Leveraged Balance Sheet

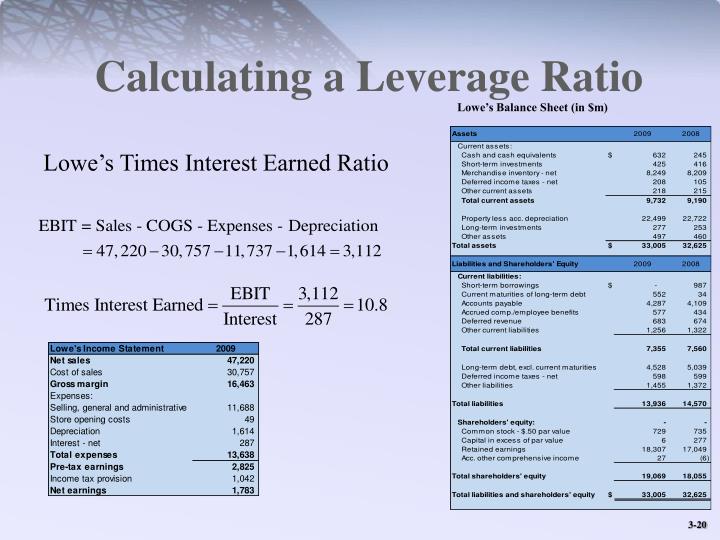

Leveraged Balance Sheet - A leverage ratio may also be used to measure a company's. When a company uses debt financing, its financial leverage increases. A company can analyze its leverage by seeing what percent of its assets have been. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. The financial leverage of a company is the proportion of debt in the. Web below are 5 of the most commonly used leverage ratios: Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. The financial leverage ratio is an indicator of how much. More capital is available to.

A leverage ratio may also be used to measure a company's. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. Web below are 5 of the most commonly used leverage ratios: More capital is available to. When a company uses debt financing, its financial leverage increases. The financial leverage ratio is an indicator of how much. The financial leverage of a company is the proportion of debt in the. A company can analyze its leverage by seeing what percent of its assets have been.

Web below are 5 of the most commonly used leverage ratios: Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. A leverage ratio may also be used to measure a company's. A company can analyze its leverage by seeing what percent of its assets have been. The financial leverage of a company is the proportion of debt in the. When a company uses debt financing, its financial leverage increases. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. More capital is available to. The financial leverage ratio is an indicator of how much.

