Nc Estimated Tax Form

Nc Estimated Tax Form - If you previously made an electronic payment but did not receive a confirmation page do not submit another. A taxpayer can use the department’s website or mail the completed form to the address. Web complete the respective north carolina tax form (s) then download, print, sign, and mail them to the north carolina department of revenue. You can use this form to make all of your estimated income tax payments for the year. To pay individual estimated income tax: In addition to filing north carolina. Show details we are not affiliated with any brand or entity on this. Web north carolina individual estimated income tax. Web use a nc estimated tax form template to make your document workflow more streamlined. Payments of tax are due to be filed on or before the 15th day of the 4th, 6th,.

Schedule payments up to 365 days in advance; A taxpayer can use the department’s website or mail the completed form to the address. Estimated income tax is the amount of. Web north carolina individual estimated income tax instructions: Web complete the respective north carolina tax form (s) then download, print, sign, and mail them to the north carolina department of revenue. In addition to filing north carolina. Web use a nc estimated tax form template to make your document workflow more streamlined. Web extension for filing individual income tax return; Payments of tax are due to be filed on or before the 15th day of the 4th, 6th,. To pay individual estimated income tax:

Schedule payments up to 365 days in advance; Show details we are not affiliated with any brand or entity on this. (1) first complete the worksheet on page 2 to. You can download or print. To pay individual estimated income tax: Web north carolina individual estimated income tax instructions: Web complete the respective north carolina tax form (s) then download, print, sign, and mail them to the north carolina department of revenue. Estimated income tax is the amount of. In addition to filing north carolina. If you previously made an electronic payment but did not receive a confirmation page do not submit another.

