Ma Tax Withholding Form

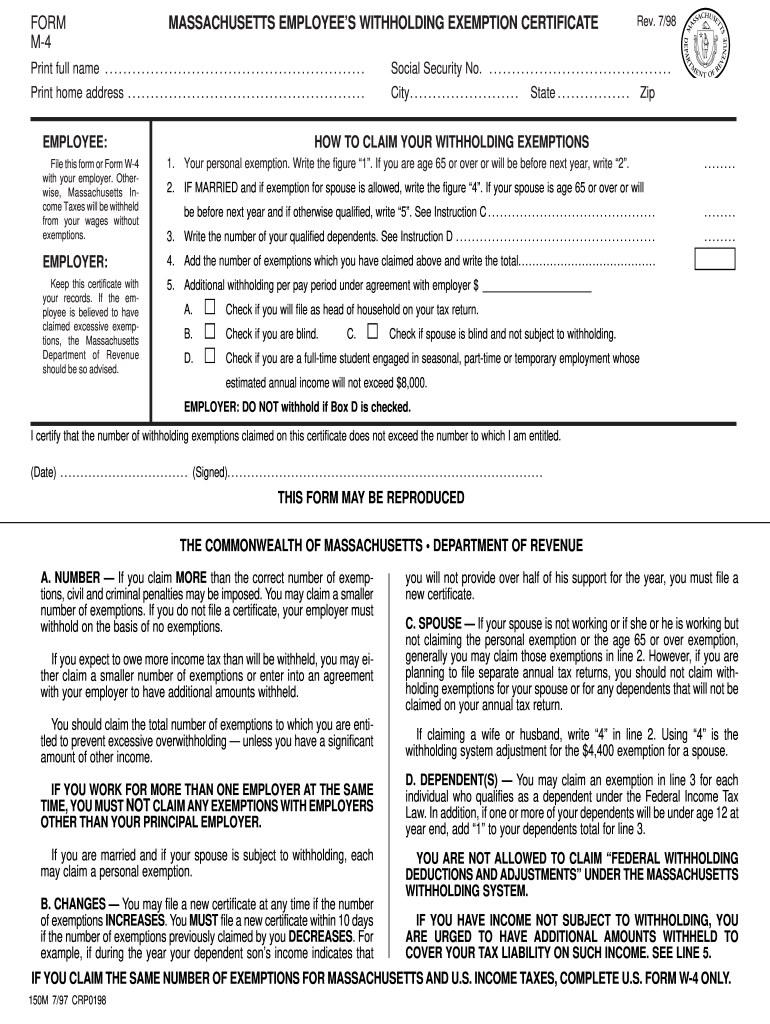

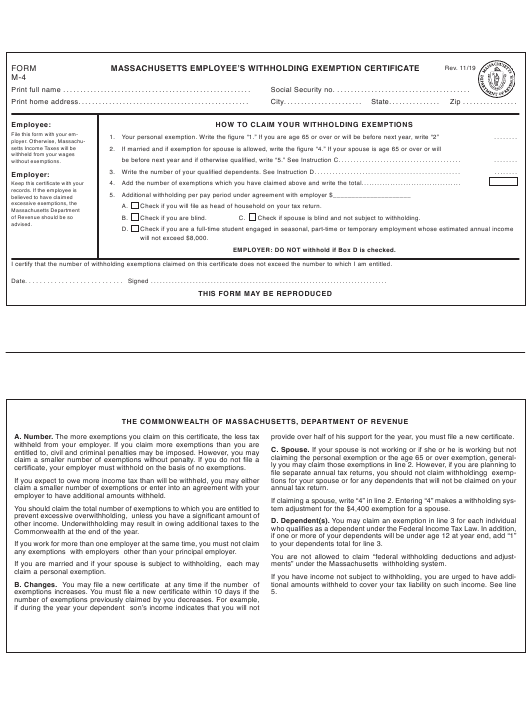

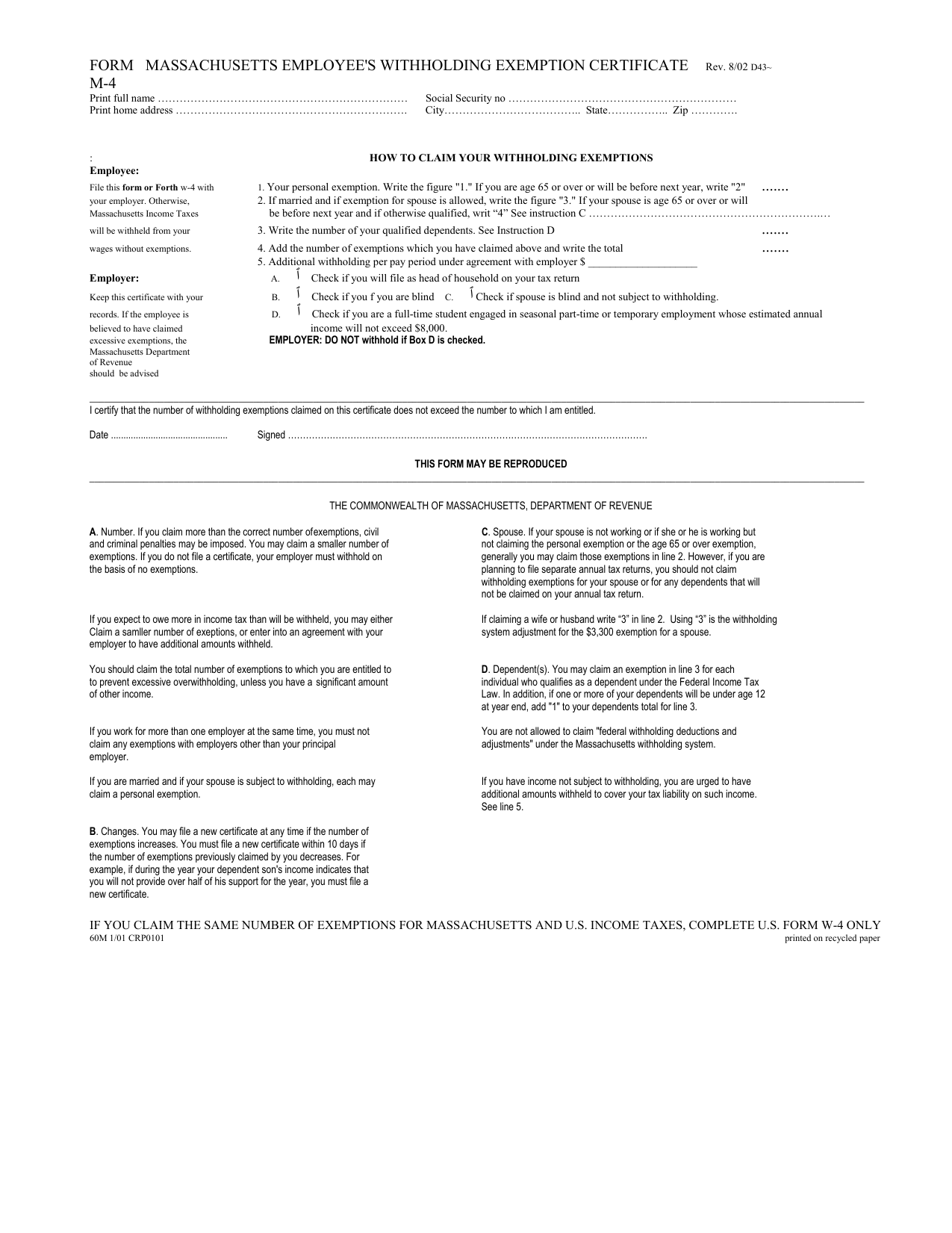

Ma Tax Withholding Form - 505, tax withholding and estimated tax. Web july 20, 2023. Massachusetts stat e withholding tax. 505, tax withholding and estimated tax. Employees hired before 2020 are not required. Enter your info to see your take home pay. State tax withholding state code: Using “4” is the withholding system adjustment for the $4,400 exemption for a spouse. Snohomish county tax preparer pleads guilty to assisting in the. Use this calculator to determine the total number of allowances to enter on your.

Using “4” is the withholding system adjustment for the $4,400 exemption for a spouse. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Employees hired before 2020 are not required. Web what is tax withholding? If you're an employee, your employer probably withholds income tax from your paycheck and pays it to the irs in your name. Web smartasset's massachusetts paycheck calculator shows your hourly and salary income after federal, state and local taxes. How does this impact me? 505, tax withholding and estimated tax. Use this calculator to determine the total number of allowances to enter on your. Massachusetts stat e withholding tax.

