Minnesota Form M1 Instructions 2021

Minnesota Form M1 Instructions 2021 - Web form m1 is the most common individual income tax return filed for minnesota residents. Additions to income (from line 2 of form m1). Correct amount federal adjusted gross income (see instructions). If the result is less than $12,525 and you had amounts withheld or paid estimated tax, file a minnesota income tax return and schedule m1nr to receive a refund. Web city 2021 federal filing status (place an x in one box): Original or previously adjusted amount b. We use scanning equipment to process paper returns. New foreign single married filing jointly married filing separately spouse name spouse ssn dependents (see instructions): Www.revenue.state.mn.us/aliens gambling winnings | minnesota department of revenue State zip code (4) head of household (5) qualifying widow(er)

State zip code (4) head of household (5) qualifying widow(er) Original or previously adjusted amount b. We use scanning equipment to process paper returns. New foreign single married filing jointly married filing separately spouse name spouse ssn dependents (see instructions): If the result is less than $12,525 and you had amounts withheld or paid estimated tax, file a minnesota income tax return and schedule m1nr to receive a refund. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. Add lines 1 and 2. Web you will need instructions for this form and for 2021 form m1.a. Additions to income (from line 2 of form m1). Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements.

Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Www.revenue.state.mn.us/aliens gambling winnings | minnesota department of revenue Original or previously adjusted amount b. More about the minnesota form m1 instructions we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. We use scanning equipment to process paper returns. New foreign single married filing jointly married filing separately spouse name spouse ssn dependents (see instructions): Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. State zip code (4) head of household (5) qualifying widow(er) Add lines 1 and 2. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year 2022.

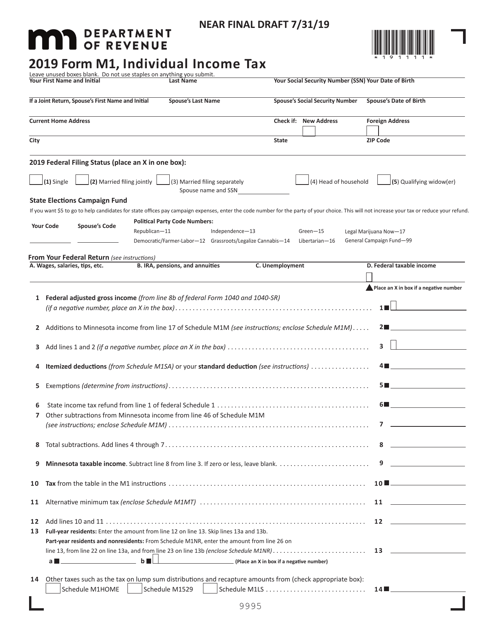

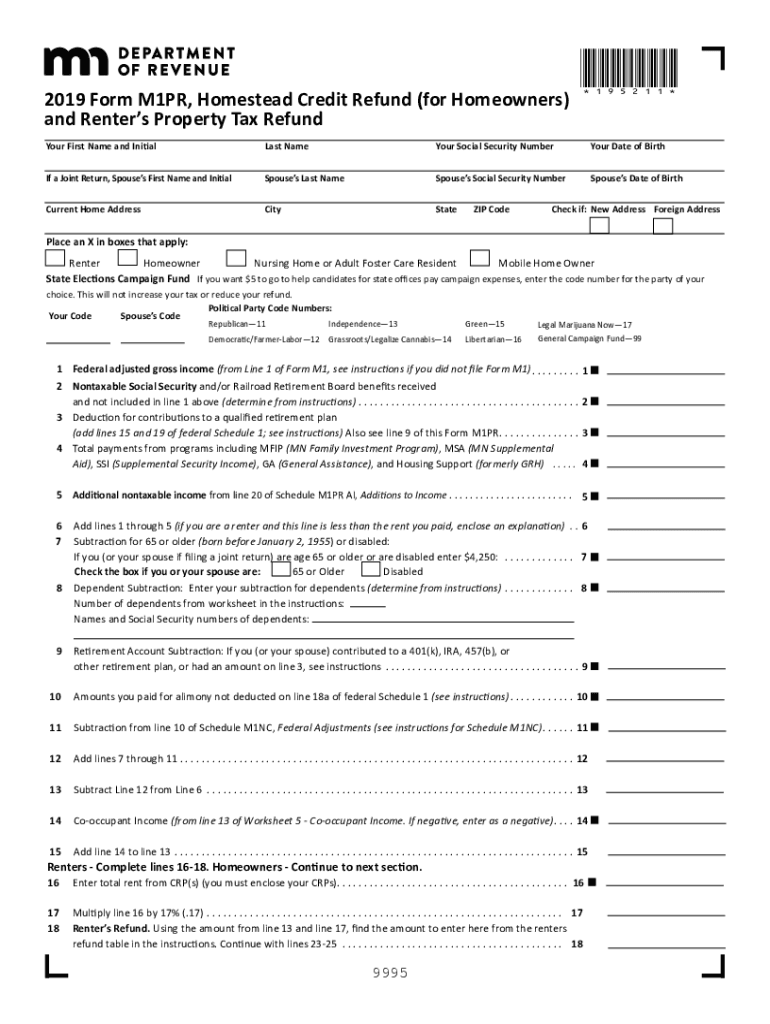

2020 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

Correct amount federal adjusted gross income (see instructions). Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Www.revenue.state.mn.us/aliens gambling winnings | minnesota department of revenue Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for.