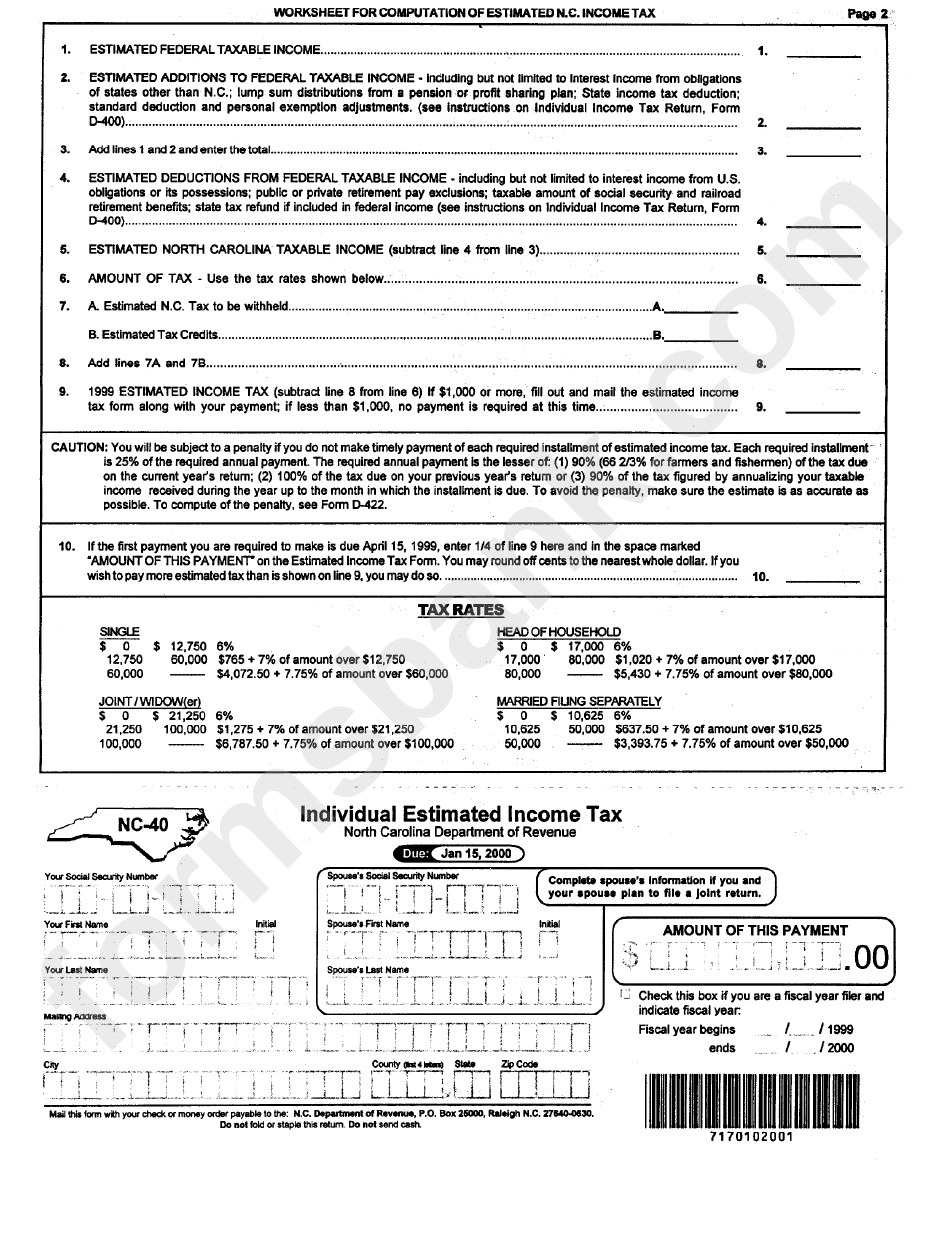

Fillable Form Nc40 Individual Estimated Tax printable pdf

Want to schedule all four. Schedule payments up to 365 days in advance; To pay individual estimated income tax: Web extension for filing individual income tax return; Payments of tax are due to be filed on or before the 15th day of the 4th, 6th,.

Estimated Tax For Individuals Stock Photo Download Image Now iStock

If you previously made an electronic payment but did not receive a confirmation page do not submit another. A taxpayer can use the department’s website or mail the completed form to the address. Want to schedule all four. In addition to filing north carolina. Show details we are not affiliated with any brand or entity on this.

