Nc W2 Form

Nc W2 Form - However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. You must file the 1099 forms only if there is state tax withholding. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Find a tax type search for a form Even if you do not receive your. Sales and use electronic data interchange (edi) step by step instructions for efile; Web north carolina state filing requirements. Select the create button in the upper right. Use the following link for instructions: How do i get a copy?

A copy of this form is given to the employee, the irs and the state taxing authority (if applicable) each january for the prior calendar (tax) year. However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. How do i get a copy? Electronic filing options and requirements; Web home page | ncdor Web north carolina state filing requirements. You must file the 1099 forms only if there is state tax withholding. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If you want to download a tax form, use the navigation above, search the site, or choose a link below: Use the following link for instructions:

If you want to download a tax form, use the navigation above, search the site, or choose a link below: Log into fiori and select the my online selections tile. Use the following link for instructions: Web download tax forms and instructions ncdor has recently redesigned its website. How do i get a copy? A copy of this form is given to the employee, the irs and the state taxing authority (if applicable) each january for the prior calendar (tax) year. Sales and use electronic data interchange (edi) step by step instructions for efile; As an employer in the state of north carolina, you must file. Select the create button in the upper right. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

Blank W2c Form 20202021 Fill and Sign Printable Template Online US

However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. Web download tax forms and instructions ncdor has recently redesigned its website. If you want to download a tax form, use the navigation above, search the site, or choose a link below: As an employer in the state of north carolina, you must.

W2 Form Copy C or Copy 2 (LW2CLW22)

Web north carolina state filing requirements. Even if you do not receive your. Web download tax forms and instructions ncdor has recently redesigned its website. Use the following link for instructions: If you want to download a tax form, use the navigation above, search the site, or choose a link below:

W2 Mate 2021 2022 W2 Forms Zrivo

How do i get a copy? If too much is withheld, you will generally be due a refund. As an employer in the state of north carolina, you must file. Web home page | ncdor Use the following link for instructions:

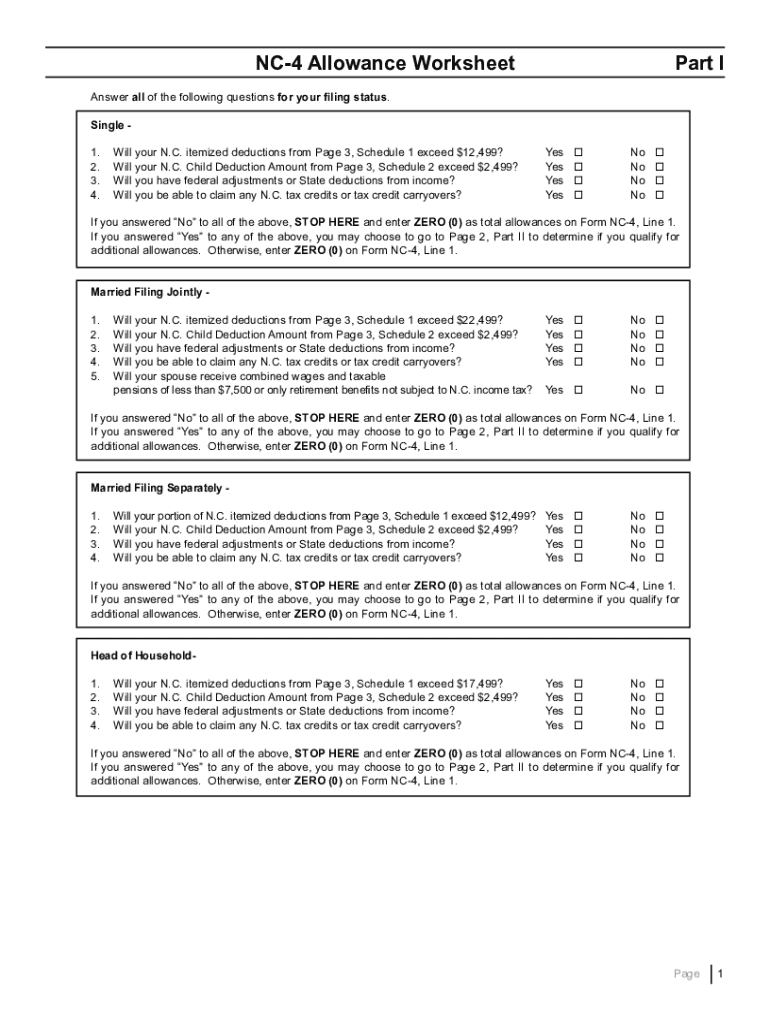

Download North Carolina Form NC4 for Free Page 2 FormTemplate

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund. Select the create button in the upper right. As an employer in the state of north carolina, you must file. Web north carolina state filing requirements.

Nc 4 Allowance Worksheet Form Fill Out and Sign Printable PDF

How do i get a copy? Use the following link for instructions: Web north carolina state filing requirements. As an employer in the state of north carolina, you must file. You must file the 1099 forms only if there is state tax withholding.

