Mn Tax Form M1 Instructions

Mn Tax Form M1 Instructions - Use this tool to search for a specific tax form using the tax form number or name. Web before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your federal taxable income. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. This form is for income earned in tax. Web you must file yearly by april 15. Web using the amount from line 13 and line 17, find the amount to enter here from the renters refund table in the instructions. Web for examples of qualifying education expenses, see the form m1 instructions. Web current home address city 2020 federal filing status (place an x in one box): Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill in, and mail your state income tax return.

Web current home address city 2020 federal filing status (place an x in one box): Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill in, and mail your state income tax return. If your total purchases for. Web this will not increase your tax or reduce your refund. This form is for income earned in tax. Use this tool to search for a specific tax form using the tax form number or name. Web if they total more than $770, file form ut1, individual use tax return, by april 15, 2020, for all taxable items you purchased during the calendar year. Web more about the minnesota form m1x. Subtraction limits the maximum subtraction allowed for purchases of personal computer hardware. This form is for income earned in tax.

State zip code (4) head of household (5) qualifying widow(er) dependent 3 first name dependent 3 last name dependent 3 ssn. Single (2) married filing jointly (3) married filing separately state zip code spouse’s date of birth. Web using the amount from line 13 and line 17, find the amount to enter here from the renters refund table in the instructions. We last updated minnesota form m1mt in february 2023 from the minnesota department of revenue. Web current home address city 2020 federal filing status (place an x in one box): Ira, pensions, and annuities c. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. Web you must file yearly by april 15. Web more about the minnesota form m1mt. Web you must file a minnesota form m1, individual income tax return, if you are a:

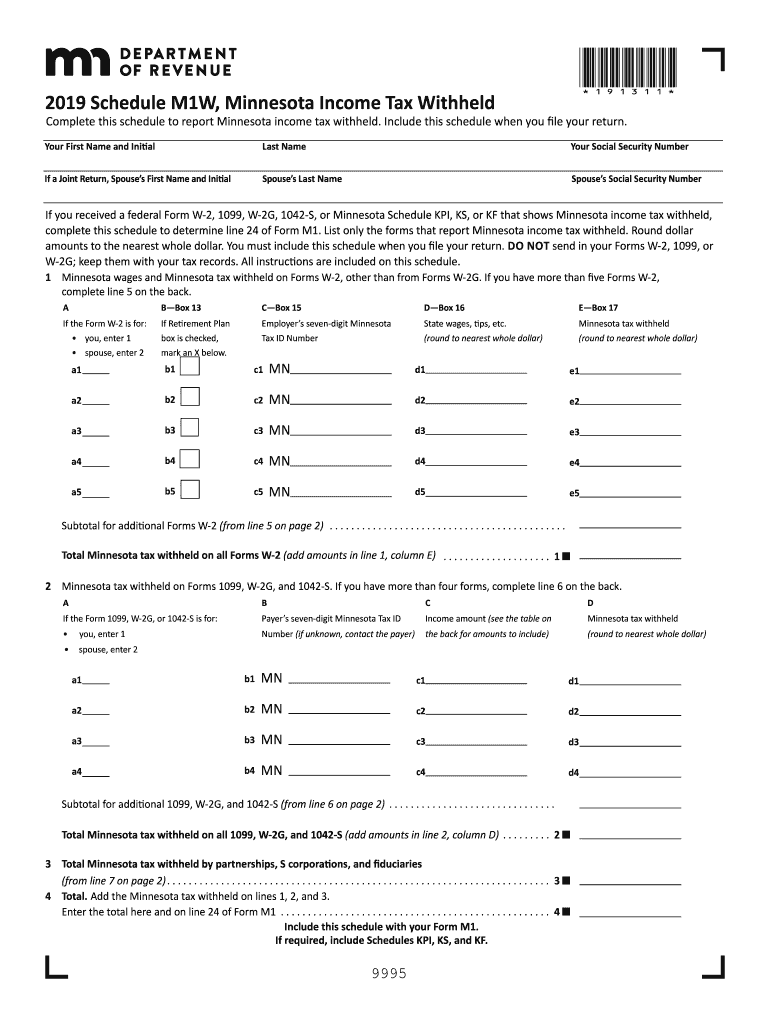

Fill Free fillable Minnesota Department of Revenue PDF forms

Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota department of. Web more about the minnesota form m1x. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. You can also look for forms by category below the search box. Web you must.

