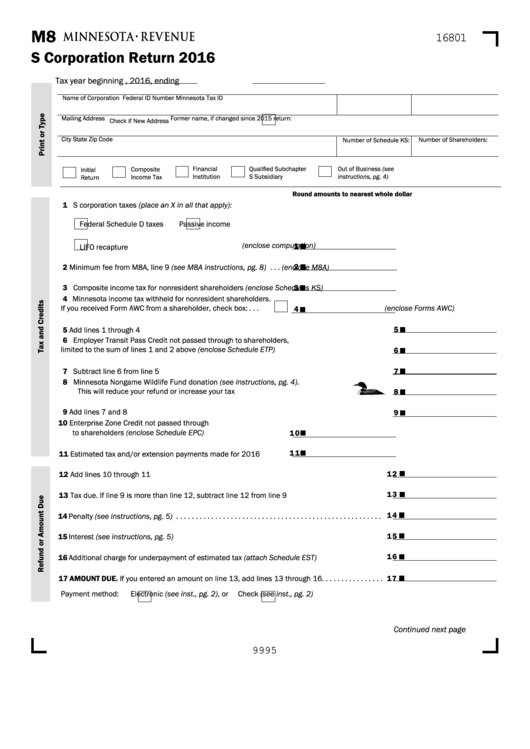

Mn Form M8

Mn Form M8 - Minnesota s corporation income tax, mail station 1770, st. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Who must file the entire share of an entity’s. Shareholder’s share of income, credits and modifications. Web estimated payments for s corporations filing form m8 (rev. If you make a claim for a refund and we do not act on it within six. Minnesota s corporation income tax mail station 1770 st. Who must file the entire share of an entity’s. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022.

Minnesota s corporation income tax mail station 1770 600 n. An s corporation must pay estimated tax if. Web send minnesota instructions via email, link, or fax. Use fill to complete blank online. If you make a claim for a refund and we do not act on it within six. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Web corporations doing business in minnesota that have elected to be taxed as s corporations under. Irc section 1362 must file form m8. To file an amended return, use one of the following: •form m4x, amended franchise tax return, if you are a corporate partner.

To file an amended return, use one of the following: Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Irc section 1362 must file form m8. You can also download it, export it or print it out. The sum of its estimated s corporation taxes,. Minnesota s corporation income tax mail station 1770 st. Minnesota s corporation income tax mail station 1770 600 n. The entire share of an. Type text, add images, blackout confidential.

Fillable Online mn form 3024 Fax Email Print pdfFiller

Edit your form m8 online. If you make a claim for a refund and we do not act on it within six. Who must file the entire share of an entity’s. Minnesota s corporation income tax, mail station 1770, st. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file.

Service M8

Who must file the entire share of an entity’s. The entire share of an. Web we last updated the s corporation return (m8 and m8a) in february 2023, so this is the latest version of form m8, fully updated for tax year 2022. Who must file the entire share of an entity’s. Irc section 1362 must file form m8.

2019 Form MN DoR M8 Instructions Fill Online, Printable, Fillable

Save or instantly send your ready documents. The entire share of an. An s corporation must pay estimated tax if. Irc section 1362 must file form m8. Who must file the entire share of an entity’s.

