Northwestern Mutual Ira Withdrawal Form

Northwestern Mutual Ira Withdrawal Form - In some situations, you might have more options and access if you leave your funds in a qualified plan rather than rolling them over to an ira. Web how it works open the northwestern mutual surrender form pdf and follow the instructions easily sign the northwestern mutual transfer form with your finger send filled & signed northwestern mutual 1035 exchange form pdf or save quick guide on how to complete northwestern mutual surrender form forget about scanning and printing out forms. Web ratings are for the northwestern mutual life insurance company and northwestern long term care insurance company. Web you can withdraw money from your 401(k) as you wish, but doing so prior to age 59½ typically triggers a 10 percent penalty. Web part of our finance fundamentals series. Web you can also withdraw the funds you have added from a roth ira before you are 59½ without incurring taxes — but if you withdraw any of its earnings, you’ll incur a 10 percent penalty. If you roll over traditional ira funds into a roth, you’ll need to pay income taxes on those funds in the year that you do the rollover. To inform northwestern mutual of a disability, please complete the following form. Web download ira rollover and distribution options brochure this brochure explains the benefits of a rollover ira for when you are changing jobs or finally reach your goal of retirement. That’s on top of income taxes unless you qualify for an exception.

That’s on top of income taxes unless you qualify for an exception. Web ratings are for the northwestern mutual life insurance company and northwestern long term care insurance company. Keep in mind, the irs requires you to withdraw a minimum amount each year (required minimum distributions, aka rmds) when you turn 72. If you roll over traditional ira funds into a roth, you’ll need to pay income taxes on those funds in the year that you do the rollover. Web once you start withdrawing money in retirement, you'll pay taxes at your current income level. Once issued, the annuity cannot be terminated (surrendered), and the premium paid for the annuity is not refundable and cannot be withdrawn. Web you can also withdraw the funds you have added from a roth ira before you are 59½ without incurring taxes — but if you withdraw any of its earnings, you’ll incur a 10 percent penalty. Web how it works open the northwestern mutual surrender form pdf and follow the instructions easily sign the northwestern mutual transfer form with your finger send filled & signed northwestern mutual 1035 exchange form pdf or save quick guide on how to complete northwestern mutual surrender form forget about scanning and printing out forms. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web you can withdraw money from your 401(k) as you wish, but doing so prior to age 59½ typically triggers a 10 percent penalty.

With a roth ira, your contributions are made after taxes have been taken out. Once issued, the annuity cannot be terminated (surrendered), and the premium paid for the annuity is not refundable and cannot be withdrawn. Web how it works open the northwestern mutual surrender form pdf and follow the instructions easily sign the northwestern mutual transfer form with your finger send filled & signed northwestern mutual 1035 exchange form pdf or save quick guide on how to complete northwestern mutual surrender form forget about scanning and printing out forms. Web part of our finance fundamentals series. Web you can also withdraw the funds you have added from a roth ira before you are 59½ without incurring taxes — but if you withdraw any of its earnings, you’ll incur a 10 percent penalty. Need to file a disability claim but don't know how to get started or what to expect? Web once you start withdrawing money in retirement, you'll pay taxes at your current income level. If you roll over traditional ira funds into a roth, you’ll need to pay income taxes on those funds in the year that you do the rollover. Web northwestern mutual ira terms of withdrawal pdf. Get everything done in minutes.

