Leasehold Improvements Balance Sheet

Leasehold Improvements Balance Sheet - They are supposed to be recognized once the expense is. Therefore, they are accounted for with other fixed assets in. Leasehold improvements generally revert to the ownership of the landlord upon termination. These changes are generally made by landlords of commercial properties and may be. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space.

Leasehold improvements generally revert to the ownership of the landlord upon termination. Therefore, they are accounted for with other fixed assets in. These changes are generally made by landlords of commercial properties and may be. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. They are supposed to be recognized once the expense is.

Therefore, they are accounted for with other fixed assets in. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. They are supposed to be recognized once the expense is. Leasehold improvements generally revert to the ownership of the landlord upon termination. These changes are generally made by landlords of commercial properties and may be.

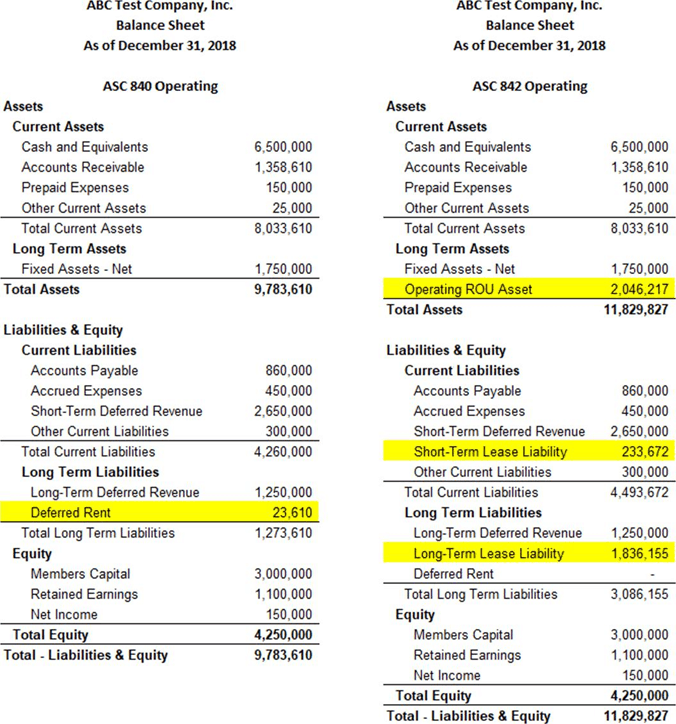

Adjusting to the new lease accounting standard KraftCPAs

Leasehold improvements generally revert to the ownership of the landlord upon termination. These changes are generally made by landlords of commercial properties and may be. Therefore, they are accounted for with other fixed assets in. They are supposed to be recognized once the expense is. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased.

Lease Liabilities The True Impact on the Balance Sheet

Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. These changes are generally made by landlords of commercial properties and may be. Therefore, they are accounted for with other fixed assets in. They are supposed to be recognized once the expense is. Leasehold improvements generally revert to the ownership of the landlord upon.

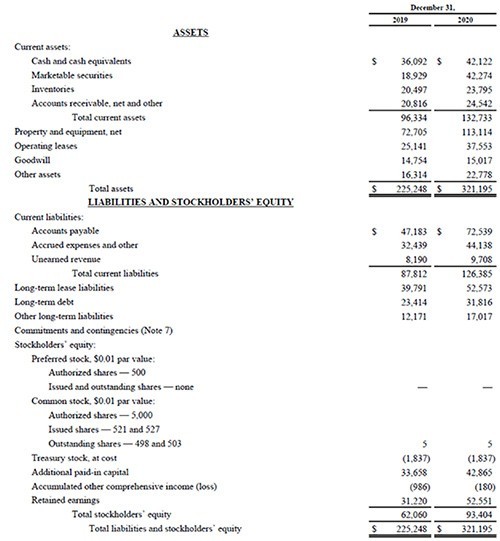

Balance Sheet( in thousands)(1) Includes capital lease obligations of

These changes are generally made by landlords of commercial properties and may be. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. Leasehold improvements generally revert to the ownership of the landlord upon termination. Therefore, they are accounted for with other fixed assets in. They are supposed to be recognized once the expense.

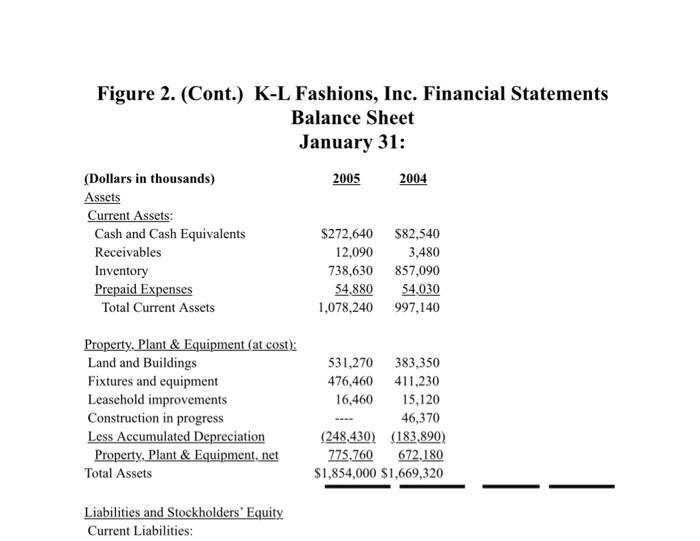

Figure 2. (Cont.) KL Fashions, Inc. Financial

These changes are generally made by landlords of commercial properties and may be. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. Leasehold improvements generally revert to the ownership of the landlord upon termination. Therefore, they are accounted for with other fixed assets in. They are supposed to be recognized once the expense.

