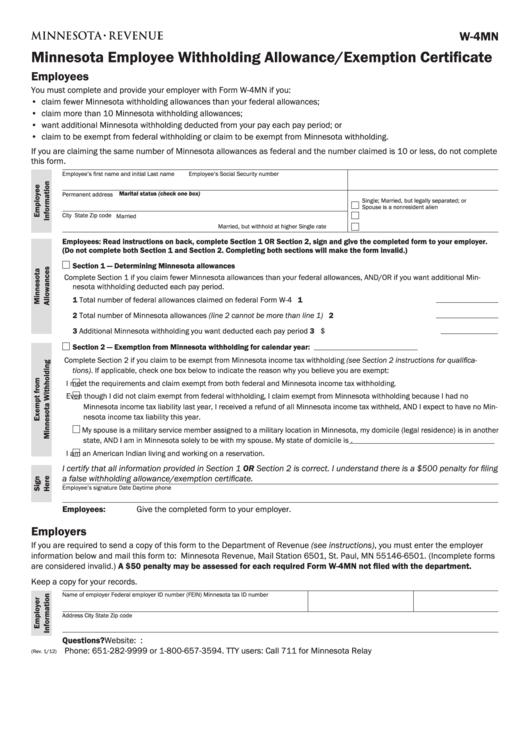

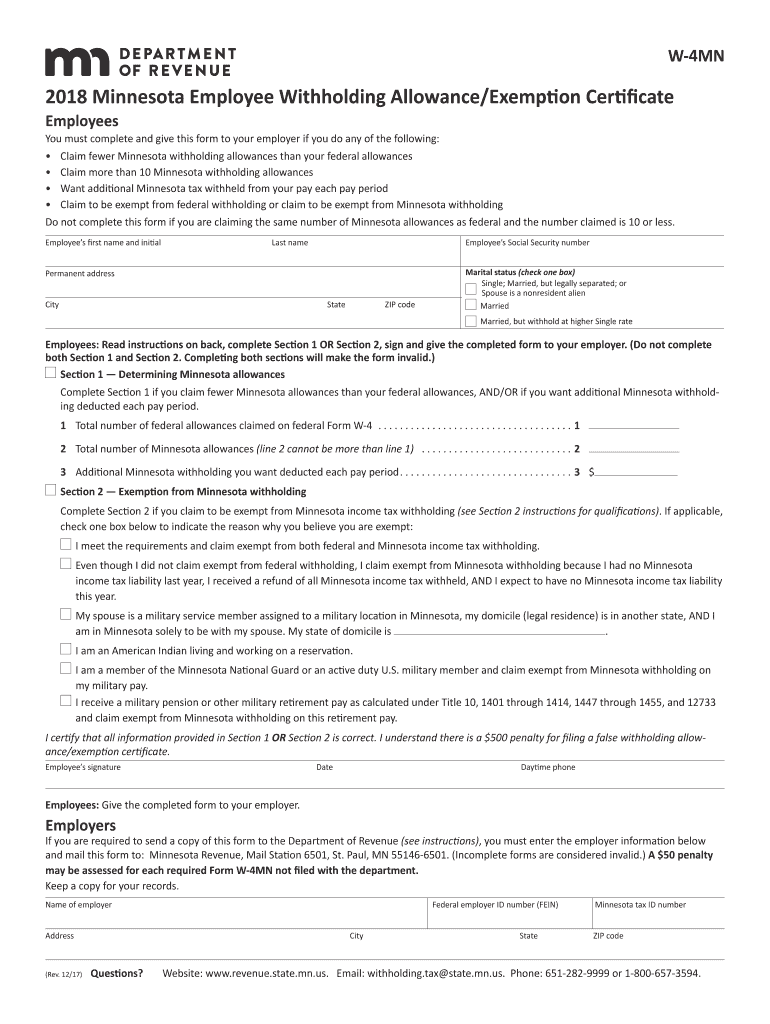

Minnesota W 4 Form

Minnesota W 4 Form - Anything agency employees can use as a reference tool? Then, determine the number of your. You may be subject to a $500 penalty if you provide a false. For each withholding allowance you claim, you reduce. How do i fix this? December 2020) department of the treasury internal revenue service. Minnesota requires nonresident aliens to claim single with no withholding allowances. Employees can view and change federal adjustments and state withholding information using self service. When does an employee complete form w. What happens to my lock in.

