Payback Period Excel Template

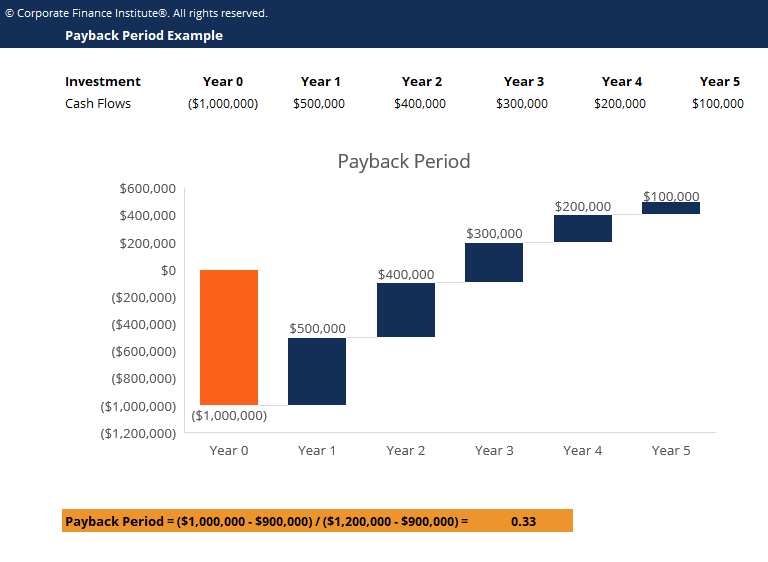

Payback Period Excel Template - Web so by adding index(f19:m19,,countif(f17:m17,”<0″)+1) and countif(f17:m17,”<0″), you get a formula for payback period that will change dynamically based on the values. We will use the following data set to demonstrate how you can calculate the. Web you can now download the excel template for free. Discounted payback period is among the topics included in the corporate finance module of the cfa level 1 curriculum. The decision rule using the payback period is to minimize the. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. As such, the payback period for this project is 2.33 years. Web the template allows the user to calculate the net present value (npv), internal rate of return (irr), and payback period from a simple cash flow stream with a. Enter financial data in your excel worksheet. Web download practice workbook what is discounted payback period?