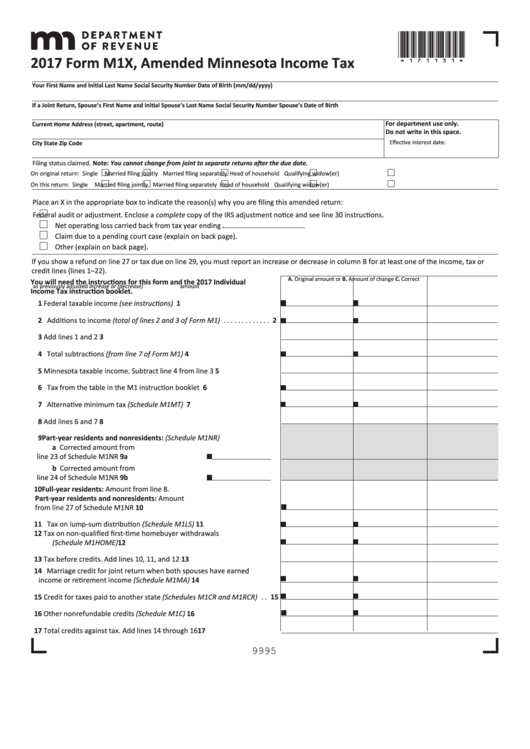

Fillable Form M1x Amended Minnesota Tax 2017 printable pdf

Use this tool to search for a specific tax form using the tax form number or name. Web using the amount from line 13 and line 17, find the amount to enter here from the renters refund table in the instructions. Web you must file yearly by april 15. We last updated minnesota form m1mt in february 2023 from the.

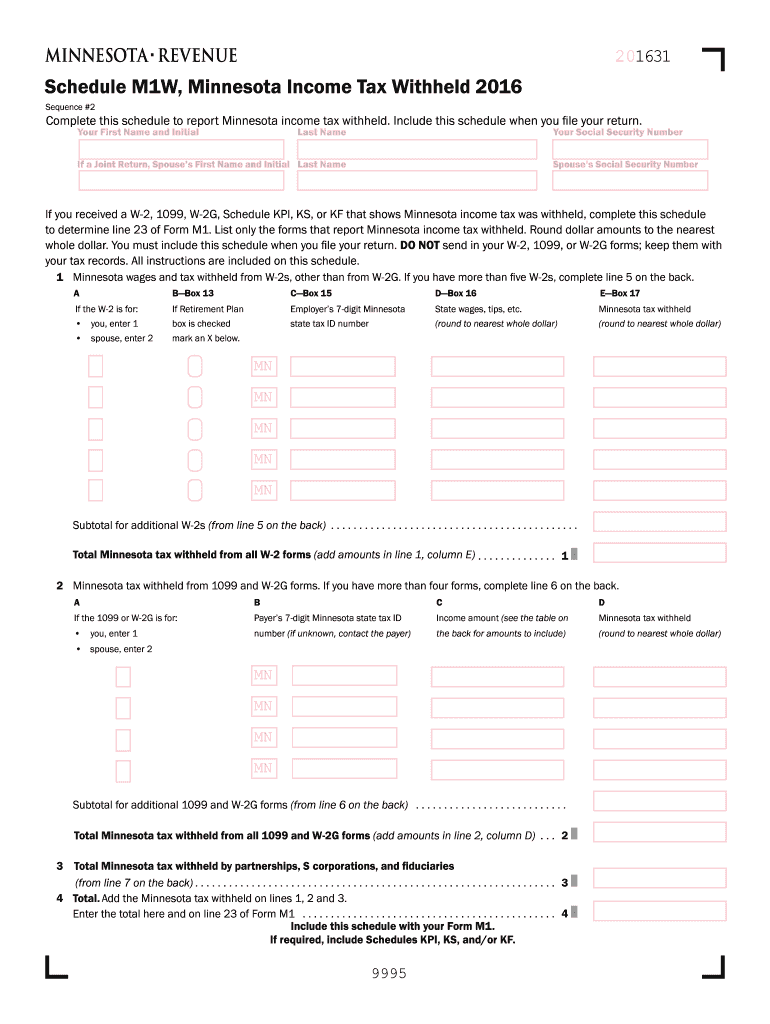

2016 Mn Fill Out and Sign Printable PDF Template signNow

Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Single (2) married filing jointly (3) married filing separately state zip code spouse’s date of birth. Web you must file yearly by april 15. You can also look for forms by category below the search box. Subtraction limits the maximum subtraction allowed for purchases.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your federal taxable income. Web if you use forms or instructions that are outdated, it will delay your refund. This form is for income earned in tax. Minnesota individual income tax applies to residents and nonresidents who.

