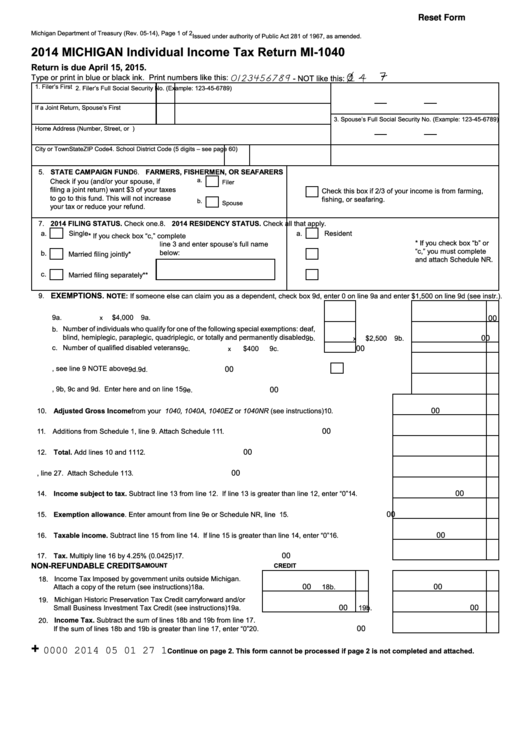

Michigan State Tax Return Form

Michigan State Tax Return Form - You may file online with efile or by mail. If a joint return, enter the name shown first. Michigan state income tax forms for current and previous tax years. Register and subscribe now to work on your mi form 4892 & more fillable forms. Due to irs staffing shortages and. Web this system contains u.s. Current michigan income taxes can. Web 2022 tax year forms and instructions individual income tax forms and instructions fiduciary tax forms estate tax forms city income tax forms use form search to find. Web michigan became the first state to allow individuals to sign up to be an organ donor on their state income tax return, according to the governor's office. Web most commonly used forms & instructions.

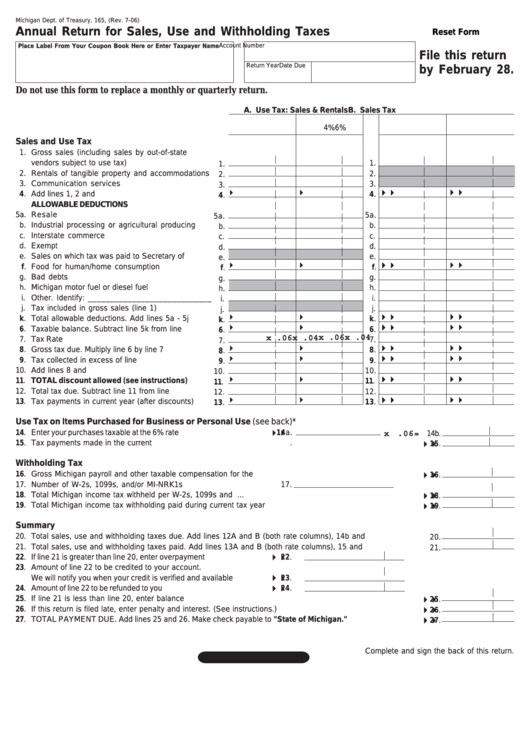

Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Treasury is committed to protecting. Web application for state real estate transfer tax (srett) refund. Web most commonly used forms & instructions. Web michigan became the first state to allow individuals to sign up to be an organ donor on their state income tax return, according to the governor's office. Due to irs staffing shortages and. Web michigan department of treasury (rev. Michigan state income tax forms for current and previous tax years. Register and subscribe now to work on your mi form 4892 & more fillable forms. Web this system contains u.s.

