Ok Form 512 Instructions 2021

Ok Form 512 Instructions 2021 - Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web show sources > form 512e is an oklahoma corporate income tax form. Web sales & use tax. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Supplemental schedule for form 512. 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code (irc) engaged in business or deriving. Download past year versions of this tax form as pdfs.

Web sales & use tax. Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form. Download past year versions of this tax form as pdfs. Making an oklahoma installment payment pursuant to irc section 965(h): Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web show sources > form 512e is an oklahoma corporate income tax form. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Supplemental schedule for form 512.

Making an oklahoma installment payment pursuant to irc section 965(h): Supplemental schedule for form 512. Download past year versions of this tax form as pdfs. Web sales & use tax. Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form. 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code (irc) engaged in business or deriving. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains:

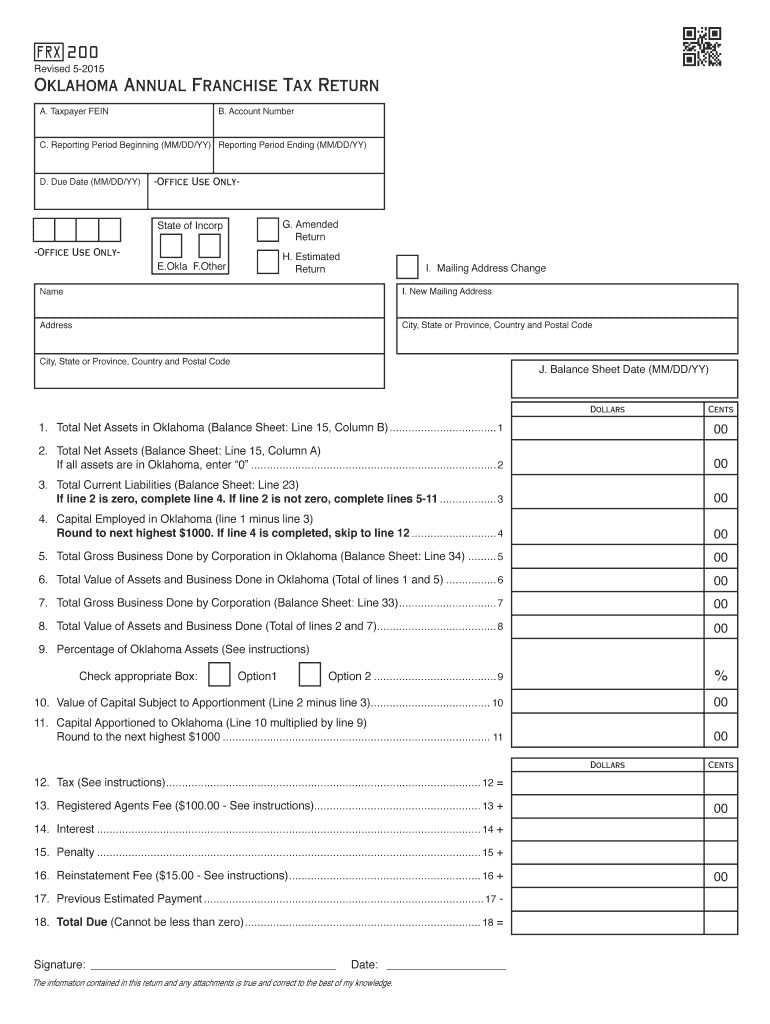

Oklahoma Form Franchise Tax Fill Out and Sign Printable PDF Template

Web sales & use tax. Supplemental schedule for form 512. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions.

