Kentucky Form 720 Extension

Kentucky Form 720 Extension - Web the new irs nos. Web kentucky state general business corporation tax extension form 720ext is due within 4 months and 15 days following the end of the corporation reporting period. Web for kentucky purposes, do not file federal form 7004 if filing kentucky form 41a720sl. Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. The requirement may be met by. 53 and 16 are added to form 720, part i. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Web use this form if you are requesting a kentucky extension of time to file. Renewable diesel and kerosene changes. Any extension granted is for time to file.

Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. See the instructions for form 6627, environmental taxes. Type text, add images, blackout confidential details, add comments, highlights and more. Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Web the new irs nos. Web use this form if you are requesting a kentucky extension of time to file. Sign it in a few clicks. Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. Form 720ext is produced from entries on the other extensions > state extension information section. Renewable diesel and kerosene changes.

See the instructions for form 6627, environmental taxes. Web use this form if you are requesting a kentucky extension of time to file. Taxpayers who request a federal extension are not required to file a separate kentucky extension,. Do not send a copy of the electronically filed return with the payment of tax. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. The requirement may be met by. Web for kentucky purposes, do not file federal form 7004 if filing kentucky form 41a720sl. Web the new irs nos. Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. Type text, add images, blackout confidential details, add comments, highlights and more.

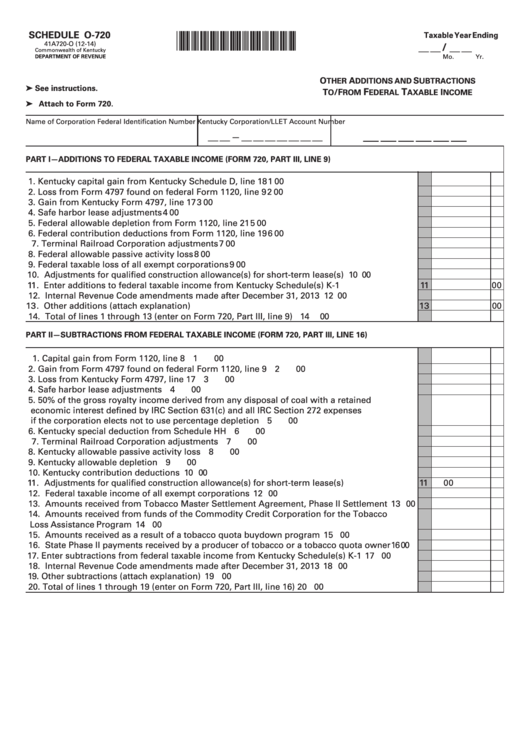

Fillable Schedule O720 (Form 41a720O) Other Additions And

Any extension granted is for time to file. Web tax period beginning and ending dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated.

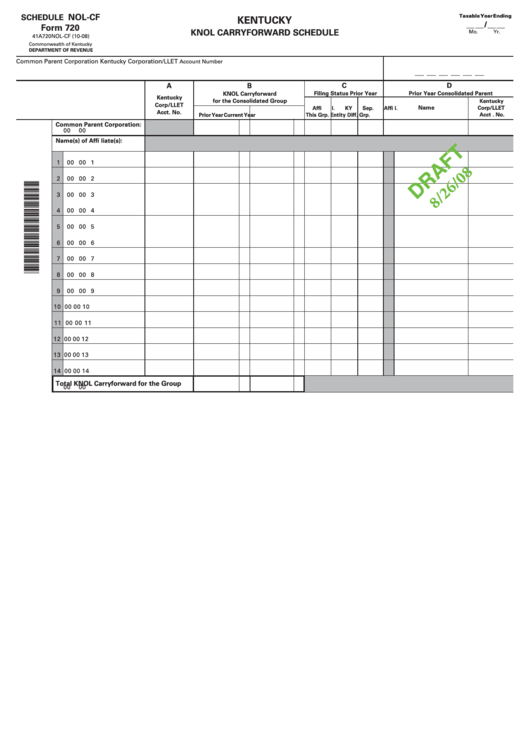

Form 720 Schedule NolCf Kentucky Knol Carryforward Schedule (Draft

Sign it in a few clicks. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. Do not send a copy of the electronically filed return with the payment of tax. Web.

