Portfolio Optimization Excel Template

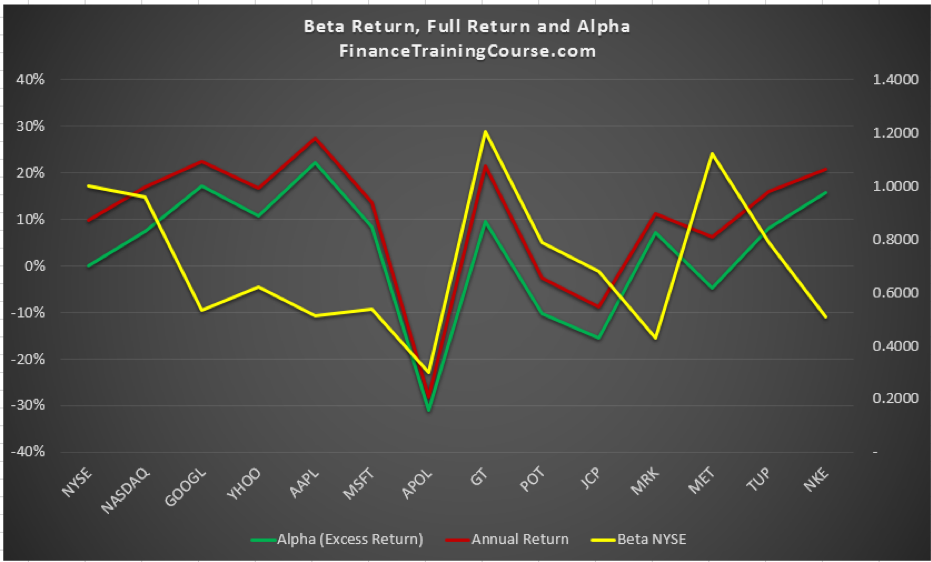

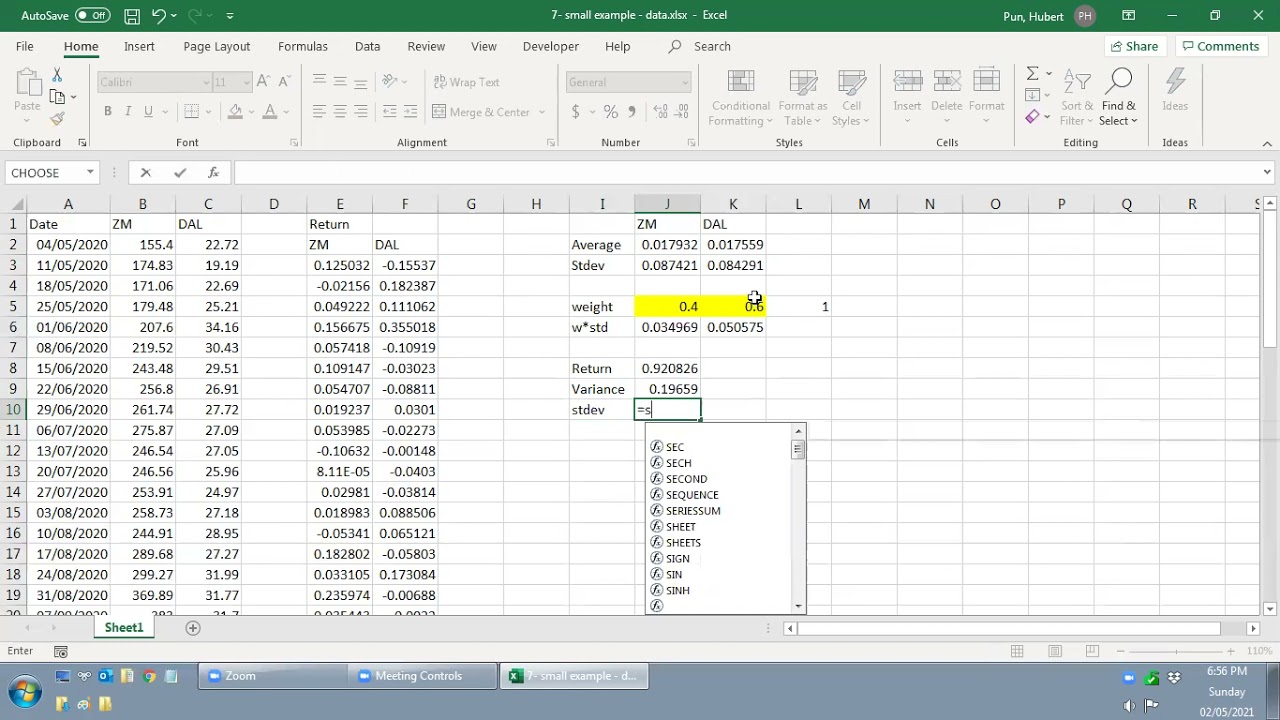

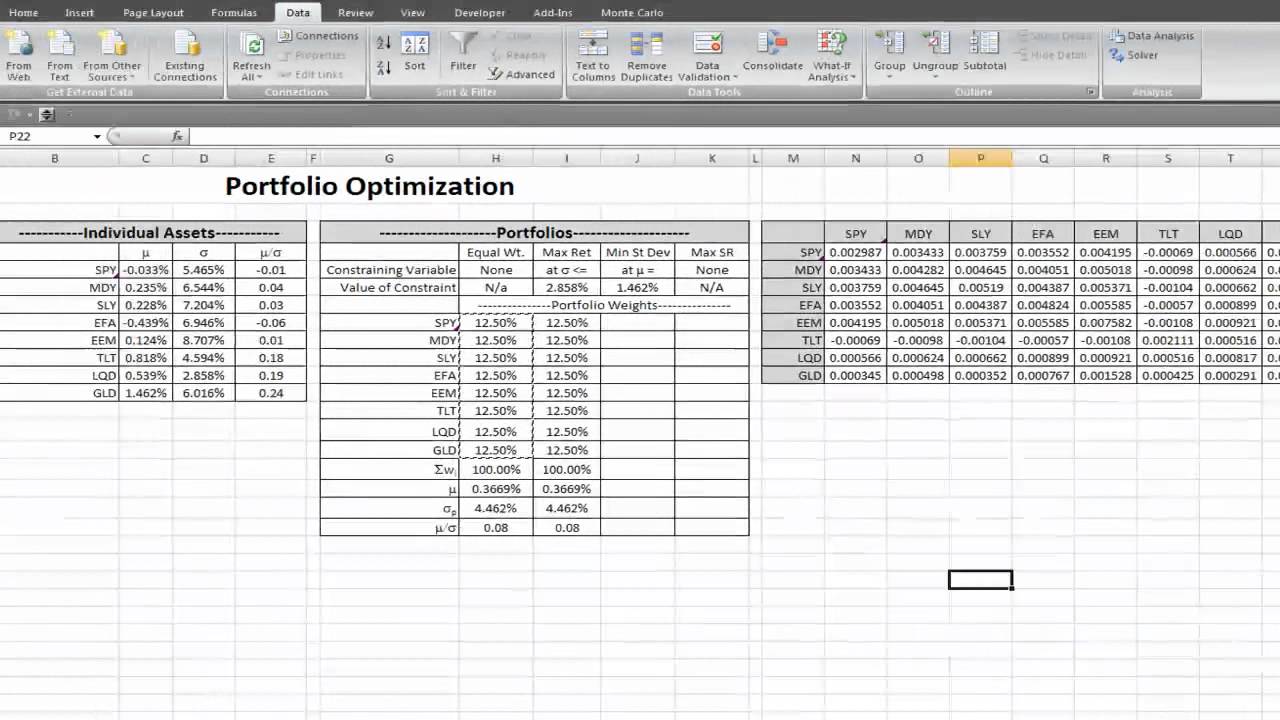

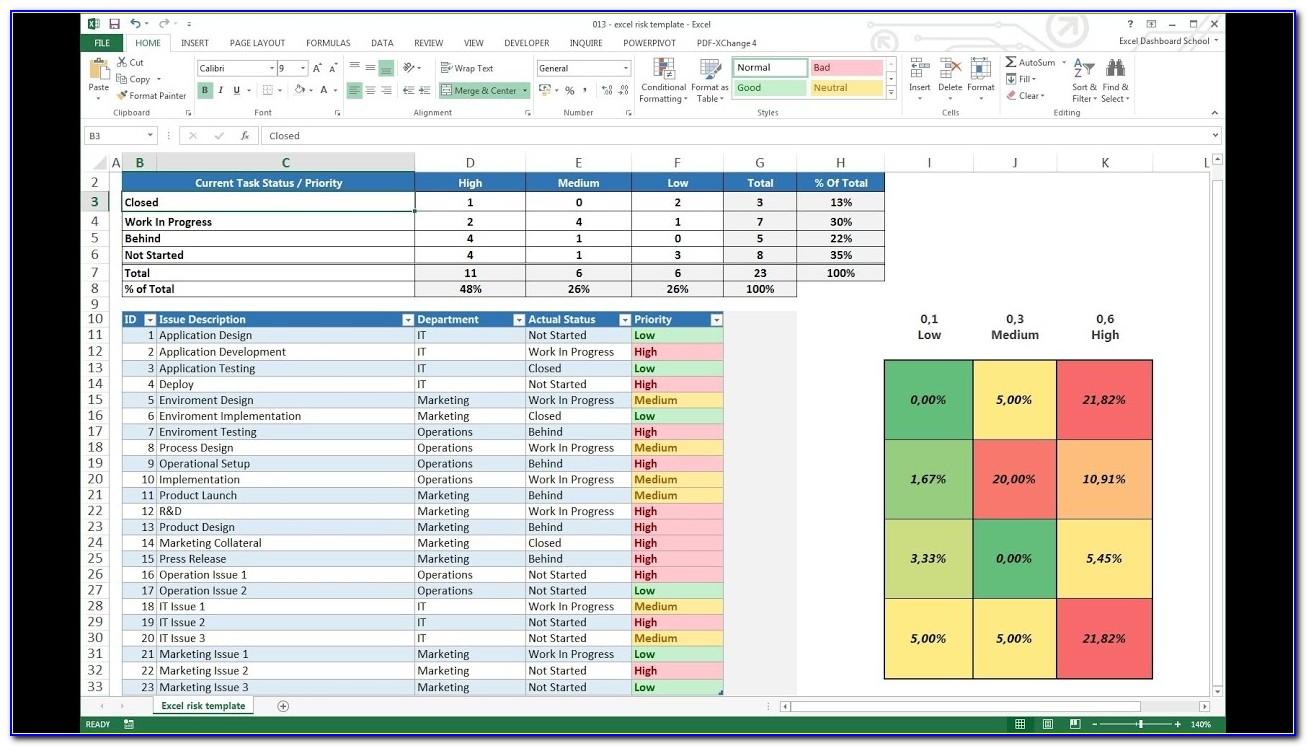

Portfolio Optimization Excel Template - The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice. Web these excel solutions focus on asset allocation for portfolios of financial investments and can be applied to optimize trading and investment strategies in financial markets. The first example covers the classic textbook example of the two security case. Web the global minimum variance portfolio solves the optimization problem 2 min s.t. Web the video tutorial below demonstrates two methods of portfolio optimization in excel. With these two worksheets as a basis, we will use the microsoft excel solver to model the complex portfolio. Web the efficient frontier a portfolio frontier is a graph that maps out all possible portfolios with different asset weight combinations, with levels of portfolio standard. Web the excel portfolio optimization model calculates the optimal capital weightings for portfolios of financial or business investments that maximizes return for the. Web video starts off with a classic finance textbook two security portfolio, and demonstrates how to select an optimal blend of the investments. Web in this demonstration, we are going to use 5 years of monthly stock price data for 5 companies such as mcd, sbux, pfe, amgn, and axp.

