Non Resident Tax Form Canada

Non Resident Tax Form Canada - Tax you withheld from the nonresident partners or shareholders. This guide will walk you through the rules and. This is the amount to be. For best results, download and open this form in adobe reader. According to the cra, individuals who normally,. Web shareholders are missouri residents. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states. The cra publishes the form and. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo.

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) This is the amount to be. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. According to the cra, individuals who normally,. For best results, download and open this form in adobe reader. Tax you withheld from the nonresident partners or shareholders. There are many tax implications to be considered for those who earned income in canada and who may call. The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. Web shareholders are missouri residents. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states.

The cra publishes the form and. According to the cra, individuals who normally,. There are many tax implications to be considered for those who earned income in canada and who may call. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. This guide will walk you through the rules and. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states. Tax you withheld from the nonresident partners or shareholders. This is the amount to be.

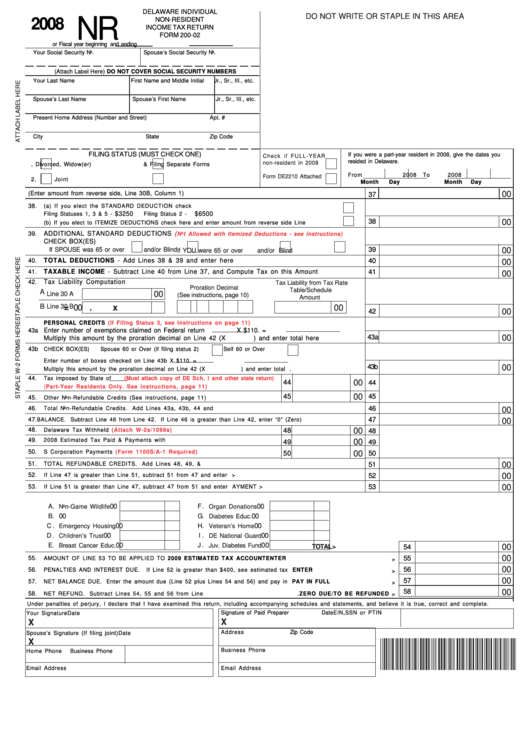

Fillable Form 20002 Delaware Individual NonResident Tax

The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. This is the amount to be. The cra publishes the form and. There are many tax implications to be considered for those who earned income in canada and who may call. Tax you withheld from the nonresident partners or.

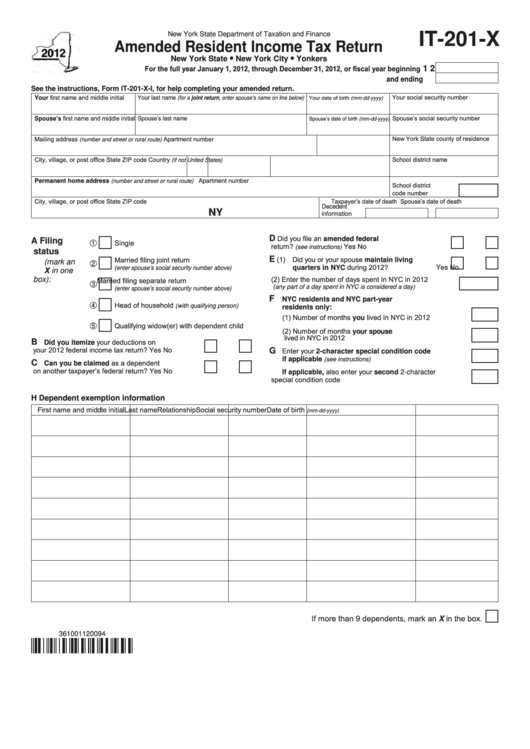

Fillable Form It201X Amended Resident Tax Return 2012

Tax you withheld from the nonresident partners or shareholders. For best results, download and open this form in adobe reader. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states. The cra publishes the form and. Web shareholders are missouri.

NonResident tax services for Canada Tax Doctors Canada

This guide will walk you through the rules and. The cra publishes the form and. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) According to the cra, individuals who normally,. The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo.