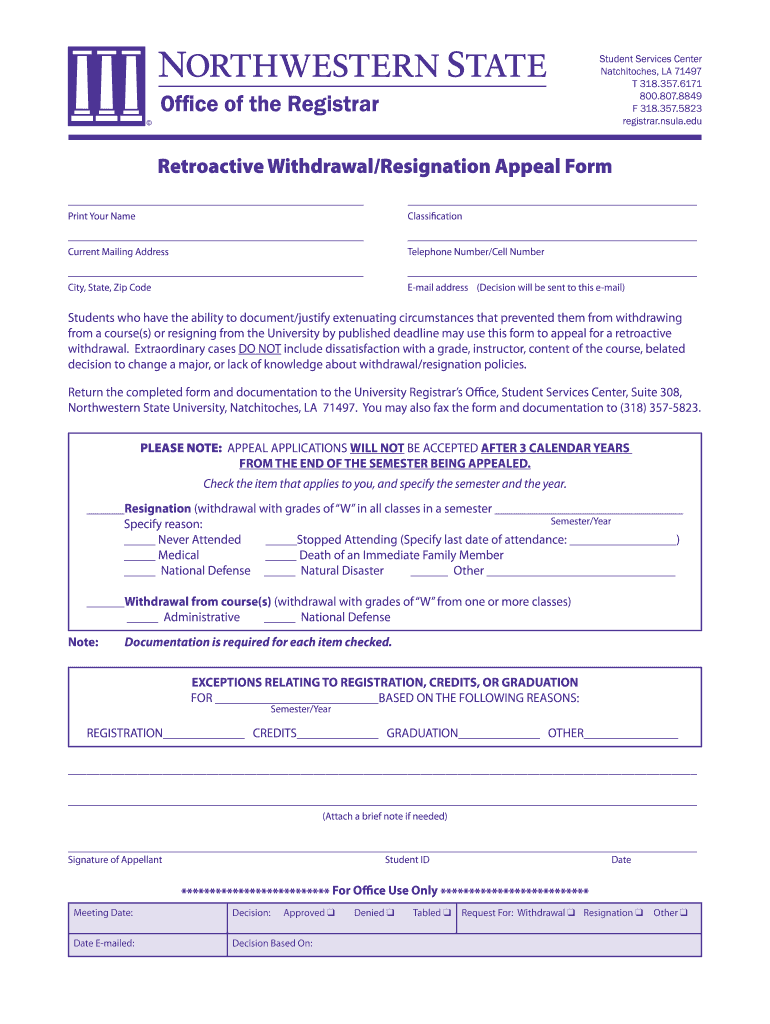

Fillable Online registrar nsula northwestern state university

Web you can withdraw money from your 401(k) as you wish, but doing so prior to age 59½ typically triggers a 10 percent penalty. Once issued, the annuity cannot be terminated (surrendered), and the premium paid for the annuity is not refundable and cannot be withdrawn. Check out how easy it is to complete and esign documents online using fillable.

Massmutual Ira Withdrawal Form Universal Network

It compares alternative options, for example staying in your current plan or taking a cash distribution and offers an easy to understand chart comparing your options. Web northwestern mutual ira terms of withdrawal pdf. If you roll over traditional ira funds into a roth, you’ll need to pay income taxes on those funds in the year that you do the.