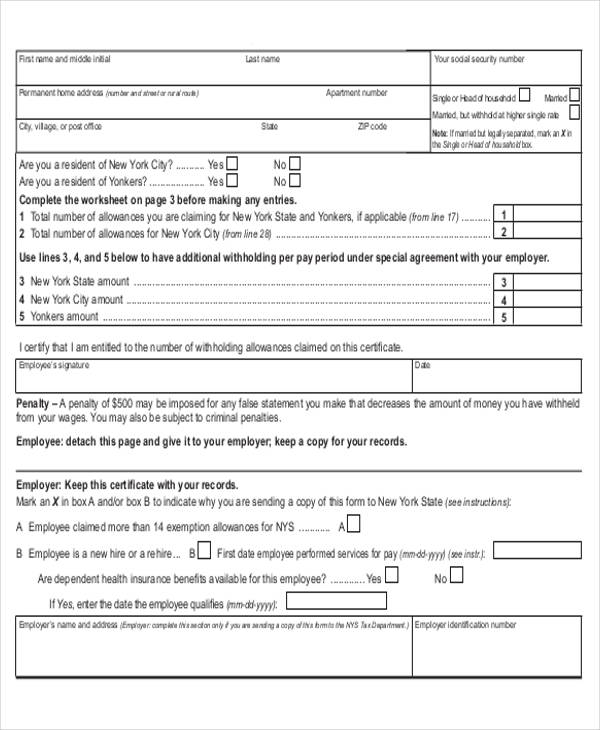

Choosing not to have income tax withheld. 505, tax withholding and estimated tax. Employees hired before 2020 are not required. State tax withholding state code: 0, a, b, c/number of. Check if spouse is blind and not subject to withholding. Check if you are exempt from. Check if you are blind. Snohomish county tax preparer pleads guilty to assisting in the. Using “4” is the withholding system adjustment for the $4,400 exemption for a spouse.

M 4 Form Fill Out and Sign Printable PDF Template signNow

Check if you will file as head of household on your tax return. If claiming a wife or husband, write “4” in line 2. Web july 20, 2023. Use this calculator to determine the total number of allowances to enter on your. 0, a, b, c/number of.

Filing Exempt On Taxes For 6 Months How To Do This

Massachusetts stat e withholding tax. Snohomish county tax preparer pleads guilty to assisting in the. Employees hired before 2020 are not required. Choosing not to have income tax withheld. Using “4” is the withholding system adjustment for the $4,400 exemption for a spouse.

Ma State Tax Withholding Form

Snohomish county tax preparer pleads guilty to assisting in the. If you're an employee, your employer probably withholds income tax from your paycheck and pays it to the irs in your name. 505, tax withholding and estimated tax. If claiming a wife or husband, write “4” in line 2. Web the income tax withholding formula for the state of massachusetts.

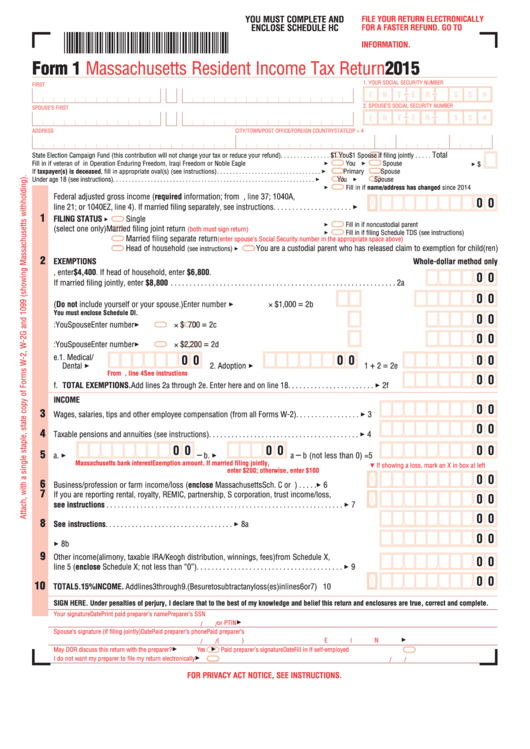

Form 1 Massachusetts Resident Tax Return 2015 printable pdf

Web smartasset's massachusetts paycheck calculator shows your hourly and salary income after federal, state and local taxes. You can choose not to have federal income tax withheld from your. 0, a, b, c/number of. Check if you are blind. Enter your info to see your take home pay.

