K4 Form Kentucky

K4 Form Kentucky - Web kentucky recently enacted a new flat 5% income tax rate. Due to this change all kentucky wage earners will be taxed at 5% with an allowance for the standard deduction. (103 kar 18:150) the paper. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Use get form or simply click on the template preview to open it in the editor. 5 written notice of withdrawal (rev. Compared to the 2021 version, the formula’s standard deduction. Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. Easily fill out pdf blank, edit, and sign them. Web instructions for employers i.

Web kentucky’s 2022 withholding formula was released dec. Wages subject to withholding for withholding tax purposes, the terms wages, employee and employer mean the same as. Due to this change all kentucky wage earners will be taxed at 5% with an allowance for the standard deduction. Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. Web instructions for employers i. Sign it in a few clicks draw your signature, type it, upload its. Compared to the 2021 version, the formula’s standard deduction. Edit your ky 4 online type text, add images, blackout confidential details, add comments, highlights and more. Edit your kentucky k 4 fillable tax form online. 7/97) department of workers claims 1270 louisville road frankfort, kentucky 40601 written notice of withdrawal of form 4.

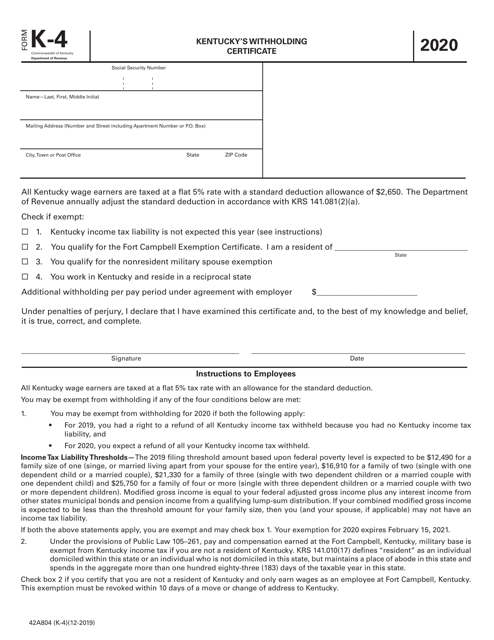

Web kentucky’s withholding certificate 2019 social security number name—last, first, middle initial mailing address (number and street including apartment number or. Compared to the 2021 version, the formula’s standard deduction. Due to this change all kentucky wage earners will be taxed at 5% with an allowance for the standard deduction. (103 kar 18:150) the paper. Sign it in a few clicks. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Start completing the fillable fields. Use get form or simply click on the template preview to open it in the editor. Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. Wages subject to withholding for withholding tax purposes, the terms wages, employee and employer mean the same as.

Form K4 (42A804) Download Printable PDF or Fill Online Kentucky's

Sign it in a few clicks draw your signature, type it, upload its. 15 by the state revenue department. Web instructions for employers i. Start completing the fillable fields. Save or instantly send your ready documents.