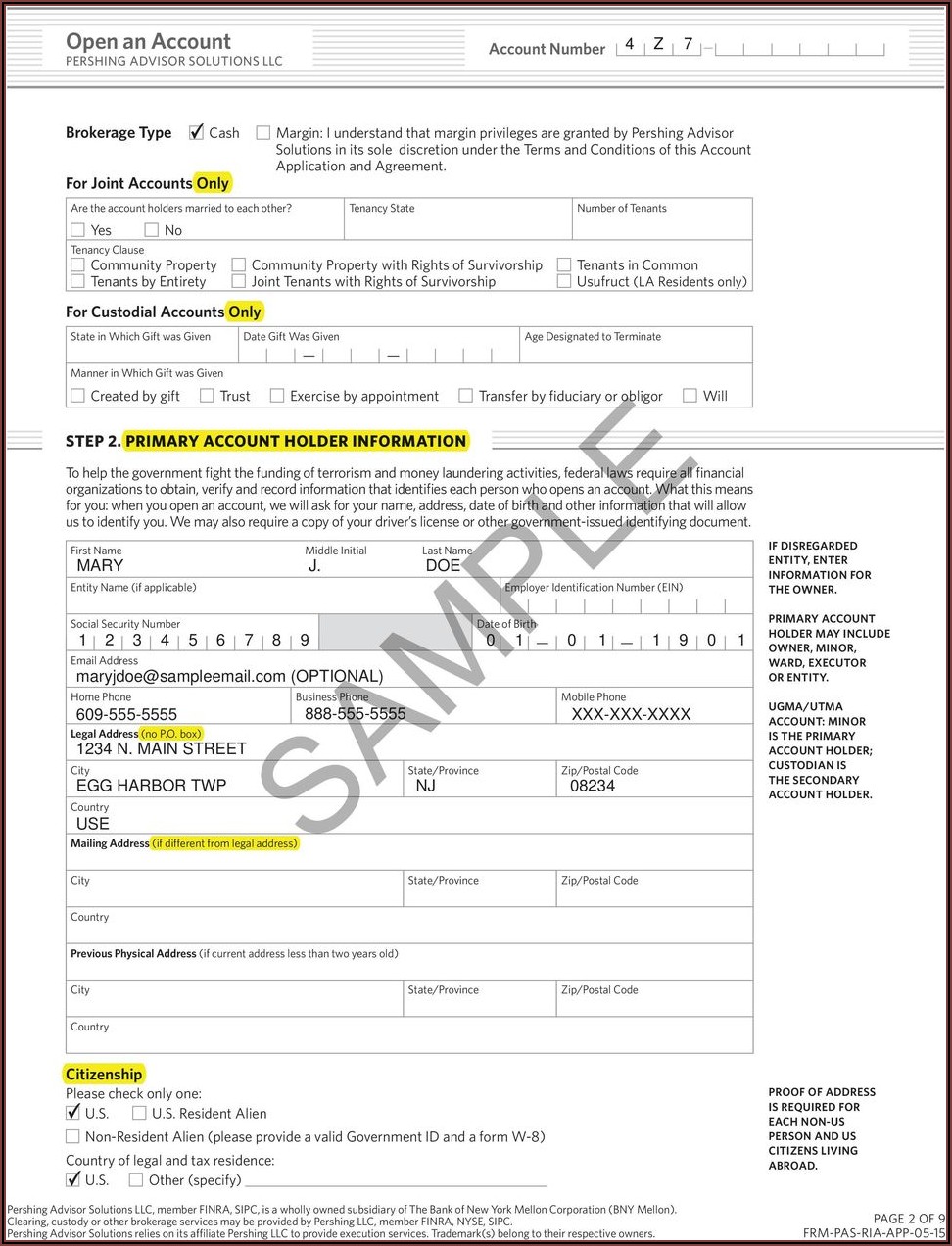

Pershing Ira Withdrawal Form Form Resume Examples goVLdJqpVv

Web download ira rollover and distribution options brochure this brochure explains the benefits of a rollover ira for when you are changing jobs or finally reach your goal of retirement. Get everything done in minutes. Web ratings are for the northwestern mutual life insurance company and northwestern long term care insurance company. Need to file a disability claim but don't.

Northwestern Mutual Terms Of Withdrawal Pdf Fill Online, Printable

Web ratings are for the northwestern mutual life insurance company and northwestern long term care insurance company. Get everything done in minutes. It compares alternative options, for example staying in your current plan or taking a cash distribution and offers an easy to understand chart comparing your options. To inform northwestern mutual of a disability, please complete the following form..

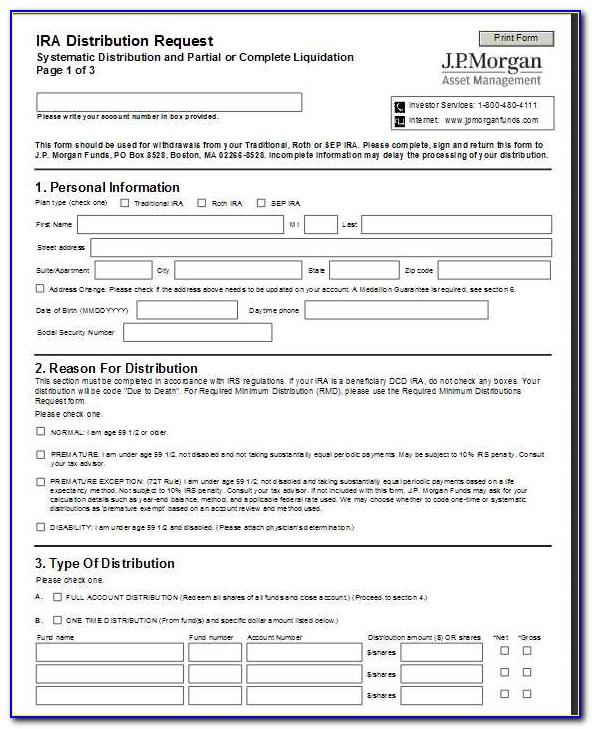

Ira Withdrawal Authorization Form 20202021 Fill and Sign Printable

Web once you start withdrawing money in retirement, you'll pay taxes at your current income level. Web you can also withdraw the funds you have added from a roth ira before you are 59½ without incurring taxes — but if you withdraw any of its earnings, you’ll incur a 10 percent penalty. Web download ira rollover and distribution options brochure.

