Ma Personal Property Tax Form

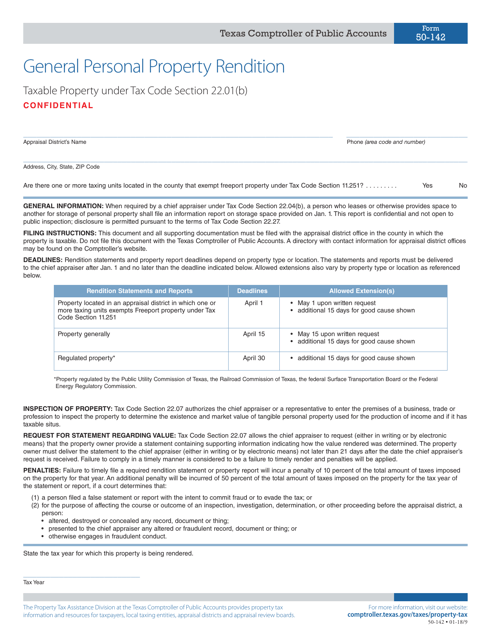

Ma Personal Property Tax Form - Most people know that property tax applies to real estate; Web generally, the owner of taxable personal property situated in any community must file a return, known as the form of list or state tax form 2, with the local board of assessors. The boards of assessors in each city and town assess personal property taxes on all personal property subject to tax situated within their communities as required by. Web form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts and corporations that own or hold personal property on january 1st. Web home government departments treasurer / collector office responsibilities personal property tax personal property tax billing cycle: Web the commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and file property returns. Web this form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal entities that. Massachusetts resident income tax return. Web today, the massachusetts real property tax rate depends on the city or town, as well as classification. If you have any suggestions.

Web each year taxpayers are required to file a return to the assessors by march 1st. Massachusetts resident income tax return (english, pdf 211.37 kb) 2020 form 1. Web today, the massachusetts real property tax rate depends on the city or town, as well as classification. This form enables a business to provide a list of its. To read them, you'll need the free adobe acrobat reader. Web generally, the owner of taxable personal property situated in any community must file a return, known as the form of list or state tax form 2, with the local board of assessors. The form of list (state tax form 2) details taxable personal property and is required by. Massachusetts resident income tax return. Web this form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal entities that. Web each business must file a personal property form of list (state tax form 2) with the assessor’s office by march 1st.

Web 2021 form efo: Property is situated in a particular city or town in the. To read them, you'll need the free adobe acrobat reader. Web you are here home › how to file your personal property tax return last updated: But, the total tax levy for the city or town remains the same. If you have any suggestions. This form enables a business to provide a list of its. Personal property, property that is not real estate, is taxable in. Web a form must be filed by march 1 even if you are considered to be exempt from personal property tax. Most people know that property tax applies to real estate;

Personal Property Tax Listing Form PRORFETY

Web today, the massachusetts real property tax rate depends on the city or town, as well as classification. Massachusetts resident income tax return (english, pdf 211.37 kb) 2020 form 1. Web all printable massachusetts personal income tax forms are in pdf format. Web home government departments treasurer / collector office responsibilities personal property tax personal property tax billing cycle: Web.

Product Code On Personal Property Tax Property Walls

Web home government departments treasurer / collector office responsibilities personal property tax personal property tax billing cycle: To read them, you'll need the free adobe acrobat reader. Web each year taxpayers are required to file a return to the assessors by march 1st. Web a form must be filed by march 1 even if you are considered to be exempt.

Fill Free fillable forms Montgomery County, Virginia

Web you are here home › how to file your personal property tax return last updated: 9/7/21 if your business owns personal property, you need to file a state tax. Each year all parties subject to personal property taxation must submit a list of all their personal property to the assessor by march 1 preceding the fiscal year. Web today,.

FREE 8+ Sample Tax Verification Forms in PDF

Web generally, the owner of taxable personal property situated in any community must file a return, known as the form of list or state tax form 2, with the local board of assessors. Each year all parties subject to personal property taxation must submit a list of all their personal property to the assessor by march 1 preceding the fiscal.