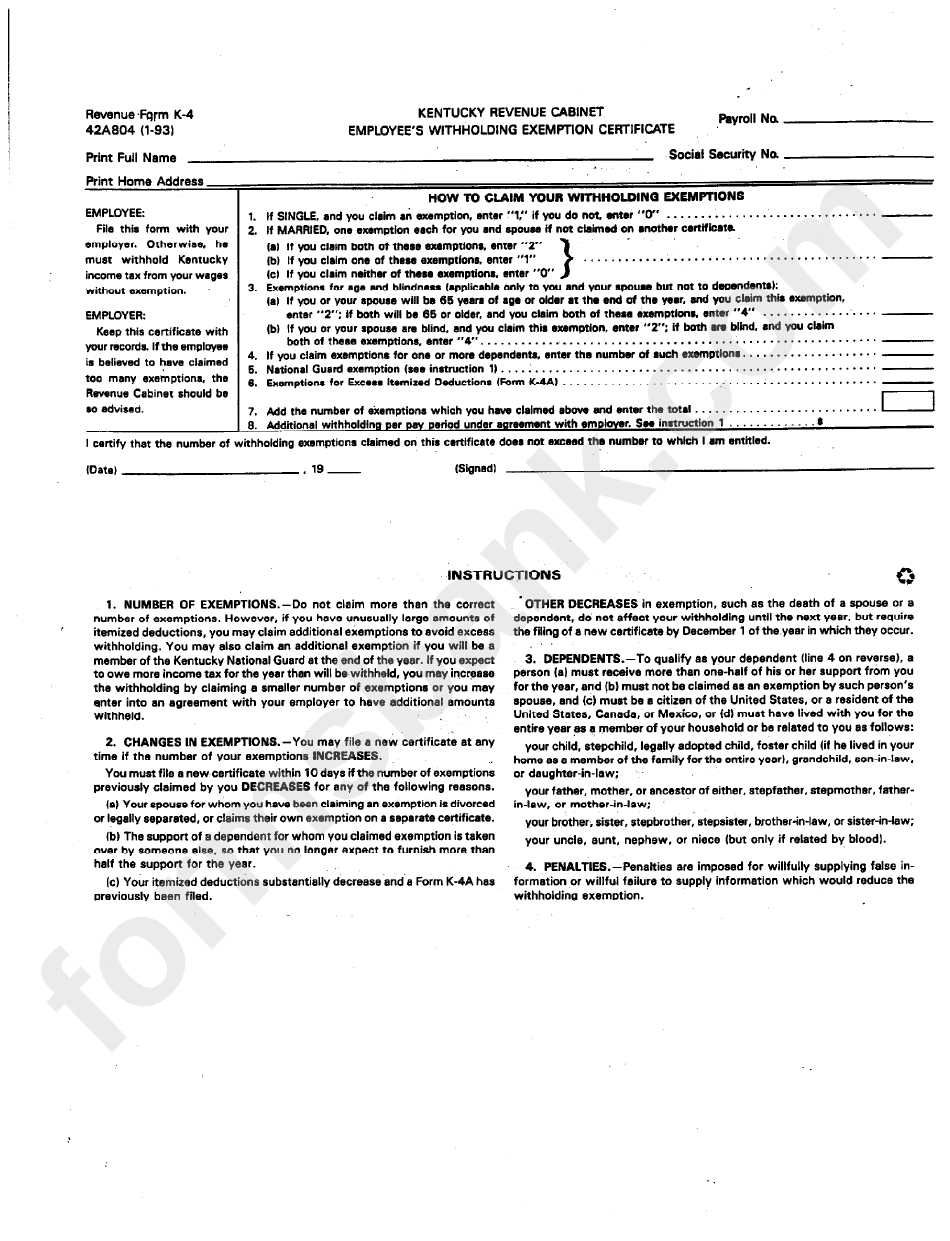

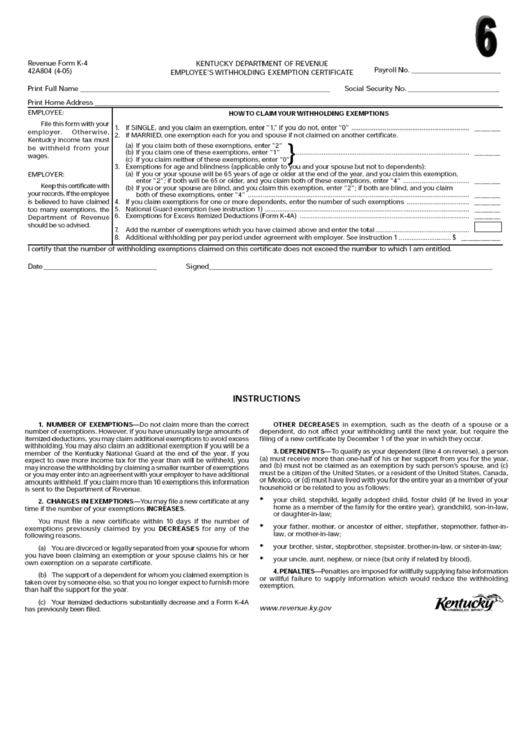

Top Kentucky Form K4 Templates free to download in PDF format

Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Sign it in a few clicks draw your signature, type it, upload its. Edit your ky 4 online type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your.

