Negative Equity Balance Sheet

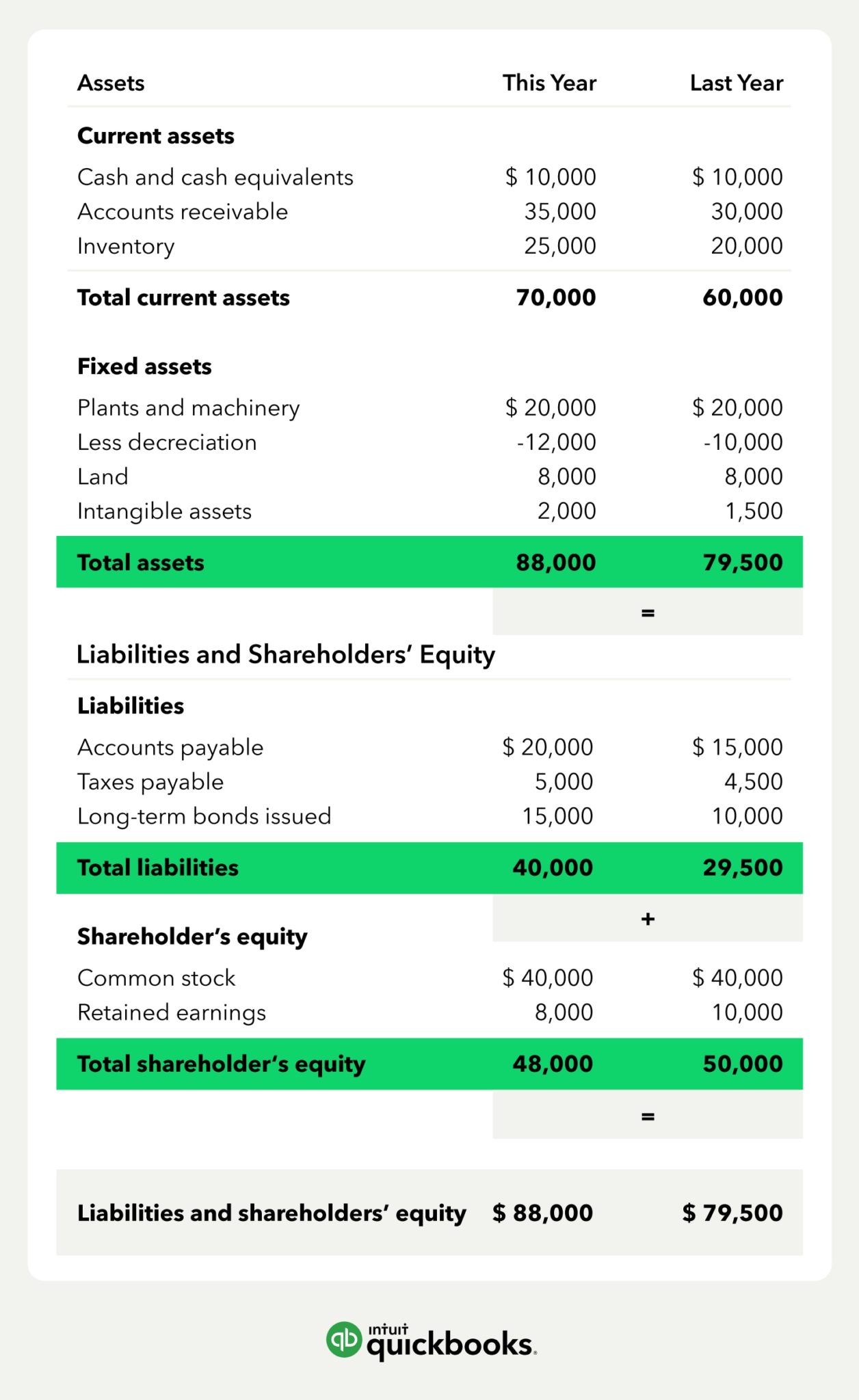

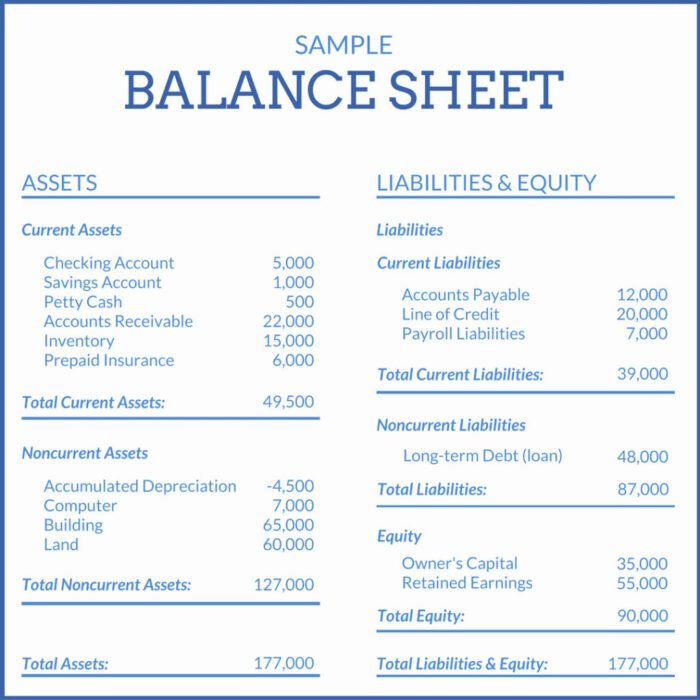

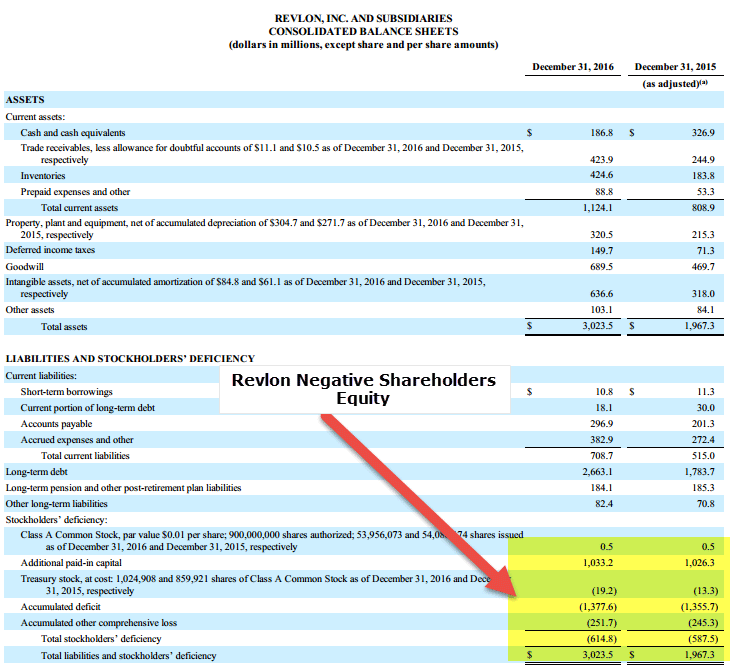

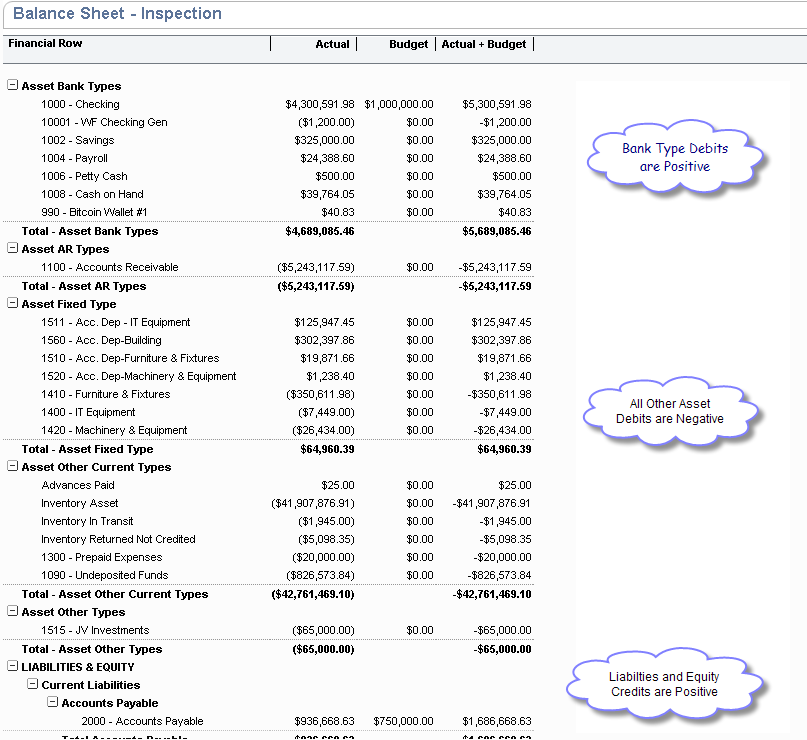

Negative Equity Balance Sheet - This situation usually happens when the company has incurred losses over a. Web start learning now on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Here are some common reasons for negative shareholders' equity:. Web if equity is positive, the company has enough assets to cover its liabilities. If negative, the company's liabilities exceed its assets. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. When prolonged, this is considered balance sheet. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s.

This situation usually happens when the company has incurred losses over a. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Here are some common reasons for negative shareholders' equity:. Web if equity is positive, the company has enough assets to cover its liabilities. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. If negative, the company's liabilities exceed its assets. Web start learning now on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. When prolonged, this is considered balance sheet. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported.

When prolonged, this is considered balance sheet. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. Web if equity is positive, the company has enough assets to cover its liabilities. Here are some common reasons for negative shareholders' equity:. This situation usually happens when the company has incurred losses over a. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. If negative, the company's liabilities exceed its assets. Web start learning now on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets.

Negative equity on balance sheet by james water Issuu