Minnesota tax forms Fill out & sign online DocHub

Web for examples of qualifying education expenses, see the form m1 instructions. Web if you use forms or instructions that are outdated, it will delay your refund. We last updated minnesota form m1mt in february 2023 from the minnesota department of revenue. State zip code (4) head of household (5) qualifying widow(er) dependent 3 first name dependent 3 last name.

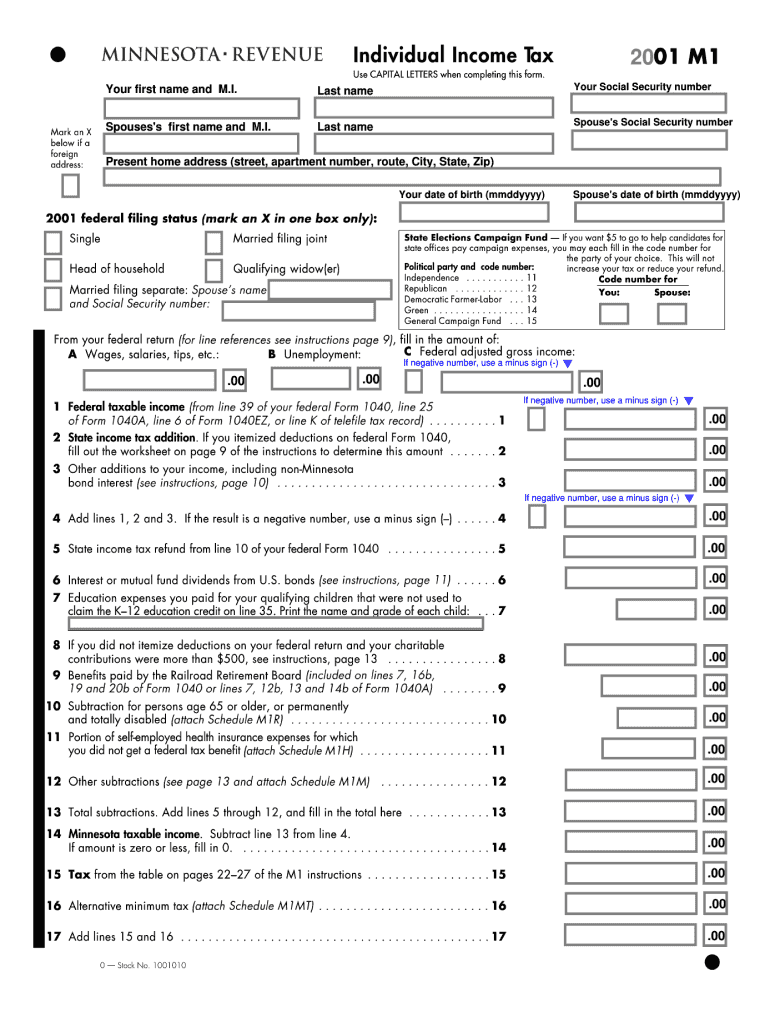

M1 Tax Documents Fill Out and Sign Printable PDF Template signNow

Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Ira, pensions, and annuities c. Web more about the minnesota form m1x. This form is for income earned in tax.

