Michigan Tax Exempt Form

Michigan Tax Exempt Form - Web michigan sales and use tax certificate of exemption: Web information regarding michigan tax exempt forms via: Web 2022 individual income tax forms and instructions need a different form? The purchaser’s proposed use of the property or services; All claims are subject to audit. Michigan sales and use tax contractor eligibility statement: Michigan does not issue “tax exemption numbers”. Or the purchaser’s exempt status. Download a pdf form 3372 sales tax exemption certificate for future use. Download a copy of the michigan general sales tax exemption form and return it to:

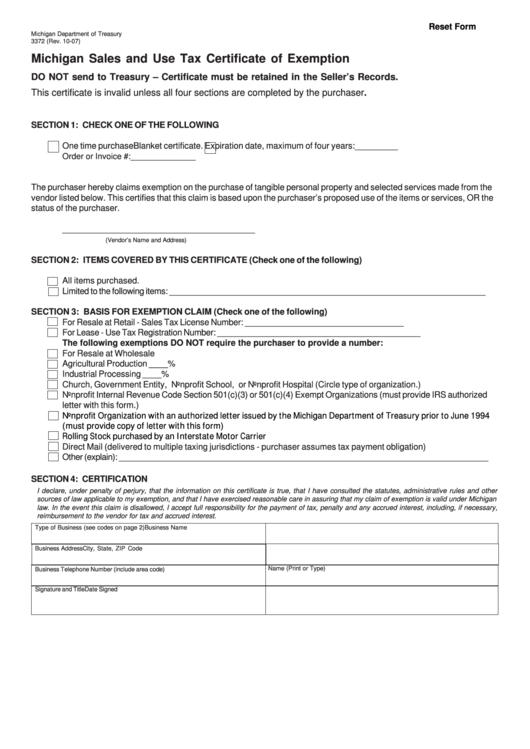

Web the purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from the seller named below. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Web michigan sales tax exemption form 3372 | fillable pdf issue a michigan resale certificate to vendors for purchase of items for resale. Download a pdf form 3372 sales tax exemption certificate for future use. Or the purchaser’s exempt status. Sellers should not accept a number as evidence of exemption from sales or use Most commonly used forms & instructions tax credits payments miscellaneous forms & instructions This claim is based upon: Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. All claims are subject to audit.

Tax exemption certificate for donated motor vehicle: Michigan sales and use tax contractor eligibility statement: Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Web michigan sales and use tax certificate of exemption: Web michigan department of treasury form 3372 (rev. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Issue a michigan resale certificate to vendors for purchase of items for resale. Certiicate must be retained in the seller’s records. Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. Web 2022 individual income tax forms and instructions need a different form?

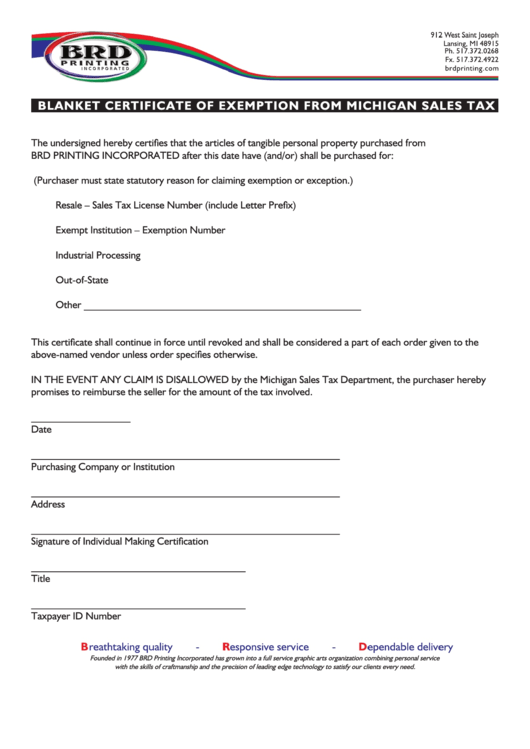

Fillable Blanket Certificate Of Exemption From Michigan Sales Tax

Michigan does not issue “tax exemption numbers”. All claims are subject to audit. Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. Tax exemption certificate for donated motor vehicle: Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor.

