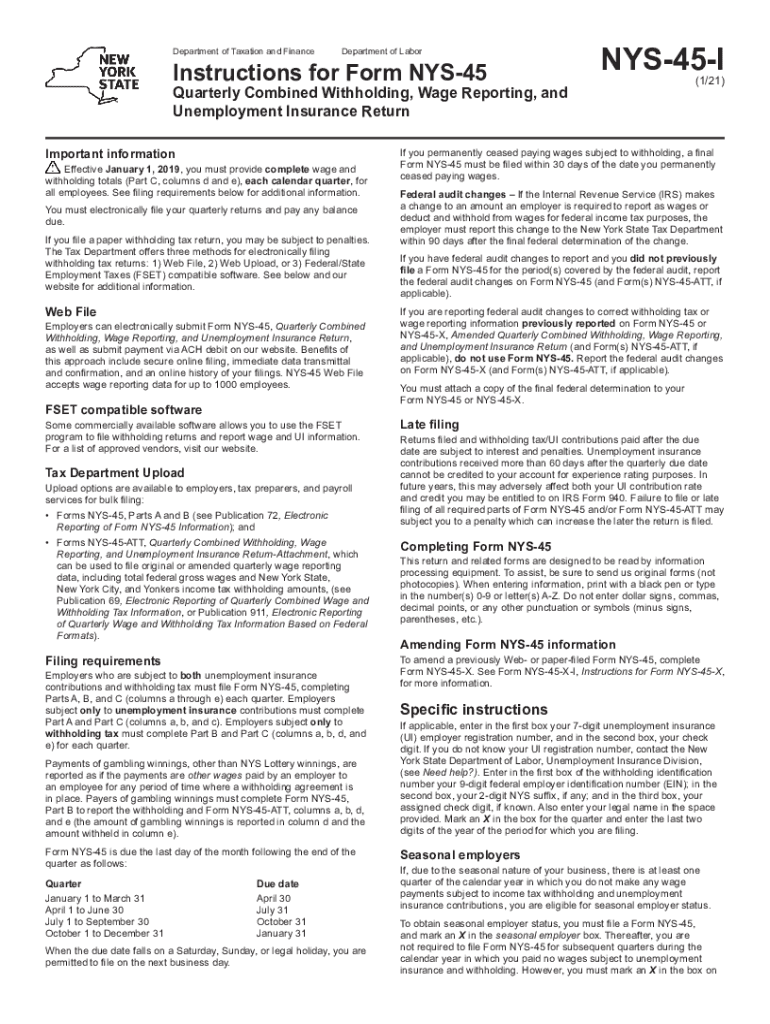

Louisiana State Withholding Form

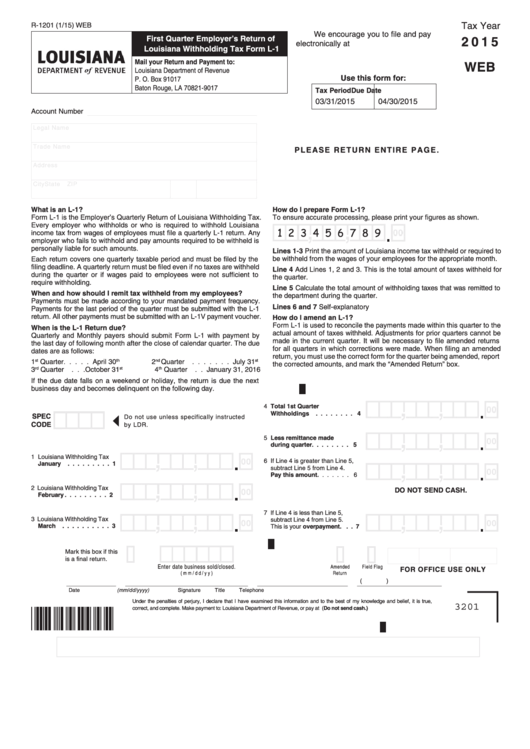

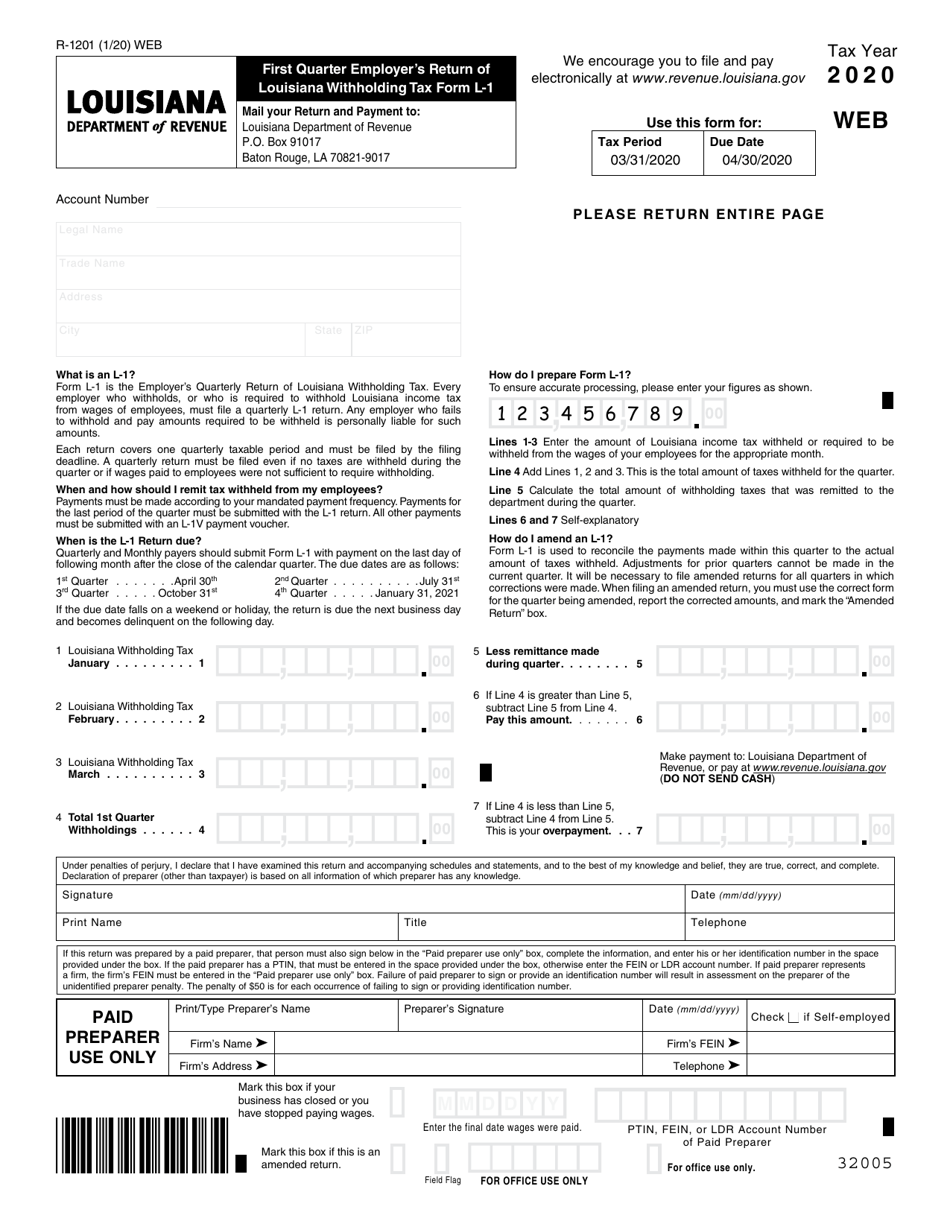

Louisiana State Withholding Form - January 2003) department of the treasury request for taxpayer identification number and certification give form to the requester. Web the income tax withholding formula for the state of louisiana will change as follows: Employees who are subject to state. Any employer who fails to withhold. 2022 louisiana resident income tax return, instructions, and tax table. Complete, edit or print tax forms instantly. Do not send to the irs. Employees who are subject to state. Web louisiana taxpayer access point (latap) is the fastest and most accurate way to file and pay your withholding with the department of revenue. Get ready for tax season deadlines by completing any required tax forms today.

Web every employer who withholds or who is required to withhold louisiana income tax from wages of employees must file a withholding return. For employees who are claiming exempt in 2022 and a new withholding form has been received, a new it0210 record must be created. Complete, edit or print tax forms instantly. Every employer who withholds, or who is required to withhold louisiana income tax from. Web the income tax withholding formula for the state of louisiana has been updated. Web louisiana taxpayer access point (latap) is the fastest and most accurate way to file and pay your withholding with the department of revenue. 2022 louisiana resident income tax return, instructions, and tax table. If too little is withheld, you will generally owe tax when you file your tax return. Any employer who fails to withhold. The income tax table for filers claiming zero (0), one, or two personal.

