Nm Pit Form

Nm Pit Form - Please refer to the instructions when completing. The document has moved here. Personal income tax correspondence taxation and revenue department p. Complete, edit or print tax forms instantly. Web mailing address if you want to write us about your return, please address your letter to: If you are a new mexico resident, you must file if you meet any of the following conditions: Filing due date paper filers: Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. You may le an amended return online through taxpayer access point (tap) at. Complete, edit or print tax forms instantly.

Personal income tax correspondence taxation and revenue department p. 2 if amending use form 2021. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Taxpayers, tax professionals and others can access the new forms and. If you are a new mexico resident, you must file if you meet any of the following conditions: The document has moved here. This form is for income earned in tax year 2022, with tax. Complete, edit or print tax forms instantly. Web you can find pit forms and instructions on our website at www.tax.newmexico.gov. Please refer to the instructions when completing.

This form is for income earned in tax year 2022, with tax. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Web nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement. The document has moved here. Filing due date paper filers: You may le an amended return online through taxpayer access point (tap) at. Please refer to the instructions when completing. Web mailing address if you want to write us about your return, please address your letter to: Personal income tax correspondence taxation and revenue department p. Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s website.

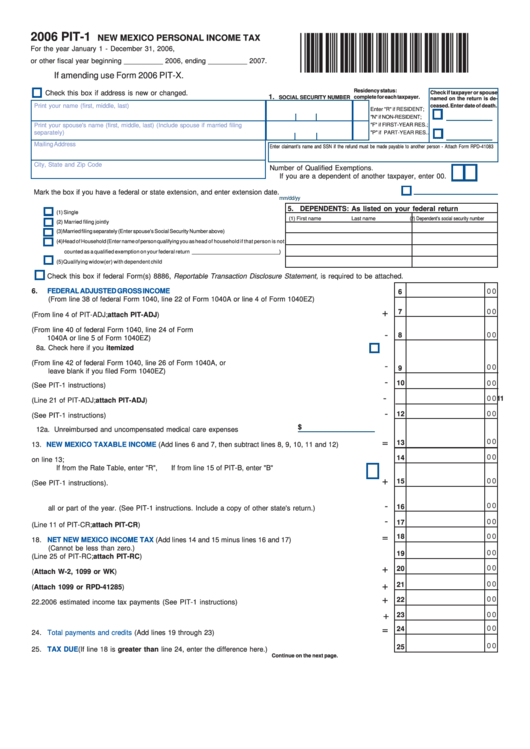

Form Pit1 New Mexico Personal Tax printable pdf download

Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s website. Personal income tax correspondence taxation and revenue department p. You may le an amended return online through taxpayer access point (tap) at. Filing due date paper filers: This form is for income earned in tax year 2022, with tax.

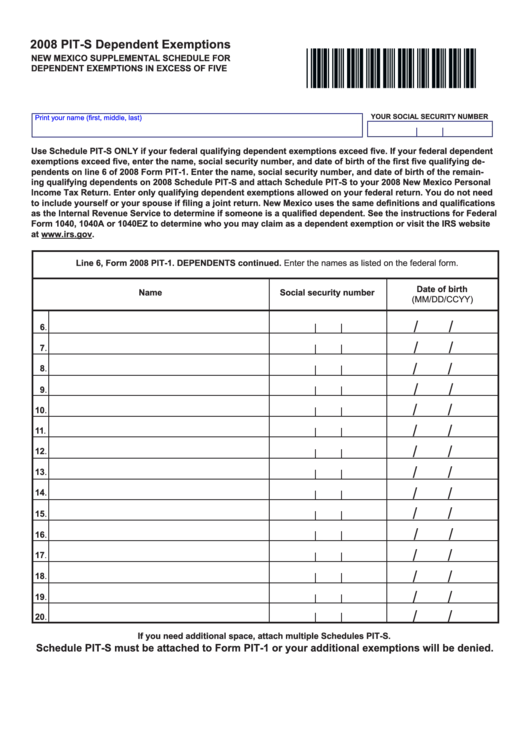

Form PitS New Mexico Supplemental Schedule For Dependent Exemptions

The document has moved here. Filing due date paper filers: This form is for income earned in tax year 2022, with tax. 2 if amending use form 2021. Complete, edit or print tax forms instantly.

