Poshmark Tax Form

Poshmark Tax Form - If you have an exemption and would like to submit your certificate for review, you may do so here. Web how to submit an exemption certificate poshmark is responsible for collecting and remitting sales tax, as applicable, per state laws and local tax laws or where poshmark is otherwise obligated to do so. Seller chooses a selling price and lists item. Poshmark allows buyer to purchase at listed price and charges a shipping fee (unknown to seller). Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. 5mb file in pdf, jpg or png format) Web sales tax exemption form. Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward. Do you have to pay taxes on your online sales?

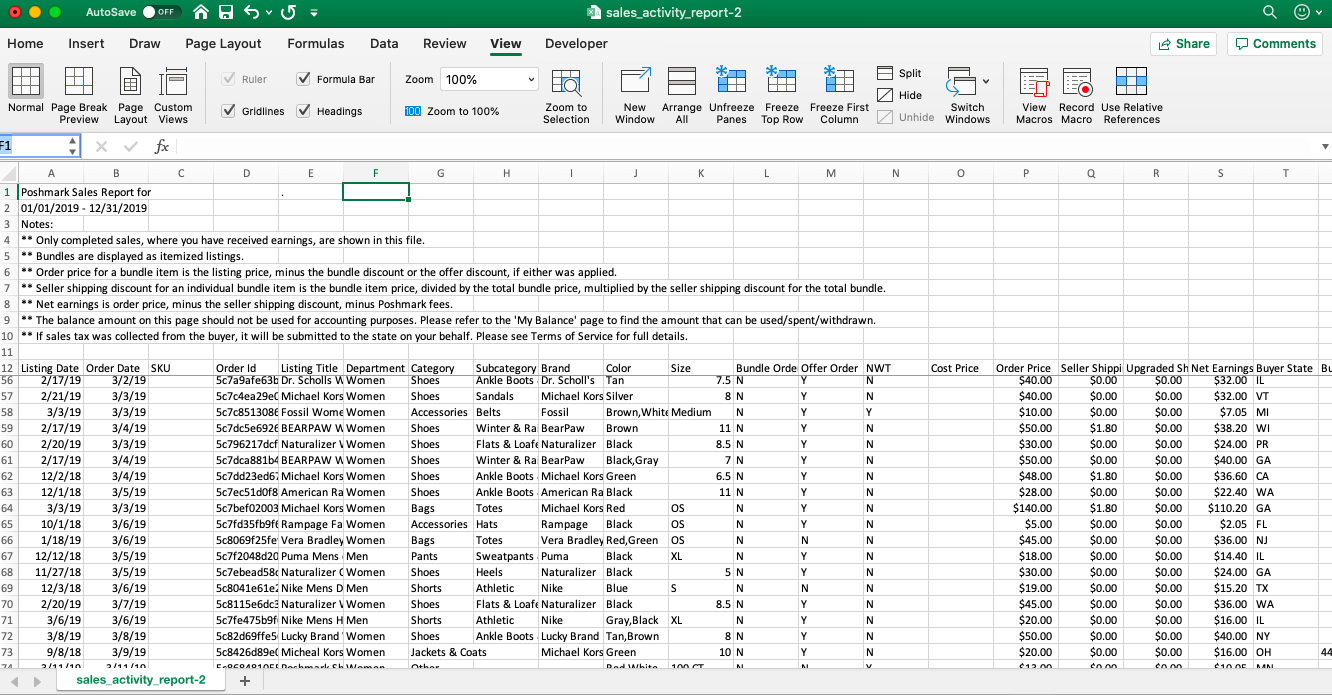

For new sellers, however, tax season can come with a lot of questions. For anything above $15, 20% goes to. Poshmark allows buyer to purchase at listed price and charges a shipping fee (unknown to seller). If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. Web sales tax exemption form. 5mb file in pdf, jpg or png format) Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. For any sales you make under $15, a flat commission fee of $2.95 goes to the platform. Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward.

Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. For new sellers, however, tax season can come with a lot of questions. Web how to submit an exemption certificate poshmark is responsible for collecting and remitting sales tax, as applicable, per state laws and local tax laws or where poshmark is otherwise obligated to do so. Web sales tax exemption form. Do you have to pay taxes on your online sales? Seller chooses a selling price and lists item. If you have an exemption and would like to submit your certificate for review, you may do so here. Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward.

Poshmark Products Listing Sheet Poshmark Seller Form Etsy Finance

5mb file in pdf, jpg or png format) Do you have to pay taxes on your online sales? Seller chooses a selling price and lists item. Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward. For any sales you make under $15, a flat commission fee of $2.95 goes to the platform.

New Poshmark Sales Tax Policy 2019 Posh Remit Program YouTube

Web sales tax exemption form. Do you have to pay taxes on your online sales? Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission.

Understanding Your Form 1099K FAQs for Merchants Clearent

Web sales tax exemption form. Seller chooses a selling price and lists item. Do you have to pay taxes on your online sales? If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. For new sellers, however, tax season can come with a lot of questions.

Poshmark SEC Filing in Anticipation of Its IPO Shows a Profitable

Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. For anything above $15, 20% goes to. Seller chooses a selling price and lists item. Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission.