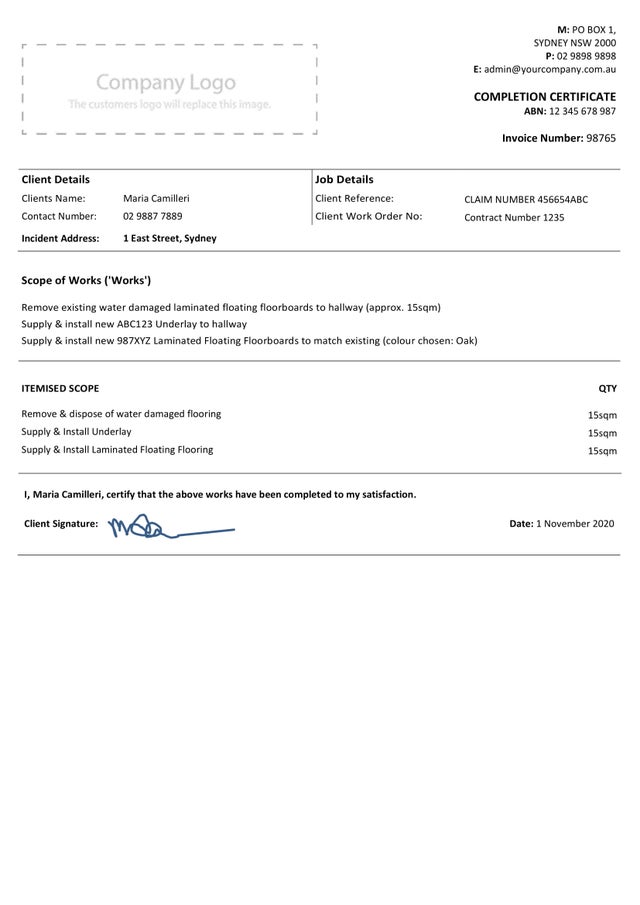

Fillable Form M8 S Corporation Return 2016 printable pdf download

You can download or print. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Minnesota s corporation income tax mail station 1770 600 n. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8.

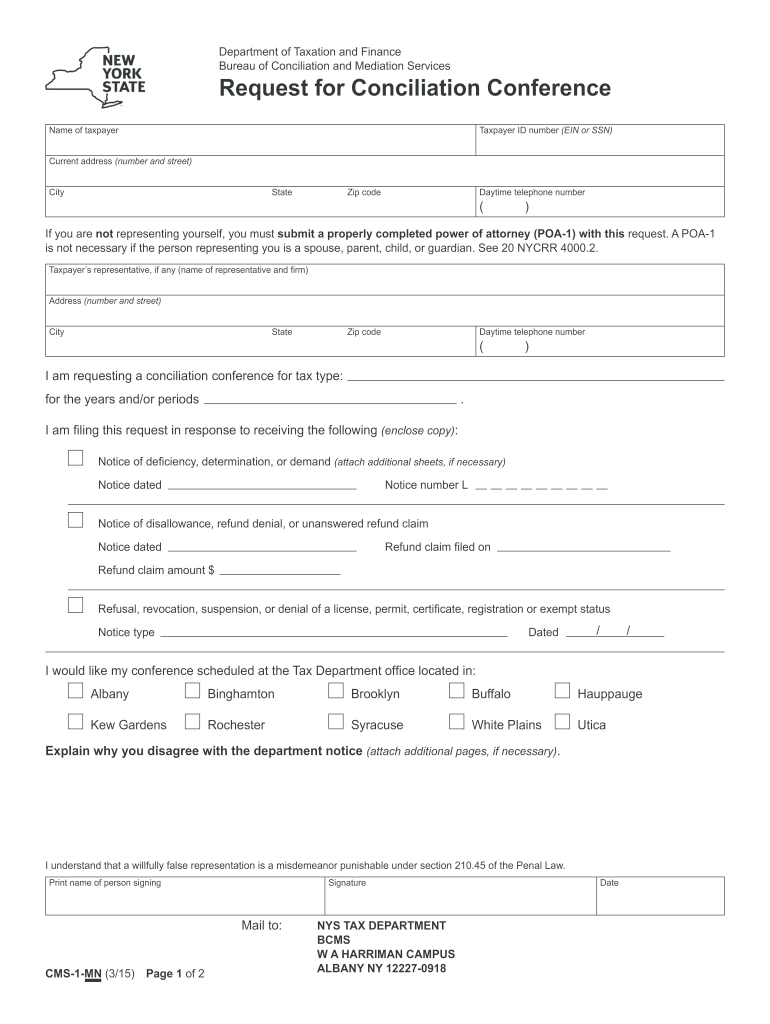

Form Cms 1 Mn Fill Online, Printable, Fillable, Blank pdfFiller

Who must file the entire share of an entity’s. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022. You can download or print. Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal.

2018 Form MN M1W Fill Online, Printable, Fillable, Blank PDFfiller

Minnesota s corporation income tax mail station 1770 st. Who must file the entire share of an entity’s. Easily fill out pdf blank, edit, and sign them. Who must file the entire share of an entity’s. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully.