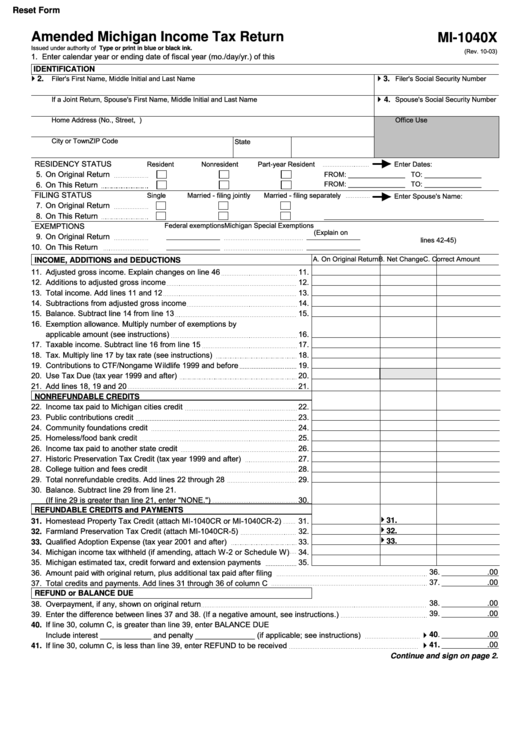

Web application for state real estate transfer tax (srett) refund. Where is your michigan tax refund money? Mto is the michigan department of treasury's web portal to many business taxes. Web welcome to michigan treasury online (mto)! You may file online with efile or by mail. Web if you had to submit an amended tax return this year, you may be wondering how come you haven't received your tax refund yet. Use this option to browse a list of forms by. Name shown on tax return. If a joint return, enter the name shown first. Corporate income tax, city of detroit individual income tax,.

Michigan State Tax Form 2020 23 Tips That Will Make You Influential

You may file online with efile or by mail. Name shown on tax return. Mto is the michigan department of treasury's web portal to many business taxes. Web if you had to submit an amended tax return this year, you may be wondering how come you haven't received your tax refund yet. Complete, edit or print tax forms instantly.