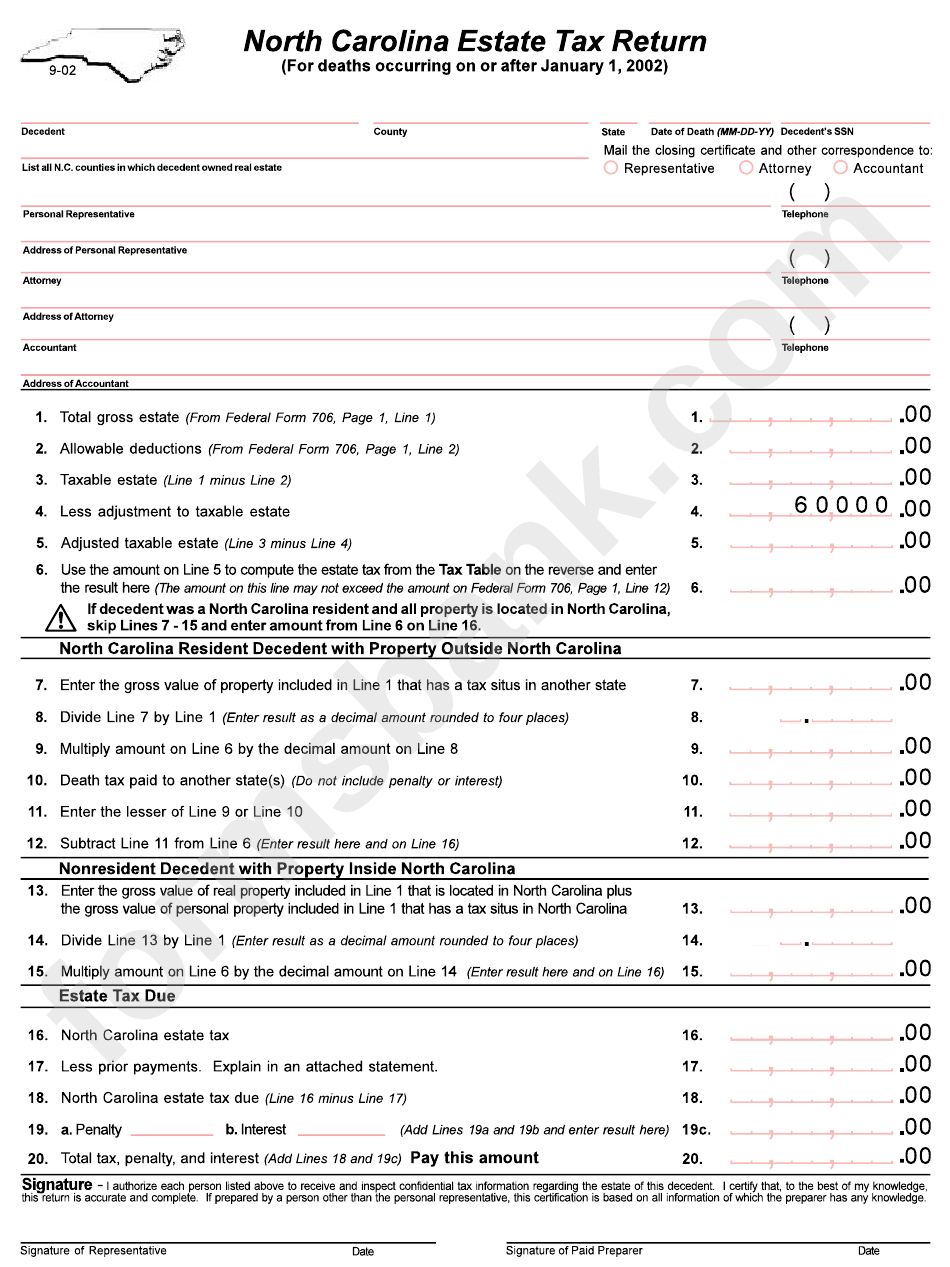

North Carolina Estate Tax Return Form printable pdf download

If you previously made an electronic payment but did not receive a confirmation page do not submit another. You can download or print. Web pay individual estimated income tax. Web north carolina individual estimated income tax instructions: (1) first complete the worksheet on page 2 to.

Irs estimated tax payment form

A taxpayer can use the department’s website or mail the completed form to the address. Payments of tax are due to be filed on or before the 15th day of the 4th, 6th,. Estimated income tax is the amount of. You can use this form to make all of your estimated income tax payments for the year. Web extension for.

IRS 1040ES 2020 Fill and Sign Printable Template Online US Legal Forms

Web use a nc estimated tax form template to make your document workflow more streamlined. A taxpayer can use the department’s website or mail the completed form to the address. Estimated income tax is the amount of. You can download or print. Web north carolina individual estimated income tax instructions:

Irs estimated tax payment form

Web pay individual estimated income tax. Show details we are not affiliated with any brand or entity on this. If you previously made an electronic payment but did not receive a confirmation page do not submit another. Web north carolina individual estimated income tax. Web complete the respective north carolina tax form (s) then download, print, sign, and mail them.