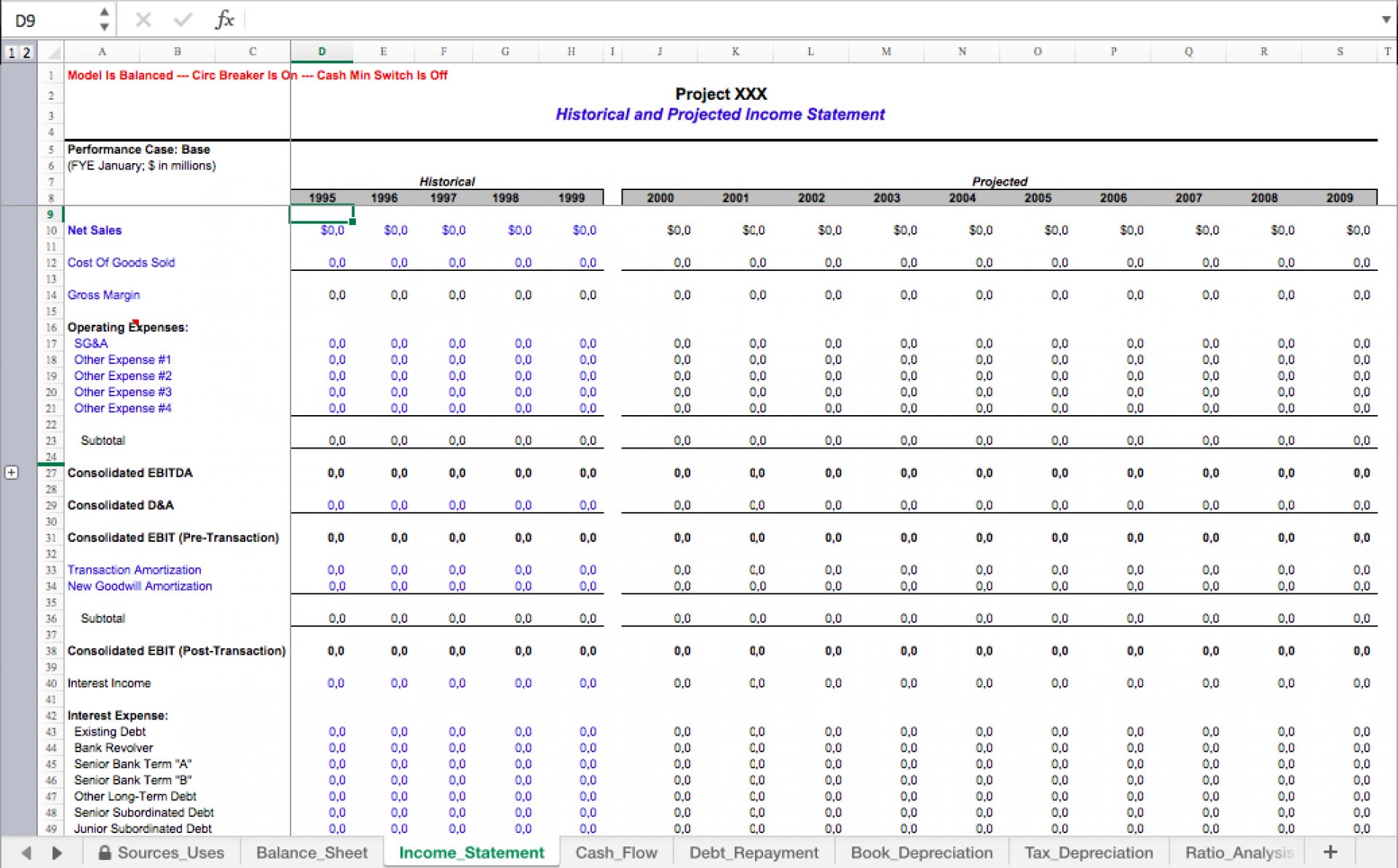

Financial Training Modelling for a merger or LBO (leveraged buyout)

Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. The financial leverage of a company is the proportion of debt in the. A company can analyze its leverage by seeing what percent of its assets have been. The financial leverage ratio is an indicator of.

Lbo Model Template

The financial leverage ratio is an indicator of how much. When a company uses debt financing, its financial leverage increases. A company can analyze its leverage by seeing what percent of its assets have been. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. Web.

Simple LBO Template Excel Model (Leveraged Buyout) Alexander Jarvis

A company can analyze its leverage by seeing what percent of its assets have been. When a company uses debt financing, its financial leverage increases. The financial leverage ratio is an indicator of how much. More capital is available to. Web below are 5 of the most commonly used leverage ratios:

leveragea05.jpg

Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. The financial leverage of a company is the proportion of debt in the. A company can analyze its leverage by seeing what percent of its assets have been. More capital is available to. The financial leverage ratio.

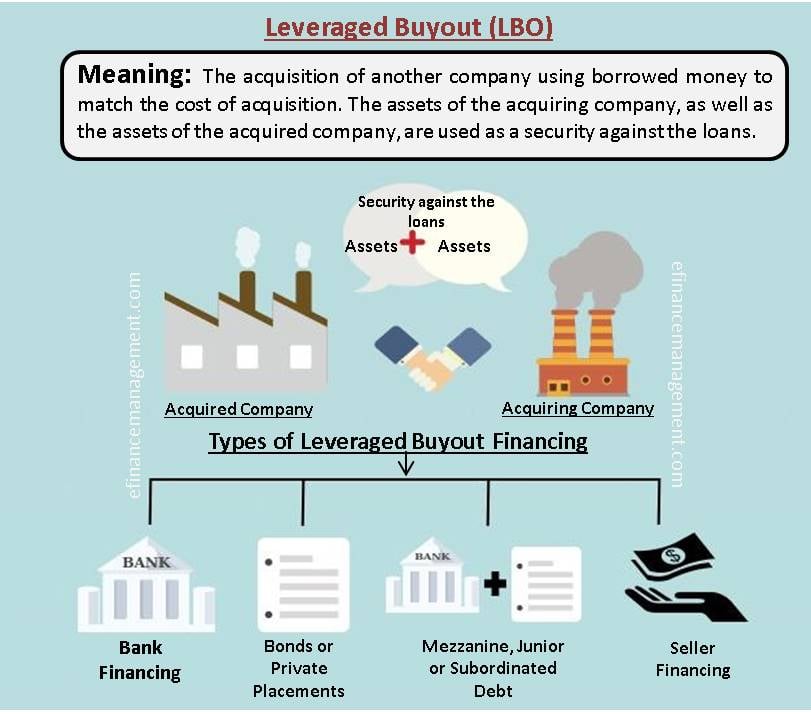

Financial Leverage Meaning, Measuring Ratios, Degree, Illustration eFM

Web below are 5 of the most commonly used leverage ratios: Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. The financial leverage of a company is the proportion of debt in the. The financial leverage ratio is an indicator of how much. When a.

PPT Corporate Performance PowerPoint Presentation ID5436719

When a company uses debt financing, its financial leverage increases. The financial leverage of a company is the proportion of debt in the. The financial leverage ratio is an indicator of how much. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. More capital is available.

Leveraged Buyout, Balance Sheet Example YouTube

A company can analyze its leverage by seeing what percent of its assets have been. When a company uses debt financing, its financial leverage increases. The financial leverage of a company is the proportion of debt in the. Web below are 5 of the most commonly used leverage ratios: Web a leverage ratio is any one of several financial measurements.

Balance Sheet Leverage Edu

Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. A company can analyze its leverage by seeing what percent of its assets have been. The financial leverage of a company is the proportion of debt in the. More capital is available to. When a company uses.

Leveraged The New Economics of Debt and Financial Fragility, Schularick

The financial leverage ratio is an indicator of how much. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. More capital is available to. The financial leverage of a company is the proportion of debt in the. Web below are 5 of the most commonly used.

TriloBoat Talk Mechanical Advantage It's a Matter of Leverage

A company can analyze its leverage by seeing what percent of its assets have been. Web below are 5 of the most commonly used leverage ratios: A leverage ratio may also be used to measure a company's. The financial leverage of a company is the proportion of debt in the. More capital is available to.

A Company Can Analyze Its Leverage By Seeing What Percent Of Its Assets Have Been.

The financial leverage of a company is the proportion of debt in the. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. More capital is available to.

Web Below Are 5 Of The Most Commonly Used Leverage Ratios:

The financial leverage ratio is an indicator of how much. A leverage ratio may also be used to measure a company's. When a company uses debt financing, its financial leverage increases.