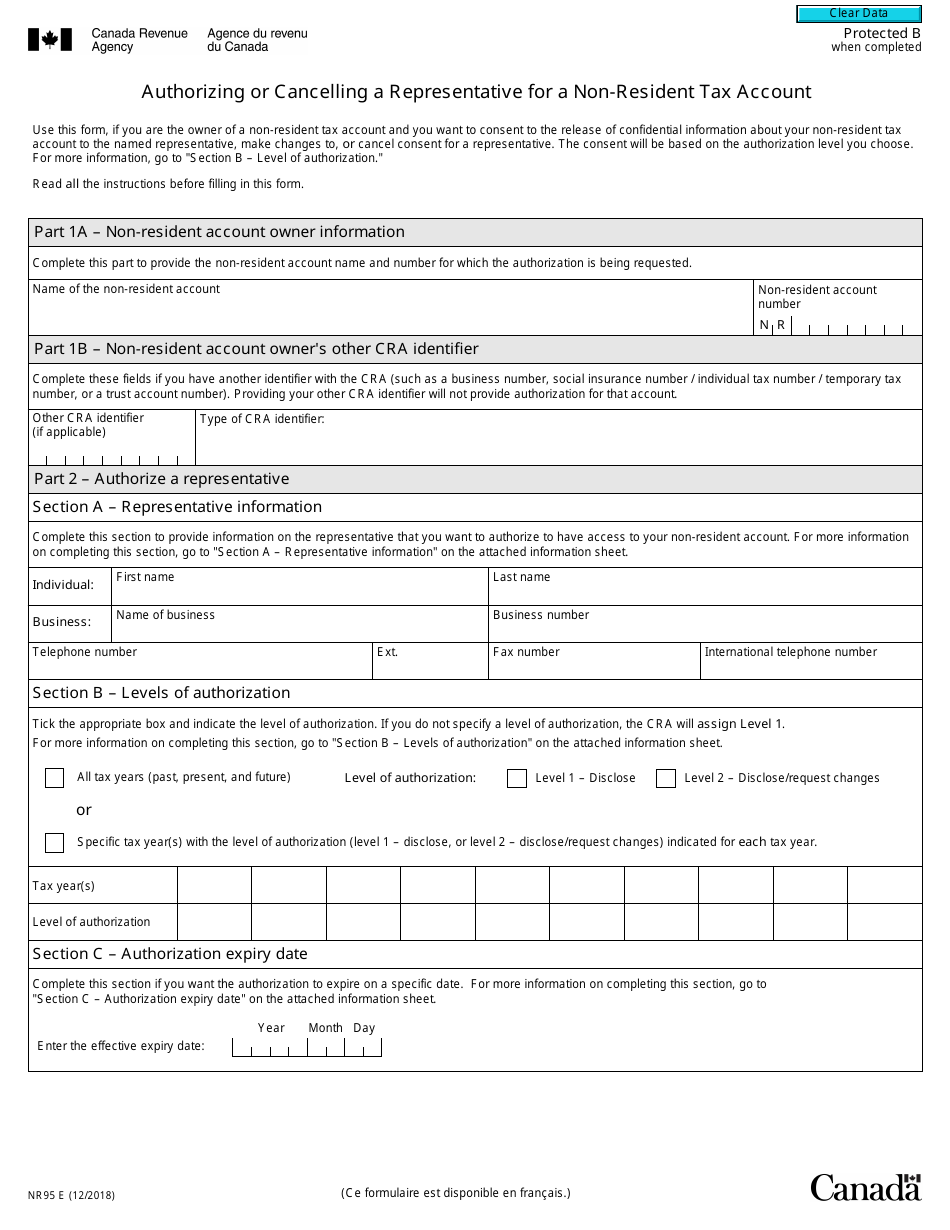

Form NR95 Download Fillable PDF or Fill Online Authorizing or

Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. There are many tax implications to be considered for those who earned income in canada and who may call. The cra publishes the form and. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes.

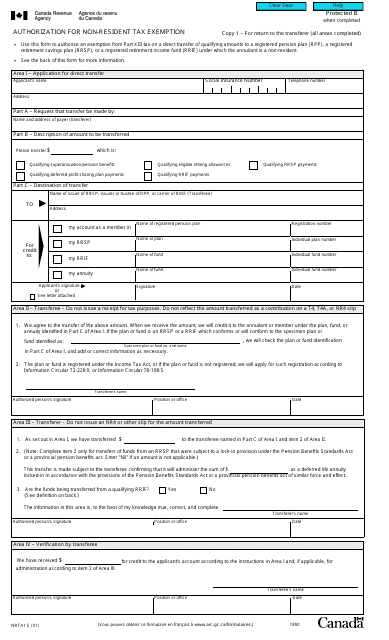

Form NRTA1 Download Fillable PDF or Fill Online Authorization for Non

Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. Web shareholders are missouri residents. This is the amount to be. Web per missouri code section 143.121,.