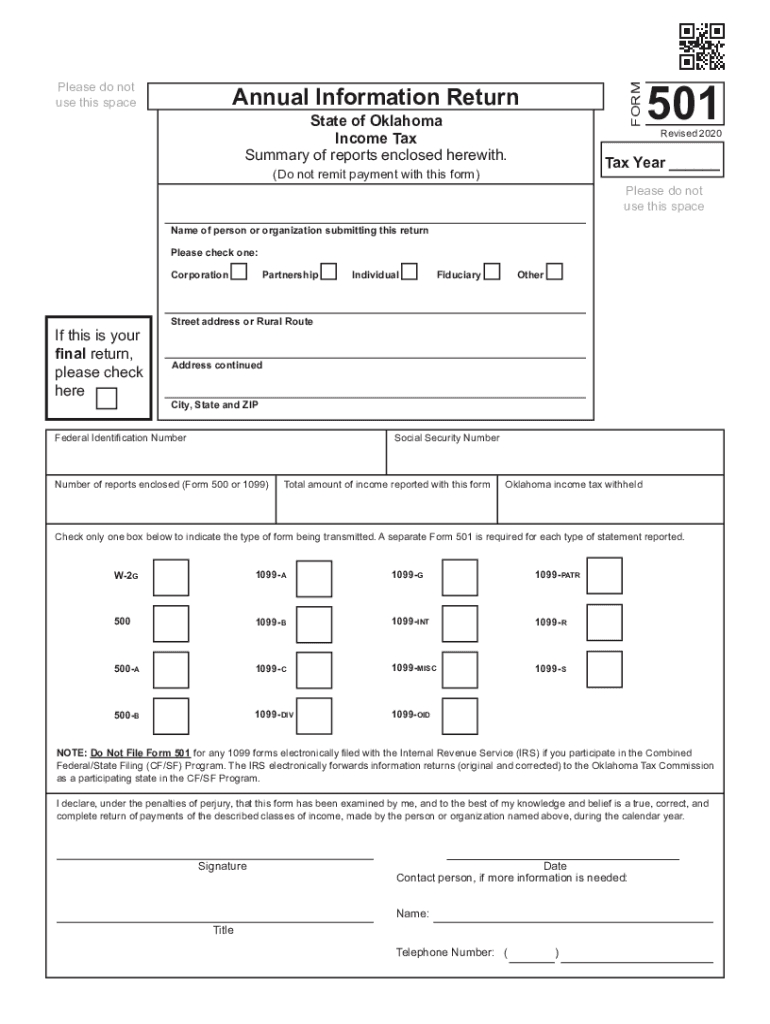

OK Form 729 20152021 Fill and Sign Printable Template Online US

Web sales & use tax. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Supplemental schedule for form 512. 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code (irc) engaged in business or deriving. Making an oklahoma installment payment pursuant to irc section 965(h):

request_formform512 MassHire Downtown Boston Career Center

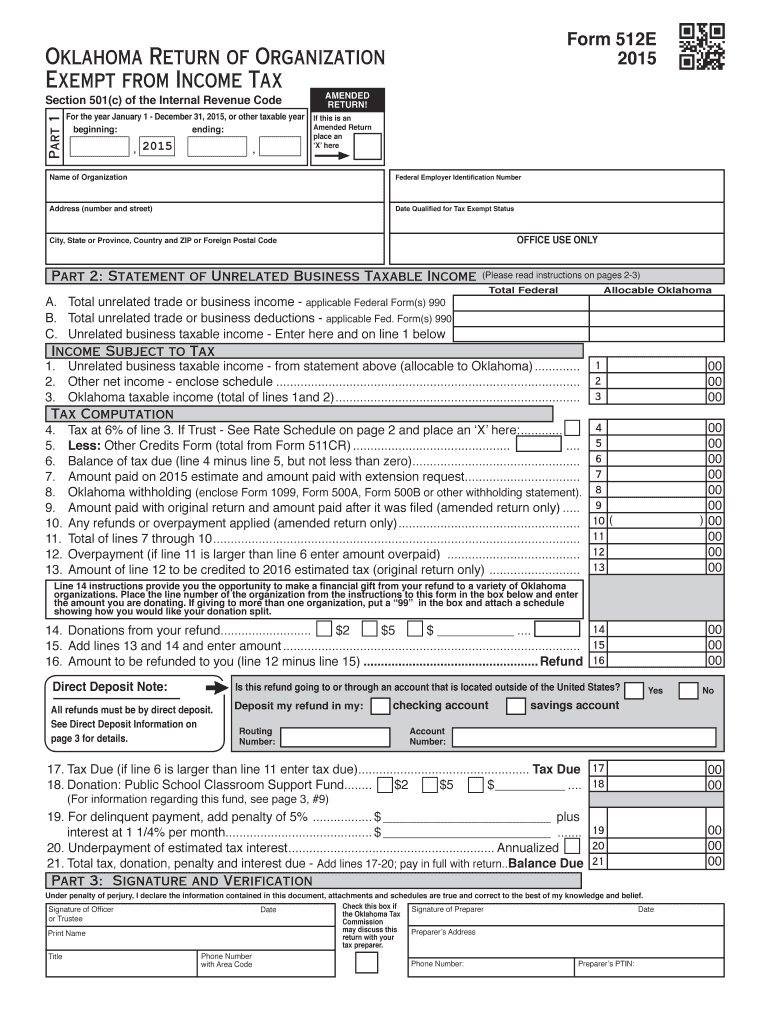

Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Download past year versions of this tax form as pdfs. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web show sources > form 512e.

