Liquor Liability Coverage Form

Liquor Liability Coverage Form - Learn if your business needs liquor liability coverage and how it can affect your insurance costs. Web iso has revised its commercial general liability forms and endorsements, including making changes to coverage for liquor liability. The carrier has also included form #cg 21 50, “amendment of liquor liability exclusion,” which seems to. Web liquor liability coverage form commercial general liability cg 00 33 04 13 liquor liability coverage form various provisions in this policy restrict coverage. The changes—which are among several that iso made to its cgl program in 2013—took effect in april, although agents should check with their insurance companies to find out if they plan to adopt the revisions. Get liquor liability coverage from the hartford. Web liquor liability insurance, also known as dram shop insurance, is liability coverage for businesses that serve, sell, distribute, manufacture or supply alcoholic beverages. Web • basic form product* features expense costs inside the limits of liability, an exclusion for assault or battery coverage and a significant credit for the purchaser • 25 percent credit for bars • 15 percent credit for restaurants Insuring agreement we will pay those sums that the insured becomes legally obligated to pay as damages because of injury to which this insurance applies if liability for such injury is imposed on the insured by reason of the selling, serving or furnishing of any alcoholic beverage. If your company faces a claim of bodily injury or property damage that an intoxicated person has caused after they were served liquor at your location.

Web • basic form product* features expense costs inside the limits of liability, an exclusion for assault or battery coverage and a significant credit for the purchaser • 25 percent credit for bars • 15 percent credit for restaurants We will pay those sums that the insured becomes legally obligated to pay as damages because of injury to which this insurance applies if liability for such injury is imposed on the insured by reason of the selling, serving or furnishing of any alcoholic beverage. The changes—which are among several that iso made to its cgl program in 2013—took effect in april, although agents should check with their insurance companies to find out if they plan to adopt the revisions. Web liquor liability coverage form commercial general liability cg 00 33 04 13 liquor liability coverage form various provisions in this policy restrict coverage. If your company faces a claim of bodily injury or property damage that an intoxicated person has caused after they were served liquor at your location. Get liquor liability coverage from the hartford. What does in the business mean? Read the entire policy carefully to determine rights, duties and what is. Learn if your business needs liquor liability coverage and how it can affect your insurance costs. $ information required to complete this schedule, if not shown above, will be shown in the declarations.

Read the entire policy carefully to determine rights, duties and what is. Web liquor liability insurance helps protect businesses that sell, serve or distribute alcohol. Insuring agreement we will pay those sums that the insured becomes legally obligated to pay as damages because of injury to which this insurance applies if liability for such injury is imposed on the insured by reason of the selling, serving or furnishing of any alcoholic beverage. Web • basic form product* features expense costs inside the limits of liability, an exclusion for assault or battery coverage and a significant credit for the purchaser • 25 percent credit for bars • 15 percent credit for restaurants Businessowners coverage form schedule a. Web we have covered the exposure by including liquor liability coverage form cg 00 33. The carrier has also included form #cg 21 50, “amendment of liquor liability exclusion,” which seems to. What does in the business mean? Get liquor liability coverage from the hartford. Learn if your business needs liquor liability coverage and how it can affect your insurance costs.

Adding Liquor Liability Coverage to Your Restaurant And Bar Insurance

Get liquor liability coverage from the hartford. We will pay those sums that the insured becomes legally obligated to pay as damages because of injury to which this insurance applies if liability for such injury is imposed on the insured by reason of the selling, serving or furnishing of any alcoholic beverage. Web liquor liability coverage this endorsement modifies insurance.

Certificate of Insurance / Liquor Liability — Rent at God's Love We Deliver

Web liquor liability insurance, also known as dram shop insurance, is liability coverage for businesses that serve, sell, distribute, manufacture or supply alcoholic beverages. What does in the business mean? Get liquor liability coverage from the hartford. Web liquor liability insurance helps protect businesses that sell, serve or distribute alcohol. The carrier has also included form #cg 21 50, “amendment.

Liquor Liability Coverage Restaurants, Bars, & Breweries, Pandemic Risks

The carrier has also included form #cg 21 50, “amendment of liquor liability exclusion,” which seems to. Web liquor liability insurance, also known as dram shop insurance, is liability coverage for businesses that serve, sell, distribute, manufacture or supply alcoholic beverages. Web we have covered the exposure by including liquor liability coverage form cg 00 33. Get liquor liability coverage.