How much tax does a nonresident Canadian citizen have to pay annually

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) This is the amount to be. According to the cra, individuals who normally,. The cra publishes the form and. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship.

Tax from nonresidents in Spain, what is it and how to do it properly

For best results, download and open this form in adobe reader. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web shareholders are missouri residents. There are many tax implications to be considered for those who earned income in canada and who may call. This is the amount to be.

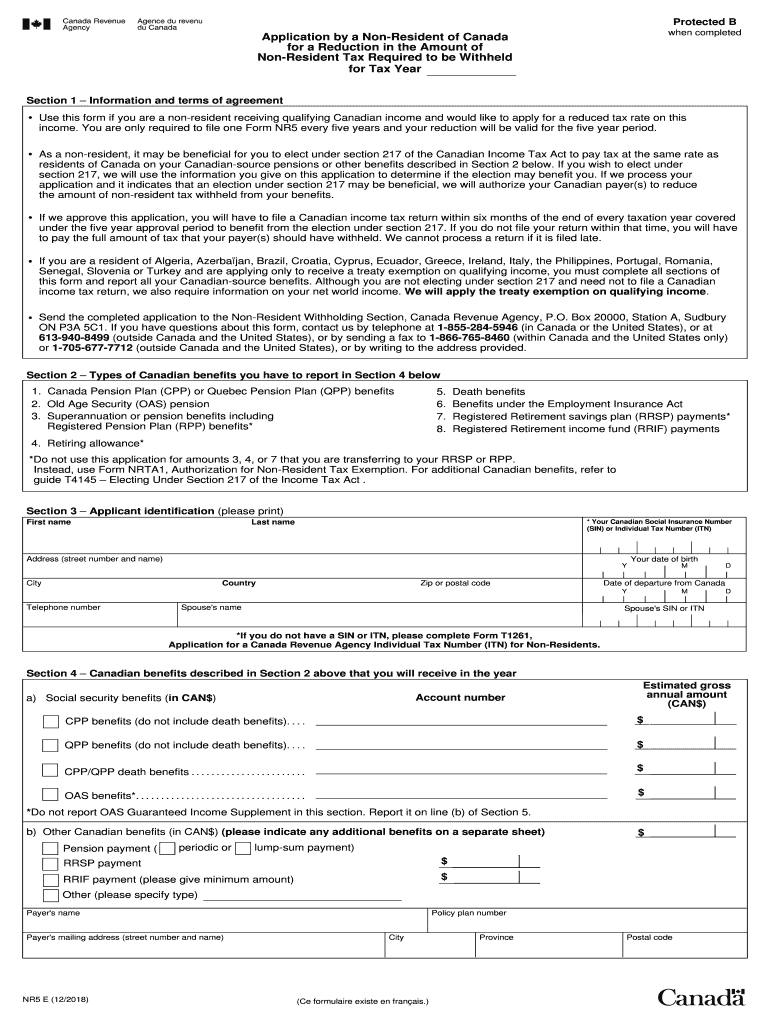

Nr5 Fill Out and Sign Printable PDF Template signNow

Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states. This is the amount to be. This guide.