Quarterly filing is available to taxpayers whose. We also updated our digital platform to include custom forms for every. Any employer who fails to withhold. Web louisiana taxpayer access point (latap) is the fastest and most accurate way to file and pay your withholding with the department of revenue. Do not send to the irs. Get ready for tax season deadlines by completing any required tax forms today. The income tax table for filers claiming zero (0), one, or two personal. 2022 louisiana resident income tax return, instructions, and tax table. If too little is withheld, you will generally owe tax when you file your tax return. Web louisiana revised statute 47:114 provides for the filing of state withholding tax returns either quarterly, monthly, or semimonthly.

Ms State Withholding Form

Every employer who withholds, or who is required to withhold louisiana income tax from. Complete, edit or print tax forms instantly. Web the income tax withholding formula for the state of louisiana will change as follows: Taxpayers claiming two (2) personal exemptions must use the married taxpayer. Employees who are subject to state.

How To Apply For Louisiana Withholding Number DTAXC

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web louisiana taxpayer access point (latap) is the fastest and most accurate way to file and pay your withholding with the department of revenue. For employees who are claiming exempt in 2022 and a new withholding form has been received,.

Louisiana State Tax Withholding Form 2022

Web louisiana taxpayer access point (latap) is the fastest and most accurate way to file and pay your withholding with the department of revenue. The income tax table for filers claiming zero (0), one, or two personal. If too little is withheld, you will generally owe tax when you file your tax return. Any employer who fails to withhold. For.

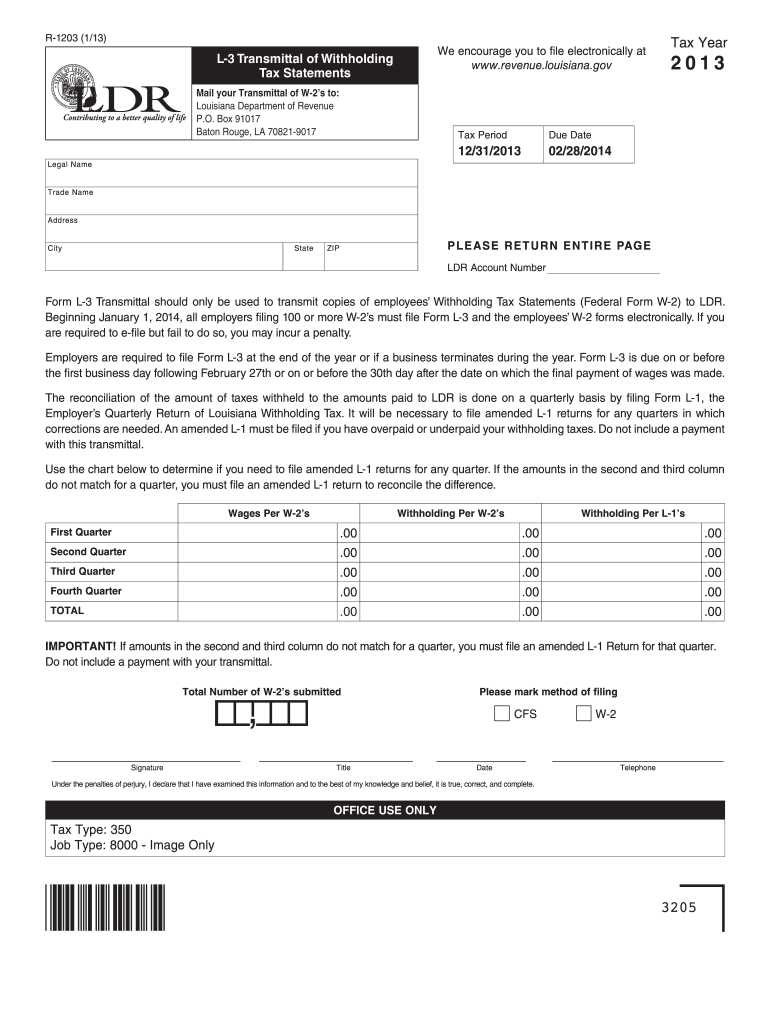

Fillable R1201, 2015 , Louisiana Withholding Tax Form L1 printable

The income tax table for filers claiming zero (0), one, or two personal. We also updated our digital platform to include custom forms for every. For employees who are claiming exempt in 2022 and a new withholding form has been received, a new it0210 record must be created. Complete, edit or print tax forms instantly. 2022 louisiana resident income tax.