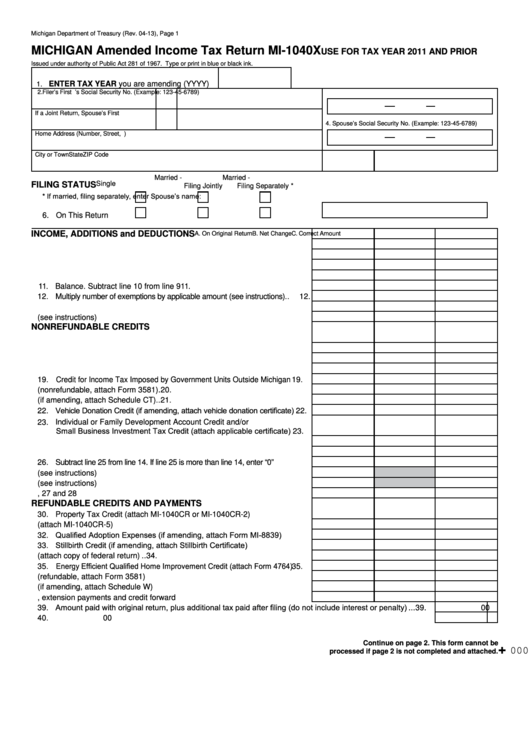

Fillable Form Mi1040x Michigan Amended Tax Return printable

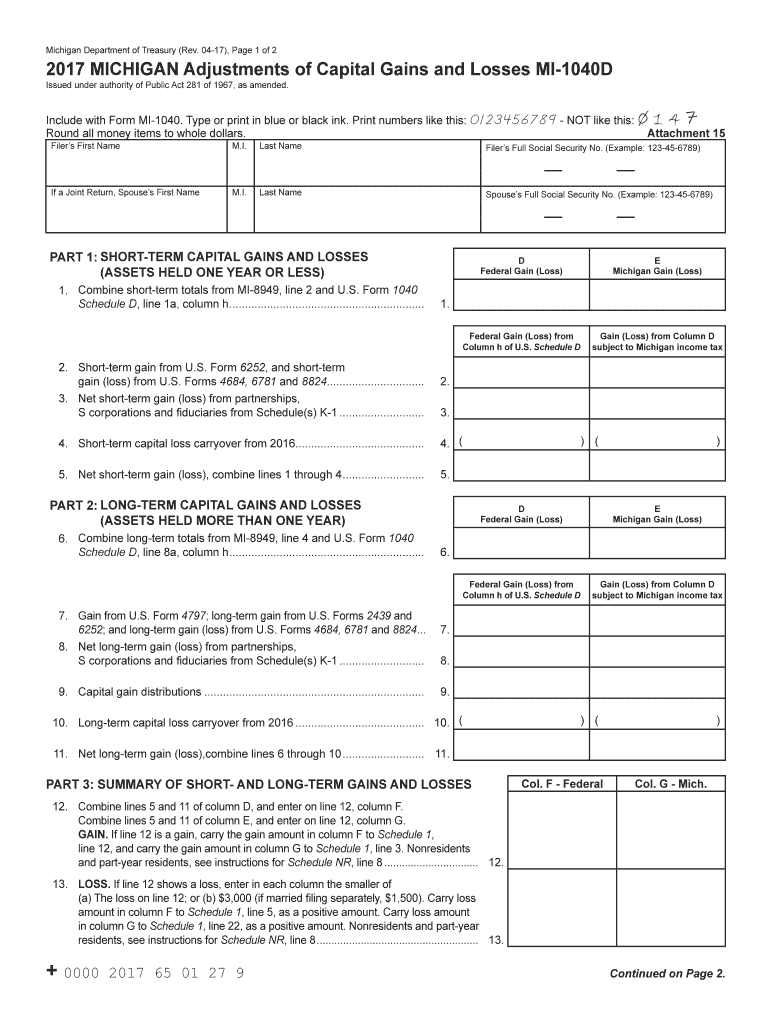

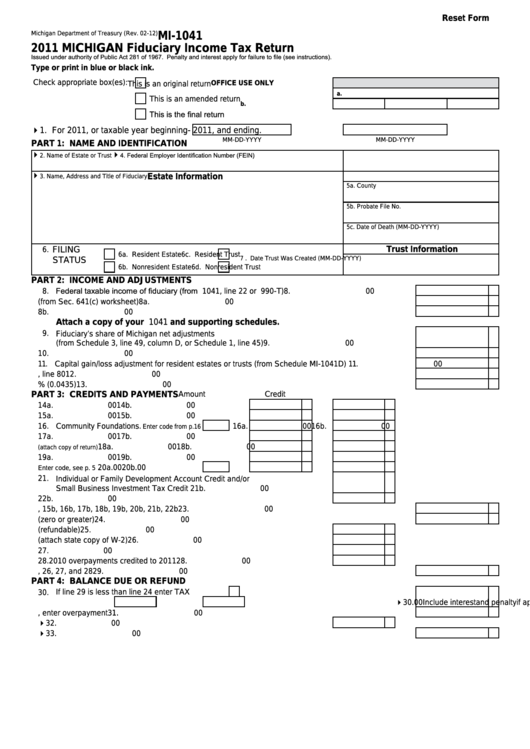

Web 2022 tax year forms and instructions individual income tax forms and instructions fiduciary tax forms estate tax forms city income tax forms use form search to find. Current michigan income taxes can. You may file online with efile or by mail. You may file online with efile or by mail. Michigan state income tax forms for current and previous.