Employees can view and change federal adjustments and state withholding information using self service. When does a recipient complete. What if i am exempt from minnesota withholding? Then, determine the number of your. Data is secured by a. You may be subject to a $500 penalty if you provide a false. Your employees must complete form w. What if i am exempt from minnesota. How do i fix this? Anything agency employees can use as a reference tool?

Data is secured by a. Minnesota requires nonresident aliens to claim single with no withholding allowances. Then, determine the number of your. What if i am exempt from minnesota. What if i am exempt from minnesota withholding? Anything agency employees can use as a reference tool? When does an employee complete form w. What happens to my lock in. You may be subject to a $500 penalty if you provide a false. When does a recipient complete.

Michigan W 4 2021 2022 W4 Form

What happens to my lock in. Your employees must complete form w. Anything agency employees can use as a reference tool? What if i am exempt from minnesota withholding? What if i am exempt from minnesota.

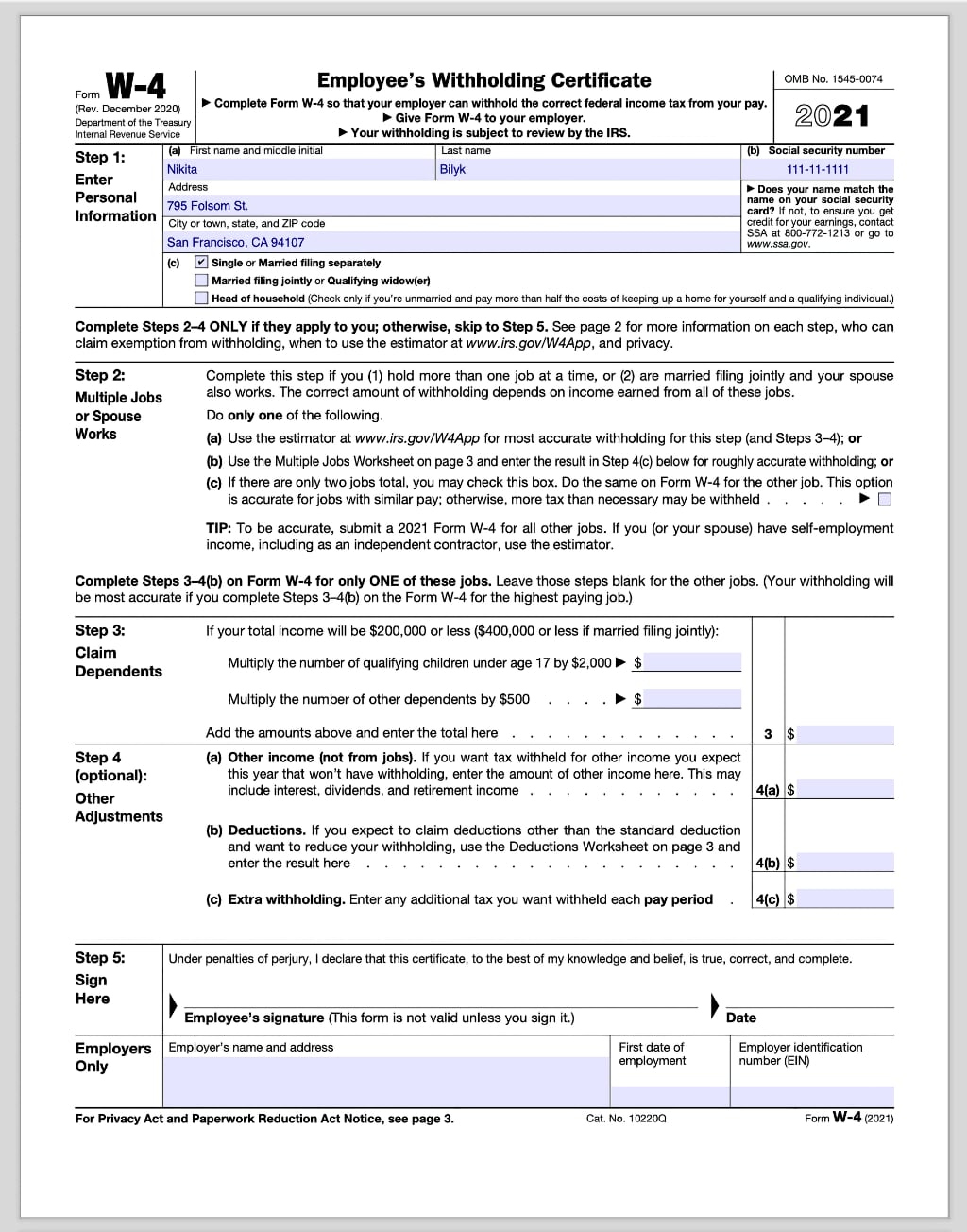

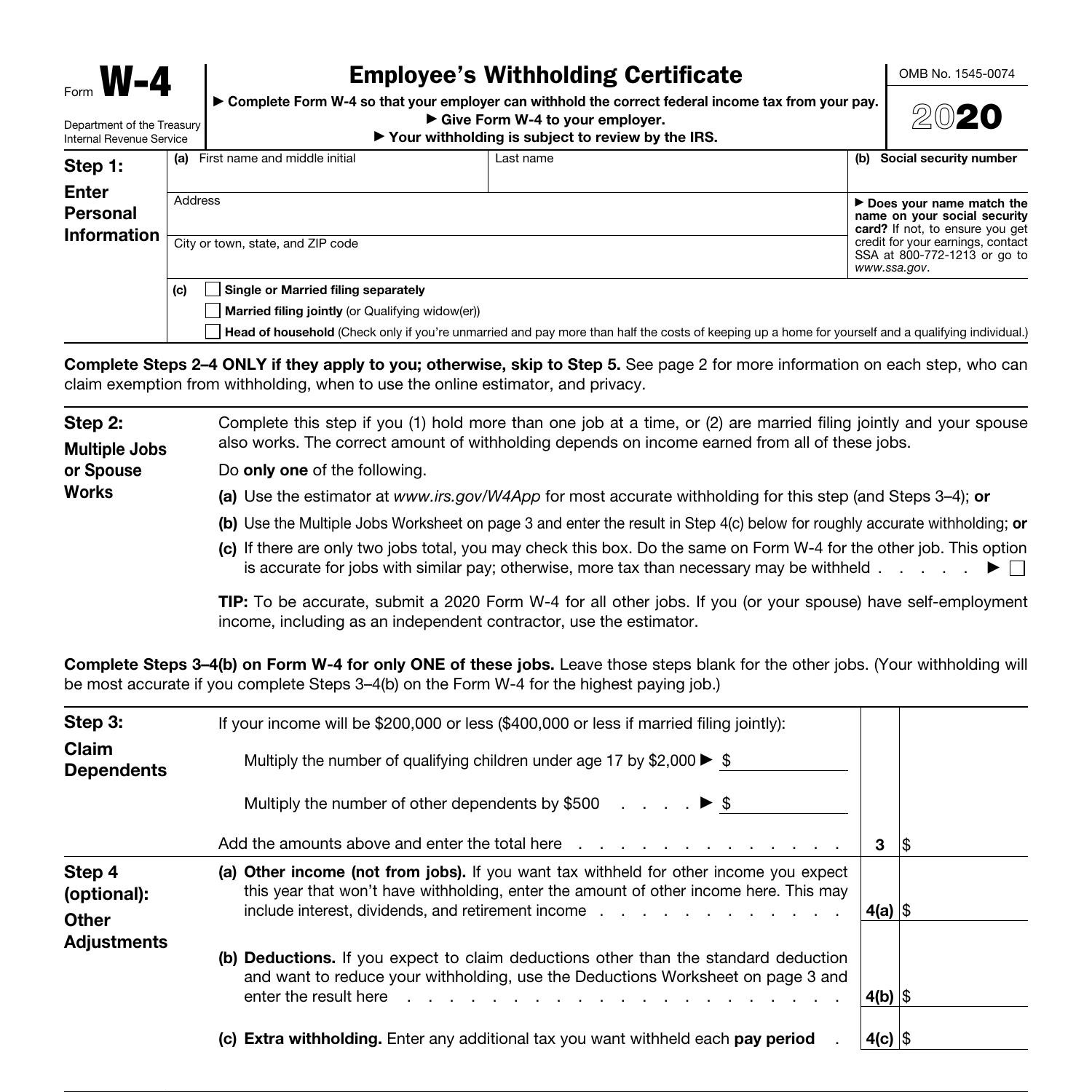

2021 is here. Today is a great time to review your W4 for 2021 and

You may be subject to a $500 penalty if you provide a false. For each withholding allowance you claim, you reduce. December 2020) department of the treasury internal revenue service. Employees can view and change federal adjustments and state withholding information using self service. What happens to my lock in.