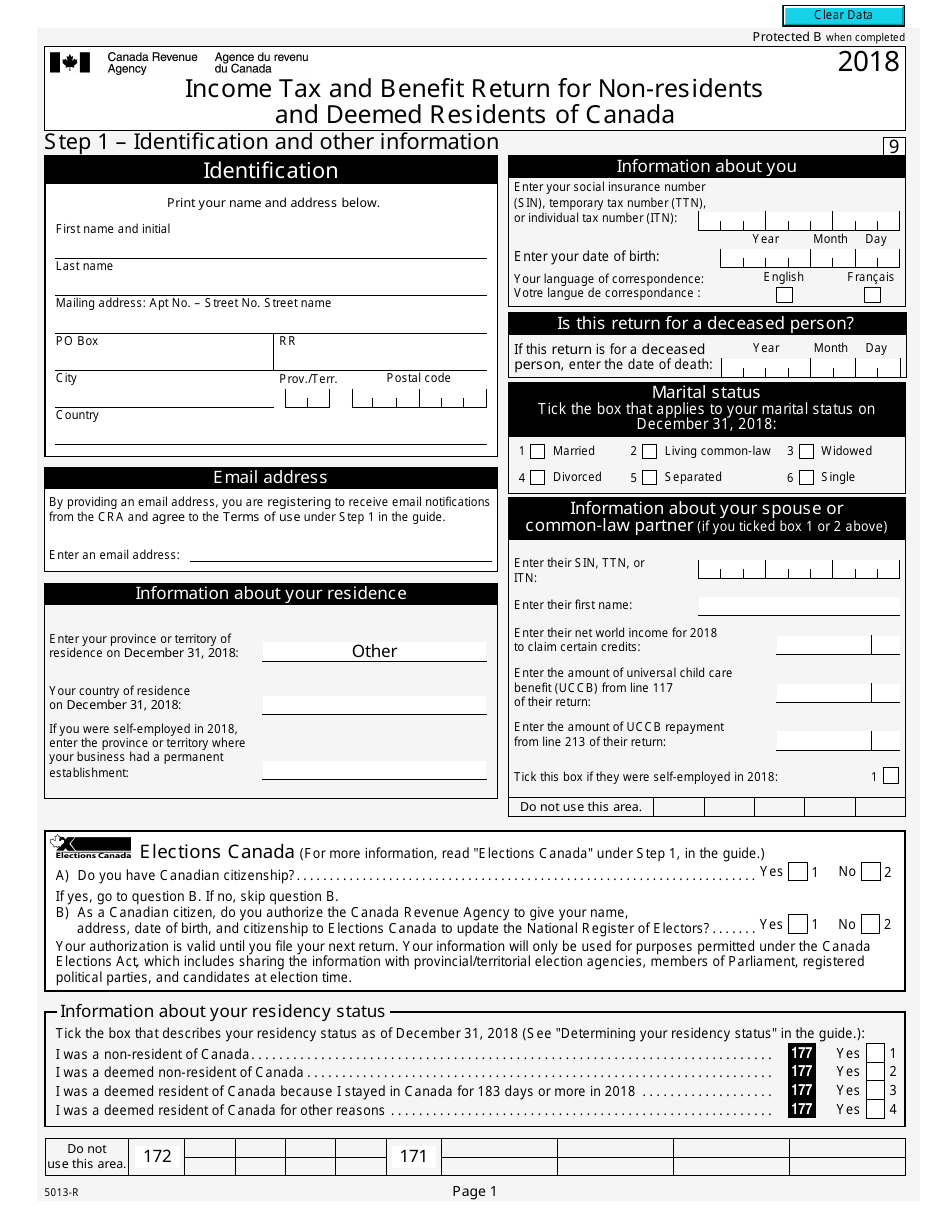

Revenue Canada 2012 Tax Return Forms designedbycarl

Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. Tax you withheld from the nonresident partners or shareholders. For best results, download and open this form in adobe reader. The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated.

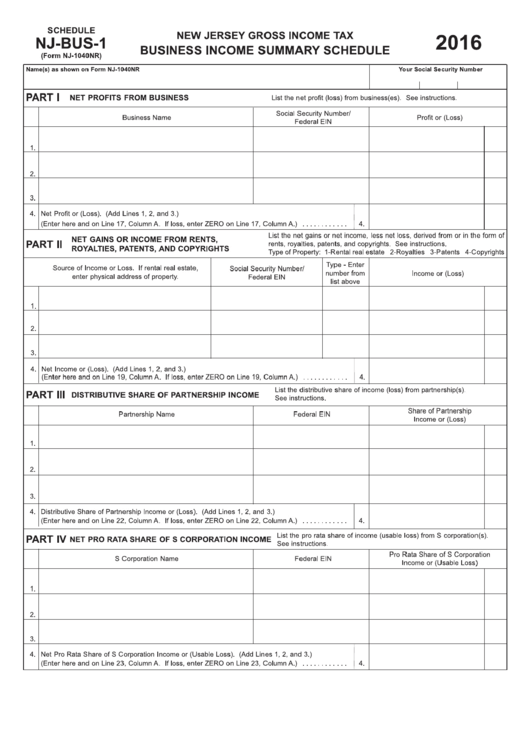

Fillable Form Nj1040nr NonResident Tax Return 2016

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. The cra publishes the form and. For best results, download and open this form in adobe reader. Nonresident alien income tax return only if.

Nonresident Alien Income Tax Return Only If You Have Income That Is Subject To Tax, Such As Wages, Tips, Scholarship And Fellowship.

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The cra publishes the form and. Tax you withheld from the nonresident partners or shareholders. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states.

There Are Many Tax Implications To Be Considered For Those Who Earned Income In Canada And Who May Call.

The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. For best results, download and open this form in adobe reader. This is the amount to be. According to the cra, individuals who normally,.

Web Shareholders Are Missouri Residents.

This guide will walk you through the rules and.