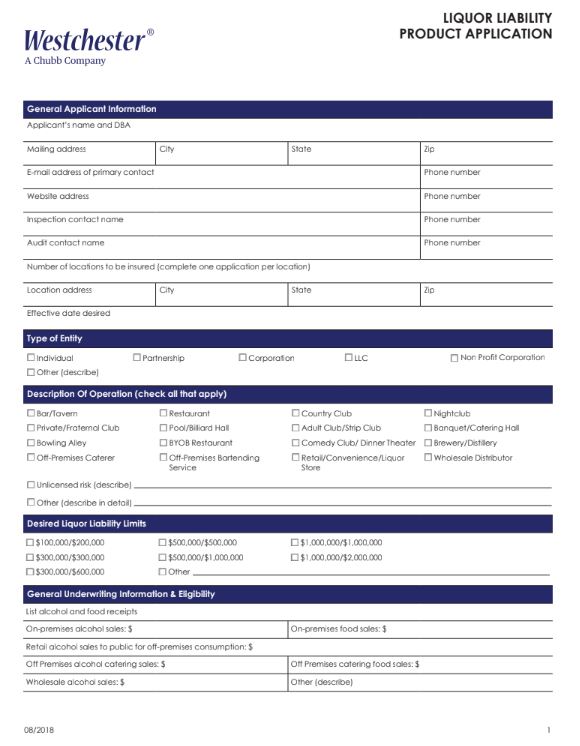

Liquor Application Liability Fill Out and Sign Printable PDF Template

Businessowners coverage form schedule a. Insuring agreement we will pay those sums that the insured becomes legally obligated to pay as damages because of injury to which this insurance applies if liability for such injury is imposed on the insured by reason of the selling, serving or furnishing of any alcoholic beverage. The changes—which are among several that iso made.

Liquor Liability is not just for Restaurants and Bars Trutela Insurance

Businessowners coverage form schedule a. Insuring agreement we will pay those sums that the insured becomes legally obligated to pay as damages because of injury to which this insurance applies if liability for such injury is imposed on the insured by reason of the selling, serving or furnishing of any alcoholic beverage. Web • basic form product* features expense costs.

Liquor Liability Insurance Quote Form

Learn if your business needs liquor liability coverage and how it can affect your insurance costs. Web we have covered the exposure by including liquor liability coverage form cg 00 33. What does in the business mean? Web liquor liability coverage this endorsement modifies insurance provided under the following: Read the entire policy carefully to determine rights, duties and what.

Print Acord Form Liquor Liability Fill Online, Printable, Fillable

We will pay those sums that the insured becomes legally obligated to pay as damages because of injury to which this insurance applies if liability for such injury is imposed on the insured by reason of the selling, serving or furnishing of any alcoholic beverage. Web liquor liability coverage this endorsement modifies insurance provided under the following: The changes—which are.

Liquor Liability Submissions Jackson Sumner & Associates

Web liquor liability coverage form commercial general liability cg 00 33 04 13 liquor liability coverage form various provisions in this policy restrict coverage. The carrier has also included form #cg 21 50, “amendment of liquor liability exclusion,” which seems to. We will pay those sums that the insured becomes legally obligated to pay as damages because of injury to.

Liquor Liability Insurance YouTube

Web we have covered the exposure by including liquor liability coverage form cg 00 33. What does in the business mean? Web liquor liability coverage form commercial general liability cg 00 33 04 13 liquor liability coverage form various provisions in this policy restrict coverage. We will pay those sums that the insured becomes legally obligated to pay as damages.

Liquor Liability Insurance Near Me Florida JAISIN

Read the entire policy carefully to determine rights, duties and what is. Learn if your business needs liquor liability coverage and how it can affect your insurance costs. Get liquor liability coverage from the hartford. The changes—which are among several that iso made to its cgl program in 2013—took effect in april, although agents should check with their insurance companies.

Web Liquor Liability Coverage Form Commercial General Liability Cg 00 33 04 13 Liquor Liability Coverage Form Various Provisions In This Policy Restrict Coverage.

Web liquor liability coverage this endorsement modifies insurance provided under the following: Web iso has revised its commercial general liability forms and endorsements, including making changes to coverage for liquor liability. The changes—which are among several that iso made to its cgl program in 2013—took effect in april, although agents should check with their insurance companies to find out if they plan to adopt the revisions. Read the entire policy carefully to determine rights, duties and what is.

Web • Basic Form Product* Features Expense Costs Inside The Limits Of Liability, An Exclusion For Assault Or Battery Coverage And A Significant Credit For The Purchaser • 25 Percent Credit For Bars • 15 Percent Credit For Restaurants

Web we have covered the exposure by including liquor liability coverage form cg 00 33. Insuring agreement we will pay those sums that the insured becomes legally obligated to pay as damages because of injury to which this insurance applies if liability for such injury is imposed on the insured by reason of the selling, serving or furnishing of any alcoholic beverage. If your company faces a claim of bodily injury or property damage that an intoxicated person has caused after they were served liquor at your location. Web liquor liability insurance, also known as dram shop insurance, is liability coverage for businesses that serve, sell, distribute, manufacture or supply alcoholic beverages.

What Does In The Business Mean?

Web liquor liability insurance helps protect businesses that sell, serve or distribute alcohol. Learn if your business needs liquor liability coverage and how it can affect your insurance costs. Get liquor liability coverage from the hartford. The carrier has also included form #cg 21 50, “amendment of liquor liability exclusion,” which seems to.

$ Information Required To Complete This Schedule, If Not Shown Above, Will Be Shown In The Declarations.

Businessowners coverage form schedule a. We will pay those sums that the insured becomes legally obligated to pay as damages because of injury to which this insurance applies if liability for such injury is imposed on the insured by reason of the selling, serving or furnishing of any alcoholic beverage.