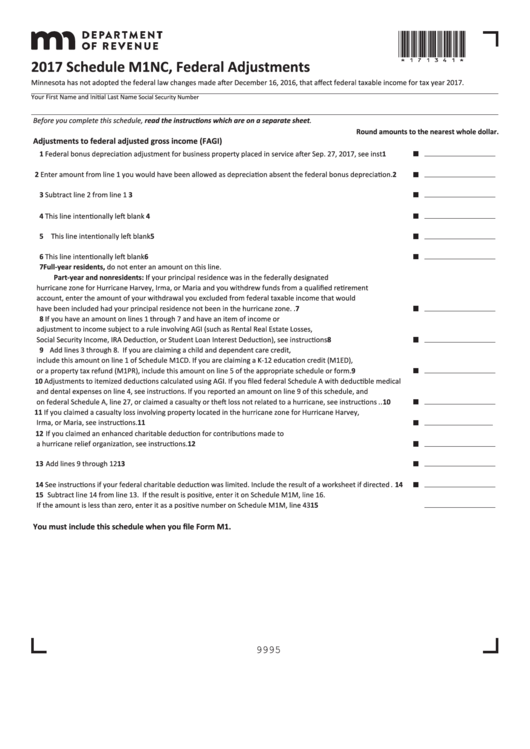

Fillable Schedule M1nc Federal Adjustments 2017 printable pdf download

This form is for income earned in tax. Use this tool to search for a specific tax form using the tax form number or name. We last updated minnesota form m1x in february 2023 from the minnesota department of revenue. Minnesota individual income tax, mail station 0010, 600 n. Web this will not increase your tax or reduce your refund.

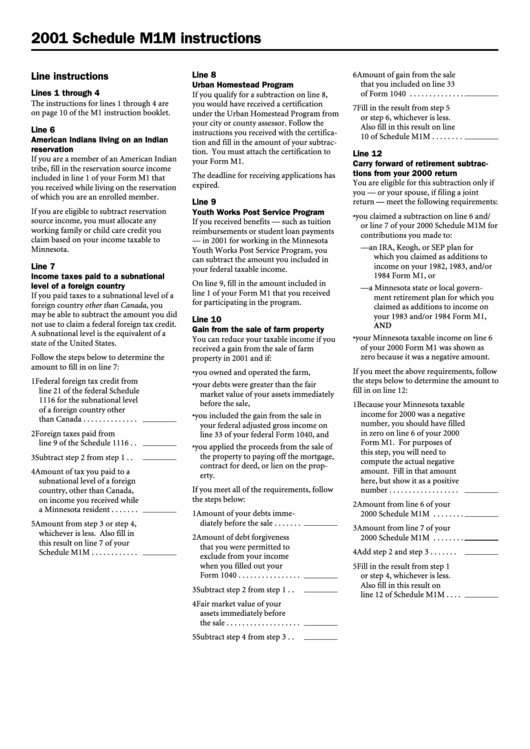

Schedule M1m Instructions 2001 printable pdf download

Web current home address city 2020 federal filing status (place an x in one box): State zip code (4) head of household (5) qualifying widow(er) dependent 3 first name dependent 3 last name dependent 3 ssn. Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill in, and mail your.

Tax Table M1 Instructions

This form is for income earned in tax. Web go to www.revenue.state.mn.us to: Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota department of. Web you must file yearly by april 15. Web more about the minnesota form m1mt.

2020 Minnesota Tax Fill Out and Sign Printable PDF Template signNow

Use this tool to search for a specific tax form using the tax form number or name. Web you must file yearly by april 15. Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill in, and mail your state income tax return. Web using the amount from line 13.

Web Before Starting Your Minnesota Income Tax Return ( Form M1, Individual Income Tax ), You Must Complete Federal Form 1040 To Determine Your Federal Taxable Income.

Use this tool to search for a specific tax form using the tax form number or name. Web if they total more than $770, file form ut1, individual use tax return, by april 15, 2020, for all taxable items you purchased during the calendar year. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. We last updated minnesota form m1x in february 2023 from the minnesota department of revenue.

You Can Also Look For Forms By Category Below The Search Box.

Web if you use forms or instructions that are outdated, it will delay your refund. Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota department of. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web for examples of qualifying education expenses, see the form m1 instructions.

We Last Updated Minnesota Form M1Mt In February 2023 From The Minnesota Department Of Revenue.

Web this will not increase your tax or reduce your refund. This form is for income earned in tax. Web more about the minnesota form m1mt. If your total purchases for.

This Form Is For Income Earned In Tax.

Web you must file yearly by april 15. Extension of time to appeal from an order of commissioner of revenue. Web more about the minnesota form m1x. Web current home address city 2020 federal filing status (place an x in one box):