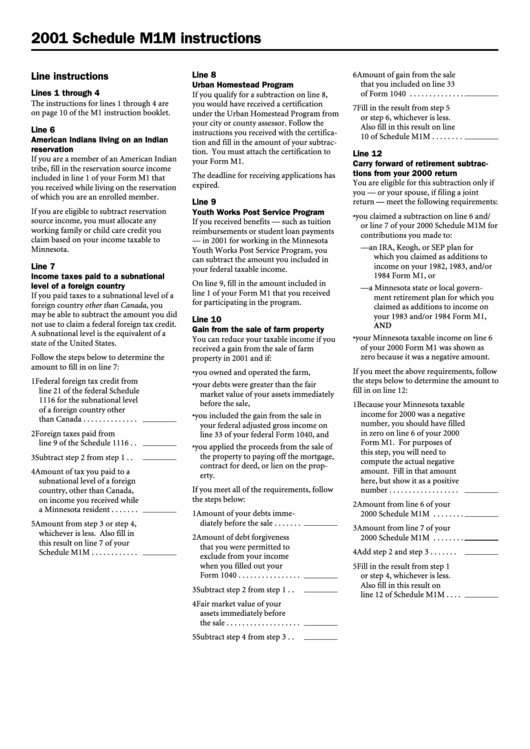

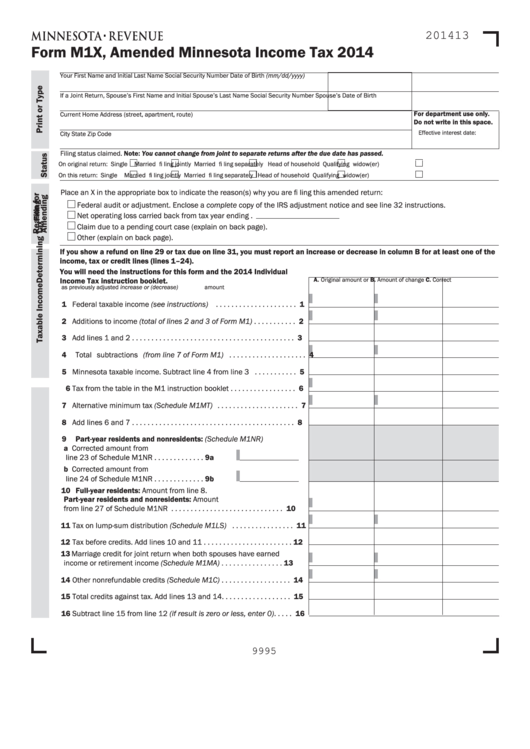

Schedule M1m Instructions 2001 printable pdf download

Additions to income (from line 2 of form m1). Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Add lines 1 and 2. If the.