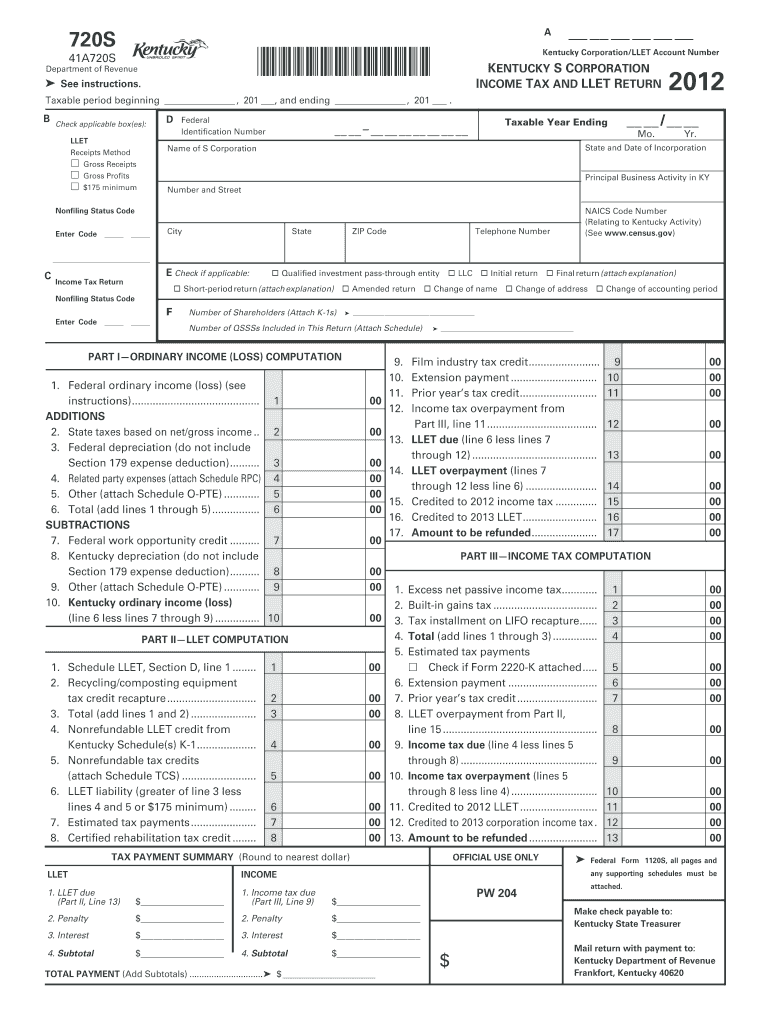

Form 720 Kentucky Corporation Tax And Llet Return 2013

Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Web use this form if you are requesting a kentucky extension of time to file. Web the new irs nos. Web for kentucky purposes, do not file federal form 7004 if filing kentucky form 41a720sl. Web taxpayers who request a federal extension are not required to.

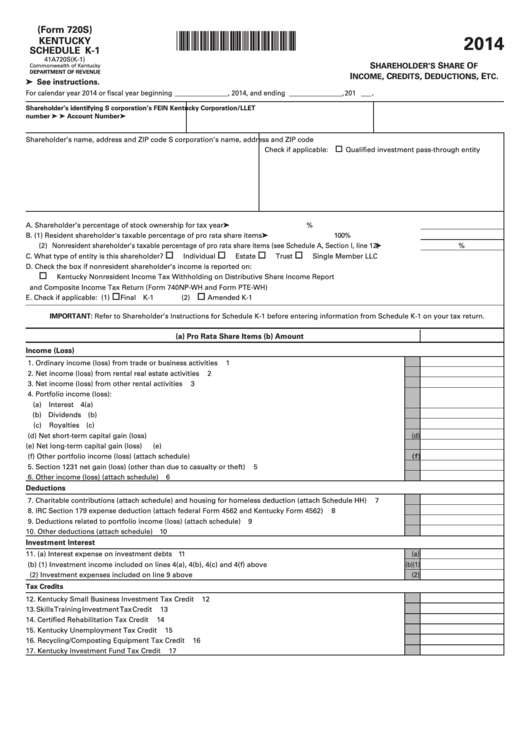

Fillable Kentucky Schedule K1 (Form 720s) Shareholder'S Share Of

Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Taxpayers who request a federal extension are not required to file a separate kentucky extension,. This form is for income earned in tax year 2022, with. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest.

