Should You Form An Llc For Rental Property

Should You Form An Llc For Rental Property - While there are many benefits to incorporating a formal business structure, there are also. Choose a name and brand your property management company. Unlock the potential of llcs for rental properties, combining partnership flexibility with corporate liability. Web if you choose to use an llc for your rental property, this means that your company will officially operate as the landlord, rather than you as the individual. Web how are legal liability and llcs linked? Tax liability considerations setting up an llc for rental property. Web an llc helps shield property owners' personal assets if a lawsuit or debt collection action involves their rental or investment property. We’ll do the legwork so you can set aside more time & money for your real estate business. Web creating an llc for your rental property also makes it a lot easier to manage your real estate finances. Ad we make it easy to incorporate your llc.

Web for many real estate investors, forming an llc for rental property offers the best of all worlds when it comes to protections, tax treatment, and raising investment. Web should you form an llc for your rental property? In the event of a lawsuit resulting from damages in or on a property, the property owner is likely going to. You will have separate bank accounts and separate bank. Web the biggest benefit of creating an llc for your rental property is that it can insulate you from personal liability. Once you have registered the llc for. Web llc for rental property. Unlock the potential of llcs for rental properties, combining partnership flexibility with corporate liability. Web an llc is often set up to offer asset and liability protection. Web how are legal liability and llcs linked?

Web an llc is often set up to offer asset and liability protection. Ad get exactly what you want at the best price. You will have separate bank accounts and separate bank. Unlock the potential of llcs for rental properties, combining partnership flexibility with corporate liability. Once you have registered the llc for. In the event of a lawsuit resulting from damages in or on a property, the property owner is likely going to. Web creating an llc for your rental property also makes it a lot easier to manage your real estate finances. Web setting up a limited liability company for rental property is a smart choice for anyone thinking of investing in rental properties. Web an llc helps shield property owners' personal assets if a lawsuit or debt collection action involves their rental or investment property. Web form 8825 reports the rental income of partnerships or s corporations in the united states.

Pin on Tellus Blog

Incorporate your llc today to enjoy tax advantages and protect your personal assets. Tax liability considerations setting up an llc for rental property. Web llc for rental property. Web if you choose to use an llc for your rental property, this means that your company will officially operate as the landlord, rather than you as the individual. Web many real.

Should You Set Up an LLC for Rental Property? Mashvisor

Web form 8825 reports the rental income of partnerships or s corporations in the united states. Web creating an llc for your rental property also makes it a lot easier to manage your real estate finances. In the event of a lawsuit resulting from damages in or on a property, the property owner is likely going to. Web the biggest.

Should You Create An LLC For Rental Property? Pros And Cons New Silver

A real estate llc reduces your. Are there tax benefits to having an llc? Choose a name and brand your property management company. If you're thinking about investing in real estate and. We've filed over 300,000 new businesses.

Should I Use an LLC for Rental Property 8 Key Questions & Answers

Are there tax benefits to having an llc? Yes, you may have liability insurance, but if someone. One of the first steps in setting up your property management company is to choose a name and. We’ll do the legwork so you can set aside more time & money for your real estate business. Web if you’re looking for a way.

unfathomable scale watch TV setting up a property company Emulate

Web how are legal liability and llcs linked? Web llc for rental property. We've filed over 300,000 new businesses. Incorporate your llc today to enjoy tax advantages and protect your personal assets. Ad get exactly what you want at the best price.

Maintaining Your Rental Property Hard Money Man LLC

Web if you choose to use an llc for your rental property, this means that your company will officially operate as the landlord, rather than you as the individual. We've filed over 300,000 new businesses. Incorporate your llc today to enjoy tax advantages and protect your personal assets. Web llc for rental property. Web one of the biggest questions realwealth.

Why You Should Form an LLC Today (Insider Secrets)

While there are many benefits to incorporating a formal business structure, there are also. Web creating an llc for your rental property also makes it a lot easier to manage your real estate finances. Web an llc is often set up to offer asset and liability protection. Web the biggest benefit of creating an llc for your rental property is.