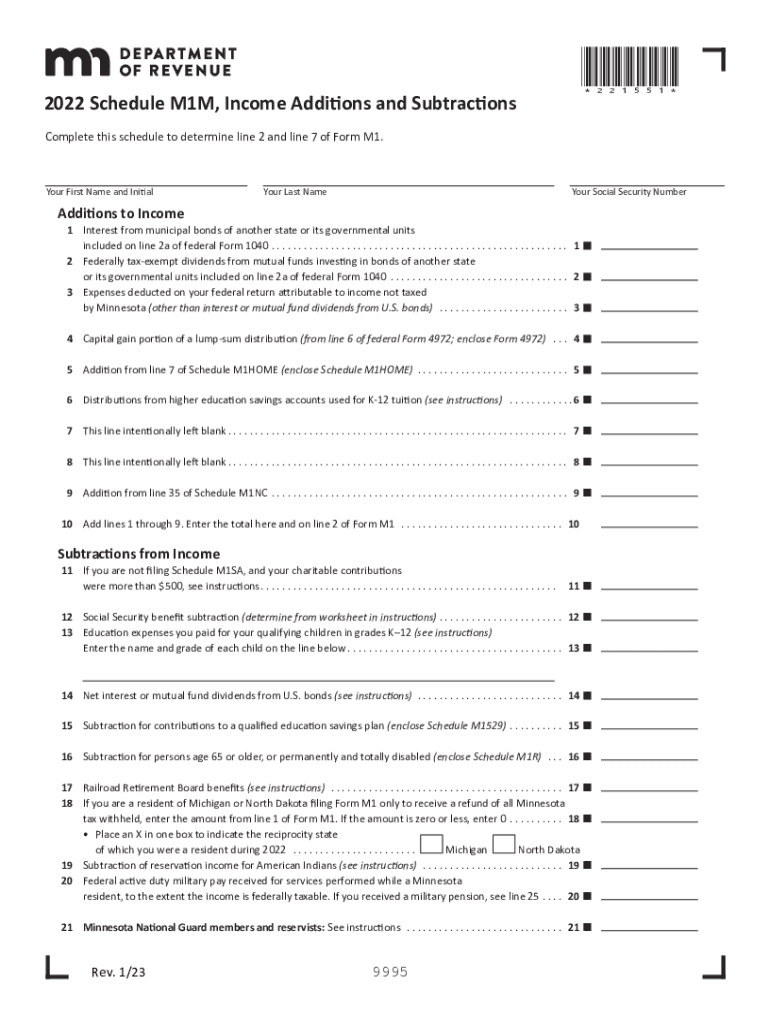

Fill Free fillable Minnesota Department of Revenue PDF forms

Web form m1 is the most common individual income tax return filed for minnesota residents. You must file yearly by april 15. If the result is less than $12,525 and you had amounts withheld or paid estimated tax, file a minnesota income tax return and schedule m1nr to receive a refund. Web we last updated the minnesota individual income tax.

Mn schedule m1m Fill out & sign online DocHub

Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Additions to income (from line 2 of form m1). Original or previously adjusted amount b. Add.

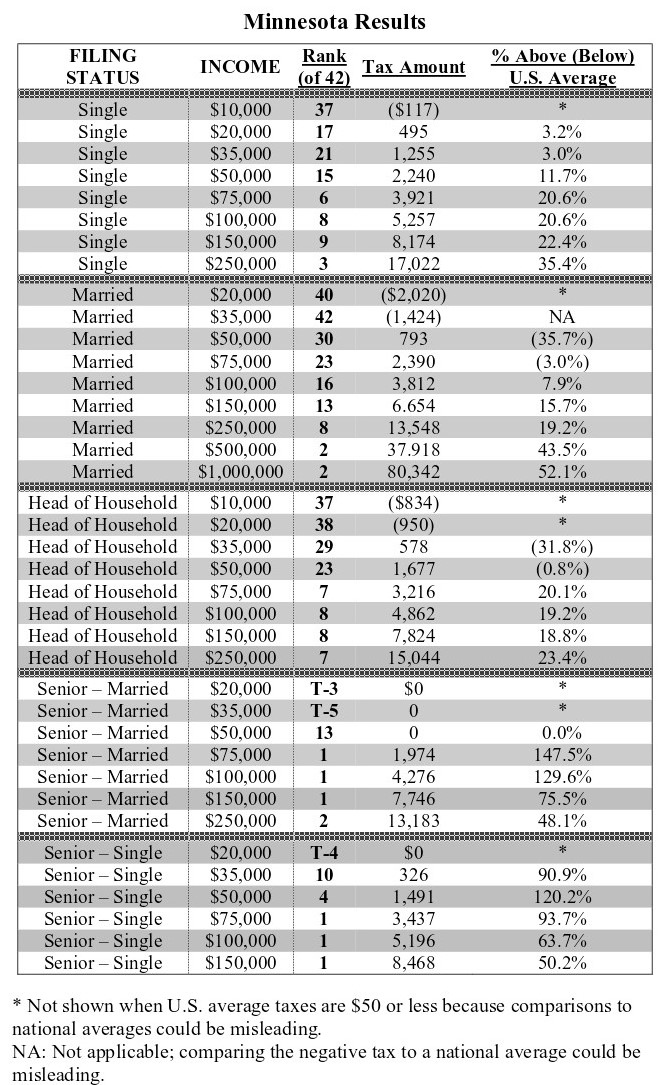

Minnesota Tax Table M1

Add lines 1 and 2. State zip code (4) head of household (5) qualifying widow(er) Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest.

Mn Withholding Tables 2021 2022 W4 Form

Follow these instructions to ensure we process your return efficiently and accurately: Additions to income (from line 2 of form m1). Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. New foreign single married filing jointly married filing separately spouse name spouse ssn dependents (see instructions): We use scanning equipment.