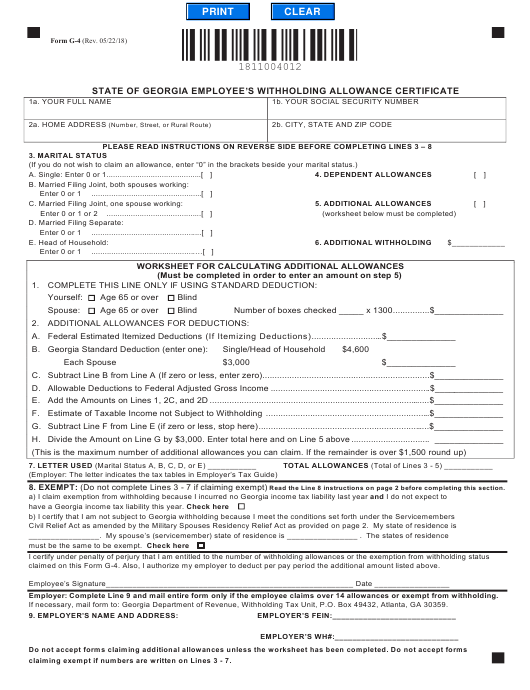

State Employee Withholding Form 2023

For employees who are claiming exempt in 2022 and a new withholding form has been received, a new it0210 record must be created. Taxpayers claiming two (2) personal exemptions must use the married taxpayer. If too little is withheld, you will generally owe tax when you file your tax return. The income tax table for filers claiming zero (0), one,.

Form L1 (R1201) Download Fillable PDF or Fill Online First Quarter

Complete, edit or print tax forms instantly. Web the income tax withholding formula for the state of louisiana has been updated. We also updated our digital platform to include custom forms for every. Web louisiana revised statute 47:114 provides for the filing of state withholding tax returns either quarterly, monthly, or semimonthly. January 2003) department of the treasury request for.

Employee Withholding Exemption Certificate (L4) Louisiana Free Download

Web louisiana revised statute 47:114 provides for the filing of state withholding tax returns either quarterly, monthly, or semimonthly. Complete, edit or print tax forms instantly. Every employer who withholds, or who is required to withhold louisiana income tax from. Do not send to the irs. Any employer who fails to withhold.

Workers Comp Forms Louisiana Universal Network

If too little is withheld, you will generally owe tax when you file your tax return. 2022 louisiana resident income tax return, instructions, and tax table. Get ready for tax season deadlines by completing any required tax forms today. We also updated our digital platform to include custom forms for every. Do not send to the irs.

Louisiana Department Of Revenue Fill Out and Sign Printable PDF

Any employer who fails to withhold. Employees who are subject to state. Every employer who withholds, or who is required to withhold louisiana income tax from. Get ready for tax season deadlines by completing any required tax forms today. Web louisiana taxpayer access point (latap) is the fastest and most accurate way to file and pay your withholding with the.

