employers may continue to use the older. 6, 1986, in the u.s. Employers need to record the document. Employees are authorized to work in the u.s.

Application For Extension Of Time To File Instructions Who Should Get An Extension Of Time To File?

Employers must then evaluate whether the documents presented to them appear genuine and relate to the employee. Is designed to be a fillable form on tablets and mobile devices; It includes information such as the employee’s. You must get an extension of time to file if you are required to file a 2018 indiana individual income tax return, but cannot file by the april 15, 2019 due date.

It Was Created By The United States Citizenship And Immigration Services (Uscis) Sector Of The Department Of Homeland Security (Dhs) And Must Be Completed For Every Employee Hired In The U.s.

Employees are who they say they are. This form is for income earned in tax year 2022, with tax returns due in april 2023. Employers are liable for errors in the completion of this form. The form is completed by both the employer—you, in this case—and your employee.

For Federal Tax Purposes, You Are Considered A U.s.

Web file (form 4868) by april 15, 2021, then you automatically have an extension with indiana. Web federal law requires that every employer who recruits, refers for a fee, or hires an individual for employment in the u.s. Web if you are a u.s. This part of the form is completed by the employee.