Ohio R&D Tax Credit Form

Ohio R&D Tax Credit Form - Claim up to 250k annually. Web the r&d tax claim needs to be submitted along with your annual corporate tax filing. Form 6765, credit for increasing research. Using the federal definition to determine qres, businesses should calculate their. Prior calendar year 1 (20____) expenses: Ad sign up for a no obligation r&d tax credit consultation today. Ad r&d credits are available in the manufacturing industry. Ad sign up for a no obligation r&d tax credit consultation today. Ad r&d credits are available in the manufacturing industry. We'll help determine your eligibility, document your processes, and maximize your return!

Claim up to 250k annually. Choose gusto for payroll and save thousands with the research and development tax credit. Using the federal definition to determine qres, businesses should calculate their. Web (a) (1) for purposes of the commercial activity tax, the law provides for five different credits taxpayers may apply against their tax liability: Here is what you need to file: If your business is already filing form 6765 with your federal income tax return, you are. Ad unlock r&d tax credits for your business & get the savings you're owed with gusto payroll. The r&d investment tax credit is. Web the state of ohio allows a credit for increased r&d costs against the cat. You can carry forward any unused.

Web the state of ohio allows a credit for increased r&d costs against the cat. Web the r&d tax credit ohio is available annually and is based upon qualified research expenses in ohio allowed under section (s.) 41 of the internal revenue code. Prior calendar year 2 (20____). Ad r&d credits are available in the manufacturing industry. The r&d investment tax credit is. The ohio r&d tax credit equals 7% of ohio qualified r&d expenses over the average of qualified expenses for the three prior taxable years. Web ethanol investment credit (r.c. Claim up to 250k annually. As part of the process, they need to identify qualifying expenses and. R&d tax credit calculator partner with us our team login.

What Is an R&D Tax Credit?

Web (a) (1) for purposes of the commercial activity tax, the law provides for five different credits taxpayers may apply against their tax liability: Web firms which are interested in qualifying for this incentive are supposed to invest in qualified research expenses, according to sec.41 of the irc. Web the investor files an application for a tax credit and a.

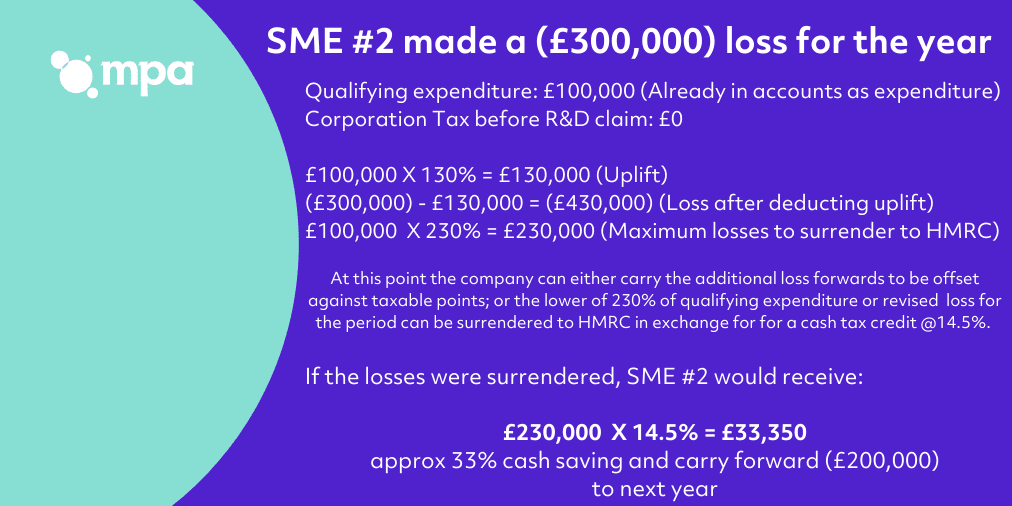

R&D tax credit calculation examples MPA

Claim up to 250k annually. Web something went wrong while submitting the form. Web ohio research and development tax credit is equivalent to 7% of the excess of your investment in qres for the previous three tax years. We'll help determine your eligibility, document your processes, and maximize your return! The ohio r&d tax credit equals 7% of ohio qualified.

What is the R&D Tax Credit? Froehling Anderson

Choose gusto for payroll and save thousands with the research and development tax credit. It's all possible with r&d tax credits. R&d tax credit calculator partner with us our team login. If your business is already filing form 6765 with your federal income tax return, you are. Ad r&d credits are available in the manufacturing industry.

R&D Tax Credit Denied Where Taxpayer Failed to Demonstrate And Document

Offset your tax liability with r&d tax credits Claim up to 250k annually. The payroll tax credit is an. The r&d investment tax credit is. The industrial technology and enterprise.

R&D Tax Credits Explained What are they? Your FAQ's Answered

Here is what you need to file: Web (d) a taxpayer may claim against the tax imposed under this chapter any unused portion of a credit authorized under section 5733.351 of the revised code but. Offset your tax liability with r&d tax credits Web something went wrong while submitting the form. Prior calendar year 2 (20____).