Buy HPE Data Cartridge LTO8 Type M (LTO7 M8) Labeled 20 Pack RTG

Web fill online, printable, fillable, blank 2020 m8, s corporaon return (minnesota department of revenue) form. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment. If you make a claim for a refund and we do not act on it within six. Who must file the entire.

DSchäkel, kurze Form M8, Edelstahl A4 1.4401, Bruchlast 3000kg1017008

Shareholder’s share of income, credits and modifications. Minnesota s corporation income tax mail station 1770 600 n. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022. Minnesota s corporation income tax, mail station 1770, st. Web send minnesota instructions via.

2014 Form MN DoR M8 Instructions Fill Online, Printable, Fillable

You can also download it, export it or print it out. Easily fill out pdf blank, edit, and sign them. Irc section 1362 must file form m8. Web corporations doing business in minnesota that have elected to be taxed as s corporations under. Web we last updated the s corporation return (m8 and m8a) in february 2023, so this is.

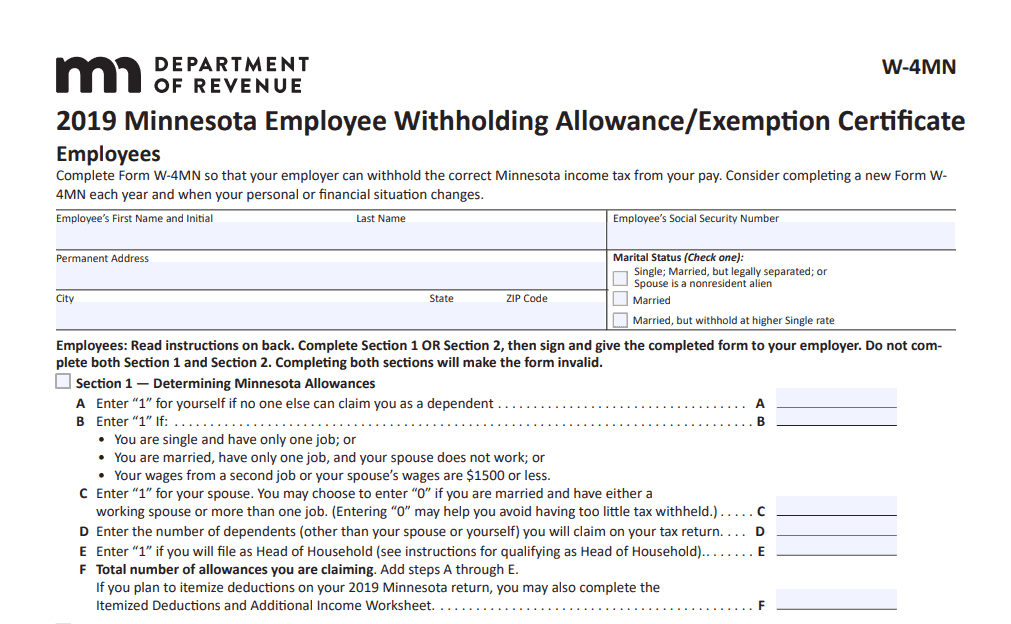

W 4 Mn Form 2021 2022 W4 Form

Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Type text, add images, blackout confidential. An s corporation must pay estimated tax if. Minnesota s corporation income tax mail station 1770 st. You can download or print.

Web What Is The Minnesota M8 Form?

The entire share of an. Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. The sum of its estimated s corporation taxes,. Who must file the entire share of an entity’s.

If You Make A Claim For A Refund And We Do Not Act On It Within Six.

Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment. Use fill to complete blank online. •form m4x, amended franchise tax return, if you are a corporate partner. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8.

Irc Section 1362 Must File Form M8.

Web fill online, printable, fillable, blank 2020 m8, s corporaon return (minnesota department of revenue) form. Use form m8x to make a claim for refund and report changes to your minnesota liability. Who must file the entire share of an entity’s. To file an amended return, use one of the following:

Web Corporations Doing Business In Minnesota That Have Elected To Be Taxed As S Corporations Under.

Minnesota s corporation income tax mail station 1770 600 n. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. An s corporation must pay estimated tax if. Irc section 1362 must file form m8.