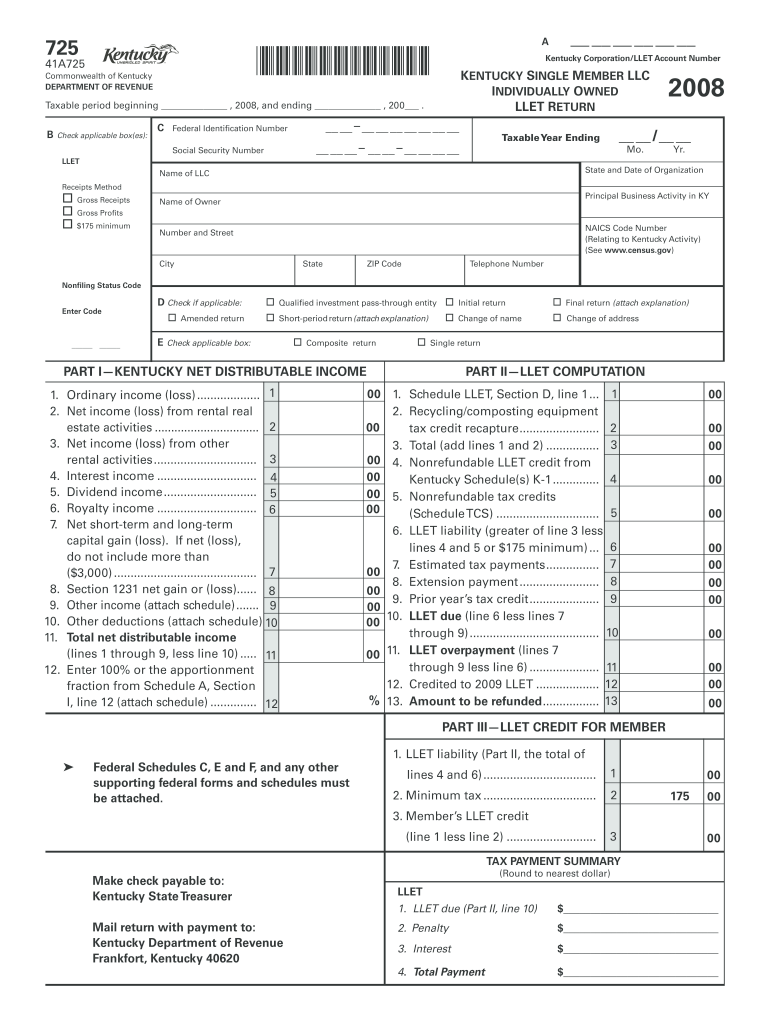

2008 Form KY DoR 725 (41A725) Fill Online, Printable, Fillable, Blank

Web for kentucky purposes, do not file federal form 7004 if filing kentucky form 41a720sl. Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Web the new irs nos. Do not send a copy of the electronically filed return with the payment of tax. Edit your kentucky form 720.

2012 Form KY DoR 720S Fill Online, Printable, Fillable, Blank PDFfiller

Sign it in a few clicks. 53 and 16 are added to form 720, part i. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. Form 720ext is produced from entries on the other extensions > state extension information.

Form 720 Es Ky Fillable Fill Online, Printable, Fillable, Blank

Web tax period beginning and ending dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays. See the instructions for form 6627, environmental taxes. This form is for income earned in tax year 2022, with. Renewable diesel and kerosene changes. Web we last updated the kentucky corporation income tax and.

Form 720 Kentucky Corporation Tax YouTube

Web kentucky state general business corporation tax extension form 720ext is due within 4 months and 15 days following the end of the corporation reporting period. Any extension granted is for time to file. Edit your kentucky form 720 es 2019 online. Web the new irs nos. Web for kentucky purposes, do not file federal form 7004 if filing kentucky.