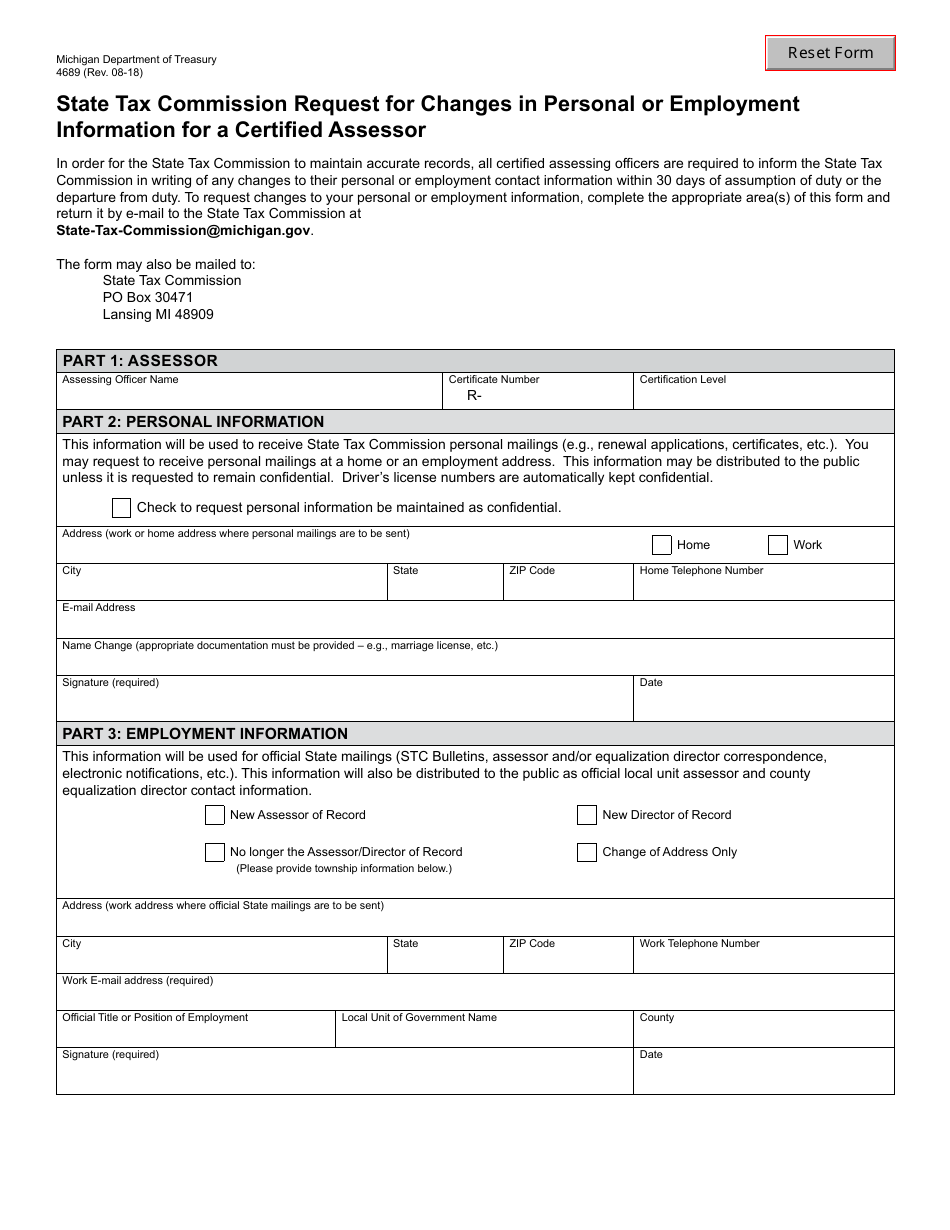

Michigan State Tax Commission

You can access the department of treasury web site or call the computerized return information. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Due to irs staffing shortages and. Complete, edit or print tax forms instantly. Michigan state tax refund.

