Michigan Tax Form Schedule 1

Michigan Tax Form Schedule 1 - This is the amount from your u.s. Capital gains from the sale of u.s. You must attach copies of federal schedules that. Web we last updated michigan schedule 1 in february 2023 from the michigan department of treasury. Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. This form is for income earned in tax year 2022, with tax returns due in april. Web 2021 michigan schedule 1 additions and subtractions michigan department of treasury 3423 (rev. Web enter your agi from your federal return. Web we maintain tax forms for the following tax years/tax types: Schedule 1 listing the amounts received and the issuing agency.

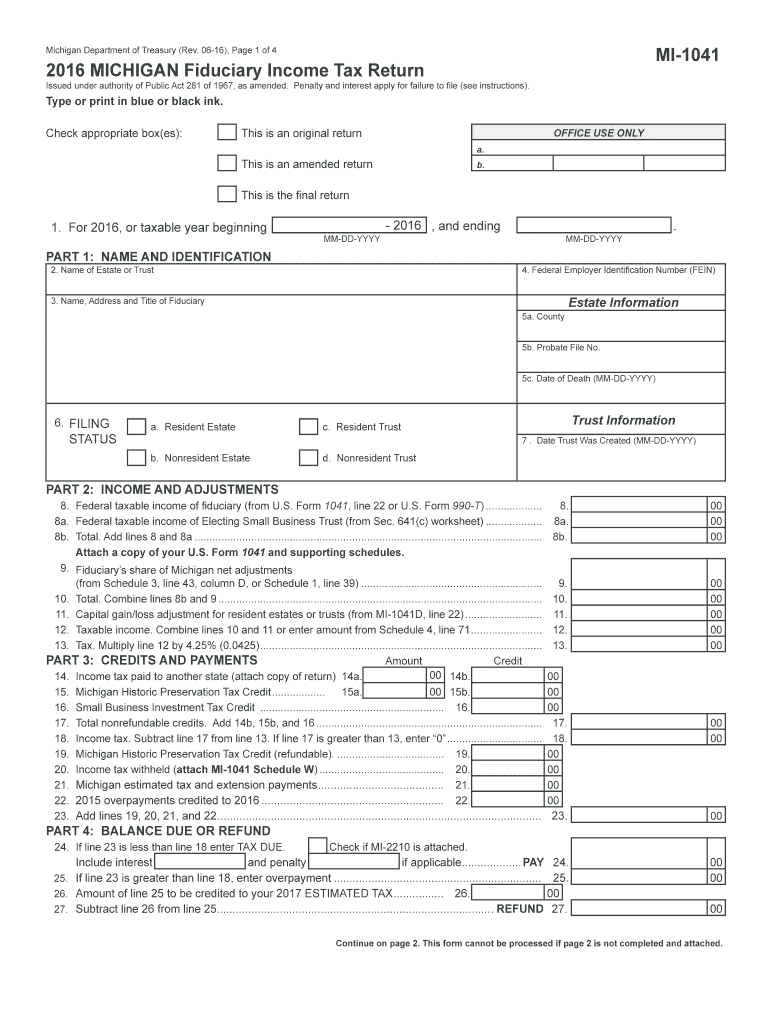

Web michigan department of treasury 3423 (rev. More about the michigan schedule 1 instructions. Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Enter losses from a business or property. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. Capital gains from the sale of u.s. Web we last updated michigan schedule 1 in february 2023 from the michigan department of treasury. Tax year 2016 corporate, partnership and fiduciary (estates & trusts) annual returns; Issued under authority of public act 281 of 1967,. Web 2021 michigan schedule 1 additions and subtractions michigan department of treasury 3423 (rev.