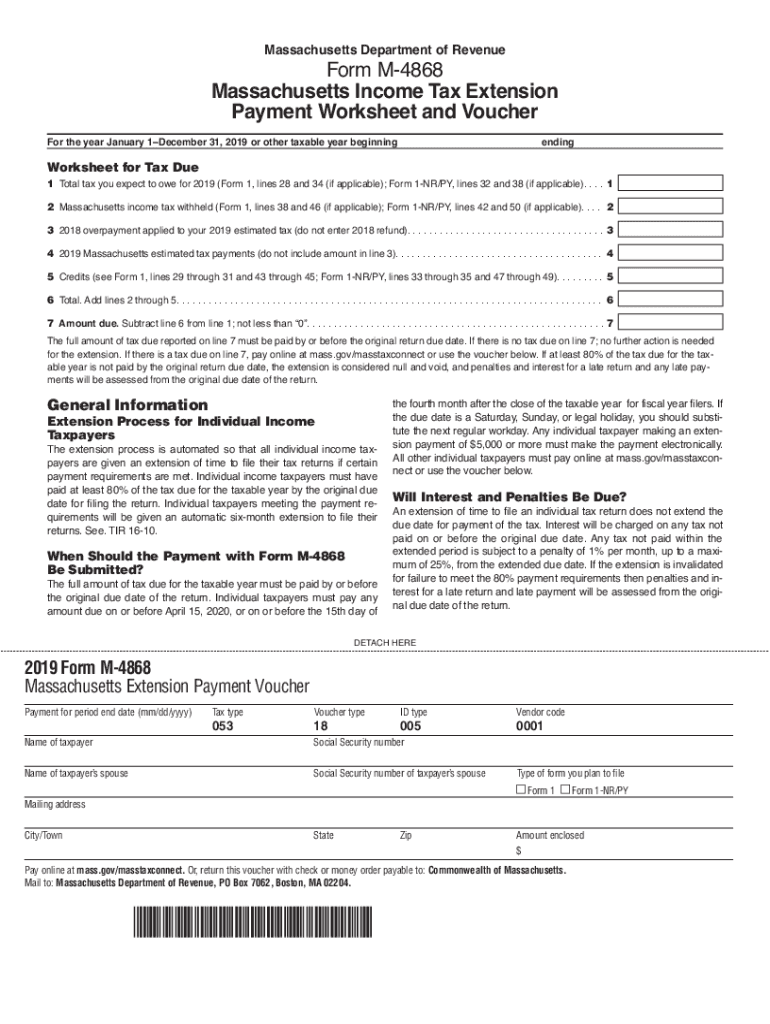

Tax Extention Forms Ma Fill Out and Sign Printable PDF Template signNow

Web change the entries on the form. How does this impact me? You can choose not to have federal income tax withheld from your. Web july 20, 2023. Web smartasset's massachusetts paycheck calculator shows your hourly and salary income after federal, state and local taxes.

Massachusetts Tax Withholding Tables 2017

Web the income tax withholding formula for the state of massachusetts includes the following changes: Check if you are exempt from. Web smartasset's massachusetts paycheck calculator shows your hourly and salary income after federal, state and local taxes. If you're an employee, your employer probably withholds income tax from your paycheck and pays it to the irs in your name..

