Loan Payoff Form

Loan Payoff Form - More than 4.4 million borrowers have been repaying their loans for at least 20 years, and 2.3 million of these borrowers have never defaulted or been. Web the following tips will allow you to fill out loan payoff form easily and quickly: Online access guides for 401 (k) accounts and equity awards. Login is currently unavailable, please check back again soon. The payoff amount will almost always be higher than your statement balance because of interest. Use this calculator to work out how long it might take to pay off your personal loan, student loan or other type of credit agreement. I further authorize associated bank to close this account to any future advances if it is a Web the current balance on your monthly loan statement is not the same as the payoff amount, which is the amount necessary to completely satisfy the loan and close it out. If you have the funds to pay off an installment loan early, request a payoff letter from your lender. Any loan payments submitted using other sba forms on pay.gov will be rejected.

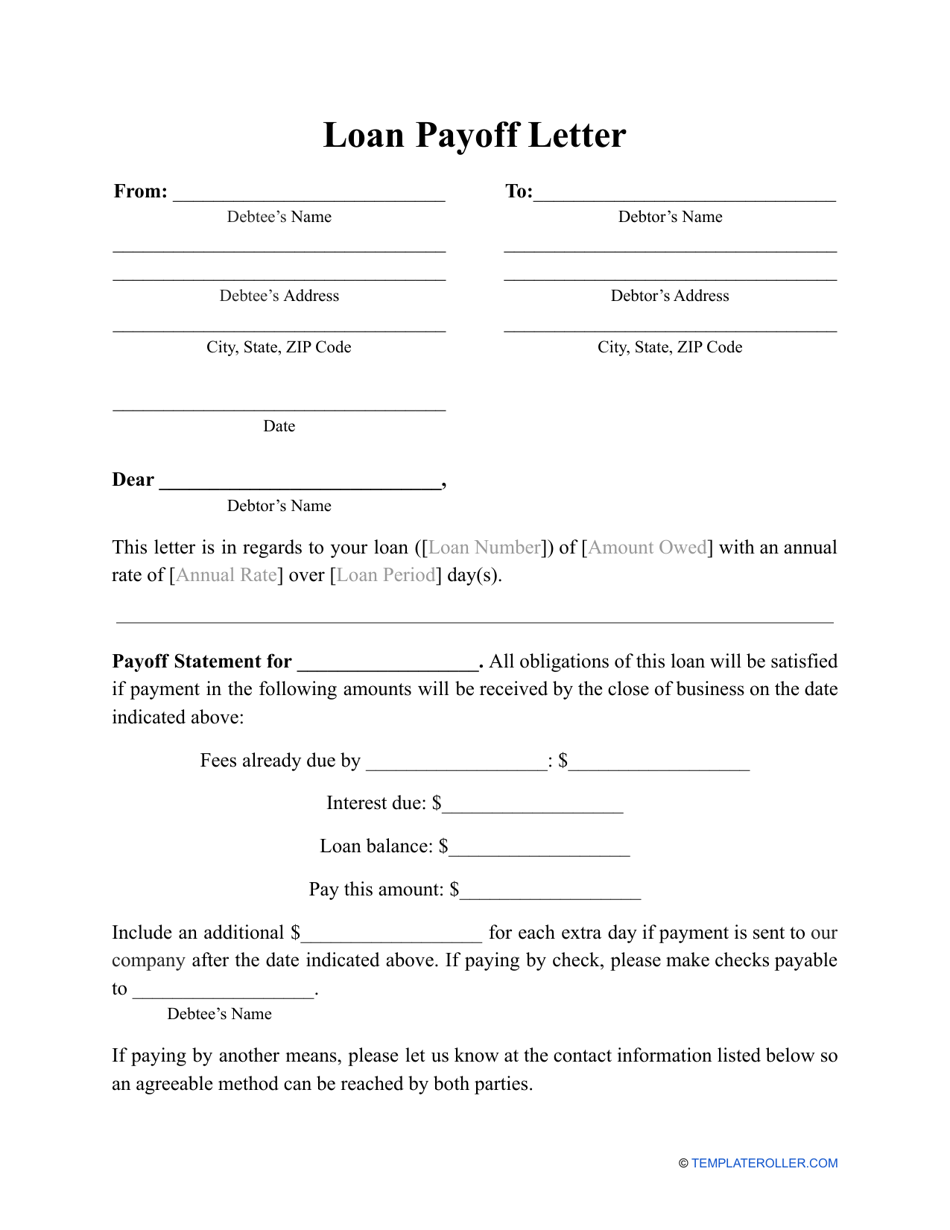

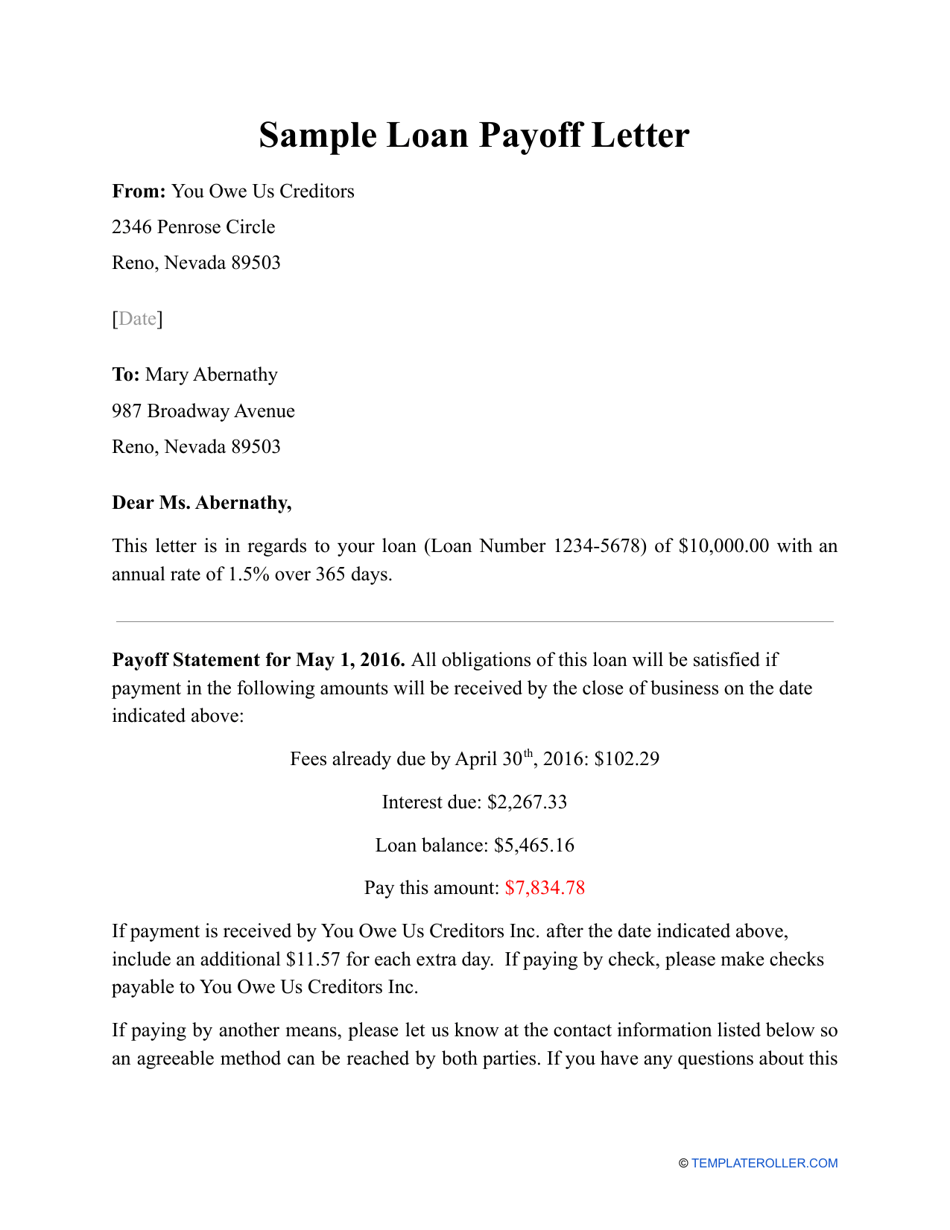

Web loan payoff form 1. Web “for someone with $5,000 in credit card debt on a card with a 22.16% [rate] and a $250 monthly payment, they will pay $1,298 in total interest and take 26 months to pay off the balance,” said. The borrower will commonly request this as part of accepting the final payment for the borrowed money and that they have paid back all principal and interest under the. Hit the arrow with the inscription. Your organization's logo and contact information as the header of the page. It tells you the amount due, where to send the money, how to. Web to create a sample loan payoff letter that will lay out all of the details necessary for a borrower to complete in order to pay off a loan in full, you will want to include the following information: More than 4.4 million borrowers have been repaying their loans for at least 20 years, and 2.3 million of these borrowers have never defaulted or been. Web the average rate on new car loans in june was 7.2 percent, up slightly from the start of the year, according to edmunds.com. It tells you the amount due, where to send the money, how to pay, and any additional charges due.