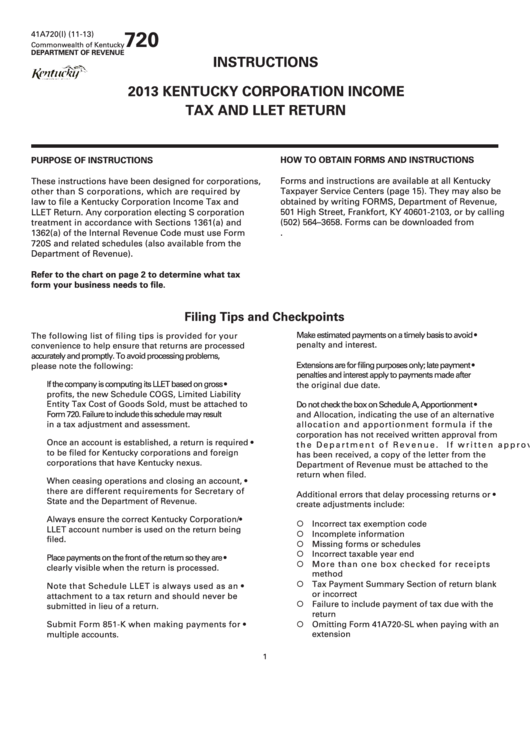

Instructions For Form 720 Kentucky Corporation Tax And Llet

Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. See the instructions for form 6627, environmental taxes. Taxpayers who request a federal extension are not required to file a separate kentucky extension,. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this.

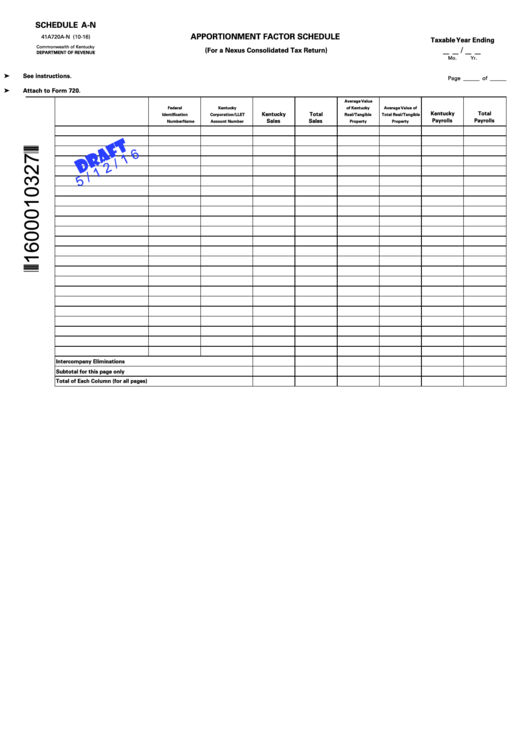

Schedule AN Draft Attach To Form 720 Apportionment Factor Schedule

Web use this form if you are requesting a kentucky extension of time to file. Web the new irs nos. See the instructions for form 6627, environmental taxes. Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. Form 720ext is produced from entries on the.

See The Instructions For Form 6627, Environmental Taxes.

Renewable diesel and kerosene changes. 53 and 16 are added to form 720, part i. Sign it in a few clicks. Web the new irs nos.

Web We Last Updated The Kentucky Corporation Income Tax And Llet Return In February 2023, So This Is The Latest Version Of Form 720, Fully Updated For Tax Year 2022.

Web use this form if you are requesting a kentucky extension of time to file. This form is for income earned in tax year 2022, with. The requirement may be met by. Web tax period beginning and ending dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays.

Edit Your Kentucky Form 720 Es 2019 Online.

Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Form 720ext is produced from entries on the other extensions > state extension information section. Web for kentucky purposes, do not file federal form 7004 if filing kentucky form 41a720sl.

Any Extension Granted Is For Time To File.

Do not send a copy of the electronically filed return with the payment of tax. Type text, add images, blackout confidential details, add comments, highlights and more. Web kentucky state general business corporation tax extension form 720ext is due within 4 months and 15 days following the end of the corporation reporting period. Taxpayers who request a federal extension are not required to file a separate kentucky extension,.