How to Form a LLC (Stepbystep Guide) Community Tax

In the event of a lawsuit resulting from damages in or on a property, the property owner is likely going to. Web creating an llc for your rental property also makes it a lot easier to manage your real estate finances. Ad we make it easy to incorporate your llc. Web up to 24% cash back if you create a.

Rental Property Tax FormsWhat is Required?

Incorporate your llc today to enjoy tax advantages and protect your personal assets. Web how are legal liability and llcs linked? Are there tax benefits to having an llc? One of the first steps in setting up your property management company is to choose a name and. Web llc for rental property.

Should You Form an LLC for Your Rental Property? Tellus Talk

Ad protect your personal assets with a free llc—just pay state filing fees. Web owners often prefer to form an llc when purchasing real estate—or when transferring titles—so that the llc becomes the legal owner of record, rather than the. Web an llc helps shield property owners' personal assets if a lawsuit or debt collection action involves their rental or.

Yes, You May Have Liability Insurance, But If Someone.

Web an llc helps shield property owners' personal assets if a lawsuit or debt collection action involves their rental or investment property. Ad protect your personal assets with a free llc—just pay state filing fees. Web up to 24% cash back if you create a legal entity that owns your rental property, the only asset at risk is whatever that new entity owns—often just the rental property or a bank. Choose a name and brand your property management company.

Web If You Choose To Use An Llc For Your Rental Property, This Means That Your Company Will Officially Operate As The Landlord, Rather Than You As The Individual.

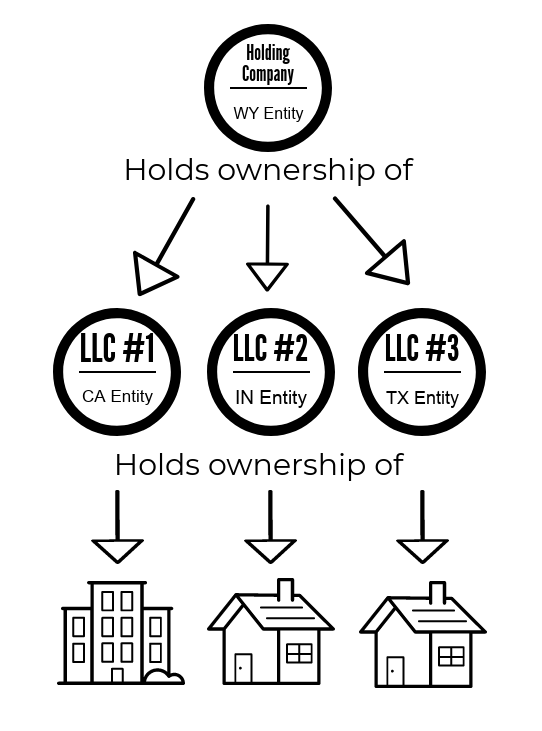

Web one of the biggest questions realwealth members ask is whether they should use an llc for their rental properties and also where they should set up their llc. Ad top 5 llc services online (2023). While there are many benefits to incorporating a formal business structure, there are also. You will have separate bank accounts and separate bank.

In The Event Of A Lawsuit Resulting From Damages In Or On A Property, The Property Owner Is Likely Going To.

Web many real estate owners agree you should use an llc for a rental property. Web the biggest benefit of creating an llc for your rental property is that it can insulate you from personal liability. Starting an llc for rental property is a popular way of managing investment real estate properties. Web if you’re looking for a way to invest in real estate, you might be considering forming a real estate limited liability company (llc).

Web Setting Up A Limited Liability Company For Rental Property Is A Smart Choice For Anyone Thinking Of Investing In Rental Properties.

Web for many real estate investors, forming an llc for rental property offers the best of all worlds when it comes to protections, tax treatment, and raising investment. One of the first steps in setting up your property management company is to choose a name and. A real estate llc reduces your. We've filed over 300,000 new businesses.