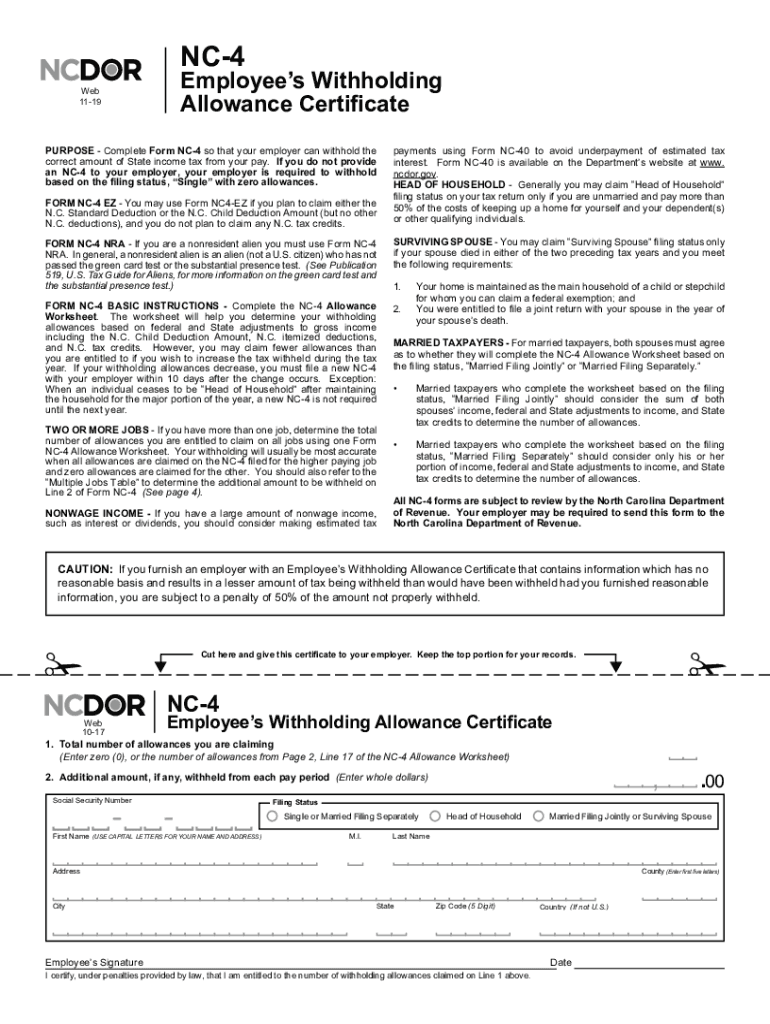

2019 Form NC DoR NC4 Fill Online, Printable, Fillable, Blank pdfFiller

Web download tax forms and instructions ncdor has recently redesigned its website. You must file the 1099 forms only if there is state tax withholding. However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. If too little is withheld, you will generally owe tax when you file your tax return and may.

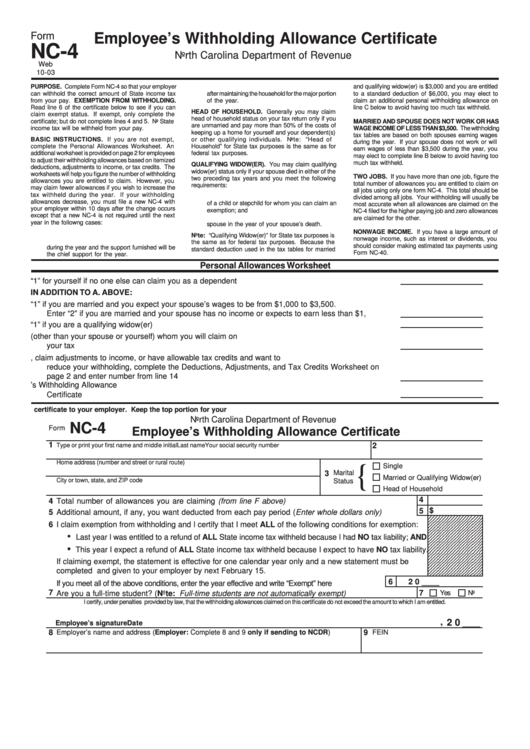

New Employee Nc Tax Forms 2023

Log into fiori and select the my online selections tile. If you want to download a tax form, use the navigation above, search the site, or choose a link below: Electronic filing options and requirements; As an employer in the state of north carolina, you must file. Web download tax forms and instructions ncdor has recently redesigned its website.

NC DoR NC4 2000 Fill out Tax Template Online US Legal Forms

If too much is withheld, you will generally be due a refund. Log into fiori and select the my online selections tile. Even if you do not receive your. As an employer in the state of north carolina, you must file. If too little is withheld, you will generally owe tax when you file your tax return and may owe.

NC4 Employee's Withholding Allowance Certificate (North Carolina State

If too much is withheld, you will generally be due a refund. Web north carolina state filing requirements. Web download tax forms and instructions ncdor has recently redesigned its website. Electronic filing options and requirements; However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until.

You Must File The 1099 Forms Only If There Is State Tax Withholding.

Sales and use electronic data interchange (edi) step by step instructions for efile; Use the following link for instructions: Select the create button in the upper right. However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until.

If Too Much Is Withheld, You Will Generally Be Due A Refund.

Web north carolina state filing requirements. Electronic filing options and requirements; If you want to download a tax form, use the navigation above, search the site, or choose a link below: A copy of this form is given to the employee, the irs and the state taxing authority (if applicable) each january for the prior calendar (tax) year.

Even If You Do Not Receive Your.

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web home page | ncdor As an employer in the state of north carolina, you must file. How do i get a copy?

Find A Tax Type Search For A Form

Log into fiori and select the my online selections tile. Web download tax forms and instructions ncdor has recently redesigned its website.