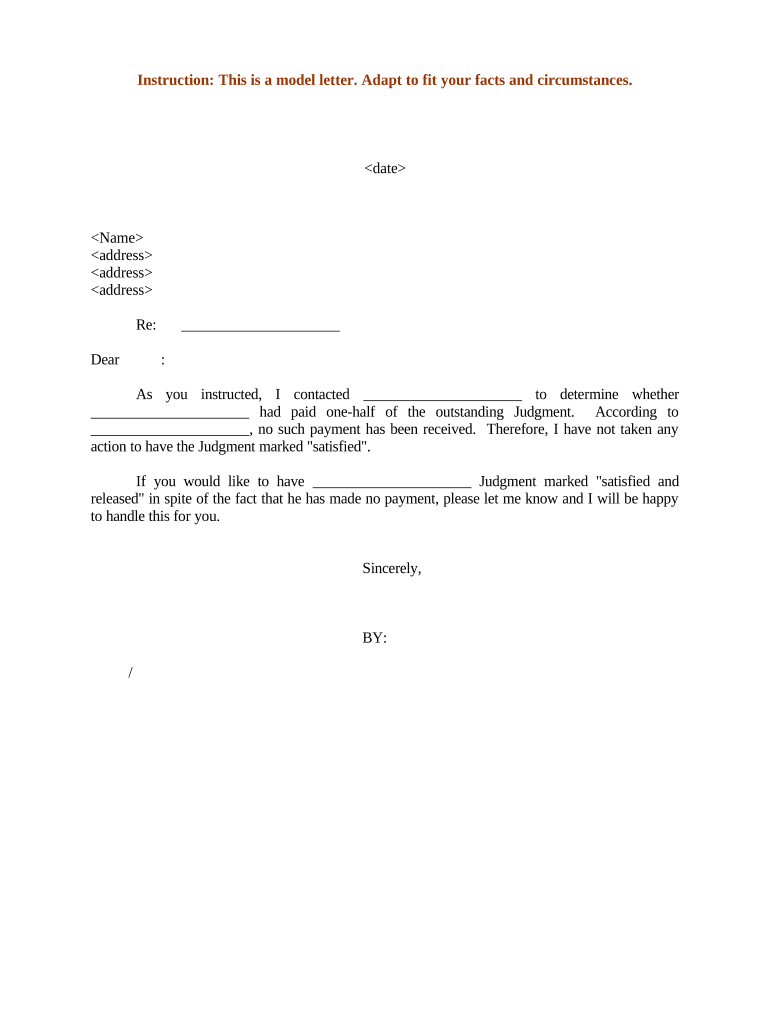

I further authorize associated bank to close this account to any future advances if it is a The borrower will commonly request this as part of accepting the final payment for the borrowed money and that they have paid back all principal and interest under the. Interest may accrue on a loan every day between the statement date and the. Web updated february 20, 2023 a promissory note release is given to a borrower after the final payment on a loan to release them of all further liabilities and obligations. Web “for someone with $5,000 in credit card debt on a card with a 22.16% [rate] and a $250 monthly payment, they will pay $1,298 in total interest and take 26 months to pay off the balance,” said. Click on the get form key to open the document and move to editing. Web (we) / authorize roundpoint mortgage servicing corporation to provide a payoff quote to representing the amount required to satisfy my (our) loan in full. Web the current balance on your monthly loan statement is not the same as the payoff amount, which is the amount necessary to completely satisfy the loan and close it out. Web the plan's supporters say it won't push costs onto taxpayers. Engaged parties names, places of residence and numbers etc.