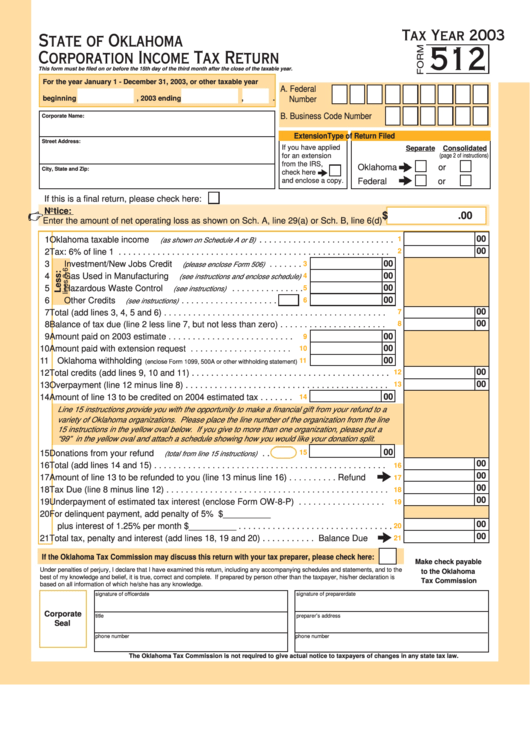

Fillable Form 512 Oklahoma Corporation Tax Return 2003

Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web show sources > form 512e is an oklahoma corporate income tax form. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code.

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Supplemental schedule for form 512. 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code (irc) engaged in business.

Oklahoma W9 2021 Form Calendar Template Printable

Web sales & use tax. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code (irc) engaged in business or deriving. Supplemental schedule for form 512. Web the 2020 512 packet instructions (oklahoma) form is.