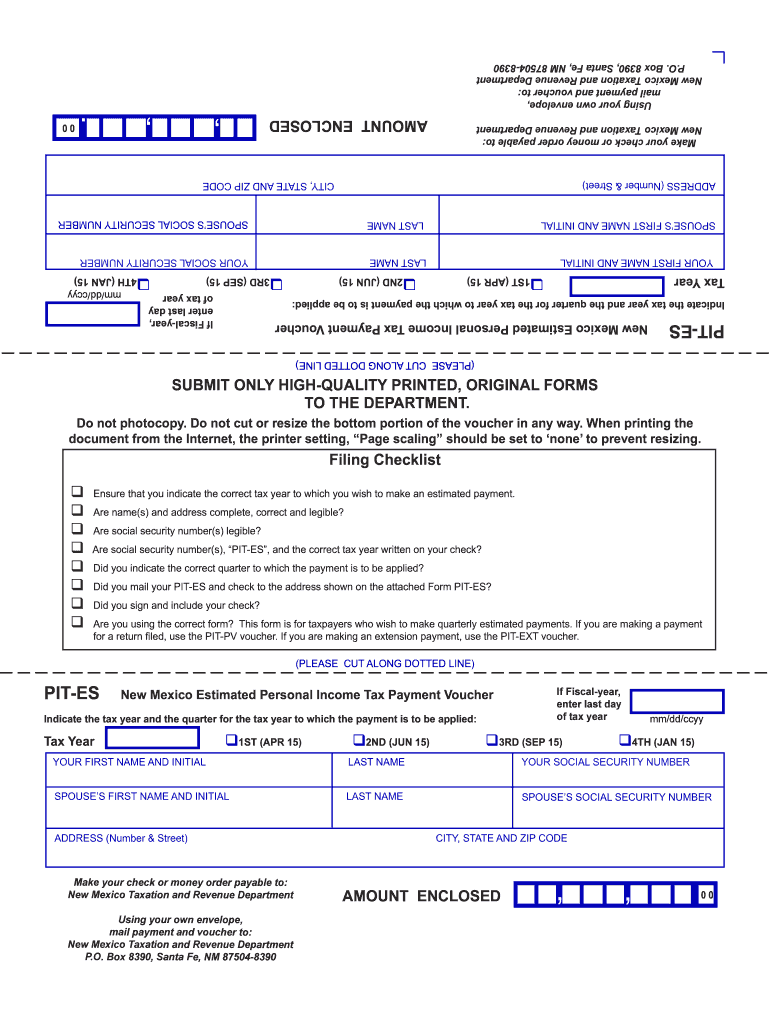

2013 Form NM PITES Fill Online, Printable, Fillable, Blank pdfFiller

The forms and instructions can be accessed. Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s website. If you are a new mexico resident, you must file if you meet any of the following conditions: Personal income tax correspondence taxation and revenue department p. You may le an amended.

2019 Form NM TRD PIT1 Fill Online, Printable, Fillable, Blank pdfFiller

The forms and instructions can be accessed. Personal income tax correspondence taxation and revenue department p. Web taxpayers who allocate and apportion income from both inside and outside the state of new mexico must complete this schedule. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax.

2016 Form NM TRD PIT1 Instructions Fill Online, Printable, Fillable

Filing due date paper filers: Web mailing address if you want to write us about your return, please address your letter to: The forms and instructions can be accessed. At the top of the page, click forms & publications. Web taxpayers who allocate and apportion income from both inside and outside the state of new mexico must complete this schedule.

NM TRD PIT1 Instructions 2018 Fill out Tax Template Online US

Web nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement. Please refer to the instructions when completing. You may le an amended return online through taxpayer access point (tap) at. At the top of the page, click forms & publications. Web you can.

Form PIT 1 Personal Tax YouTube

Please refer to the instructions when completing. Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s website. Web you can find pit forms and instructions on our website at www.tax.newmexico.gov. Complete, edit or print tax forms instantly. Personal income tax correspondence taxation and revenue department p.

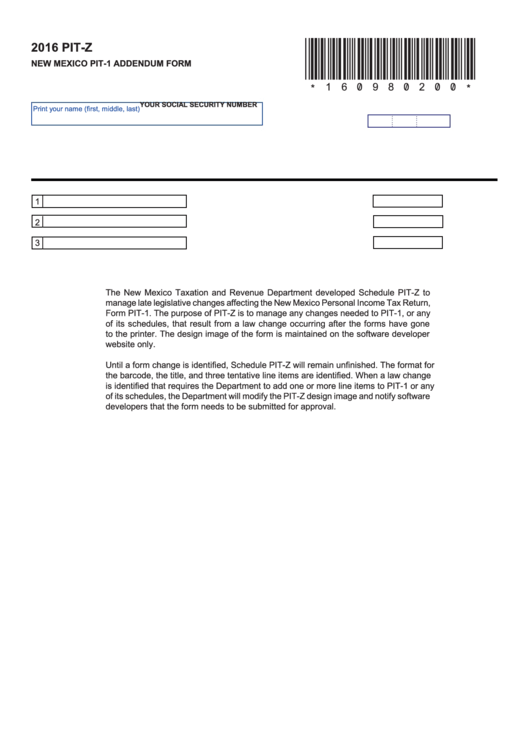

Form 2016 PitZ New Mexico Pit1 Addendum Form printable pdf download

The forms and instructions can be accessed. Filing due date paper filers: Web taxpayers who allocate and apportion income from both inside and outside the state of new mexico must complete this schedule. Please refer to the instructions when completing. Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s.