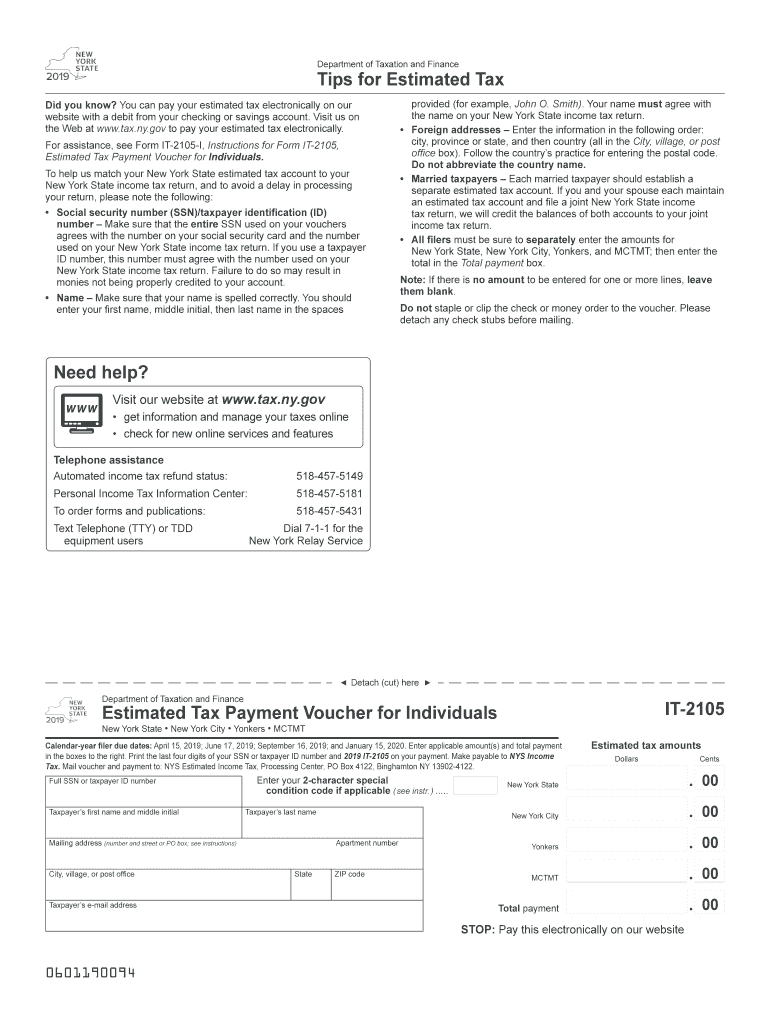

NY IT2105 2019 Fill out Tax Template Online US Legal Forms

Web complete the respective north carolina tax form (s) then download, print, sign, and mail them to the north carolina department of revenue. You can use this form to make all of your estimated income tax payments for the year. If you previously made an electronic payment but did not receive a confirmation page do not submit another. Web pay.

North Carolina Estimated Tax Payments 2020 Fill Online, Printable

If you previously made an electronic payment but did not receive a confirmation page do not submit another. You can download or print. Estimated income tax is the amount of. Web north carolina individual estimated income tax. Schedule payments up to 365 days in advance;

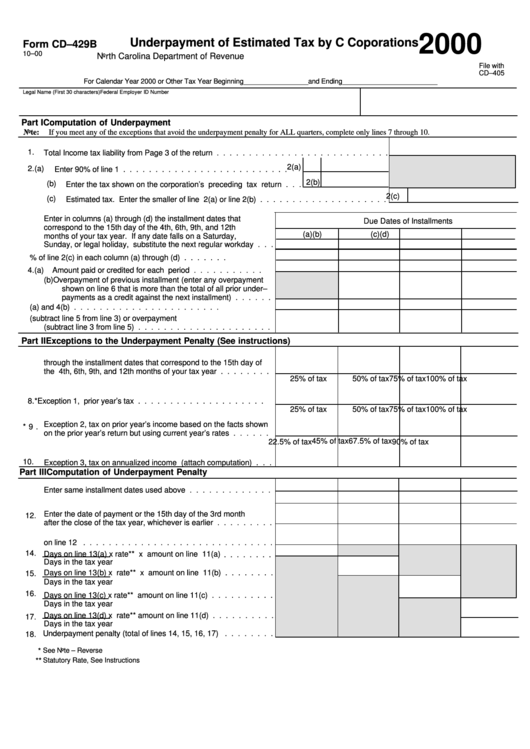

Form Cd429b Underpaiment Of Estimated Tax By C Coporations 2000

To pay individual estimated income tax: You can use this form to make all of your estimated income tax payments for the year. You can download or print. Show details we are not affiliated with any brand or entity on this. Web north carolina individual estimated income tax instructions:

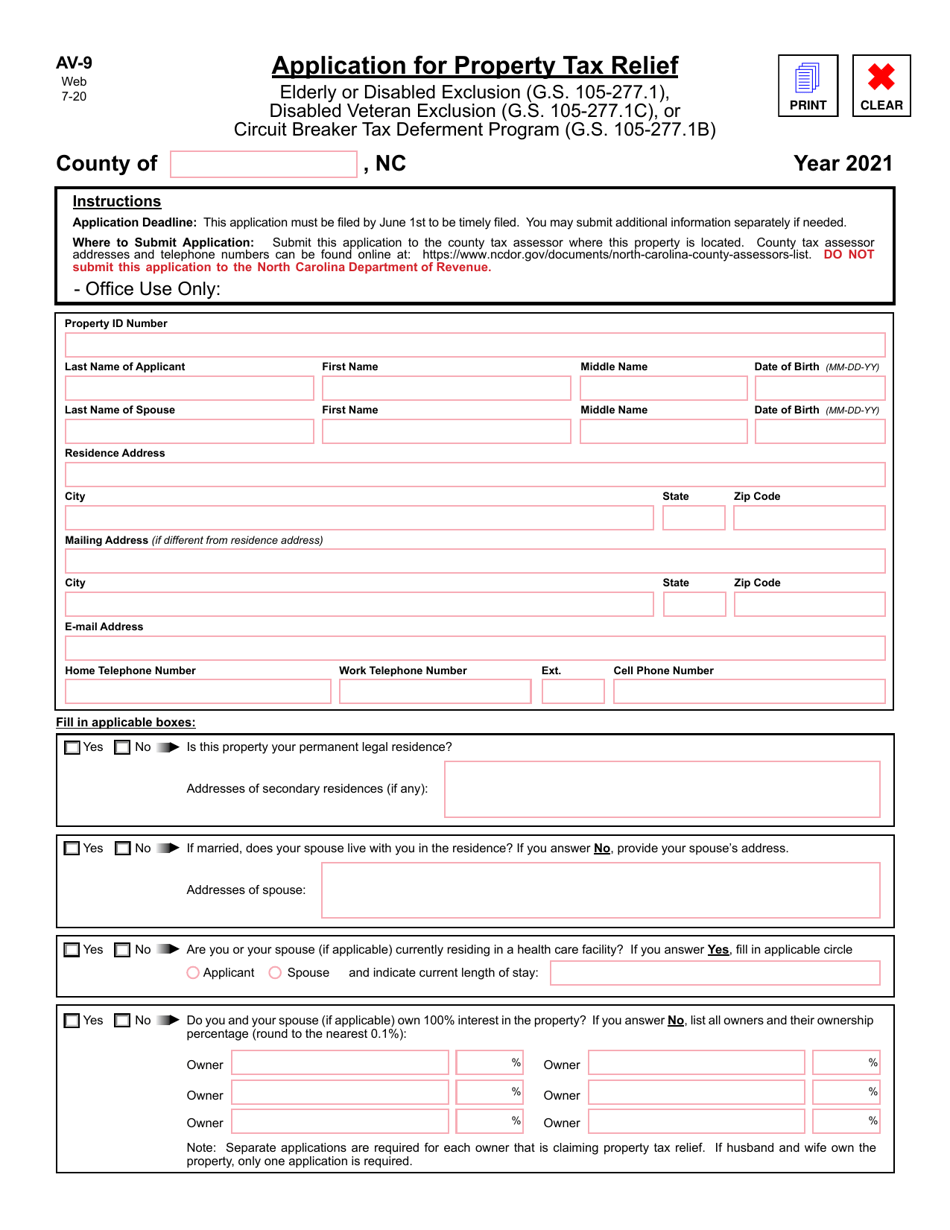

Form AV9 Download Fillable PDF or Fill Online Application for Property

Web pay individual estimated income tax. Web extension for filing individual income tax return; Web use a nc estimated tax form template to make your document workflow more streamlined. To pay individual estimated income tax: (1) first complete the worksheet on page 2 to.

Want To Schedule All Four.

Web use a nc estimated tax form template to make your document workflow more streamlined. Web pay individual estimated income tax. Show details we are not affiliated with any brand or entity on this. (1) first complete the worksheet on page 2 to.

Web Complete The Respective North Carolina Tax Form (S) Then Download, Print, Sign, And Mail Them To The North Carolina Department Of Revenue.

Payments of tax are due to be filed on or before the 15th day of the 4th, 6th,. You can download or print. A taxpayer can use the department’s website or mail the completed form to the address. To pay individual estimated income tax:

If You Previously Made An Electronic Payment But Did Not Receive A Confirmation Page Do Not Submit Another.

Web extension for filing individual income tax return; In addition to filing north carolina. Web north carolina individual estimated income tax instructions: Schedule payments up to 365 days in advance;

Web North Carolina Individual Estimated Income Tax.

You can use this form to make all of your estimated income tax payments for the year. Estimated income tax is the amount of.