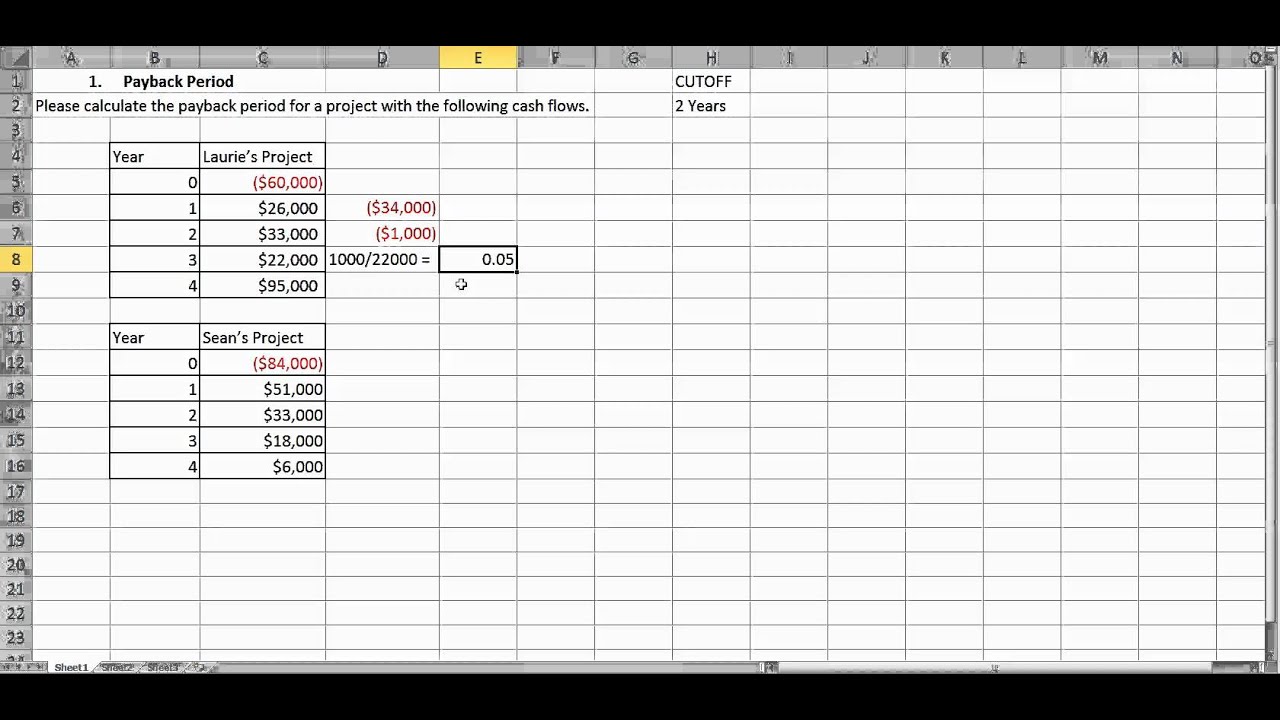

Web 2 easy ways of calculating payback period in excel with uneven cash flows. Web types of payback period. Web = 4 + 0.57 = 4.57 the above screenshot gives you the formulae that i have used to determine the payback period in excel. Discounted payback period is among the topics included in the corporate finance module of the cfa level 1 curriculum. Web i require column h to start payments from a loan calculator built into spreadsheet, after column g is completed payments from a separate loan calculator based on the payback. Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular. We will use the following data set to demonstrate how you can calculate the. Web so by adding index(f19:m19,,countif(f17:m17,”<0″)+1) and countif(f17:m17,”<0″), you get a formula for payback period that will change dynamically based on the values. Enter financial data in your excel worksheet. Web $400k ÷ $200k = 2 years

Web 2 easy ways of calculating payback period in excel with uneven cash flows. Web i require column h to start payments from a loan calculator built into spreadsheet, after column g is completed payments from a separate loan calculator based on the payback. Web pp = initial investment / cash flow for example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000 = 5 if you invested. Web types of payback period. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Web applying the formula provides the following: Web = 4 + 0.57 = 4.57 the above screenshot gives you the formulae that i have used to determine the payback period in excel. Web $400k ÷ $200k = 2 years The decision rule using the payback period is to minimize the. As such, the payback period for this project is 2.33 years.

How to Calculate the Payback Period With Excel

Web i require column h to start payments from a loan calculator built into spreadsheet, after column g is completed payments from a separate loan calculator based on the payback. Web $400k ÷ $200k = 2 years Web the template allows the user to calculate the net present value (npv), internal rate of return (irr), and payback period from a.