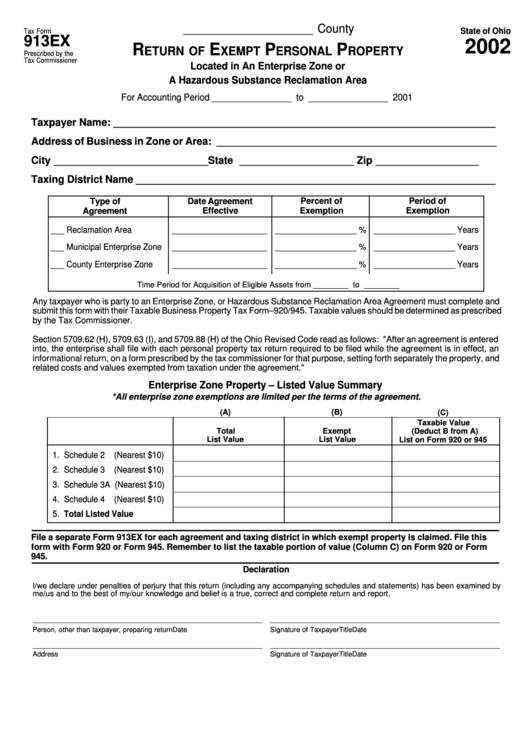

Tax Form 913ex Return Of Exempt Personal Property 2002 printable

Each year all parties subject to personal property taxation must submit a list of all their personal property to the assessor by march 1 preceding the fiscal year. Web a form must be filed by march 1 even if you are considered to be exempt from personal property tax. If you have any suggestions. This form enables a business to.

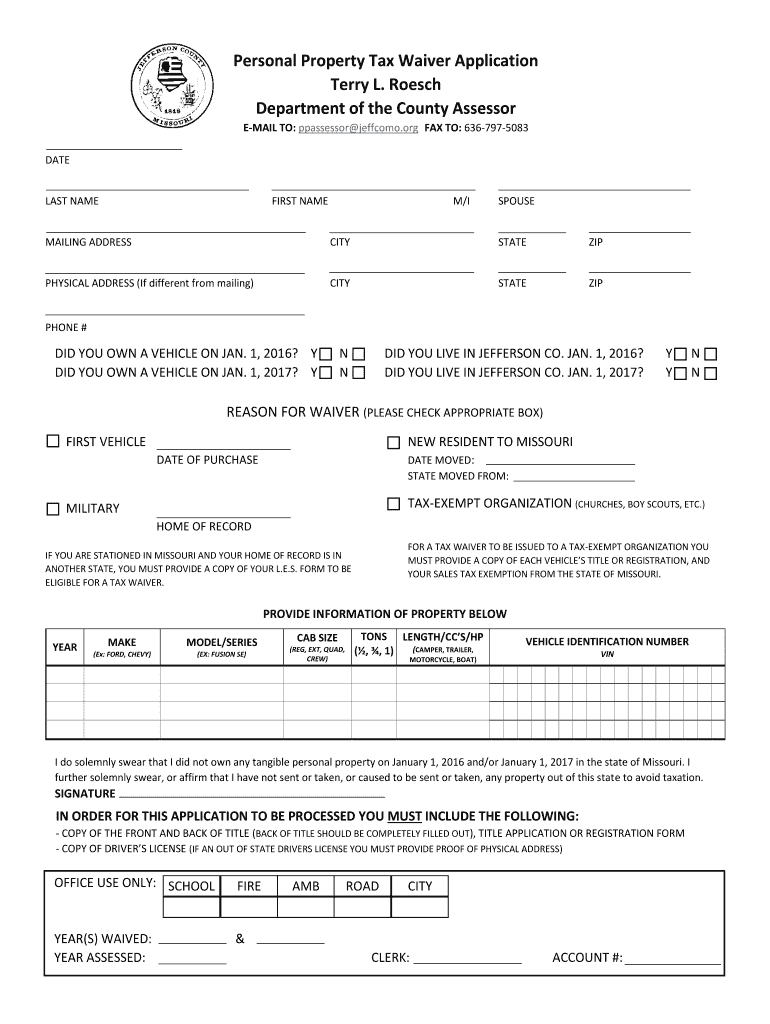

Personal Property Tax Waiver Jefferson County Mo Fill Out and Sign

To read them, you'll need the free adobe acrobat reader. Property is situated in a particular city or town in the. Web q & a on assessment and taxation of personal property. This form enables a business to provide a list of its. If you have any suggestions.