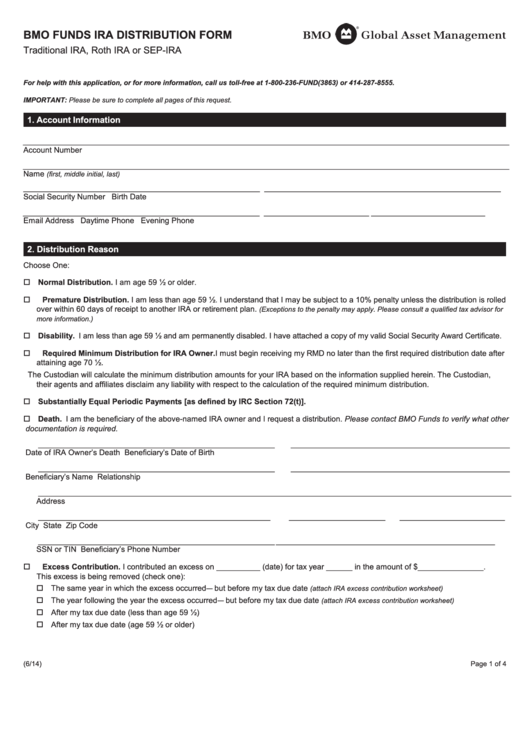

Fillable Bmo Funds Ira Distribution Form printable pdf download

With a roth ira, your contributions are made after taxes have been taken out. In some situations, you might have more options and access if you leave your funds in a qualified plan rather than rolling them over to an ira. It compares alternative options, for example staying in your current plan or taking a cash distribution and offers an.

Mutual Of Omaha Annuity Withdrawal Form Form Resume Examples

Web part of our finance fundamentals series. Web ratings are for the northwestern mutual life insurance company and northwestern long term care insurance company. It compares alternative options, for example staying in your current plan or taking a cash distribution and offers an easy to understand chart comparing your options. With a roth ira, your contributions are made after taxes.

What Are Traditional IRA Withdrawal Rules?

Once issued, the annuity cannot be terminated (surrendered), and the premium paid for the annuity is not refundable and cannot be withdrawn. Web ratings are for the northwestern mutual life insurance company and northwestern long term care insurance company. Get everything done in minutes. That’s on top of income taxes unless you qualify for an exception. Keep in mind, the.

Nationwide Ira Withdrawal Form Universal Network

If you roll over traditional ira funds into a roth, you’ll need to pay income taxes on those funds in the year that you do the rollover. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web download ira rollover and distribution options brochure this brochure explains the benefits of.

Northwestern Mutual IRA Review (2022)

That’s on top of income taxes unless you qualify for an exception. Web you can also withdraw the funds you have added from a roth ira before you are 59½ without incurring taxes — but if you withdraw any of its earnings, you’ll incur a 10 percent penalty. In some situations, you might have more options and access if you.

Web Download Ira Rollover And Distribution Options Brochure This Brochure Explains The Benefits Of A Rollover Ira For When You Are Changing Jobs Or Finally Reach Your Goal Of Retirement.

Web how it works open the northwestern mutual surrender form pdf and follow the instructions easily sign the northwestern mutual transfer form with your finger send filled & signed northwestern mutual 1035 exchange form pdf or save quick guide on how to complete northwestern mutual surrender form forget about scanning and printing out forms. Income annuities have no cash value. Web you can also withdraw the funds you have added from a roth ira before you are 59½ without incurring taxes — but if you withdraw any of its earnings, you’ll incur a 10 percent penalty. That’s on top of income taxes unless you qualify for an exception.

Web Part Of Our Finance Fundamentals Series.

To inform northwestern mutual of a disability, please complete the following form. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. It compares alternative options, for example staying in your current plan or taking a cash distribution and offers an easy to understand chart comparing your options. Web you can withdraw money from your 401(k) as you wish, but doing so prior to age 59½ typically triggers a 10 percent penalty.

Need To File A Disability Claim But Don't Know How To Get Started Or What To Expect?

Keep in mind, the irs requires you to withdraw a minimum amount each year (required minimum distributions, aka rmds) when you turn 72. Web northwestern mutual ira terms of withdrawal pdf. Web once you start withdrawing money in retirement, you'll pay taxes at your current income level. In some situations, you might have more options and access if you leave your funds in a qualified plan rather than rolling them over to an ira.

If You Roll Over Traditional Ira Funds Into A Roth, You’ll Need To Pay Income Taxes On Those Funds In The Year That You Do The Rollover.

Web ratings are for the northwestern mutual life insurance company and northwestern long term care insurance company. Get everything done in minutes. With a roth ira, your contributions are made after taxes have been taken out. Once issued, the annuity cannot be terminated (surrendered), and the premium paid for the annuity is not refundable and cannot be withdrawn.