Payback Time Formula Excel BHe

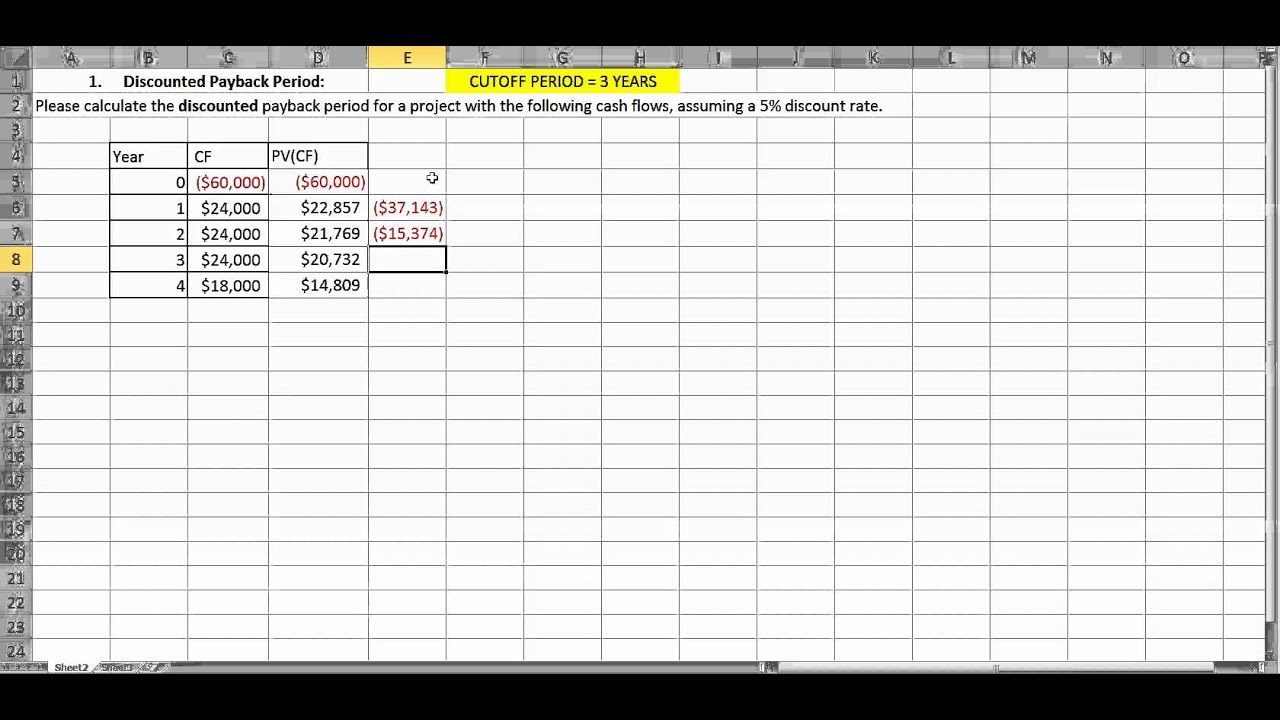

Discounted payback period is among the topics included in the corporate finance module of the cfa level 1 curriculum. Web in particular, the added step of discounting a project’s cash flows is critical for projects with prolonged payback periods (i.e., 10+ years). The decision rule using the payback period is to minimize the. Web pp = initial investment / cash.

Payback Period Excel Template CFI Marketplace

Web i require column h to start payments from a loan calculator built into spreadsheet, after column g is completed payments from a separate loan calculator based on the payback. Web types of payback period. Web $400k ÷ $200k = 2 years The decision rule using the payback period is to minimize the. If your data contains both cash inflows.

Payback Period Template Download Free Excel Template

The integer this one is a simple. As such, the payback period for this project is 2.33 years. Web i require column h to start payments from a loan calculator built into spreadsheet, after column g is completed payments from a separate loan calculator based on the payback. Discounted payback period is among the topics included in the corporate finance.

How to Calculate Payback Period in Excel.