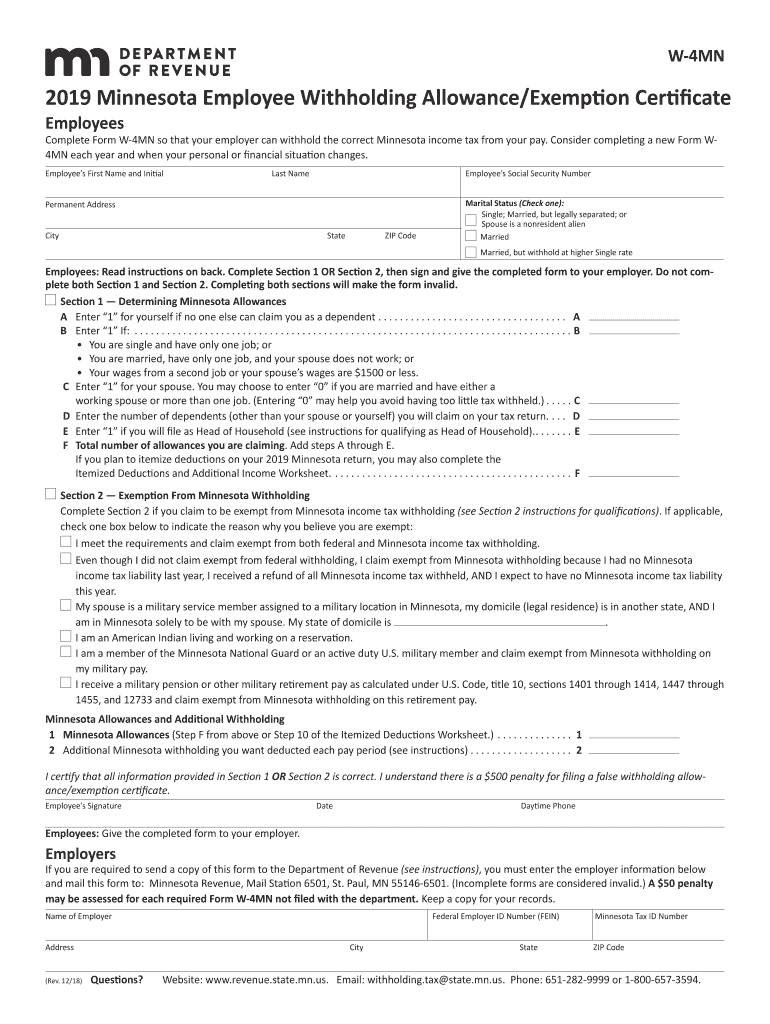

Download Form W4MN Minnesota for Free Page 3 FormTemplate

How do i fix this? You may be subject to a $500 penalty if you provide a false. What if i am exempt from minnesota. Your employees must complete form w. What happens to my lock in.

Minnesota W4 App

Then, determine the number of your. What if i am exempt from minnesota. When does an employee complete form w. December 2020) department of the treasury internal revenue service. Minnesota requires nonresident aliens to claim single with no withholding allowances.

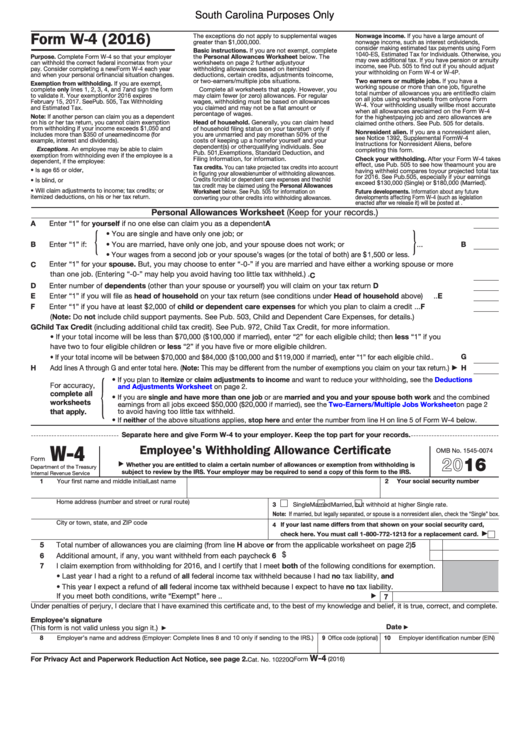

Form W4 Employee'S Withholding Allowance Certificate (South Carolina

Your employees must complete form w. What if i am exempt from minnesota. Minnesota requires nonresident aliens to claim single with no withholding allowances. How do i fix this? For each withholding allowance you claim, you reduce.