Web video starts off with a classic finance textbook two security portfolio, and demonstrates how to select an optimal blend of the investments. The first example covers the classic textbook example of the two security case. Web portfolio optimization is an application that evaluates the optimal capital weightings for a basket of financial investments which offers the best return for the least. 1σpm, = ′′σ= m mm m1 this optimization problem can be solved easily using the solver with. Web the excel portfolio optimization model calculates the optimal capital weightings for portfolios of financial or business investments that maximizes return for the. Web with these two worksheets as a basis, we will use the microsoft excel solver to model the complex portfolio optimization of more than 2 assets. Web in this demonstration, we are going to use 5 years of monthly stock price data for 5 companies such as mcd, sbux, pfe, amgn, and axp. Web the efficient frontier a portfolio frontier is a graph that maps out all possible portfolios with different asset weight combinations, with levels of portfolio standard. The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice. Finally we will integrate our.

Web in this demonstration, we are going to use 5 years of monthly stock price data for 5 companies such as mcd, sbux, pfe, amgn, and axp. Web 2.74k subscribers subscribe 93k views 5 years ago excel training for finance students this video demonstrates how to make a simple portfolio optimizer in. With these two worksheets as a basis, we will use the microsoft excel solver to model the complex portfolio. Web the global minimum variance portfolio solves the optimization problem 2 min s.t. Web with these two worksheets as a basis, we will use the microsoft excel solver to model the complex portfolio optimization of more than 2 assets. The first example covers the classic textbook example of the two security case. Finally we will integrate our. If you understand the process,. Web up to 10% cash back portfolio optimization: Web the efficient frontier a portfolio frontier is a graph that maps out all possible portfolios with different asset weight combinations, with levels of portfolio standard.

Portfolio Optimization Models in EXCEL Online Course

Web the video tutorial below demonstrates two methods of portfolio optimization in excel. Web 2.74k subscribers subscribe 93k views 5 years ago excel training for finance students this video demonstrates how to make a simple portfolio optimizer in. The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice..

Portfolio Optimization 5.0 free download for Mac MacUpdate

The first example covers the classic textbook example of the two security case. Web the video tutorial below demonstrates two methods of portfolio optimization in excel. Web the excel portfolio optimization model calculates the optimal capital weightings for portfolios of financial or business investments that maximizes return for the. Web in this demonstration, we are going to use 5 years.

Basic Excel portfolio optimization YouTube

1σpm, = ′′σ= m mm m1 this optimization problem can be solved easily using the solver with. The first example covers the classic textbook example of the two security case. With these two worksheets as a basis, we will use the microsoft excel solver to model the complex portfolio. Web portfolio optimization is an application that evaluates the optimal capital.

Portfolio Optimization in Excel.mp4 YouTube

Web in this demonstration, we are going to use 5 years of monthly stock price data for 5 companies such as mcd, sbux, pfe, amgn, and axp. If you understand the process,. With these two worksheets as a basis, we will use the microsoft excel solver to model the complex portfolio. Web the global minimum variance portfolio solves the optimization.

Portfolio Optimization Excel Template Flyer Template

Web portfolio optimization is an application that evaluates the optimal capital weightings for a basket of financial investments which offers the best return for the least. Web up to 10% cash back portfolio optimization: Web 2.74k subscribers subscribe 93k views 5 years ago excel training for finance students this video demonstrates how to make a simple portfolio optimizer in. 1σpm,.

Markowitz Portfolio Selection with Excel Solver YouTube

Web the global minimum variance portfolio solves the optimization problem 2 min s.t. Web portfolio optimization is an application that evaluates the optimal capital weightings for a basket of financial investments which offers the best return for the least. Web worksheet that models portfolio optimization of 2 assets. Web with these two worksheets as a basis, we will use the.

Project Portfolio Management Excel Template

Web the video tutorial below demonstrates two methods of portfolio optimization in excel. 1σpm, = ′′σ= m mm m1 this optimization problem can be solved easily using the solver with. Finally we will integrate our. Web these excel solutions focus on asset allocation for portfolios of financial investments and can be applied to optimize trading and investment strategies in financial.

Portfolio Excel Template For Your Needs

The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice. With these two worksheets as a basis, we will use the microsoft excel solver to model the complex portfolio. Web portfolio optimization is an application that evaluates the optimal capital weightings for a basket of financial investments which.

MeanVariance Portfolio Optimization with Excel

Web the video tutorial below demonstrates two methods of portfolio optimization in excel. Web up to 10% cash back portfolio optimization: Web in this demonstration, we are going to use 5 years of monthly stock price data for 5 companies such as mcd, sbux, pfe, amgn, and axp. Finally we will integrate our. 1σpm, = ′′σ= m mm m1 this.

Multiple Project Planner Excel Template

The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice. Web in this demonstration, we are going to use 5 years of monthly stock price data for 5 companies such as mcd, sbux, pfe, amgn, and axp. Web 2.74k subscribers subscribe 93k views 5 years ago excel training.

Web The Video Tutorial Below Demonstrates Two Methods Of Portfolio Optimization In Excel.

The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice. Web video starts off with a classic finance textbook two security portfolio, and demonstrates how to select an optimal blend of the investments. Web the global minimum variance portfolio solves the optimization problem 2 min s.t. Web portfolio optimization is an application that evaluates the optimal capital weightings for a basket of financial investments which offers the best return for the least.

Web In This Demonstration, We Are Going To Use 5 Years Of Monthly Stock Price Data For 5 Companies Such As Mcd, Sbux, Pfe, Amgn, And Axp.

Web worksheet that models portfolio optimization of 2 assets. If you understand the process,. 1σpm, = ′′σ= m mm m1 this optimization problem can be solved easily using the solver with. Web the efficient frontier a portfolio frontier is a graph that maps out all possible portfolios with different asset weight combinations, with levels of portfolio standard.

Web 2.74K Subscribers Subscribe 93K Views 5 Years Ago Excel Training For Finance Students This Video Demonstrates How To Make A Simple Portfolio Optimizer In.

Web up to 10% cash back portfolio optimization: Web with these two worksheets as a basis, we will use the microsoft excel solver to model the complex portfolio optimization of more than 2 assets. Web the excel portfolio optimization model calculates the optimal capital weightings for portfolios of financial or business investments that maximizes return for the. Web these excel solutions focus on asset allocation for portfolios of financial investments and can be applied to optimize trading and investment strategies in financial markets.

With These Two Worksheets As A Basis, We Will Use The Microsoft Excel Solver To Model The Complex Portfolio.

Finally we will integrate our. The first example covers the classic textbook example of the two security case.