Loan Payoff Letter Template Download Printable PDF Templateroller

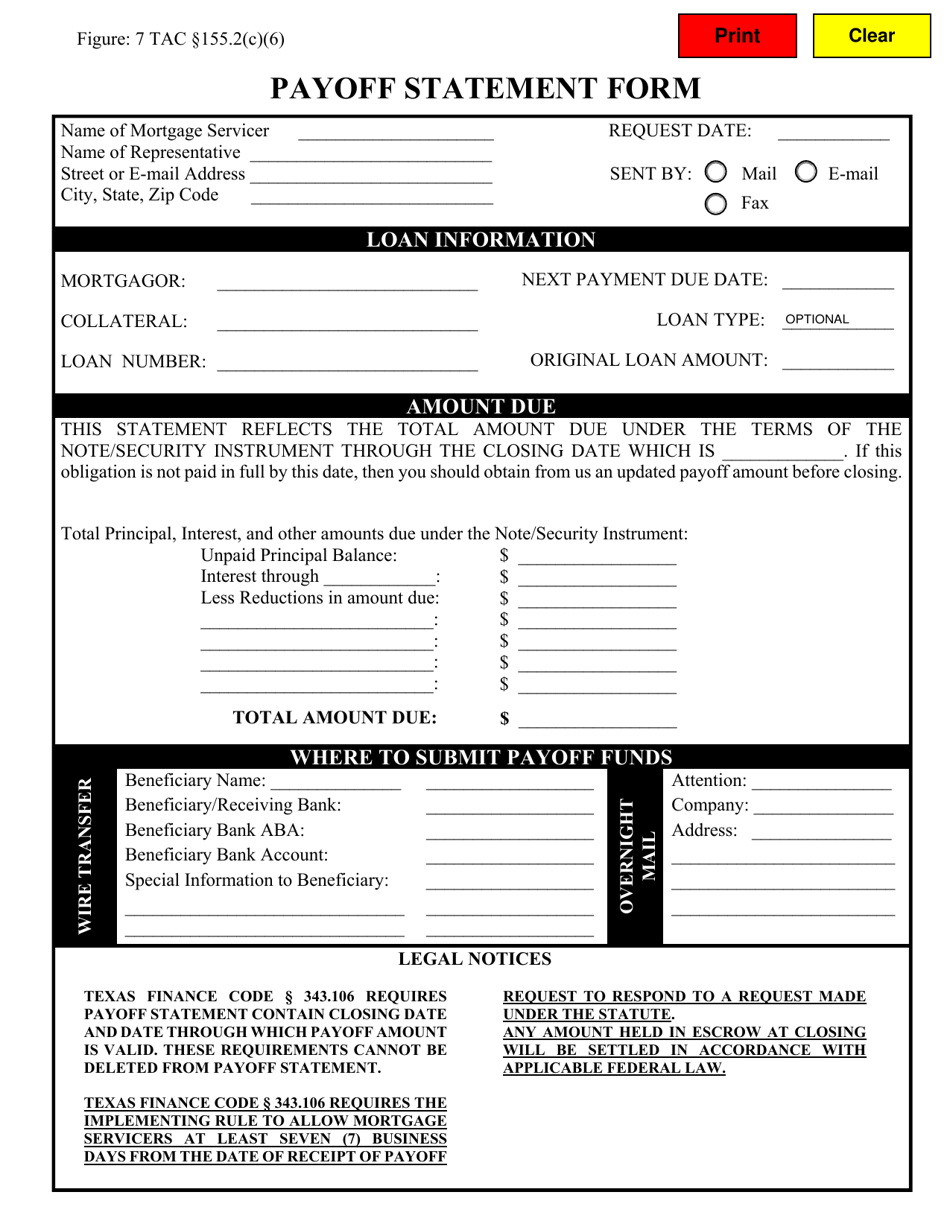

Last four digits of ssn: Web a payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. I further authorize associated bank to close this account to any future advances if it is a Make payments by check or money.