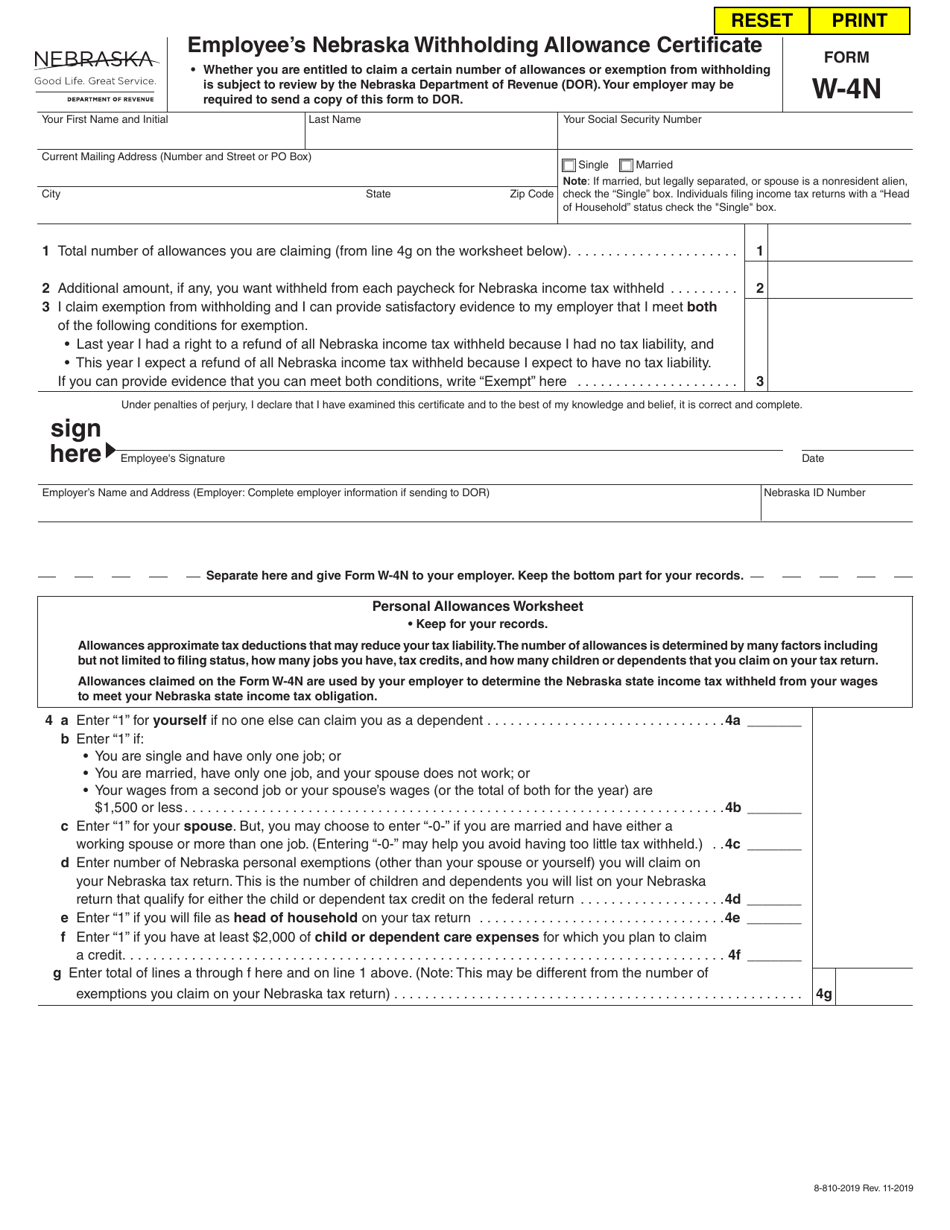

Form W4N Download Fillable PDF or Fill Online Employee's Nebraska

Your employees must complete form w. Then, determine the number of your. What if i am exempt from minnesota. What happens to my lock in. How do i fix this?

Fillable Form W4mn Minnesota Employee Withholding Allowance

For each withholding allowance you claim, you reduce. What if i am exempt from minnesota. How do i fix this? Minnesota requires nonresident aliens to claim single with no withholding allowances. Your employees must complete form w.

Form W 4MN, Minnesota Employee Withholding Allowance Fill Out and

What happens to my lock in. Your employees must complete form w. Minnesota requires nonresident aliens to claim single with no withholding allowances. When does an employee complete form w. Anything agency employees can use as a reference tool?

Form W4 2020.pdf DocDroid

When does an employee complete form w. For each withholding allowance you claim, you reduce. Minnesota requires nonresident aliens to claim single with no withholding allowances. Your employees must complete form w. What if i am exempt from minnesota.

For Each Withholding Allowance You Claim, You Reduce.

Employees can view and change federal adjustments and state withholding information using self service. What if i am exempt from minnesota withholding? What if i am exempt from minnesota. When does a recipient complete.

When Does An Employee Complete Form W.

Minnesota requires nonresident aliens to claim single with no withholding allowances. Data is secured by a. You may be subject to a $500 penalty if you provide a false. Then, determine the number of your.

Anything Agency Employees Can Use As A Reference Tool?

What happens to my lock in. Your employees must complete form w. How do i fix this? December 2020) department of the treasury internal revenue service.