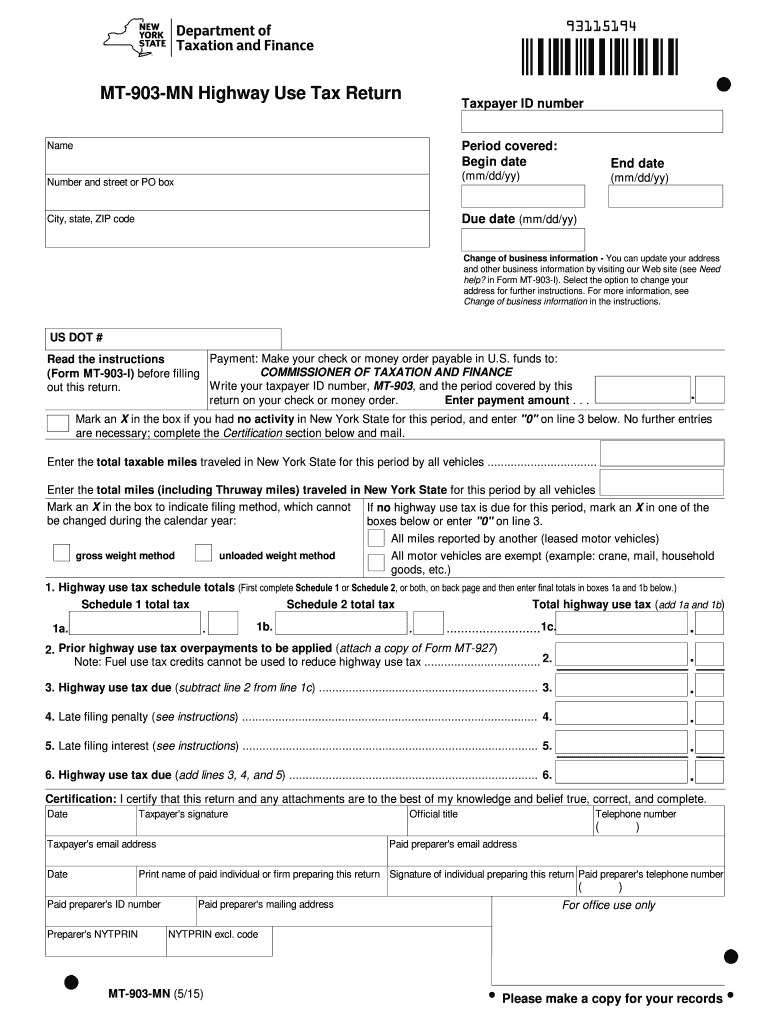

Minnesota Etaxes

Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Spouse’s social security number spouse’s date of birth check if address is: Additions to income (from line 2 of form m1). Www.revenue.state.mn.us/aliens gambling winnings | minnesota department of revenue Web you will need instructions for this form and for 2021 form m1.a.

mn state irs phone number Treats Weblogs Slideshow

Web city 2021 federal filing status (place an x in one box): Www.revenue.state.mn.us/aliens gambling winnings | minnesota department of revenue We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. Add lines 1 and 2. Web before starting your minnesota income tax return (form.

Minnesota State Tax Table M1

If the result is less than $12,525 and you had amounts withheld or paid estimated tax, file a minnesota income tax return and schedule m1nr to receive a refund. More about the minnesota form m1 instructions we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. You must file yearly by april 15. We.

Mn Tax Forms 2021 Printable Printable Form 2022

We use scanning equipment to process paper returns. Www.revenue.state.mn.us/aliens gambling winnings | minnesota department of revenue Follow these instructions to ensure we process your return efficiently and accurately: Additions to income (from line 2 of form m1). Add lines 1 and 2.

Follow These Instructions To Ensure We Process Your Return Efficiently And Accurately:

State zip code (4) head of household (5) qualifying widow(er) We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. We use scanning equipment to process paper returns. Web city 2021 federal filing status (place an x in one box):

Web We Last Updated The Minnesota Individual Income Tax Instructions (Form M1) In February 2023, So This Is The Latest Version Of Form M1 Instructions, Fully Updated For Tax Year 2022.

Spouse’s social security number spouse’s date of birth check if address is: You must file yearly by april 15. Original or previously adjusted amount b. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr.

Correct Amount Federal Adjusted Gross Income (See Instructions).

Add lines 1 and 2. Www.revenue.state.mn.us/aliens gambling winnings | minnesota department of revenue If the result is less than $12,525 and you had amounts withheld or paid estimated tax, file a minnesota income tax return and schedule m1nr to receive a refund. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements.

Additions To Income (From Line 2 Of Form M1).

More about the minnesota form m1 instructions we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Web form m1 is the most common individual income tax return filed for minnesota residents. New foreign single married filing jointly married filing separately spouse name spouse ssn dependents (see instructions): Web you will need instructions for this form and for 2021 form m1.a.