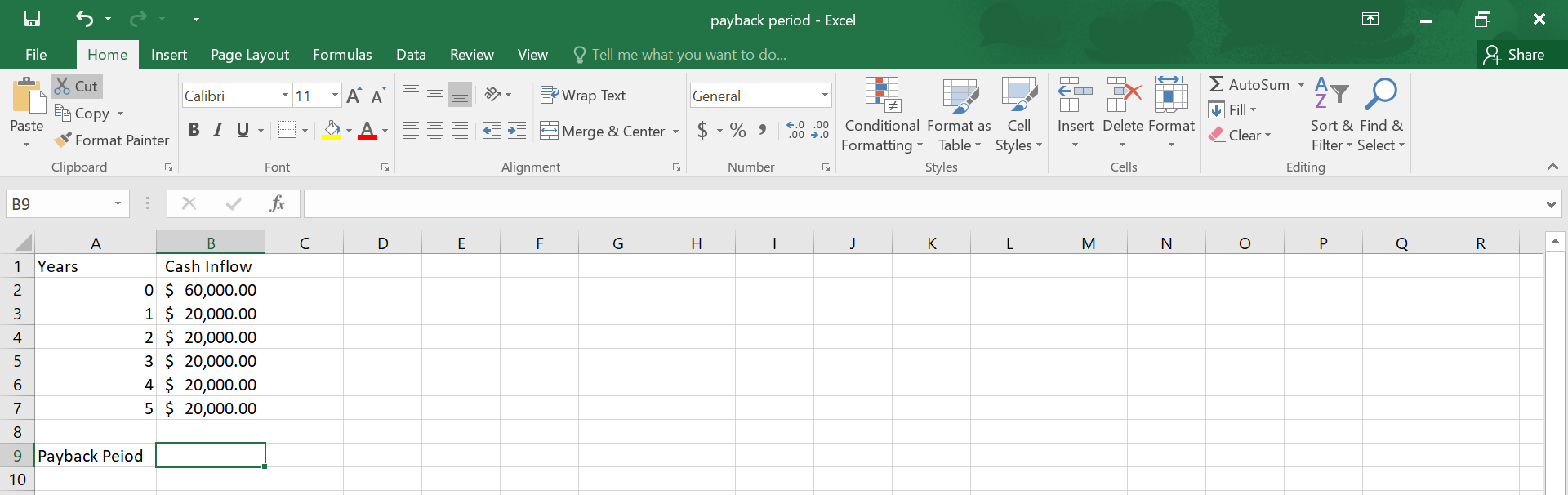

We will use the following data set to demonstrate how you can calculate the. Web pp = initial investment / cash flow for example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000 = 5 if you invested. Web this excel file will allow to calculate the net present.

Payback Period.mp4 YouTube

If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Web the template allows the user to calculate the net present value (npv), internal rate of return (irr), and payback period from a simple cash flow stream with a. Web download practice workbook what is discounted payback period? We will use the following data set.

Payback Period Excel Template PDF Template

Web i require column h to start payments from a loan calculator built into spreadsheet, after column g is completed payments from a separate loan calculator based on the payback. We will use the following data set to demonstrate how you can calculate the. Web this free template can calculate payback period calculator in excel, which will be used for.

Payback Period Excel Template CFI Marketplace

The integer this one is a simple. As such, the payback period for this project is 2.33 years. Web download practice workbook what is discounted payback period? Web in particular, the added step of discounting a project’s cash flows is critical for projects with prolonged payback periods (i.e., 10+ years). Web applying the formula provides the following:

Payback Period Excel template • 365 Financial Analyst

Enter financial data in your excel worksheet. We will use the following data set to demonstrate how you can calculate the. Web types of payback period. Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular. Web pp = initial investment / cash flow.

Payback Period Calculator Double Entry Bookkeeping

Web this excel file will allow to calculate the net present value, internal rate of return and payback period from a simple cash flow stream and see the results in. Web types of payback period. Web you can now download the excel template for free. Web $400k ÷ $200k = 2 years Web download practice workbook what is discounted payback.

Web So By Adding Index(F19:M19,,Countif(F17:M17,”<0″)+1) And Countif(F17:M17,”<0″), You Get A Formula For Payback Period That Will Change Dynamically Based On The Values.

Web $400k ÷ $200k = 2 years If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Web you can now download the excel template for free. Web 2 easy ways of calculating payback period in excel with uneven cash flows.

Web = 4 + 0.57 = 4.57 The Above Screenshot Gives You The Formulae That I Have Used To Determine The Payback Period In Excel.

Web the template allows the user to calculate the net present value (npv), internal rate of return (irr), and payback period from a simple cash flow stream with a. The integer this one is a simple. Web this excel file will allow to calculate the net present value, internal rate of return and payback period from a simple cash flow stream and see the results in. Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular.

Web Types Of Payback Period.

Web pp = initial investment / cash flow for example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000 = 5 if you invested. Enter financial data in your excel worksheet. Web i require column h to start payments from a loan calculator built into spreadsheet, after column g is completed payments from a separate loan calculator based on the payback. Web in particular, the added step of discounting a project’s cash flows is critical for projects with prolonged payback periods (i.e., 10+ years).

The Decision Rule Using The Payback Period Is To Minimize The.

We will use the following data set to demonstrate how you can calculate the. As such, the payback period for this project is 2.33 years. Web applying the formula provides the following: Web download practice workbook what is discounted payback period?