Issued under authority of public act 281 of 1967,. Also report any taxable tier 1 and tier 2 railroad. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule amd (form 5530) amended return explanation of changes: Enter losses from a business or property. This form is for income earned in tax year 2022, with tax returns due in april. Capital gains from the sale of u.s. Web michigan department of treasury 3423 (rev. Web we last updated michigan schedule 1 in february 2023 from the michigan department of treasury. Tax year 2016 corporate, partnership and fiduciary (estates & trusts) annual returns;

006 Page1 1200Px State And Local Sales Tax Rates Pdf Michigan Form

Web enter your agi from your federal return. Web we maintain tax forms for the following tax years/tax types: 1 include military and michigan national guard retirement benefits here and on schedule w, table 2. Capital gains from the sale of u.s. Tax year 2016 corporate, partnership and fiduciary (estates & trusts) annual returns;

Schedule K1 Tax Form What Is It and Who Needs to Know?

This form is for income earned in tax year 2022, with tax returns due in april. This is the amount from your u.s. 2020 michigan schedule 1 additions and subtractions. Schedule 1 listing the amounts received and the issuing agency. 1 include military and michigan national guard retirement benefits here and on schedule w, table 2.

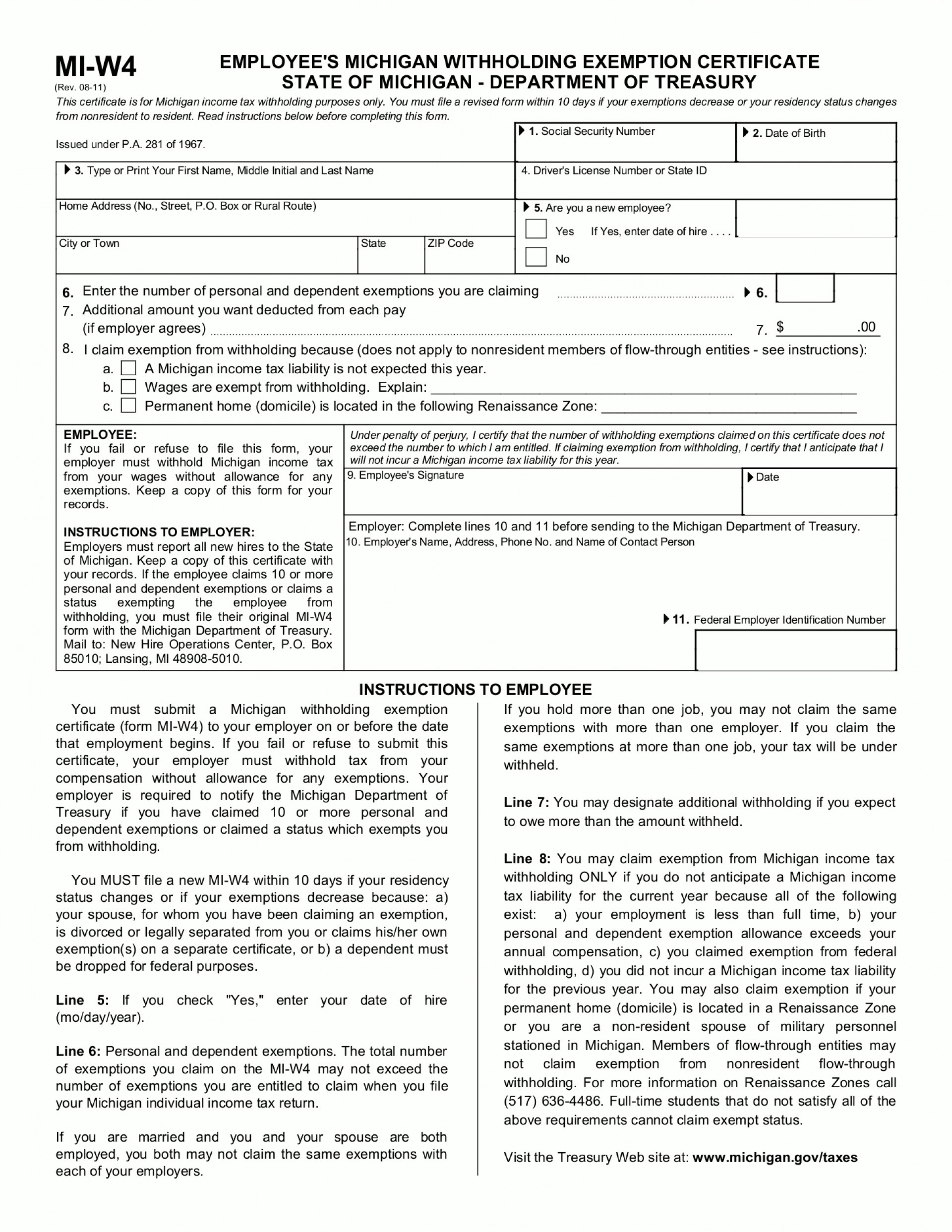

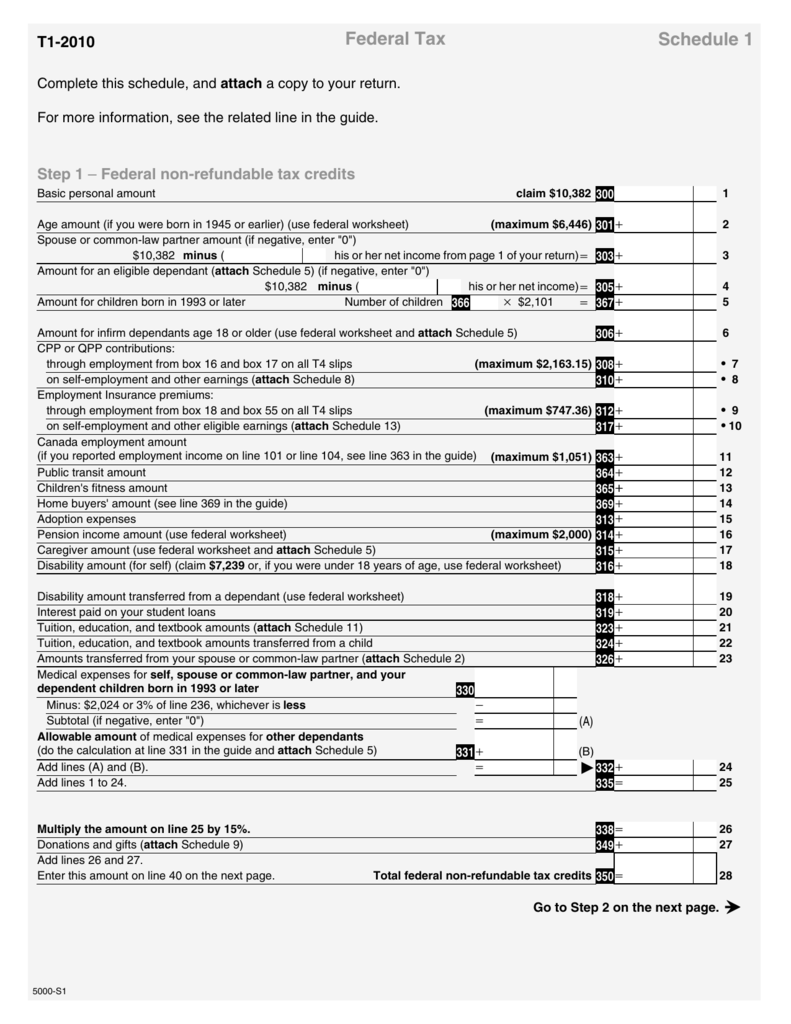

Schedule 1 Federal Tax

More about the michigan schedule 1 instructions. Web we last updated michigan schedule 1 in february 2023 from the michigan department of treasury. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. Issued under authority of public act 281.