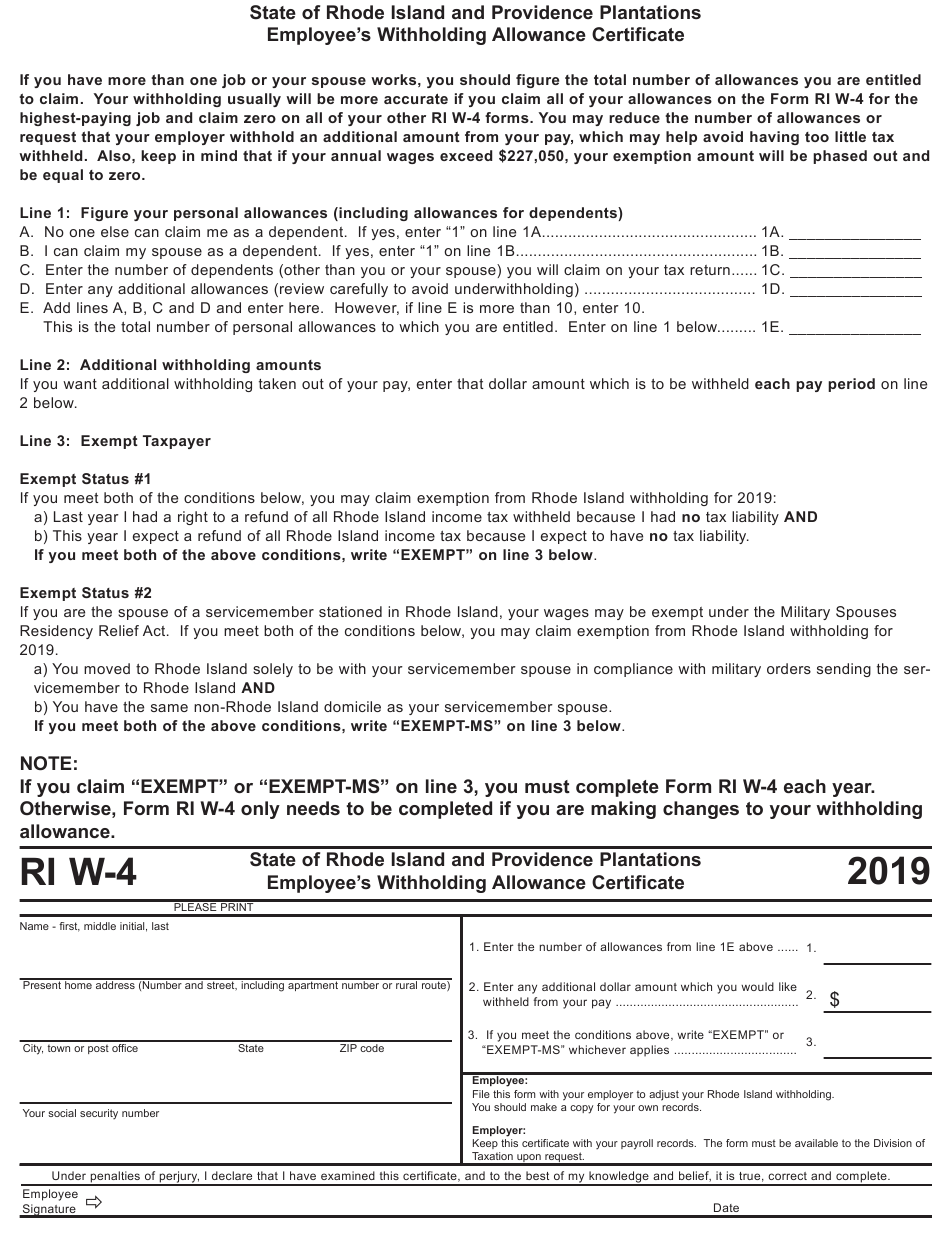

W4 Form 2023 Printable Employee's Withholding Certificate W4 2022

Web every employer who withholds or who is required to withhold louisiana income tax from wages of employees must file a withholding return. Employees who are subject to state. Web the income tax withholding formula for the state of louisiana has been updated. Web louisiana taxpayer access point (latap) is the fastest and most accurate way to file and pay.

Do Not Send To The Irs.

For employees who are claiming exempt in 2022 and a new withholding form has been received, a new it0210 record must be created. If too little is withheld, you will generally owe tax when you file your tax return. Employees who are subject to state. Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Employees who are subject to state. Every employer who withholds, or who is required to withhold louisiana income tax from. 2022 louisiana resident income tax return, instructions, and tax table. Web every employer who withholds or who is required to withhold louisiana income tax from wages of employees must file a withholding return.

Any Employer Who Fails To Withhold.

We also updated our digital platform to include custom forms for every. Taxpayers claiming two (2) personal exemptions must use the married taxpayer. Web the income tax withholding formula for the state of louisiana has been updated. January 2003) department of the treasury request for taxpayer identification number and certification give form to the requester.

Quarterly Filing Is Available To Taxpayers Whose.

Get ready for tax season deadlines by completing any required tax forms today. Web louisiana taxpayer access point (latap) is the fastest and most accurate way to file and pay your withholding with the department of revenue. Web the income tax withholding formula for the state of louisiana will change as follows: Web louisiana revised statute 47:114 provides for the filing of state withholding tax returns either quarterly, monthly, or semimonthly.