Texas Payoff Statement Form Download Fillable PDF Templateroller

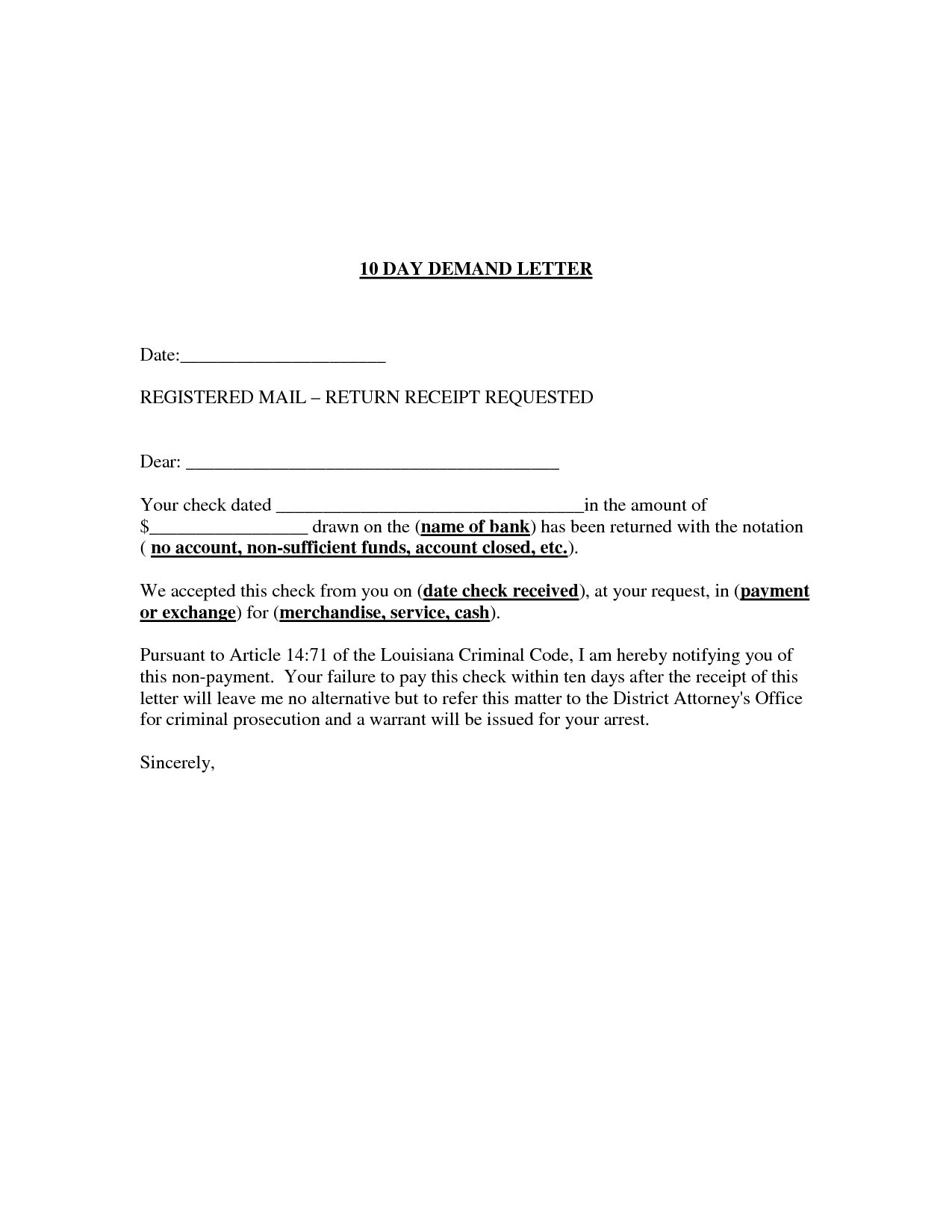

Web the 1201 borrower payment form is being phased out and borrowers should utilize the mysba loan portal to make payments. If you have the funds to pay off an installment loan early, request a payoff letter from your lender. Web get the auto loan payoff form you want. Do not submit sba loan payments using other sba forms on.

Vehicle Payoff Letter Template Fill Online, Printable, Fillable

Web a payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. Use this calculator to work out how long it might take to pay off your personal loan, student loan or other type of credit agreement. Web execute tsp.

Payoff Verification Form US Auto Supplies US AUTO SUPPLIES

Web loan payoff form 1. If you have the funds to pay off an installment loan early, request a payoff letter from your lender. The borrower will commonly request this as part of accepting the final payment for the borrowed money and that they have paid back all principal and interest under the. The revised form requires the loan servicer.

payoff letter template Doc Template pdfFiller

Web 1 day agobest loans to refinance credit card debt. Web a payoff letter is a document that provides detailed instructions on how to pay off a loan. Interest may accrue on a loan every day between the statement date and the. Web how to write by type (10) personal loan extension family i owe you (iou) payment plan personal.

Mortgage Payoff Letter Template Examples Letter Template Collection

The borrower will commonly request this as part of accepting the final payment for the borrowed money and that they have paid back all principal and interest under the. Online access guides for 401 (k) accounts and equity awards. The signature wizard will help you add your. Web a payoff letter is a document that provides detailed instructions on how.

Sample Loan Payoff Letter Download Printable PDF Templateroller

Web (we) / authorize roundpoint mortgage servicing corporation to provide a payoff quote to representing the amount required to satisfy my (our) loan in full. If you have the funds to pay off an installment loan early, request a payoff letter from your lender. Web how to write by type (10) personal loan extension family i owe you (iou) payment.