When prolonged, this is considered balance sheet. This situation usually happens when the company has incurred losses over a. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web if equity is positive, the company has enough assets to cover its liabilities. Web if the current year's net income is reported as a.

Capitaluri proprii negative ale acționarilor Exemple Răscumpărare

If negative, the company's liabilities exceed its assets. This situation usually happens when the company has incurred losses over a. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Web a negative balance in shareholders’.

Understanding Your Balance Sheet IndustriusCFO

Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web if equity is positive, the company has enough assets to cover its liabilities. When prolonged, this is considered balance sheet. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. Here are some common reasons for negative.

Marty Zigman on "The Pluses and Minuses of NetSuite Financial Statement

When prolonged, this is considered balance sheet. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Web start learning now on the other hand, negative equity refers to the negative balance of equity share capital.

Stockholders' Equity What It Is, How To Calculate It, Examples

This situation usually happens when the company has incurred losses over a. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Web if equity is positive, the company has enough assets to cover its liabilities..

Should You Invest in a Company With a Negative Equity Balance Sheet?

Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. When prolonged, this is considered balance sheet. If negative, the company's liabilities exceed its assets. This situation usually happens when the company has incurred losses over a. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s.

Understanding Negative Balances in Your Financial Statements Fortiviti

This situation usually happens when the company has incurred losses over a. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. Here are some common reasons for negative shareholders' equity:. Web start learning now on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet..

The Importance of an Accurate Balance Sheet Basis 365 Accounting

Here are some common reasons for negative shareholders' equity:. Web if equity is positive, the company has enough assets to cover its liabilities. Web start learning now on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. It happens when the company’s liabilities exceed its assets, and in more financial terms,.

Negative equity balance sheet

When prolonged, this is considered balance sheet. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Here are some common reasons for negative shareholders' equity:. If negative, the company's liabilities exceed its assets. It happens.

Negative Shareholders Equity Examples Buyback Losses

When prolonged, this is considered balance sheet. If negative, the company's liabilities exceed its assets. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web start learning now on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web if equity is positive, the.

Web Start Learning Now On The Other Hand, Negative Equity Refers To The Negative Balance Of Equity Share Capital In The Balance Sheet.

Web if equity is positive, the company has enough assets to cover its liabilities. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. If negative, the company's liabilities exceed its assets.

When Prolonged, This Is Considered Balance Sheet.

Here are some common reasons for negative shareholders' equity:. This situation usually happens when the company has incurred losses over a. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)