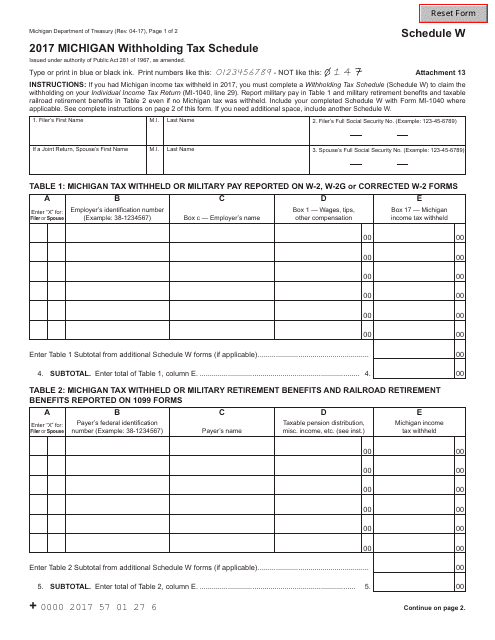

Schedule W Download Fillable PDF or Fill Online Michigan Withholding

1 include military and michigan national guard retirement benefits here and on schedule w, table 2. Web 2021 michigan schedule 1 additions and subtractions michigan department of treasury 3423 (rev. Also report any taxable tier 1 and tier 2 railroad. Web enter your agi from your federal return. Web schedule 1 is used to report types of income that aren't.

Michigan State Tax Form 2020 23 Tips That Will Make You Influential

Web commonly used michigan income tax forms are also available at michigan department of treasury offices, most public libraries, northern michigan post offices, and michigan. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. This is the amount from.

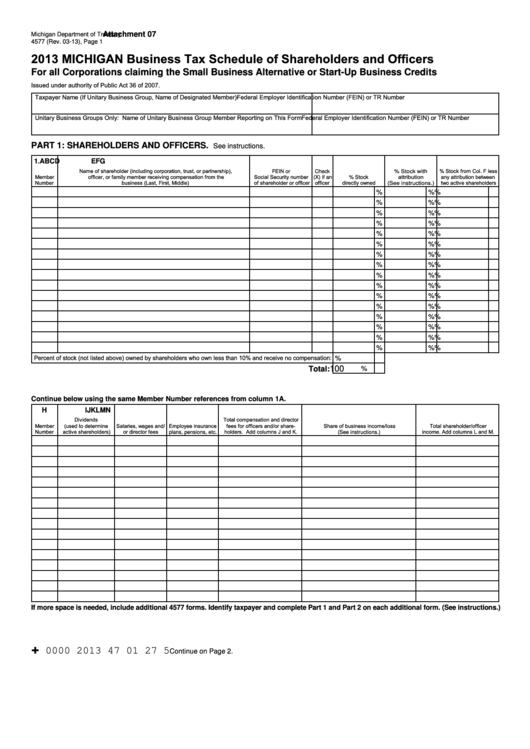

Form 4577 Michigan Business Tax Schedule Of Shareholders And Officers

Web enter your agi from your federal return. More about the michigan schedule 1 instructions. Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Capital gains from the sale of u.s. Web we maintain tax forms for the following tax years/tax types:

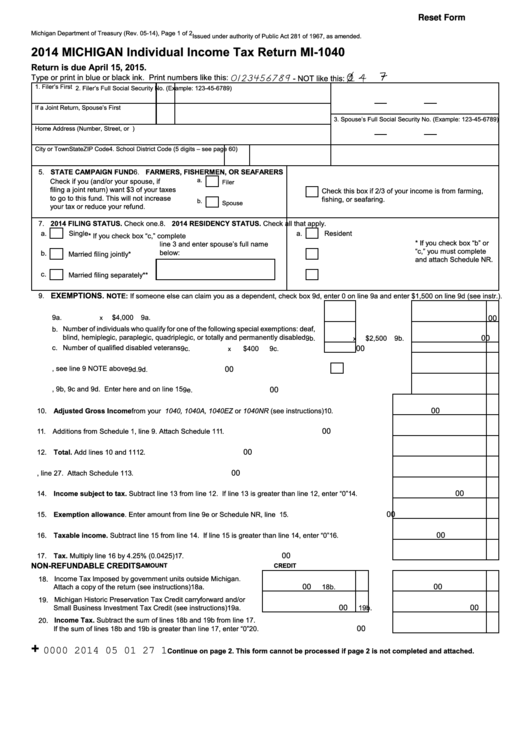

Michigan 1040 Tax Form ctrlcdesigns

This form is for income earned in tax year 2022, with tax returns due in april. Also report any taxable tier 1 and tier 2 railroad. Schedule 1 listing the amounts received and the issuing agency. 2020 michigan schedule 1 additions and subtractions. Issued under authority of public act 281 of 1967,.