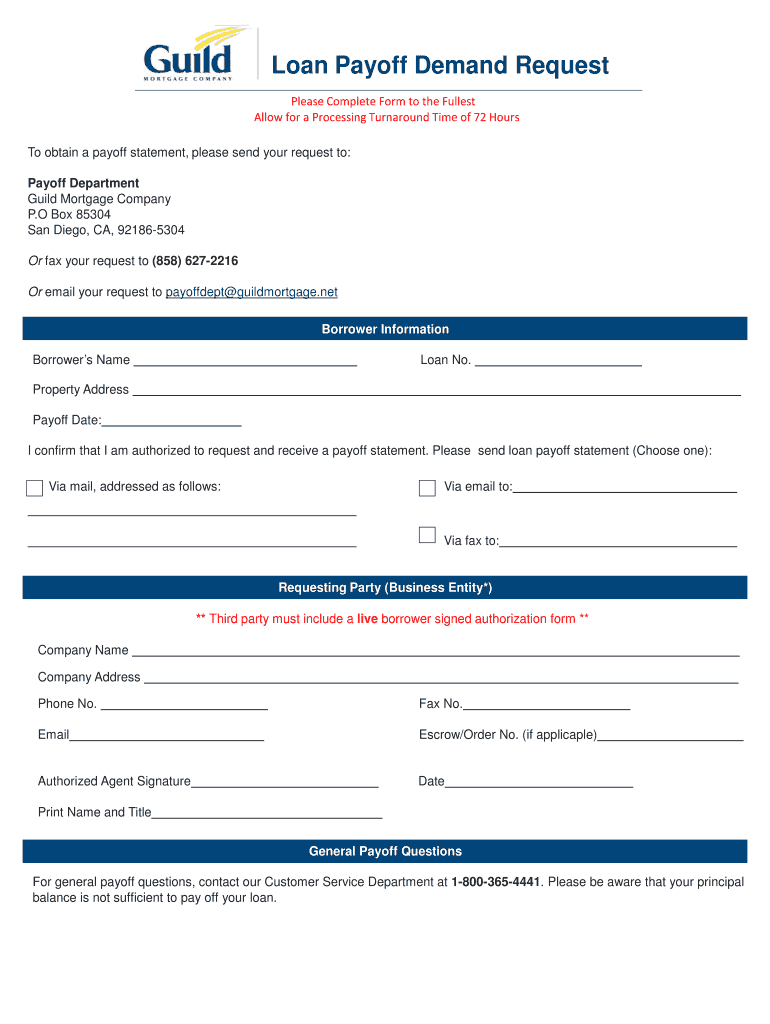

Guild Mortgage Payoff Form Fill Out and Sign Printable PDF Template

They’re often used in refinancing, consolidation loans, debts in collections, and other situations wherein a lender wants to know how much must be paid. This q&a contains general statements of policy under the administrative procedure act issued to advise the public prospectively of the manner in which the u.s. The payoff statement shows the remaining loan balance and number of.

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

Web this is just the tip of the iceberg. Change the template with smart fillable fields. It also contains the extra details like the rate of interest that the. Interest may accrue on a loan every day between the statement date and the. Web mail your payment.

Payoff form Form, Form name, Payoff

Web a payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. Best personal loans to apply online. Last four digits of ssn: Web execute tsp loan payoff form within a few moments by using the instructions listed below: Click.

This Q&A Contains General Statements Of Policy Under The Administrative Procedure Act Issued To Advise The Public Prospectively Of The Manner In Which The U.s.

Web the average rate on new car loans in june was 7.2 percent, up slightly from the start of the year, according to edmunds.com. Web retirement and benefit services provided by merrill. It also encompasses any interest you owe and potential fees your lender might charge. Web how to write by type (10) personal loan extension family i owe you (iou) payment plan personal guaranty promissory note release of debt release of guaranty small business how to get a loan (5 steps)

Use This Calculator To Work Out How Long It Might Take To Pay Off Your Personal Loan, Student Loan Or Other Type Of Credit Agreement.

Department of education (ed) and federal student aid (fsa) propose to exercise their discretion as a result of and in response to the lawfully and duly declared covid. Web get the auto loan payoff form you want. Web loan payoff form 1. A statement prepared by a lender showing the remaining terms on a mortgage or other loan.

Fill Out The Necessary Boxes Which Are Marked In Yellow.

The amendments revised the loan payoff statement form loan servicers are required to use when reporting the payoff figure for a mortgage loan. Web the 1201 borrower payment form is being phased out and borrowers should utilize the mysba loan portal to make payments. You might want to request the information about the balance due on a loan if you plan. Web a payoff statement or a mortgage payoff letter that is prepared by the lender for the borrower mentioning the amount that the borrower has to pay back to close the loan.

Interest May Accrue On A Loan Every Day Between The Statement Date And The.

Open it with online editor and begin adjusting. Last four digits of ssn: Web “for someone with $5,000 in credit card debt on a card with a 22.16% [rate] and a $250 monthly payment, they will pay $1,298 in total interest and take 26 months to pay off the balance,” said. The payoff amount will almost always be higher than your statement balance because of interest.