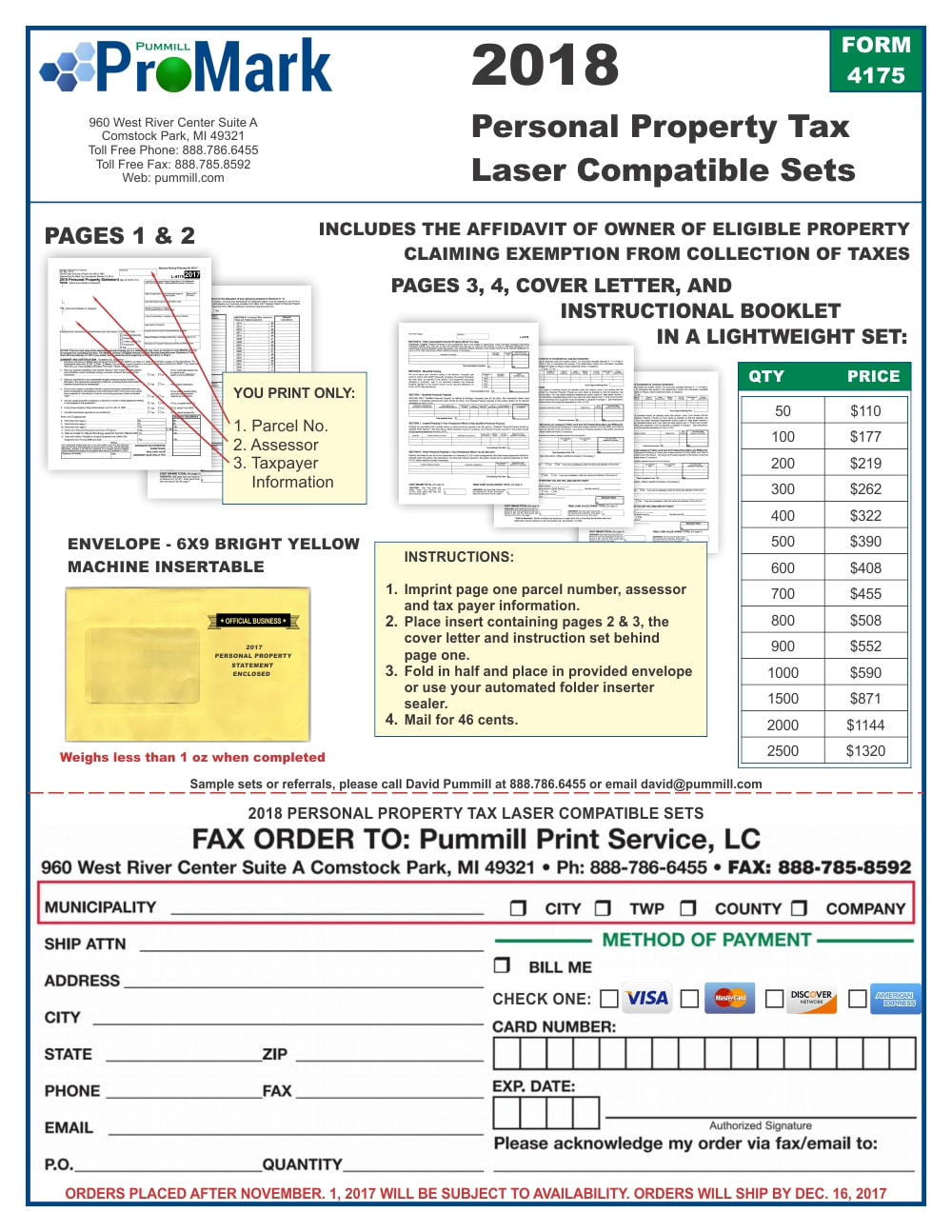

MICHIGAN PERSONAL PROPERTY TAX KIT Pummill ProMark

Each year all parties subject to personal property taxation must submit a list of all their personal property to the assessor by march 1 preceding the fiscal year. Web each business must file a personal property form of list (state tax form 2) with the assessor’s office by march 1st. Massachusetts resident income tax return (english, pdf 211.37 kb) 2020.