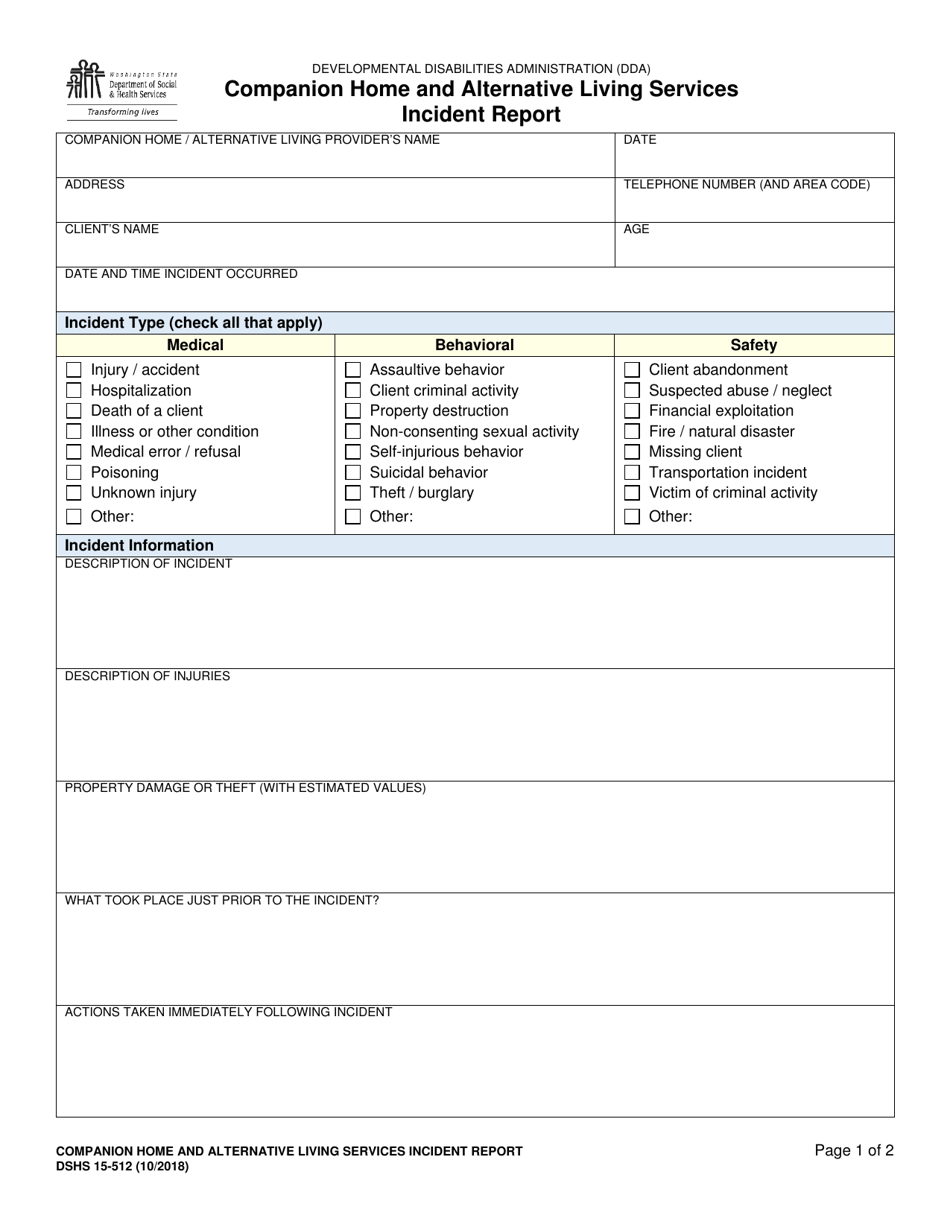

DSHS Form 15512 Download Printable PDF or Fill Online Companion Home

Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web show sources > form 512e is an oklahoma corporate income tax form. Web sales & use tax. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web 2020 oklahoma small business corporation income and franchise tax forms and.

Ok, form, yes, good, check, mark icon Download on Iconfinder

Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Download past year versions of this tax form as pdfs. 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code (irc) engaged in business or deriving. Web the 2020 512 packet instructions (oklahoma) form is.

Oklahoma 512E Instructions Fill Out and Sign Printable PDF Template

Web show sources > form 512e is an oklahoma corporate income tax form. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Supplemental schedule for form 512. Web 2020 oklahoma small business corporation income and franchise tax forms and.

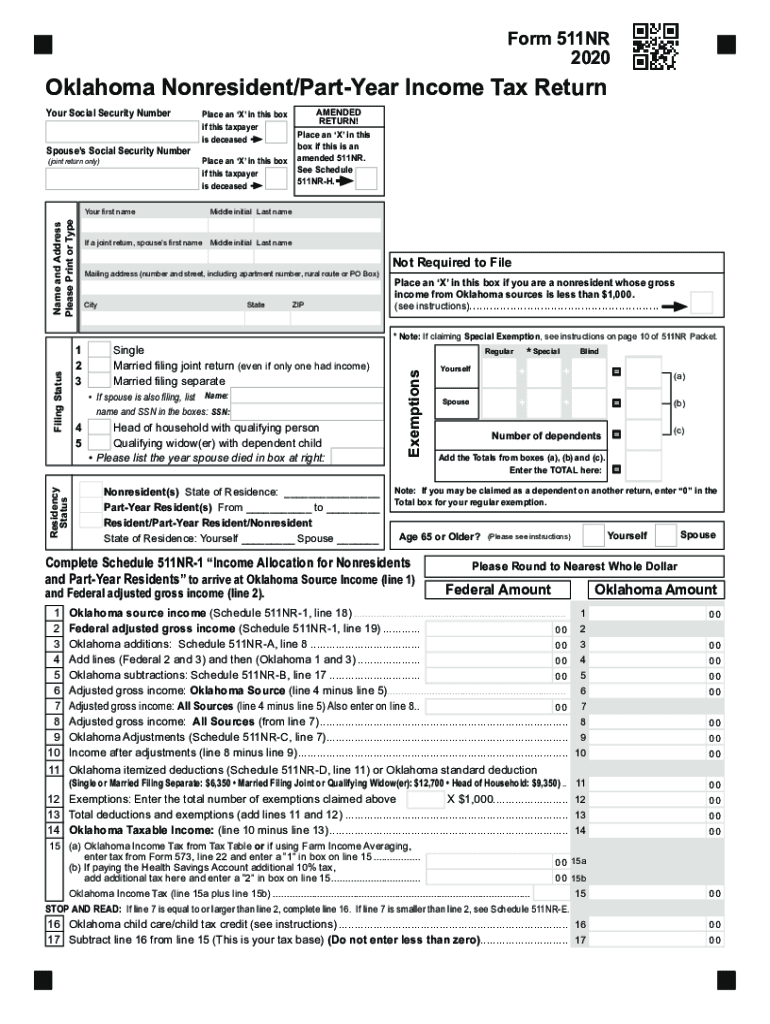

Ok state tax form 2018 Fill out & sign online DocHub

Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web show sources > form 512e is an oklahoma corporate income tax form. 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code (irc) engaged in business or deriving. Web sales & use tax. Web.

Web The 2020 512 Packet Instructions (Oklahoma) Form Is 48 Pages Long And Contains:

Supplemental schedule for form 512. Web show sources > form 512e is an oklahoma corporate income tax form. Making an oklahoma installment payment pursuant to irc section 965(h): Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains:

Web 2020 Oklahoma Small Business Corporation Income And Franchise Tax Forms And Instructions This Packet Contains:

Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Download past year versions of this tax form as pdfs. Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form. Web sales & use tax.