Minimum Debt To File Chapter 7

Minimum Debt To File Chapter 7 - — debtry the goalry mall. But court filing fees are updated periodically and can change. If you owe as low as $1, you can still file for bankruptcy. Now, this question was specifically geared towards chapter 7 bankruptcy. The truth is, there is no minimum amount of debt one will need in order to file chapter 7. Web in a nutshell learn about the chapter 7 bankruptcy income limits including how you may still be eligible for chapter 7 relief under the bankruptcy means test even if your average income exceeds the median income. If you can't afford to pay the filing fee, you may be. Web (3) in addition to the petition, the debtor must also file with the court: Updated july 12, 2023 table of contents the chapter 7. While some chapters do have upper limits for secured and unsecured debt, most individuals prefer to file for chapter 7.

(1) schedules of assets and liabilities; — debtry the goalry mall. Web here are the debt and eligibility requirements for filing chapter 7 bankruptcy. Web in a nutshell learn about the chapter 7 bankruptcy income limits including how you may still be eligible for chapter 7 relief under the bankruptcy means test even if your average income exceeds the median income. If you owe as low as $1, you can still file for bankruptcy. Web how much do you have to be in debt to file chapter 7? If it’s enough to pay 25% of your unsecured debts over 60 months, then you’re not eligible for relief under chapter 7. Those who seek chapter 7 bankruptcy may lose some of their property in exchange for a discharge of debt… There are, however, many practical reasons why you should seek other alternatives than filing bankruptcy unless your debts. Web (3) in addition to the petition, the debtor must also file with the court:

Compare all available options when personal, family, business finances are unmanageable. Web how much do you have to be in debt to file chapter 7? While there is no minimum amount of debt required in order to file for chapter 7 protection, you will need to demonstrate. While some chapters do have upper limits for secured and unsecured debt, most individuals prefer to file for chapter 7. Web if you are able to get a settlement that's significantly less than your total debts owed, you will be taxed on any forgiven debt over $600. Written by attorney andrea wimmer. There is, however, a limit that you need to be aware of, if you're considering filing for chapter. Web is there a debt limit to file chapter 7? From a practical point of view you should file if you are likely to have a significant amount of debt discharged. Web i have good news on this front, the answer is, that there's no limit.

Can I File Chapter 7 Bankruptcy to Get Rid Of Business Debt? Karra L

The truth is, there is no minimum amount of debt one will need in order to file chapter 7. There are, however, many practical reasons why you should seek other alternatives than filing bankruptcy unless your debts. The total amount of your debt is a crucial factor to consider before filing chapter 7. Web (3) in addition to the petition,.

Chapter 13 Bankruptcy Debt Limits Steiner Law Group

Web how much do you have to be in debt to file chapter 7? Sometimes the main consideration on whether to file bankruptcy on a debt is the type of debt. Here, you can’t have more than $1,257,850 in secured debt or. (2) a schedule of current income and expenditures; (3) a statement of financial affairs;

Minimum Debt to File Bankruptcy? Is There A Minimum Debt Amount To File

Web is there a debt limit to file chapter 7? Web if you have disposable income, then your ability to file chapter 7 bankruptcy depends on how much disposable income you have. Some individuals file with as little as $3,000 of debt. Sometimes the main consideration on whether to file bankruptcy on a debt is the type of debt. Web.

Chapter 7 of the United States Bankruptcy Law Code

There are currently no threshold amounts for chapter 7 bankruptcy eligibility. But court filing fees are updated periodically and can change. Web if you have disposable income, then your ability to file chapter 7 bankruptcy depends on how much disposable income you have. In contrast, a chapter 13 bankruptcy presents limits. Some individuals file with as little as $3,000 of.