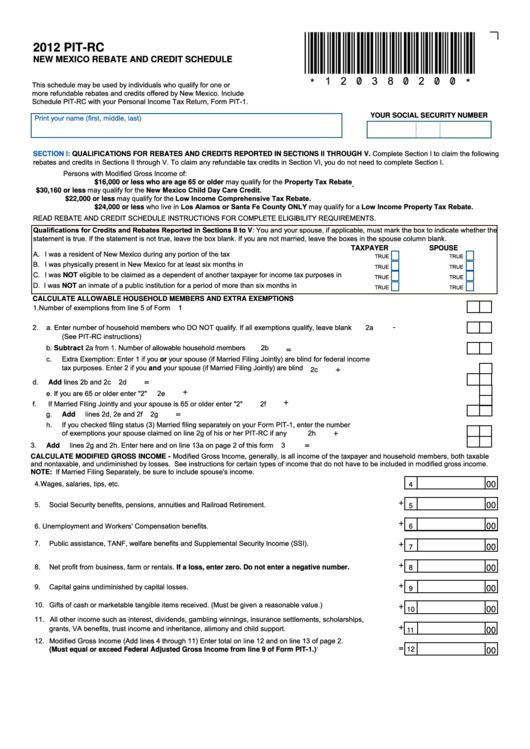

Form PitRc New Mexico Rebate And Credit Shedule 2012 printable pdf

Web you can find pit forms and instructions on our website at www.tax.newmexico.gov. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Personal income tax correspondence taxation and revenue department p.

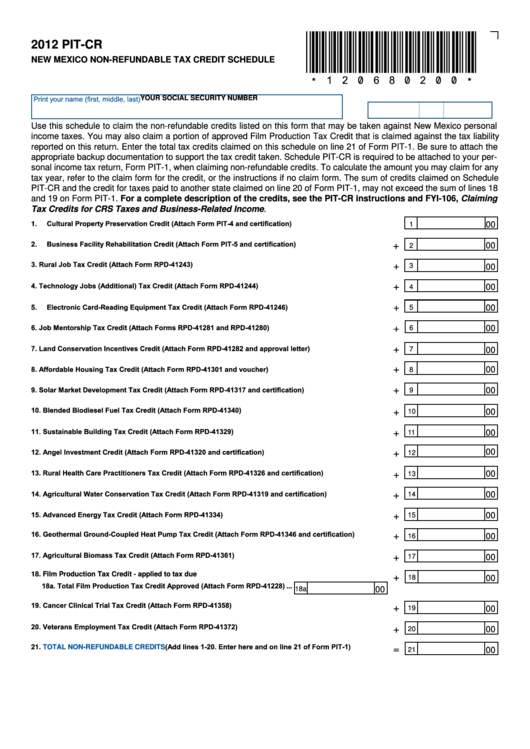

Form PitCr New Mexico NonRefundable Tax Credit Shedule 2012

At the top of the page, click forms & publications. If you are a new mexico resident, you must file if you meet any of the following conditions: Web mailing address if you want to write us about your return, please address your letter to: Web nonresidents, including foreign nationals and persons who reside in states that do not have.

Taxpayers, Tax Professionals And Others Can Access The New Forms And.

The forms and instructions can be accessed. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Filing due date paper filers: Web nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement.

Personal Income Tax Correspondence Taxation And Revenue Department P.

Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax. At the top of the page, click forms & publications. You may le an amended return online through taxpayer access point (tap) at.

The Document Has Moved Here.

Web mailing address if you want to write us about your return, please address your letter to: If you are a new mexico resident, you must file if you meet any of the following conditions: 2 if amending use form 2021. Web you can find pit forms and instructions on our website at www.tax.newmexico.gov.

Web Taxpayers Who Allocate And Apportion Income From Both Inside And Outside The State Of New Mexico Must Complete This Schedule.

Complete, edit or print tax forms instantly. Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s website. Please refer to the instructions when completing.