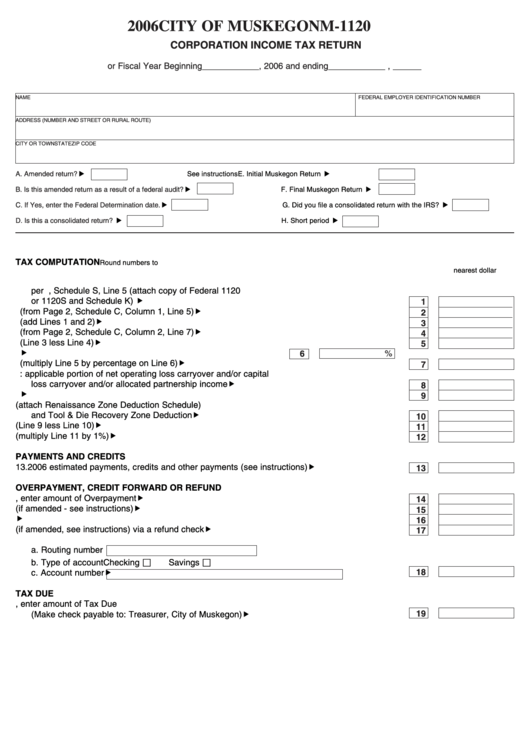

Form M1120 Corporation Tax Return State Of Michigan 2006

Complete, edit or print tax forms instantly. Due to irs staffing shortages and. Web most commonly used forms & instructions. You may file online with efile or by mail. Register and subscribe now to work on your mi form 4892 & more fillable forms.

Form Mi 1040 Michigan Tax Return 2000 Printable Pdf Download

You may file online with efile or by mail. Complete, edit or print tax forms instantly. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Issued under authority of public act 281 of 1967, as amended. Where is your michigan tax.

Fillable Form Mi1040x Amended Michigan Tax Return printable

Web most commonly used forms & instructions. Register and subscribe now to work on your mi form 4892 & more fillable forms. Web michigan became the first state to allow individuals to sign up to be an organ donor on their state income tax return, according to the governor's office. Where is your michigan tax refund money? By accessing and.

Mi 1040 Fill Out and Sign Printable PDF Template signNow

Current michigan income taxes can. Authorized representative declaration (power of attorney) tax area. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Web most commonly used forms & instructions. Michigan state tax refund status.

Fillable Form Mi1041 Michigan Fiduciary Tax Return 2011

Web 8 rows if you received a letter of inquiry regarding annual return for the return period of 2022, visit. Due to irs staffing shortages and. Complete, edit or print tax forms instantly. Web application for state real estate transfer tax (srett) refund. Use this option to browse a list of forms by.

