Maine 1099 Form

Maine 1099 Form - Web file the following forms with the state of maine: Ad discover a wide selection of 1099 tax forms at staples®. Web yes, maine requires all 1099 forms to be filed with the maine revenue services. Web what do i do? Web all 1099 forms that you file with the irs must be filed with the state of maine if the payer issues 1099 to maine residents payment is sourced to maine taxbandits. Web date of death on form 1040me, page 3 in the. Web income tax withholding returns should now be filed in bulk or individually via the maine tax portal (mtp) at revenue.maine.gov. I received a letter saying that you sent my refund to another agency. I received a bill, but i can't pay it in full. 1 2a 4 5 7 9b 14 15 16 this box shows your total distribution.

Which forms does maine require? Web yes, maine requires all 1099 forms to be filed with the maine revenue services. I received a bill, but i can't pay it in full. 1 2a 4 5 7 9b 14 15 16 this box shows your total distribution. Web income tax withholding returns should now be filed in bulk or individually via the maine tax portal (mtp) at revenue.maine.gov. Web what do i do? Meetrs will remain available after may 31,2023. Web file the following forms with the state of maine: Spaces provided above the signature area. I received a letter saying that you sent my refund to another agency.

Web maine 1099 filing requirements the pine tree state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not. The form 1099 series of taxbanditsconsists of forms. I received a letter saying that you sent my refund to another agency. Meetrs will remain available after may 31,2023. Web date of death on form 1040me, page 3 in the. Ad discover a wide selection of 1099 tax forms at staples®. Web what do i do? Staples provides custom solutions to help organizations achieve their goals. Web income tax withholding returns should now be filed in bulk or individually via the maine tax portal (mtp) at revenue.maine.gov. Web all 1099 forms that you file with the irs must be filed with the state of maine if the payer issues 1099 to maine residents payment is sourced to maine taxbandits.

Tax Form 1099K The Lowdown for Amazon FBA Sellers

Web all 1099 forms that you file with the irs must be filed with the state of maine if the payer issues 1099 to maine residents payment is sourced to maine taxbandits. Web income tax withholding returns should now be filed in bulk or individually via the maine tax portal (mtp) at revenue.maine.gov. Meetrs will remain available after may 31,2023..

IRS 1099S 2020 Fill and Sign Printable Template Online US Legal Forms

Which forms does maine require? Web all 1099 forms that you file with the irs must be filed with the state of maine if the payer issues 1099 to maine residents payment is sourced to maine taxbandits. I received a bill, but i can't pay it in full. The form 1099 series of taxbanditsconsists of forms. Web file the following.

Example Of Non Ssa 1099 Form Maine Retirement For example

Which forms does maine require? I received a bill, but i can't pay it in full. Staples provides custom solutions to help organizations achieve their goals. Ad discover a wide selection of 1099 tax forms at staples®. Web maine 1099 filing requirements the pine tree state requires filing for various 1099 forms based on amount of payment and whether state.

Does A Foreign Company Get A 1099 Leah Beachum's Template

Ad discover a wide selection of 1099 tax forms at staples®. I received a letter saying that you sent my refund to another agency. Web income tax withholding returns should now be filed in bulk or individually via the maine tax portal (mtp) at revenue.maine.gov. All employers required to withhold maine income tax must register with the maine department of.

1099 Reportable Office of the State Controller

All employers required to withhold maine income tax must register with the maine department of revenue. Web all 1099 forms that you file with the irs must be filed with the state of maine if the payer issues 1099 to maine residents payment is sourced to maine taxbandits. The form 1099 series of taxbanditsconsists of forms. Web file the following.