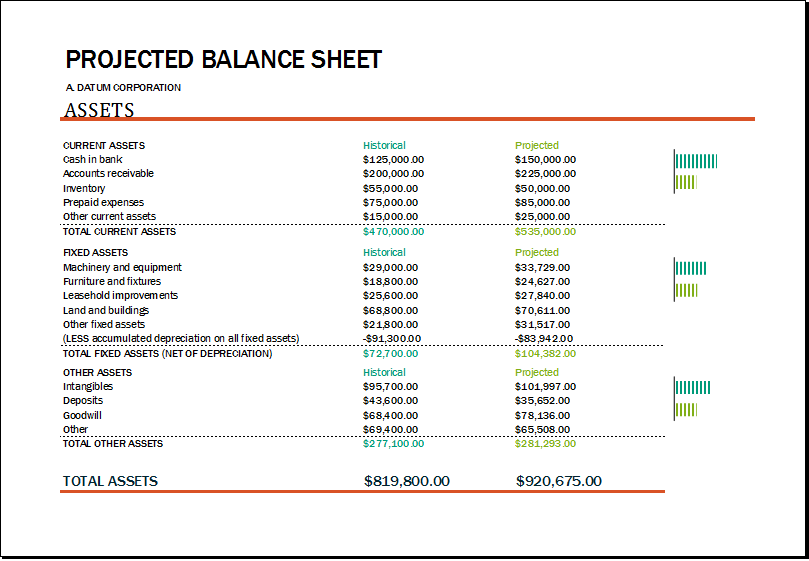

Balance Sheet Format Opening And Projected Leasehold Improvements

Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. Leasehold improvements generally revert to the ownership of the landlord upon termination. They are supposed to be recognized once the expense is. These changes are generally made by landlords of commercial properties and may be. Therefore, they are accounted for with other fixed assets.

Download Free Balance Sheet Templates in Excel

Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. They are supposed to be recognized once the expense is. Therefore, they are accounted for with other fixed assets in. Leasehold improvements generally revert to the ownership of the landlord upon termination. These changes are generally made by landlords of commercial properties and may.

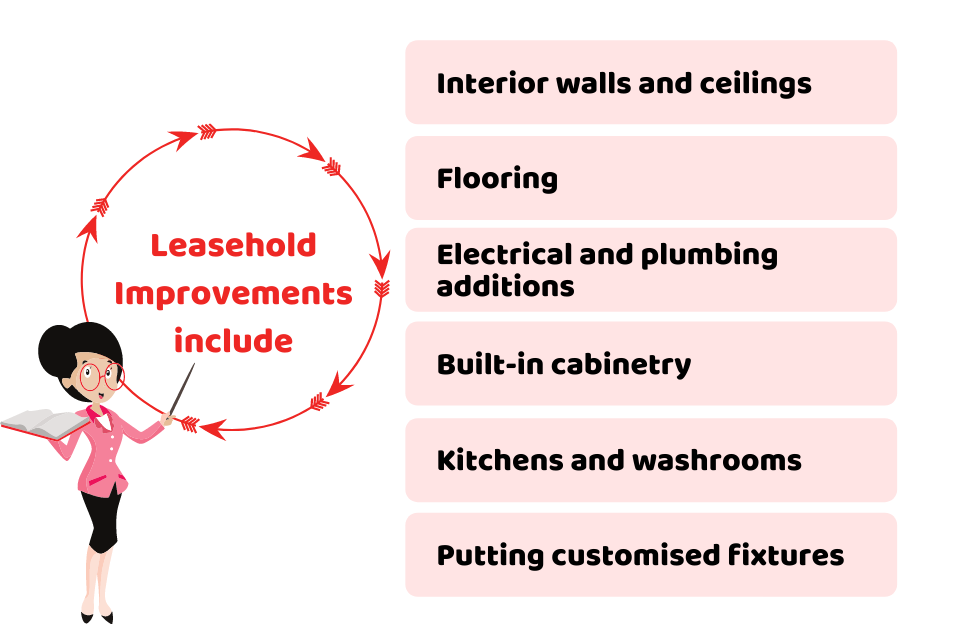

Leasehold Improvements (LI) Definition + Examples

Leasehold improvements generally revert to the ownership of the landlord upon termination. Therefore, they are accounted for with other fixed assets in. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. They are supposed to be recognized once the expense is. These changes are generally made by landlords of commercial properties and may.

Leasehold Improvements

These changes are generally made by landlords of commercial properties and may be. They are supposed to be recognized once the expense is. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. Therefore, they are accounted for with other fixed assets in. Leasehold improvements generally revert to the ownership of the landlord upon.

What Are Leasehold Improvements and How to Account for Them? Accotax

These changes are generally made by landlords of commercial properties and may be. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. Leasehold improvements generally revert to the ownership of the landlord upon termination. Therefore, they are accounted for with other fixed assets in. They are supposed to be recognized once the expense.

Mejora de Locales arrendados / PCGA, Contabilidad, Depreciación

Leasehold improvements generally revert to the ownership of the landlord upon termination. Web leasehold improvements are defined as the enhancements paid for by a tenant to leased space. Therefore, they are accounted for with other fixed assets in. These changes are generally made by landlords of commercial properties and may be. They are supposed to be recognized once the expense.

Web Leasehold Improvements Are Defined As The Enhancements Paid For By A Tenant To Leased Space.

Leasehold improvements generally revert to the ownership of the landlord upon termination. They are supposed to be recognized once the expense is. These changes are generally made by landlords of commercial properties and may be. Therefore, they are accounted for with other fixed assets in.