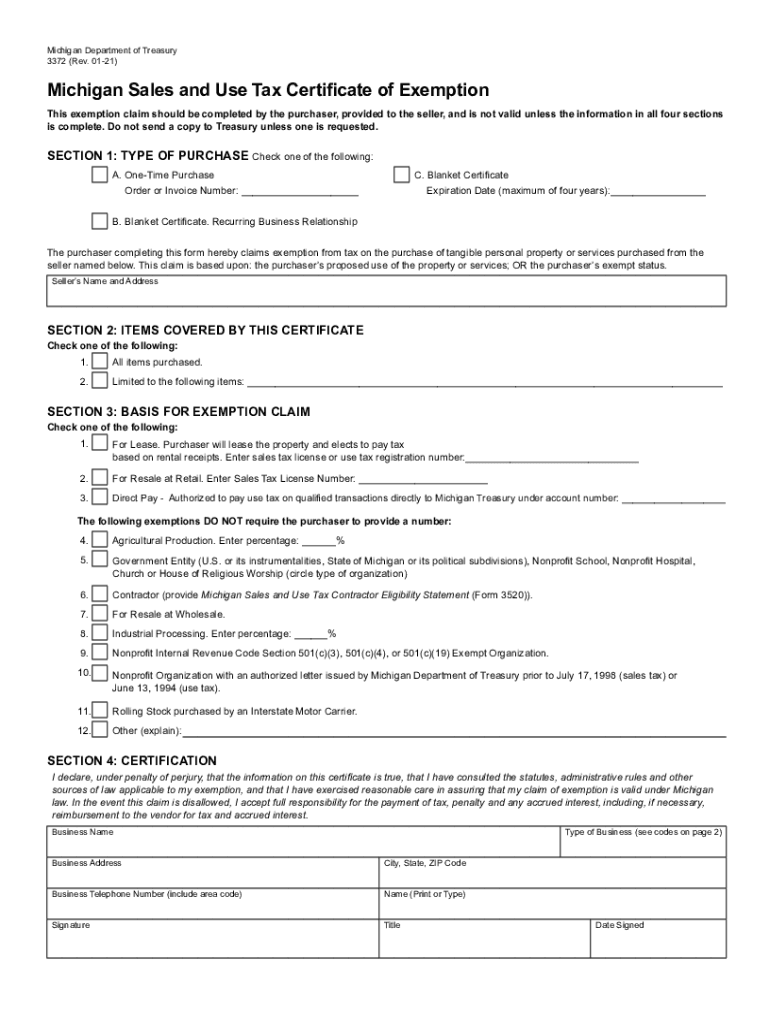

Form 3372 Fill Out and Sign Printable PDF Template signNow

You may file online with efile or by mail. You can access the department of treasury web site or call the computerized return information. Web if you had to submit an amended tax return this year, you may be wondering how come you haven't received your tax refund yet. Corporate income tax, city of detroit individual income tax,. Web 2022.

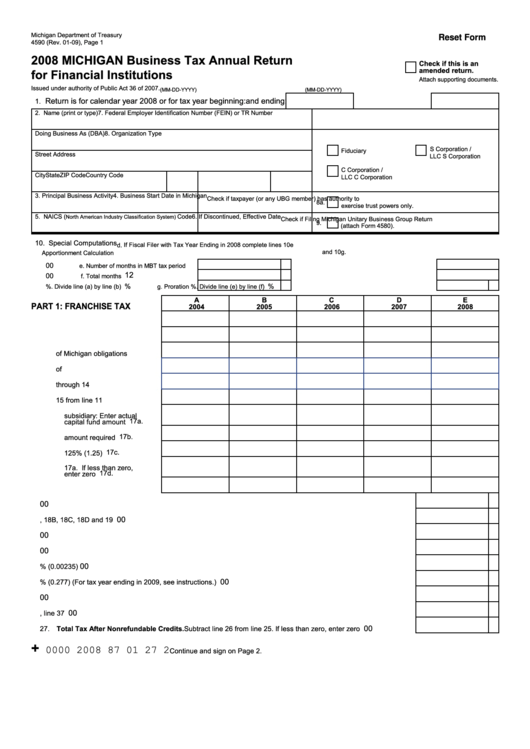

Fillable Form 4590 2008 Michigan Business Tax Annual Return For

Complete, edit or print tax forms instantly. Web 8 rows if you received a letter of inquiry regarding annual return for the return period of 2022, visit. Where is your michigan tax refund money? By accessing and using this computer system, you are consenting to system monitoring for law enforcement and other. Search by form name or key word:

Corporate Income Tax, City Of Detroit Individual Income Tax,.

Michigan state income tax forms for current and previous tax years. Web if you had to submit an amended tax return this year, you may be wondering how come you haven't received your tax refund yet. Issued under authority of public act 281 of 1967, as amended. Web welcome to michigan treasury online (mto)!

Treasury Is Committed To Protecting.

If a joint return, enter the name shown first. Web most commonly used forms & instructions. Use this option to browse a list of forms by. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by.

Complete, Edit Or Print Tax Forms Instantly.

By accessing and using this computer system, you are consenting to system monitoring for law enforcement and other. Authorized representative declaration (power of attorney) tax area. Mto is the michigan department of treasury's web portal to many business taxes. Web 8 rows if you received a letter of inquiry regarding annual return for the return period of 2022, visit.

Current Michigan Income Taxes Can.

You can access the department of treasury web site or call the computerized return information. Web application for state real estate transfer tax (srett) refund. Michigan state tax refund status. You may file online with efile or by mail.