Michigan Schedule 1 Form Fill Out and Sign Printable PDF Template

Instructions are with each form. 1 include military and michigan national guard retirement benefits here and on schedule w, table 2. 2020 michigan schedule 1 additions and subtractions. Issued under authority of public act 281 of 1967,. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1.

Michigan 1040ez Tax Form Universal Network

Web enter your agi from your federal return. Capital gains from the sale of u.s. Enter losses from a business or property. Web we maintain tax forms for the following tax years/tax types: This is the amount from your u.s.

Tax Form 1040 Schedule 1 Form Resume Examples MoYoo1BYZB

1 include military and michigan national guard retirement benefits here and on schedule w, table 2. Web enter your agi from your federal return. Instructions are with each form. Issued under authority of public act 281 of 1967,. Web we maintain tax forms for the following tax years/tax types:

Tax Year 2016 Corporate, Partnership And Fiduciary (Estates & Trusts) Annual Returns;

Issued under authority of public act 281 of 1967,. Capital gains from the sale of u.s. 2020 michigan schedule 1 additions and subtractions. Enter losses from a business or property.

More About The Michigan Schedule 1 Instructions.

Web commonly used michigan income tax forms are also available at michigan department of treasury offices, most public libraries, northern michigan post offices, and michigan. Web enter your agi from your federal return. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. Instructions are with each form.

You Must Attach Copies Of Federal Schedules That.

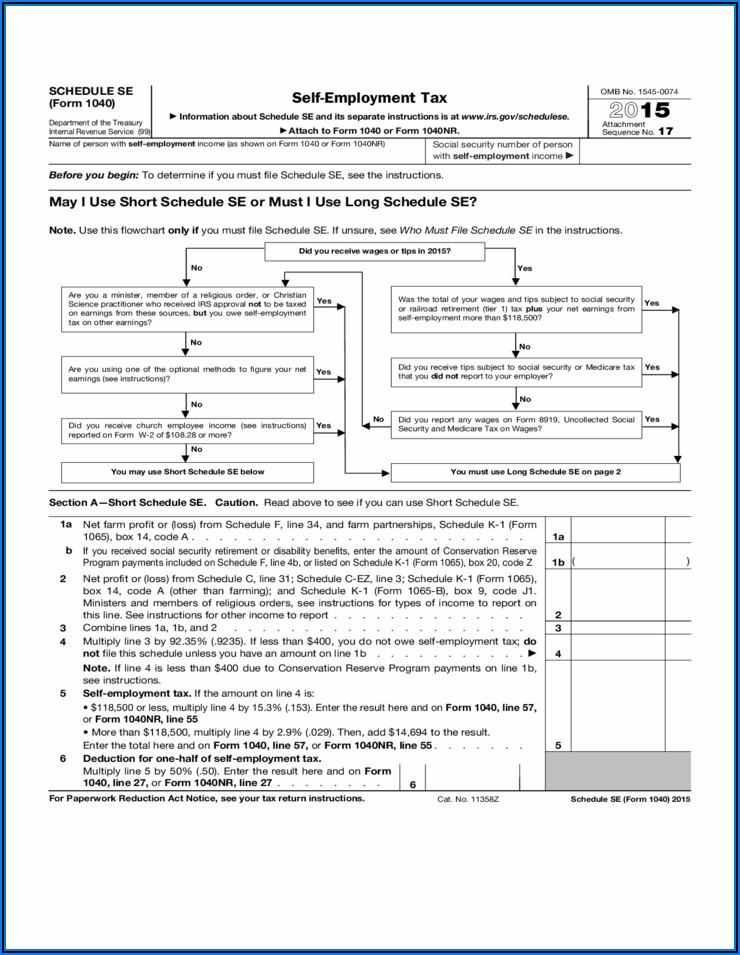

Web 2021 michigan schedule 1 additions and subtractions michigan department of treasury 3423 (rev. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated michigan schedule 1 in february 2023 from the michigan department of treasury. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings.

Web Michigan Department Of Treasury 3423 (Rev.

Also report any taxable tier 1 and tier 2 railroad. Web we maintain tax forms for the following tax years/tax types: Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Schedule 1 listing the amounts received and the issuing agency.