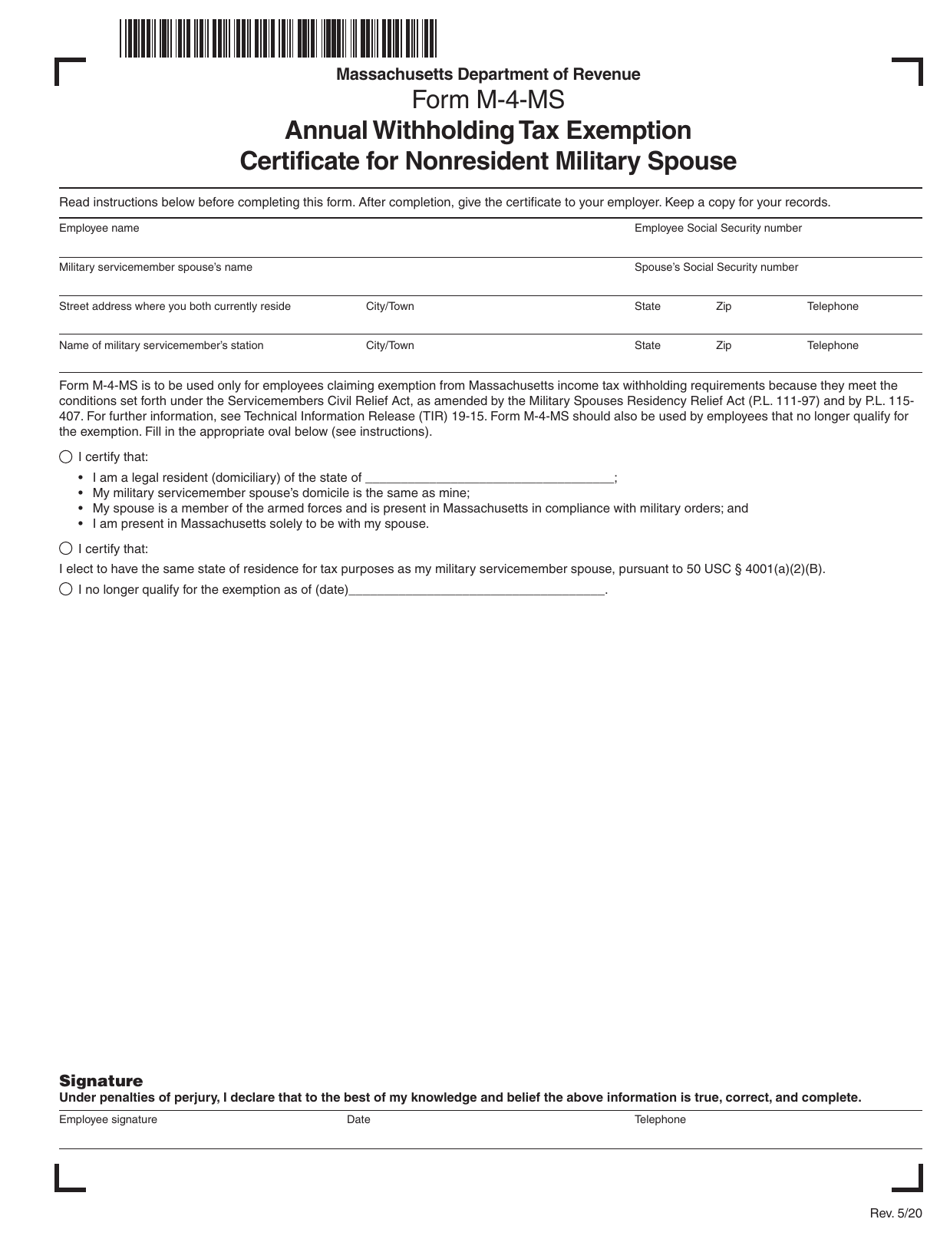

Form M4MS Download Printable PDF or Fill Online Annual Withholding

505, tax withholding and estimated tax. Web ma employee’s withholding exemption calculator. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web change the entries on the form. Web the income tax withholding formula for the state of massachusetts includes the following changes:

FREE 9+ Sample Employee Tax Forms in MS Word PDF

Web the income tax withholding formula for the state of massachusetts includes the following changes: Web smartasset's massachusetts paycheck calculator shows your hourly and salary income after federal, state and local taxes. Check if you are exempt from. Massachusetts stat e withholding tax. Use this calculator to determine the total number of allowances to enter on your.

Massachusetts Employee Withholding Form 2022 W4 Form

The tax rate has decreased from 5.05 percent to 5.00. 0, a, b, c/number of. Using “4” is the withholding system adjustment for the $4,400 exemption for a spouse. You can choose not to have federal income tax withheld from your. Check if spouse is blind and not subject to withholding.

FORM MASSACHUSETTS EMPLOYEE'S WITHHOLDING

Snohomish county tax preparer pleads guilty to assisting in the. Web the income tax withholding formula for the state of massachusetts includes the following changes: Web july 20, 2023. Web smartasset's massachusetts paycheck calculator shows your hourly and salary income after federal, state and local taxes. You can choose not to have federal income tax withheld from your.

Use This Calculator To Determine The Total Number Of Allowances To Enter On Your.

Complete, edit or print tax forms instantly. Check if you will file as head of household on your tax return. Check if you are exempt from. 505, tax withholding and estimated tax.

Web What Is Tax Withholding?

Check if you are blind. Choosing not to have income tax withheld. If claiming a wife or husband, write “4” in line 2. You can choose not to have federal income tax withheld from your.

Web Smartasset's Massachusetts Paycheck Calculator Shows Your Hourly And Salary Income After Federal, State And Local Taxes.

Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web ma employee’s withholding exemption calculator. If you're an employee, your employer probably withholds income tax from your paycheck and pays it to the irs in your name. Massachusetts stat e withholding tax.

505, Tax Withholding And Estimated Tax.

Employees hired before 2020 are not required. Snohomish county tax preparer pleads guilty to assisting in the. Using “4” is the withholding system adjustment for the $4,400 exemption for a spouse. State tax withholding state code: