Philadelphia Local Tax Form

Philadelphia Local Tax Form - To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. Mechanical amusement device tax forms through 2021; Tax types that are listed under multiple categories below are the same taxes. Web local withholding tax faqs. Liquor tax reconciliation forms through 2021; If you need to update your address, close a tax account, or request payment coupons, you can use the department. > tax forms and information tax forms and information tax credits and incentives forms and publications tax rates due dates [pdf] tax types tax law Web some taxes are listed as both income taxes and business taxes. How do i find local earned income tax (eit) rates and psd codes? The forms for those taxes are the same in each category.

Our old efile/epay website is no longer available. Tax types that are listed under multiple categories below are the same taxes. Liquor tax reconciliation forms through 2021; Web some taxes are listed as both income taxes and business taxes. Philadelphia beverage tax (pbt) liquor tax; Use and occupancy (u&o) tax; How do i find local earned income tax (eit) rates and psd codes? Web you can choose to file any city tax on the philadelphia tax center, but a few taxes must be filed online. Local income tax information local withholding tax faqs. Please note that the following list does not cover all city taxes, since some taxes must be paid through the philadelphia tax center.

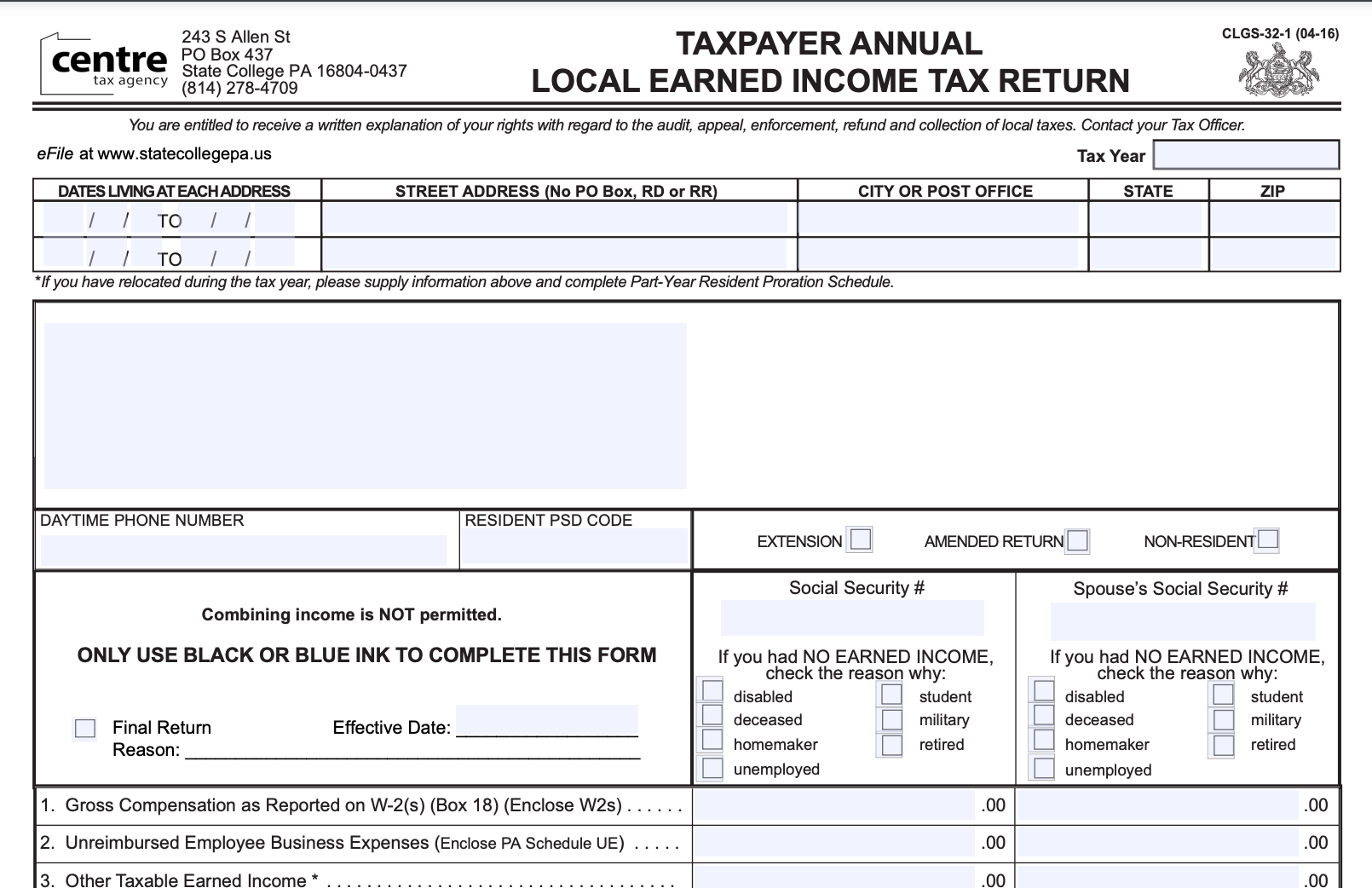

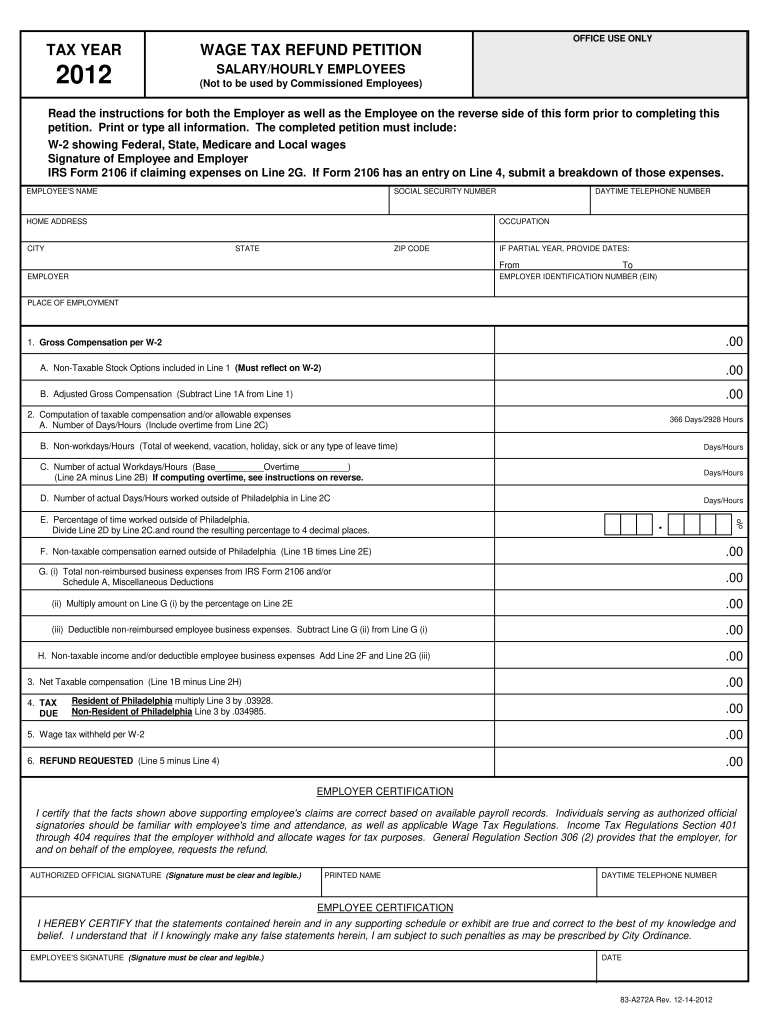

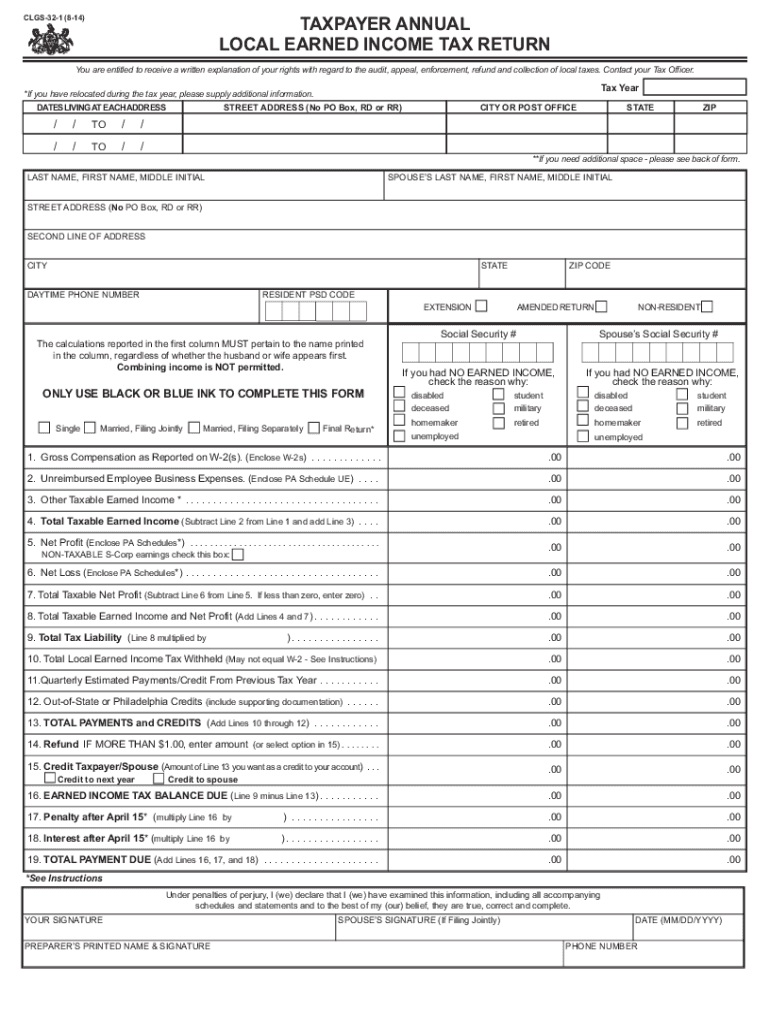

Web wage tax (employers) due date. Dates living at each address street address (no po box, rd or rr) city or post office state zip / / to. Web local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest and/or penalties for local tax filings and payments that are made on or before may 17, 2021, which is the extension for filing federal and state taxes. Business income & receipts tax (birt) forms; Web make a payment where's my income tax refund? How do i find local earned income tax (eit) rates and psd codes? See below to determine your filing frequency. Web 2022 tax forms. Property tax/rent rebate status pennsylvania department of revenue > i'm looking for: > tax forms and information tax forms and information tax credits and incentives forms and publications tax rates due dates [pdf] tax types tax law

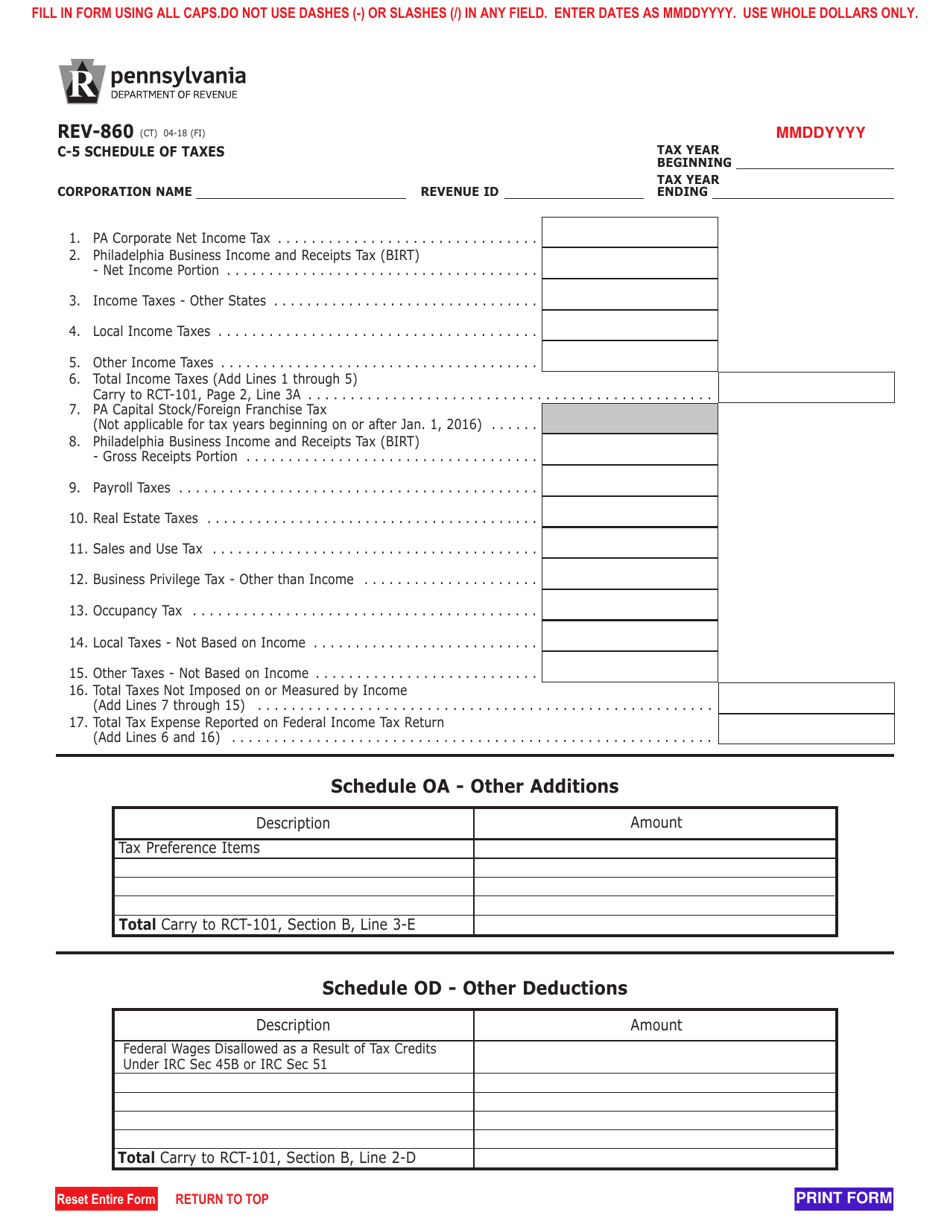

Form REV860 Download Fillable PDF or Fill Online C5 Schedule of Taxes

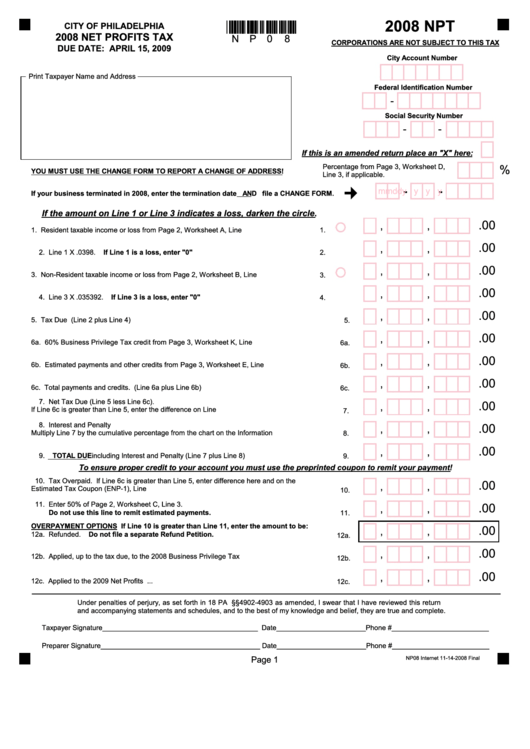

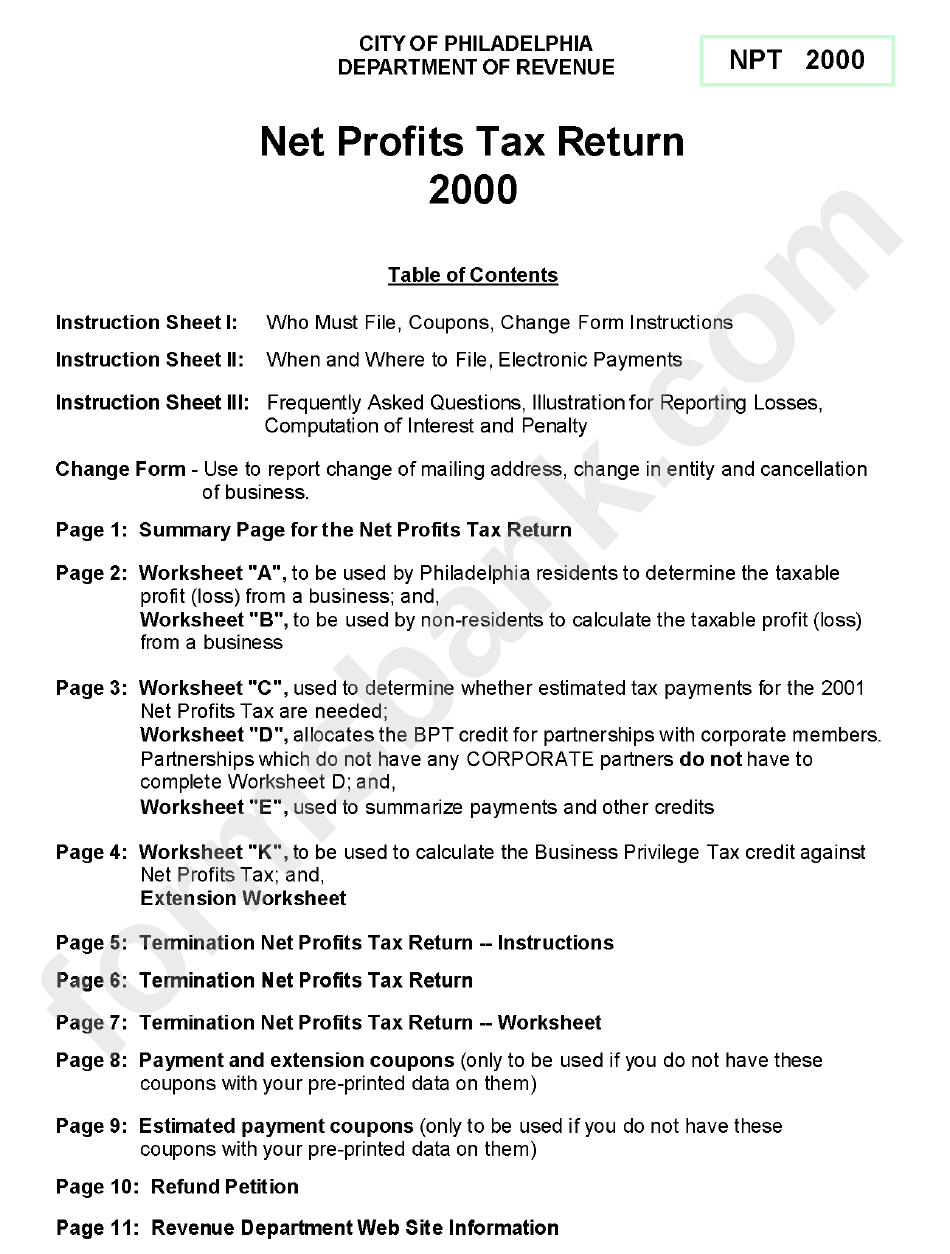

Business income & receipts tax (birt) forms; Net profits tax (npt) forms; Mechanical amusement device tax forms through 2021; How do i find local earned income tax (eit) rates and psd codes? If you need to update your address, close a tax account, or request payment coupons, you can use the department.

Local Tax Form Editable Forms

The forms for those taxes are the same in each category. How do i find local earned income tax (eit) rates and psd codes? Liquor tax reconciliation forms through 2021; Philadelphia beverage tax (pbt) liquor tax; See below to determine your filing frequency.

Late Filing Penalties on Local Tax Returns in Centre County Waived

> tax forms and information tax forms and information tax credits and incentives forms and publications tax rates due dates [pdf] tax types tax law Web some taxes are listed as both income taxes and business taxes. Tax types that are listed under multiple categories below are the same taxes. Liquor tax reconciliation forms through 2021; Web local governments may.

Form Npt Net Profits Tax City Of Philadelphia 2008 printable pdf

See below to determine your filing frequency. Please note that the following list does not cover all city taxes, since some taxes must be paid through the philadelphia tax center. Web wage tax (employers) due date. In fall 2021, philadelphia taxpayers started using a new website to file and pay city taxes electronically: How do i find local earned income.

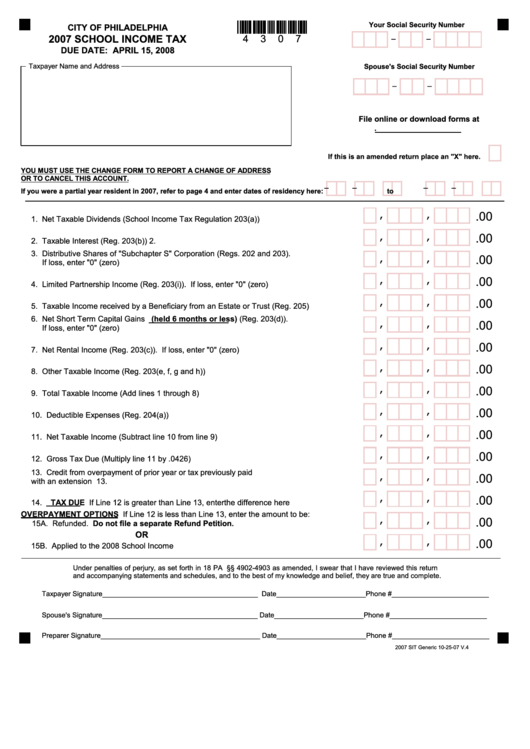

School Tax Form City Of Philadelphia 2007 printable pdf download

Liquor tax reconciliation forms through 2021; Dced local government services act 32: Property tax/rent rebate status pennsylvania department of revenue > i'm looking for: Web wage tax (employers) due date. How do i find local earned income tax (eit) rates and psd codes?

Net Profits Tax Return Worksheets (Form Npt) City Of Philadelphia

Web local withholding tax faqs. Web you can choose to file any city tax on the philadelphia tax center, but a few taxes must be filed online. The wage tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees’ paychecks. Net profits tax (npt) forms; Use and occupancy (u&o) tax;

Tax Refund Philadelphia Fill Online, Printable, Fillable, Blank

If you need to update your address, close a tax account, or request payment coupons, you can use the department. In fall 2021, philadelphia taxpayers started using a new website to file and pay city taxes electronically: Web local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest and/or penalties.

Prepare the Annual Reconciliation of Employer Wage

Dced local government services act 32: Our old efile/epay website is no longer available. Web you can choose to file any city tax on the philadelphia tax center, but a few taxes must be filed online. Net profits tax (npt) forms; The wage tax must be filed quarterly and paid on a schedule that corresponds with how much money is.

Taxpayer Annual Local Earned Tax Return PA Department Of

How do i find local earned income tax (eit) rates and psd codes? Please note that the following list does not cover all city taxes, since some taxes must be paid through the philadelphia tax center. > tax forms and information tax forms and information tax credits and incentives forms and publications tax rates due dates [pdf] tax types tax.

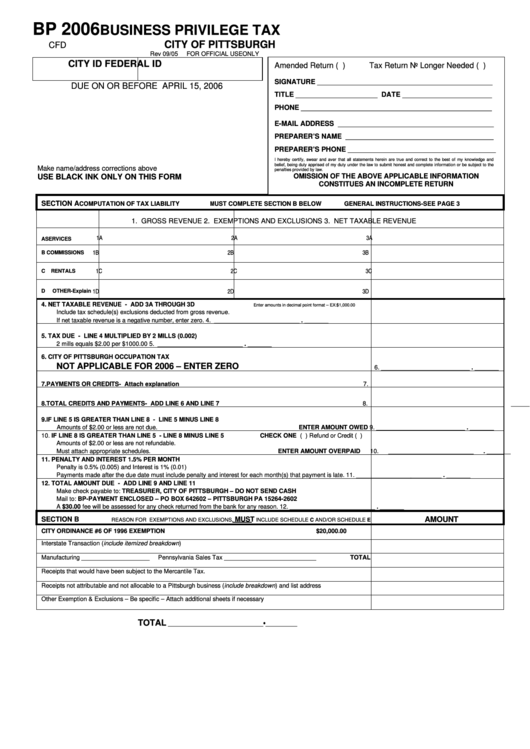

Form Bp Business Privilege Tax City Of Pittsburgh 2006 printable

Web local withholding tax faqs. Web you can choose to file any city tax on the philadelphia tax center, but a few taxes must be filed online. The wage tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees’ paychecks. Mechanical amusement device tax forms through 2021; Please note that.

Philadelphia Beverage Tax (Pbt) Liquor Tax;

Web make a payment where's my income tax refund? Web 2022 tax forms. Business income & receipts tax (birt) forms; Tax types that are listed under multiple categories below are the same taxes.

See Below To Determine Your Filing Frequency.

In fall 2021, philadelphia taxpayers started using a new website to file and pay city taxes electronically: The wage tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees’ paychecks. The forms for those taxes are the same in each category. Net profits tax (npt) forms;

Our Old Efile/Epay Website Is No Longer Available.

Dced local government services act 32: Please note that the following list does not cover all city taxes, since some taxes must be paid through the philadelphia tax center. How do i find local earned income tax (eit) rates and psd codes? Dates living at each address street address (no po box, rd or rr) city or post office state zip / / to.

Local Income Tax Information Local Withholding Tax Faqs.

Mechanical amusement device tax forms through 2021; From now on, use the philadelphia tax center to file and pay all taxes. To connect with the governor’s center for local government services (gclgs) by phone, call 888.223.6837. You can also use the tax center to pay city fees and apply for all real estate tax assistance programs, including the homestead exemption.