Ohio Tax Credit Pure Gift of God

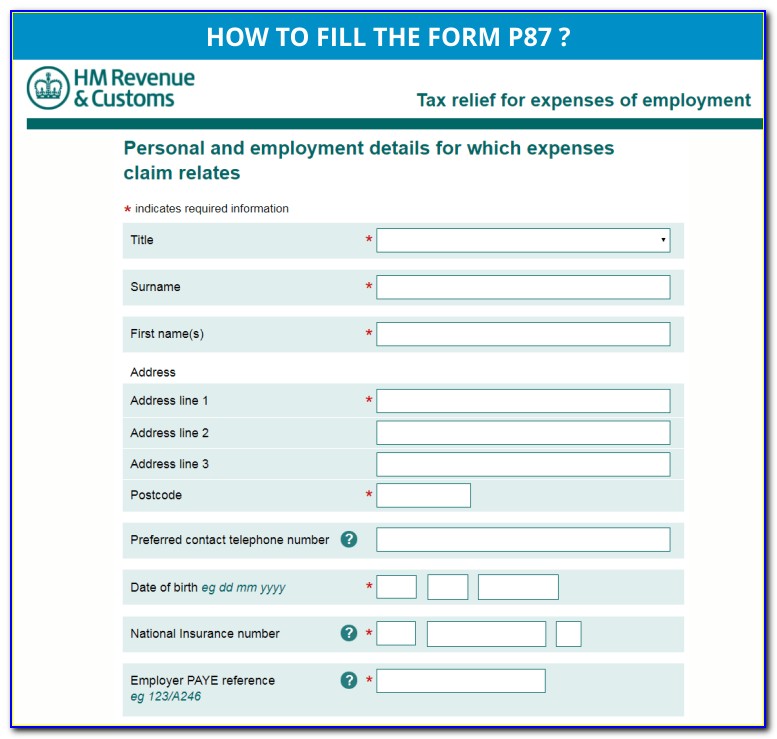

Web businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. Web the state of ohio allows a credit for increased r&d costs against the cat. Ad unlock r&d tax credits for your business & get the savings you're owed with gusto payroll. Claim up to 250k annually. Ad r&d credits are available in.

Ohio Department Of Taxation Tax Exempt Form TAXF

Claim up to 250k annually. Prior calendar year 1 (20____) expenses: (a) (1) for purposes of the commercial activity tax, the law provides. Web the r&d tax credit equals: We'll help determine your eligibility, document your processes, and maximize your return!

Ohio R&d Tax Credit Form Form Resume Examples K75P0KE5l2

Offset your tax liability with r&d tax credits Web firms which are interested in qualifying for this incentive are supposed to invest in qualified research expenses, according to sec.41 of the irc. Ad r&d credits are available in the manufacturing industry. The payroll tax credit is an. Web (a) (1) for purposes of the commercial activity tax, the law provides.

R&d Tax Credit Form Irs Form Resume Examples e4k4ErADqN

Offset your tax liability with r&d tax credits (a) (1) for purposes of the commercial activity tax, the law provides. 2 what residency statuses are available to an ohio. Web there is no special application and/or approval process for the ohio r&d credit. The ohio r&d tax credit equals 7% of ohio qualified r&d expenses over the average of qualified.

Ohio Tax Form printable pdf download

Web (d) a taxpayer may claim against the tax imposed under this chapter any unused portion of a credit authorized under section 5733.351 of the revised code but. Choose gusto for payroll and save thousands with the research and development tax credit. Web ohio research and development tax credit is equivalent to 7% of the excess of your investment in.

As Part Of The Process, They Need To Identify Qualifying Expenses And.

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Ad sign up for a no obligation r&d tax credit consultation today. Prior calendar year 1 (20____) expenses: R&d tax credit calculator partner with us our team login.

Form 6765, Credit For Increasing Research.

If your business is already filing form 6765 with your federal income tax return, you are. Web ohio research and development tax credit is equivalent to 7% of the excess of your investment in qres for the previous three tax years. Choose gusto for payroll and save thousands with the research and development tax credit. Web firms which are interested in qualifying for this incentive are supposed to invest in qualified research expenses, according to sec.41 of the irc.

Here Is What You Need To File:

The ohio r&d tax credit equals 7% of ohio qualified r&d expenses over the average of qualified expenses for the three prior taxable years. The industrial technology and enterprise. Web ethanol investment credit (r.c. Claim up to 250k annually.

Offset Your Tax Liability With R&D Tax Credits

Web qualified research expense tax credit calculation current calendar year (20____) expenses: Web something went wrong while submitting the form. Web (a) (1) for purposes of the commercial activity tax, the law provides for five different credits taxpayers may apply against their tax liability: The r&d investment tax credit is.