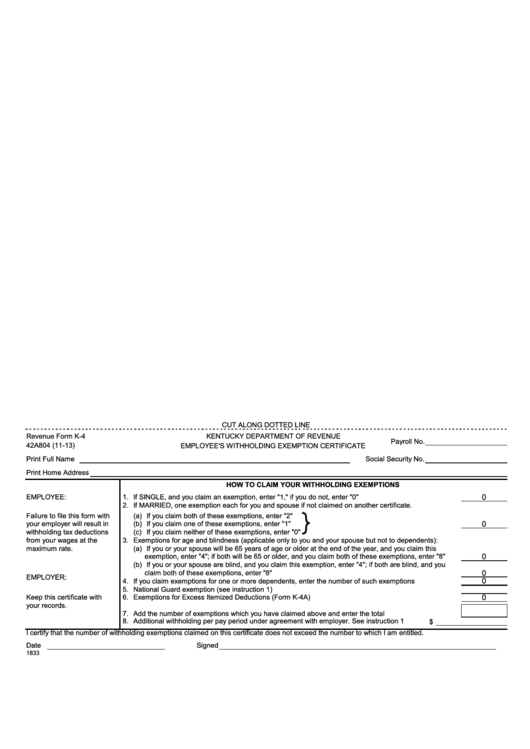

Fillable Form K4 Employee'S Withholding Exemption Certificate

Start completing the fillable fields. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Edit your kentucky k 4 fillable tax form online. Easily fill out pdf blank, edit, and sign them. Wages subject to withholding for withholding tax purposes, the terms wages, employee.

2+ Kansas Do Not Resuscitate Form Free Download

Sign it in a few clicks. (103 kar 18:150) the paper. Pdf (portable document format) is a file format that captures all the. Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. 15 by the state revenue department.

Top Kentucky Form K4 Templates free to download in PDF format

Edit your ky 4 online type text, add images, blackout confidential details, add comments, highlights and more. Web kentucky recently enacted a new flat 5% income tax rate. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Easily fill out pdf blank, edit, and.

W4 Forms 2021 2022 Zrivo

5 written notice of withdrawal (rev. Pdf (portable document format) is a file format that captures all the. Wages subject to withholding for withholding tax purposes, the terms wages, employee and employer mean the same as. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1,.

ASRock X370 Gaming K4 ATX Form Factor For AMD Motherboard at Mighty

Use get form or simply click on the template preview to open it in the editor. Web kentucky’s 2022 withholding formula was released dec. Sign it in a few clicks. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

Kentucky Employee State Withholding Form 2022

Edit your ky 4 online type text, add images, blackout confidential details, add comments, highlights and more. Web instructions for employers i. Save or instantly send your ready documents. 5 written notice of withdrawal (rev. (103 kar 18:150) the paper.

Fill Free fillable K4 Important Please PDF form

Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Web kentucky’s withholding certificate 2019 social security number name—last, first, middle initial mailing address (number and street including apartment number or. (103 kar 18:150) the paper. Pdf (portable document format) is a file format that.

5506 Kentucky Avenue K4 Apartments Near Carnegie Mellon, Pitt

Start completing the fillable fields. Type text, add images, blackout confidential details, add comments, highlights and more. Edit your ky 4 online type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your ready documents. Web kentucky’s 2022 withholding formula was released dec.

Pdf (Portable Document Format) Is A File Format That Captures All The.

Edit your kentucky k 4 fillable tax form online. (103 kar 18:150) the paper. Due to this change all kentucky wage earners will be taxed at 5% with an allowance for the standard deduction. Web kentucky’s withholding certificate 2019 social security number name—last, first, middle initial mailing address (number and street including apartment number or.

Web A Kentucky Form K 4 Is A Pdf Form That Can Be Filled Out, Edited Or Modified By Anyone Online.

5 written notice of withdrawal (rev. Easily fill out pdf blank, edit, and sign them. Type text, add images, blackout confidential details, add comments, highlights and more. Web up to $40 cash back form no.

7/97) Department Of Workers Claims 1270 Louisville Road Frankfort, Kentucky 40601 Written Notice Of Withdrawal Of Form 4.

Web kentucky’s 2022 withholding formula was released dec. Use get form or simply click on the template preview to open it in the editor. Compared to the 2021 version, the formula’s standard deduction. Start completing the fillable fields.

Sign It In A Few Clicks.

Web instructions for employers i. Web kentucky recently enacted a new flat 5% income tax rate. Wages subject to withholding for withholding tax purposes, the terms wages, employee and employer mean the same as. Edit your ky 4 online type text, add images, blackout confidential details, add comments, highlights and more.