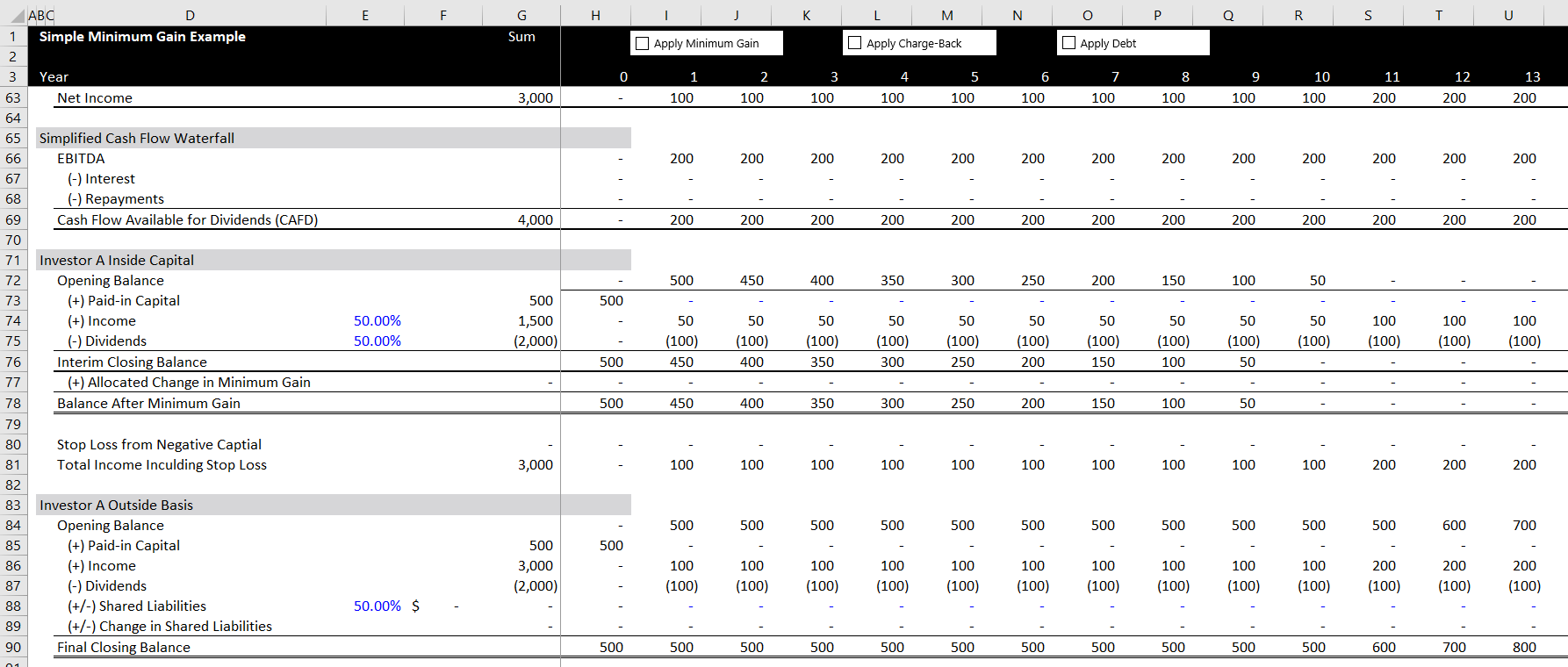

NonRecourse Debt and Minimum Gain Edward Bodmer Project and

For a person with an annual income of $43,000 per year $30,000 is a significant amount of debt. Web here are the debt and eligibility requirements for filing chapter 7 bankruptcy. Here, you can’t have more than $1,257,850 in secured debt or. The truth is, there is no minimum amount of debt one will need in order to file chapter.

Chapter 7 Bankruptcy

Updated july 12, 2023 table of contents the chapter 7. There are, however, many practical reasons why you should seek other alternatives than filing bankruptcy unless your debts. Those who seek chapter 7 bankruptcy may lose some of their property in exchange for a discharge of debt… Web (3) in addition to the petition, the debtor must also file with.

200,000 In Debt Making Minimum Wage YouTube

Web for most people, paying the minimum payments on unsecured and other debts is not a viable option if the goal is to be debt free in 5 years. If it’s enough to pay 25% of your unsecured debts over 60 months, then you’re not eligible for relief under chapter 7. Web in a nutshell learn about the chapter 7.

How Much Do You Have to Be in Debt to File Chapter 7 Bankruptcy?

(2) a schedule of current income and expenditures; Web is there a debt limit to file chapter 7? (3) a statement of financial affairs; The total amount of your debt is a crucial factor to consider before filing chapter 7. Web chapter 7 bankruptcy may allow you to get rid of many of your debts and wipe your slate clean,.

How To File Bankruptcy Chapter 7 Yourself In Ny opmakenopstardoll

But court filing fees are updated periodically and can change. Some chapters of bankruptcy do have debt limits, but there is no such thing as a debt minimum. You can have an infinite amount of debt and still be able to file for chapter 7 bankruptcy. Web here are the debt and eligibility requirements for filing chapter 7 bankruptcy. Web.

Arizona Chapter 7 Bankruptcy Bankruptcy Attorneys in AZ for Ch. 7 BK

If it’s enough to pay 25% of your unsecured debts over 60 months, then you’re not eligible for relief under chapter 7. Learn how the bankruptcy rules affect your eligibility for bankruptcy relief under chapter 7. You can have an infinite amount of debt and still be able to file for chapter 7 bankruptcy. Web in a nutshell learn about.

Updated July 12, 2023 Table Of Contents The Chapter 7.

Web in a nutshell learn about the chapter 7 bankruptcy income limits including how you may still be eligible for chapter 7 relief under the bankruptcy means test even if your average income exceeds the median income. Here, you can’t have more than $1,257,850 in secured debt or. (1) schedules of assets and liabilities; Web when you get down to it, there’s no minimum amount of debt required to declare bankruptcy.

Compare All Available Options When Personal, Family, Business Finances Are Unmanageable.

Web how much do you have to be in debt to file chapter 7? Web is there a debt limit to file chapter 7? Some chapters of bankruptcy do have debt limits, but there is no such thing as a debt minimum. Web if you are able to get a settlement that's significantly less than your total debts owed, you will be taxed on any forgiven debt over $600.

— Debtry The Goalry Mall.

There are currently no threshold amounts for chapter 7 bankruptcy eligibility. If it’s enough to pay 25% of your unsecured debts over 60 months, then you’re not eligible for relief under chapter 7. There are, however, many practical reasons why you should seek other alternatives than filing bankruptcy unless your debts. If you owe as low as $1, you can still file for bankruptcy.

(3) A Statement Of Financial Affairs;

Those who seek chapter 7 bankruptcy may lose some of their property in exchange for a discharge of debt… Web there is no minimum amount of debt to filed bankruptcy. If you can't afford to pay the filing fee, you may be. (2) a schedule of current income and expenditures;