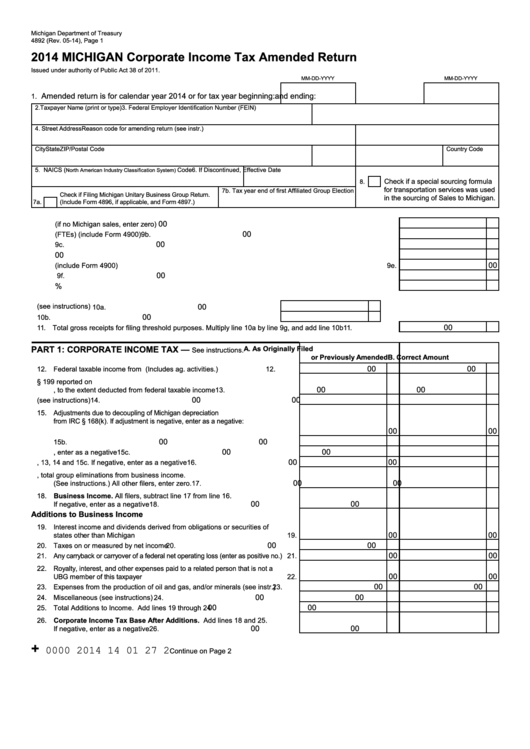

Form 4892 Michigan Corporate Tax Amended Return 2014

Look for forms using our forms search or view a list of income tax forms by year. Certiicate must be retained in the seller’s records. Or the purchaser’s exempt status. Download a pdf form 3372 sales tax exemption certificate for future use. Electronic funds transfer (eft) account update:

Michigan certificate of tax exemption from 3372 Fill out & sign online

Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Web information regarding michigan tax exempt forms via: The purchaser’s proposed use of the property or services; Most commonly used forms & instructions tax credits payments miscellaneous forms &.

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Tax exemption certificate for donated motor vehicle: Electronic funds transfer (eft) account update: You will need acrobat reader installed to view the forms. Web 2022 individual income tax forms and instructions need a different form? Web michigan sales and use tax certificate of exemption:

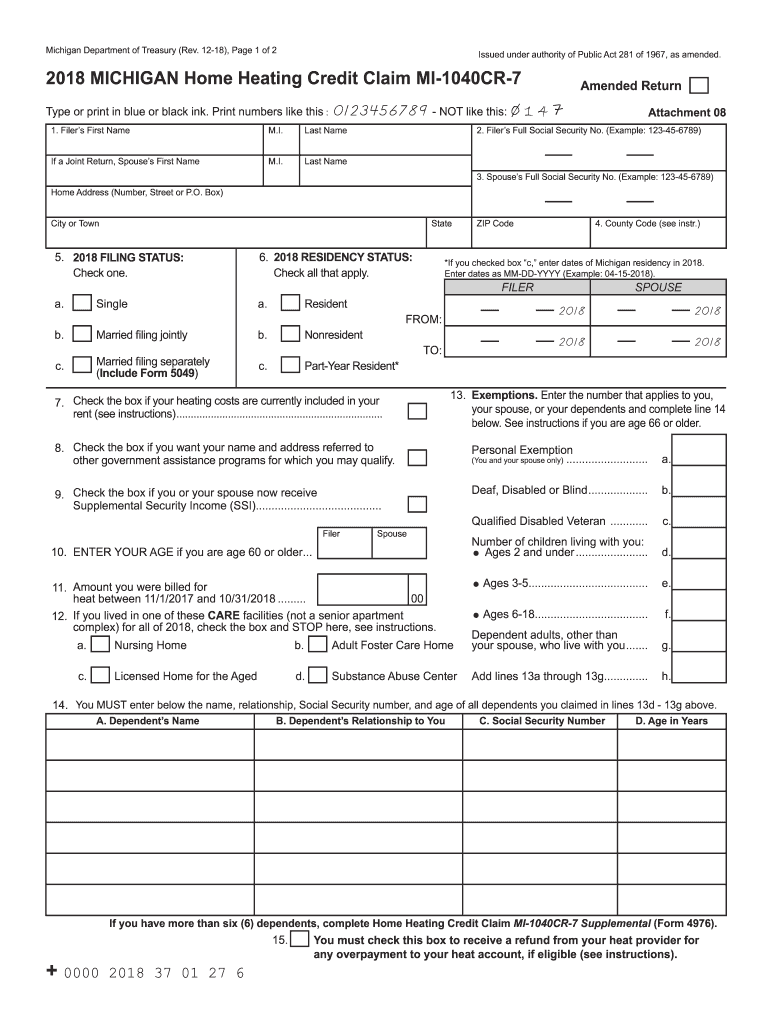

2018 Form MI MI1040CR7 Fill Online, Printable, Fillable, Blank

It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Most commonly used forms & instructions tax credits payments miscellaneous forms & instructions Michigan sales and use tax contractor eligibility statement: Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. Michigan sales and use tax certificate.

Michigan Tax Exempt Form Spring Meadow Nursery

This claim is based upon: Web 2022 individual income tax forms and instructions need a different form? It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. Web the purchaser completing this form hereby claims exemption from.

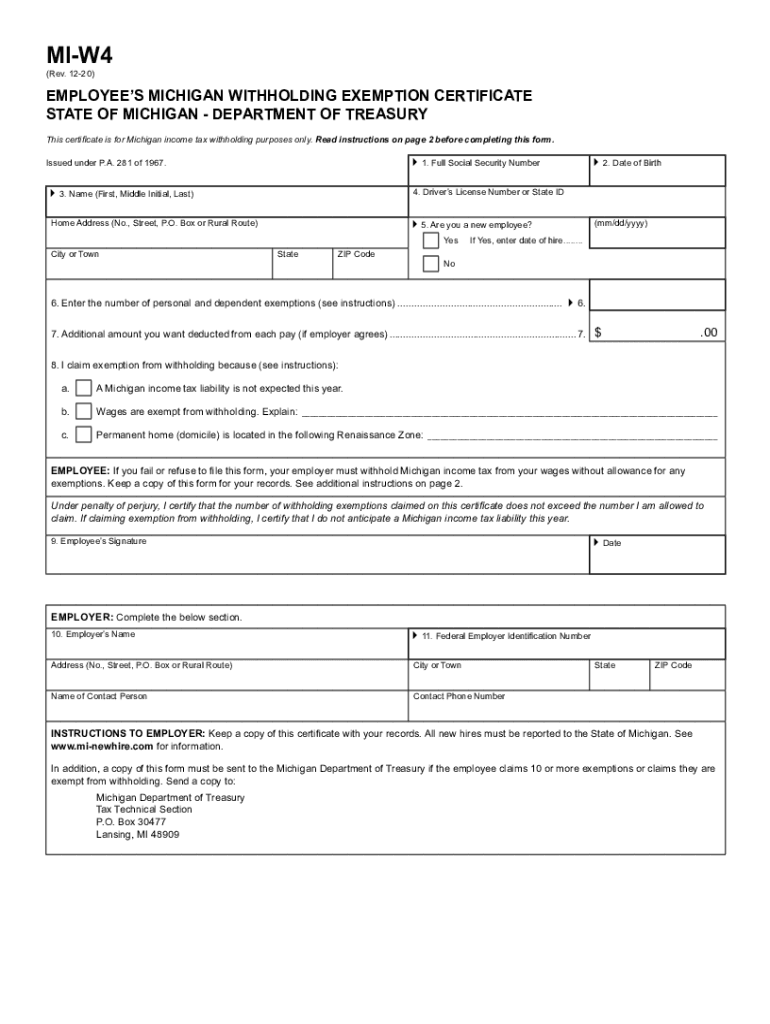

Michigan W4 Fill Out and Sign Printable PDF Template signNow

This claim is based upon: Web michigan department of treasury form 3372 (rev. Web the purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from the seller named below. Tax exemption certificate for donated motor vehicle: Sales tax return for special events:

How to get a Certificate of Exemption in Michigan

Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web the purchaser completing this form hereby claims exemption from tax.