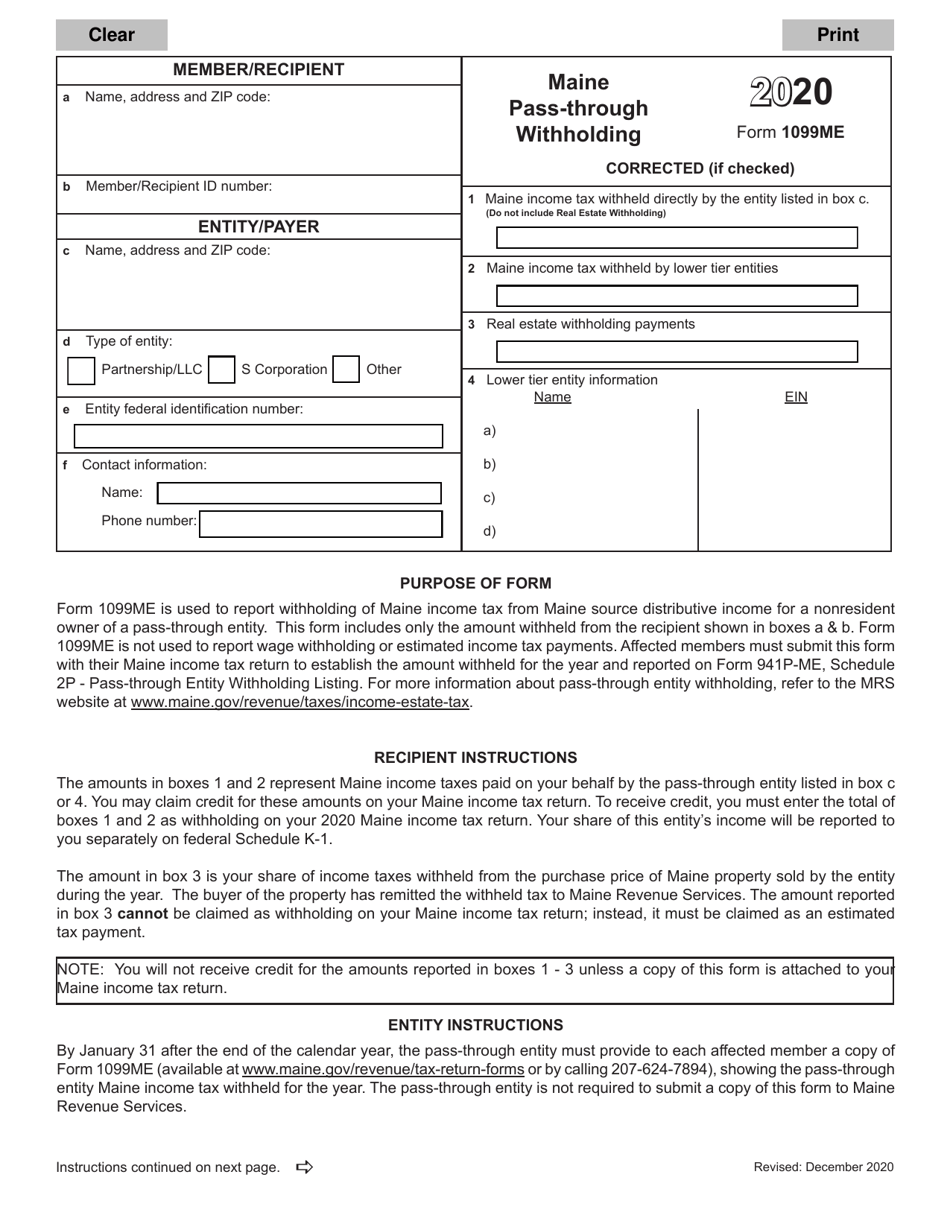

Form 1099ME Download Fillable PDF or Fill Online Maine PassThrough

I received a letter saying that you sent my refund to another agency. 1 2a 4 5 7 9b 14 15 16 this box shows your total distribution. Ad discover a wide selection of 1099 tax forms at staples®. Web what do i do? Which forms does maine require?

√画像をダウンロード 1099 misc nonemployee compensation turbotax 827694How to

All employers required to withhold maine income tax must register with the maine department of revenue. I received a bill, but i can't pay it in full. Web maine 1099 filing requirements the pine tree state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not. The form 1099 series of.

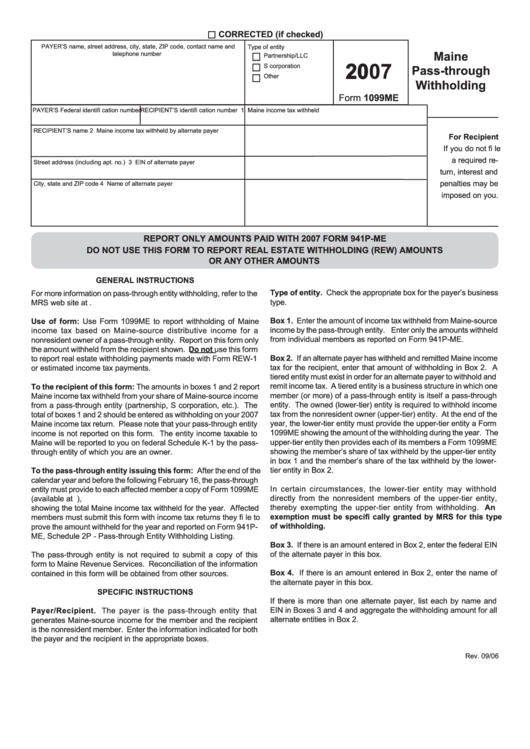

Form 1099me Maine PassThrough Withholding 2007 printable pdf download

Web file the following forms with the state of maine: Web yes, maine requires all 1099 forms to be filed with the maine revenue services. Web date of death on form 1040me, page 3 in the. Web what do i do? Web maine 1099 filing requirements the pine tree state requires filing for various 1099 forms based on amount of.

Free Printable 1099 Misc Forms Free Printable

Web maine 1099 filing requirements the pine tree state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not. Web file the following forms with the state of maine: Spaces provided above the signature area. Web date of death on form 1040me, page 3 in the. Staples provides custom solutions to.

ME 1099ME 2019 Fill out Tax Template Online US Legal Forms

Which forms does maine require? Staples provides custom solutions to help organizations achieve their goals. Web income tax withholding returns should now be filed in bulk or individually via the maine tax portal (mtp) at revenue.maine.gov. Web date of death on form 1040me, page 3 in the. Web what do i do?

Ad Discover A Wide Selection Of 1099 Tax Forms At Staples®.

1 2a 4 5 7 9b 14 15 16 this box shows your total distribution. Web yes, maine requires all 1099 forms to be filed with the maine revenue services. Web date of death on form 1040me, page 3 in the. Web all 1099 forms that you file with the irs must be filed with the state of maine if the payer issues 1099 to maine residents payment is sourced to maine taxbandits.

The Form 1099 Series Of Taxbanditsconsists Of Forms.

Staples provides custom solutions to help organizations achieve their goals. I received a letter saying that you sent my refund to another agency. Web file the following forms with the state of maine: Web income tax withholding returns should now be filed in bulk or individually via the maine tax portal (mtp) at revenue.maine.gov.

Which Forms Does Maine Require?

Meetrs will remain available after may 31,2023. All employers required to withhold maine income tax must register with the maine department of revenue. I received a bill, but i can't pay it in full. Spaces provided above the signature area.

Web What Do I Do?

Web maine 1099 filing requirements the pine tree state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not.