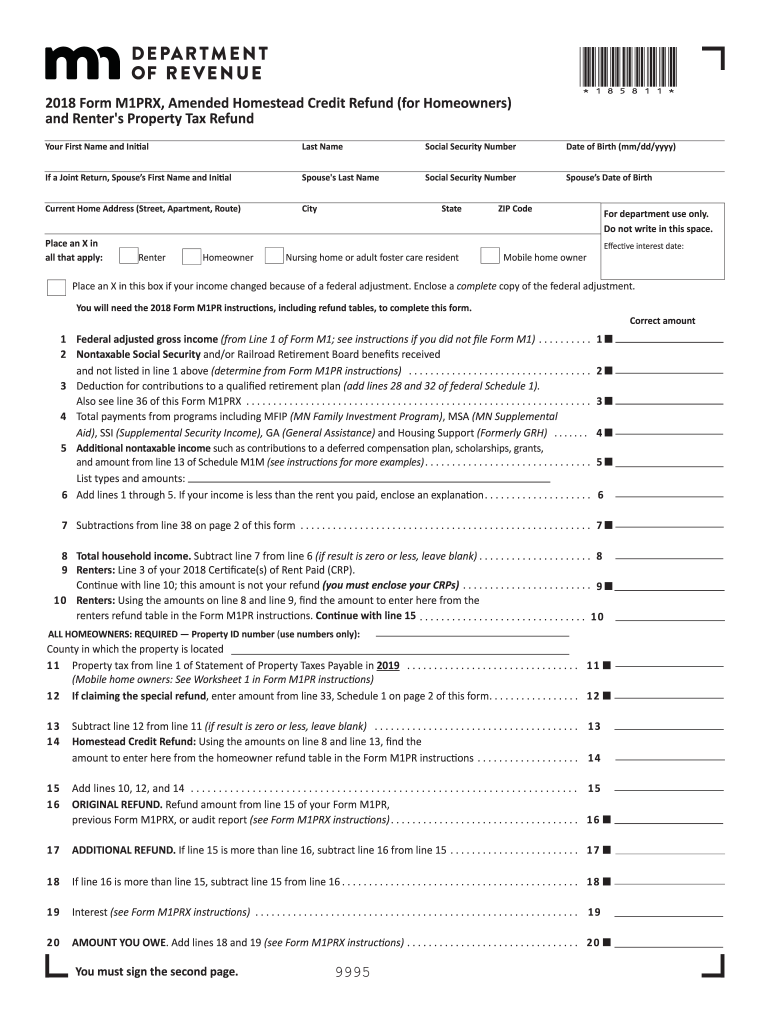

M1prx 2018 Fill Out and Sign Printable PDF Template signNow

Most people know that property tax applies to real estate; The boards of assessors in each city and town assess personal property taxes on all personal property subject to tax situated within their communities as required by. Web a form must be filed by march 1 even if you are considered to be exempt from personal property tax. But, the.

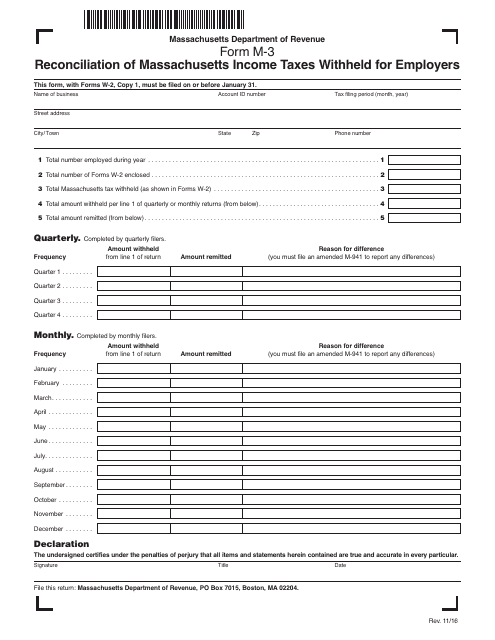

Form M3 Download Printable PDF or Fill Online Reconciliation of

Web state tax form 2 of all personal property owned, held or leased by them every year by march 1st. Web each business must file a personal property form of list (state tax form 2) with the assessor’s office by march 1st. Web this form of list (state tax form 2) must be filed each year by all individuals, partnerships,.

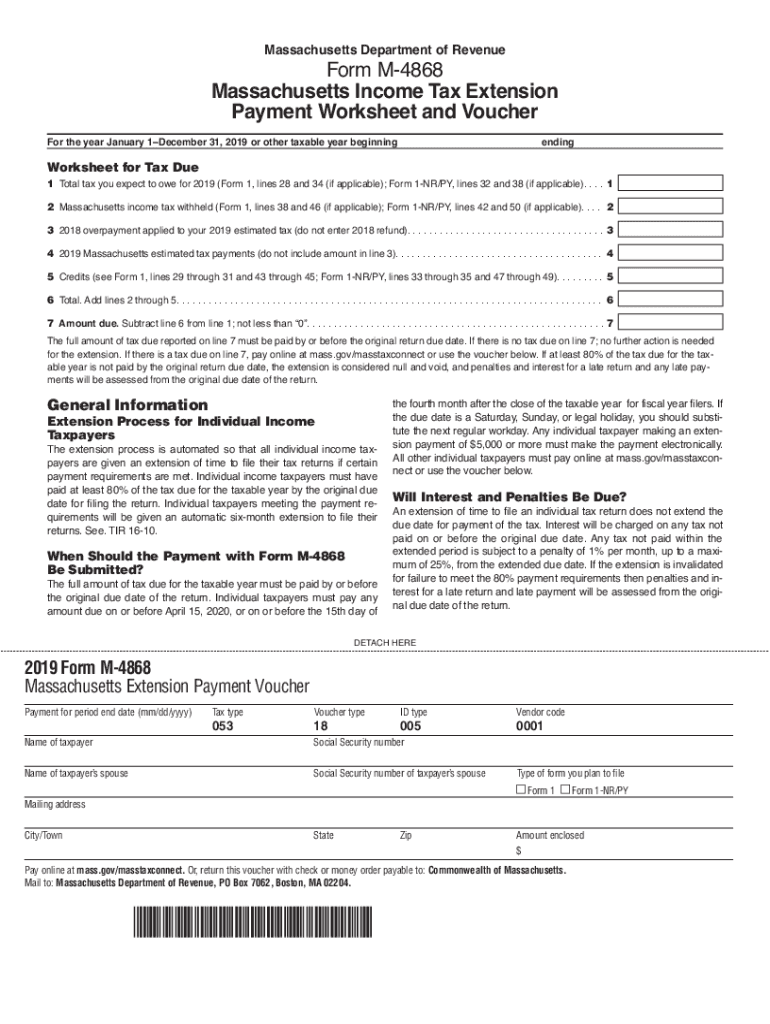

Tax Extention Forms Ma Fill Out and Sign Printable PDF Template signNow

But, the total tax levy for the city or town remains the same. Web you are here home › how to file your personal property tax return last updated: Web a form must be filed by march 1 even if you are considered to be exempt from personal property tax. Web q & a on assessment and taxation of personal.

Personal Property, Property That Is Not Real Estate, Is Taxable In.

Web state tax form 2 of all personal property owned, held or leased by them every year by march 1st. Web all printable massachusetts personal income tax forms are in pdf format. This form enables a business to provide a list of its. Each business must file a personal property.

Web Home Government Departments Treasurer / Collector Office Responsibilities Personal Property Tax Personal Property Tax Billing Cycle:

If you have any suggestions. Web today, the massachusetts real property tax rate depends on the city or town, as well as classification. Web all personal property situated in massachusetts is subject to tax, unless specifically exempt by law. Web form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts and corporations that own or hold personal property on january 1st.

Web The Commissioner Of Revenue Is Responsible For Issuing Certain Forms Used By Taxpayers To Apply For Local Tax Abatements And Exemptions And File Property Returns.

Web a form must be filed by march 1 even if you are considered to be exempt from personal property tax. If a form is not completed and returned to the board of assessors then. Each year all parties subject to personal property taxation must submit a list of all their personal property to the assessor by march 1 preceding the fiscal year. Web you are here home › how to file your personal property tax return last updated:

The Boards Of Assessors In Each City And Town Assess Personal Property Taxes On All Personal Property Subject To Tax Situated Within Their Communities As Required By.

The form of list (state tax form 2) details taxable personal property and is required by. Web 2021 form efo: To read them, you'll need the free adobe acrobat reader. Massachusetts resident income tax return (english, pdf 211.37 kb) 2020 form 1.