Top 19 Michigan Tax Exempt Form Templates free to download in PDF format

Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Look for forms using our forms search or view a list of income tax forms by year. Michigan sales and use tax contractor eligibility statement: Michigan does not issue.

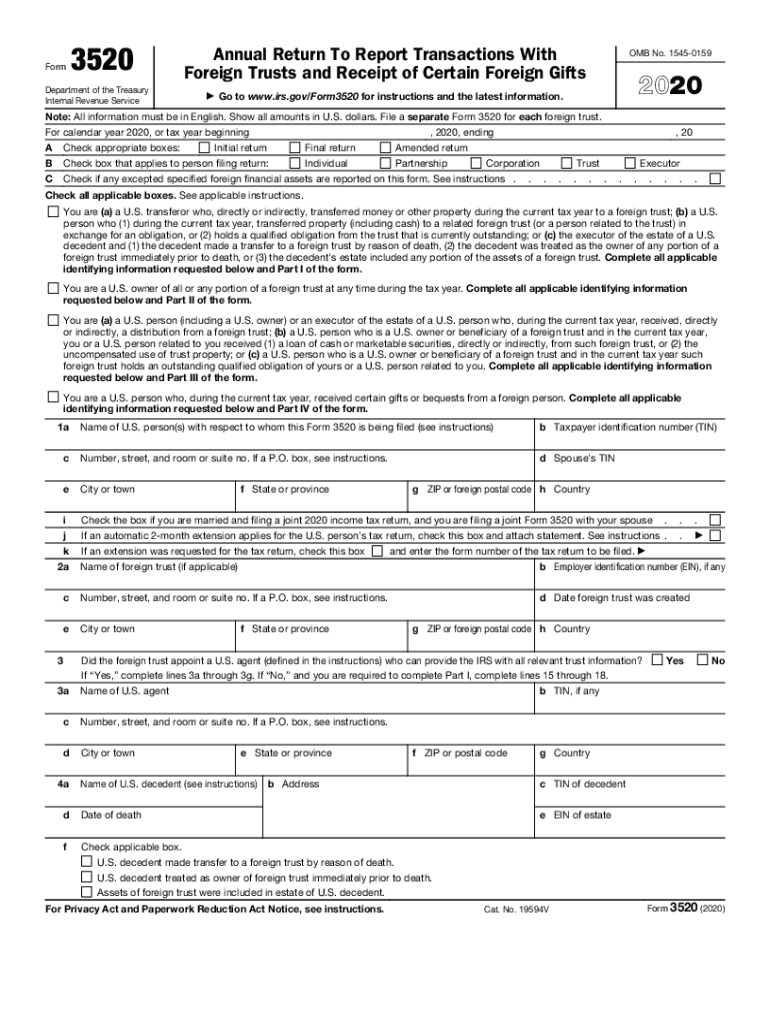

Michigan Tax Exempt Form 3520

Download a pdf form 3372 sales tax exemption certificate for future use. Sales tax return for special events: All claims are subject to audit. It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Sellers should not accept a number as evidence of exemption from sales or use

Download A Copy Of The Michigan General Sales Tax Exemption Form And Return It To:

Michigan sales and use tax contractor eligibility statement: Michigan does not issue “tax exemption numbers”. Issue a michigan resale certificate to vendors for purchase of items for resale. Download a pdf form 3372 sales tax exemption certificate for future use.

Sales Tax Return For Special Events:

Web the purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from the seller named below. Web michigan sales tax exemption form 3372 | fillable pdf issue a michigan resale certificate to vendors for purchase of items for resale. Sellers should not accept a number as evidence of exemption from sales or use Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following:

Web Information Regarding Michigan Tax Exempt Forms Via:

Or the purchaser’s exempt status. Tax exemption certificate for donated motor vehicle: Look for forms using our forms search or view a list of income tax forms by year. Certiicate must be retained in the seller’s records.

Web Michigan Department Of Treasury Form 3372 (Rev.

This claim is based upon: The purchaser’s proposed use of the property or services; Web michigan sales and use tax certificate of exemption: Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website.