Poshmark Review Is It Worth It to Buy and Sell Clothes in 2022?

For anything above $15, 20% goes to. If you have an exemption and would like to submit your certificate for review, you may do so here. Web how to submit an exemption certificate poshmark is responsible for collecting and remitting sales tax, as applicable, per state laws and local tax laws or where poshmark is otherwise obligated to do so..

Taxes for Poshmark Resellers When you sell personal used belongings for

Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. If you have an exemption and would like to submit your certificate for review, you may do so here. Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward. 5mb file.

I Promote On Poshmark,& Have Profited They Take 20 & Pay Taxes. Do I

Web sales tax exemption form. Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. Do you have to pay taxes on your online sales? If you are unsure what your tax obligations may be, we encourage you to.

FAQ What is a 1099 K? Pivotal Payments

For any sales you make under $15, a flat commission fee of $2.95 goes to the platform. For anything above $15, 20% goes to. If you have an exemption and would like to submit your certificate for review, you may do so here. 5mb file in pdf, jpg or png format) Web how to submit an exemption certificate poshmark is.

Poshmark Fees and Poshmark Taxes Explained Closet Assistant

Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. For anything above $15, 20% goes.

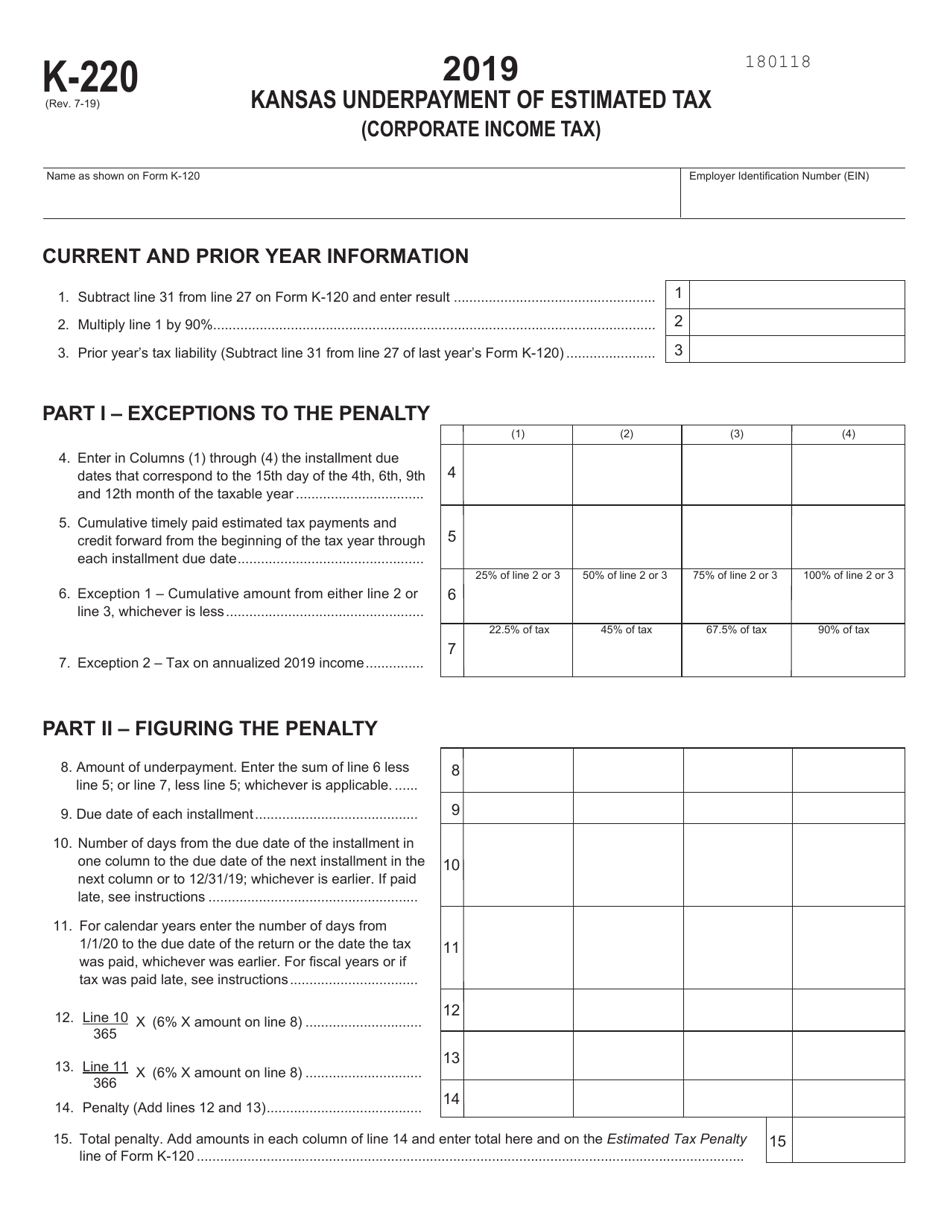

Schedule K220 Download Fillable PDF or Fill Online Kansas Underpayment

Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. Web sales tax exemption form. 5mb file in pdf, jpg or png format) Do you have to pay taxes on your online sales? Web poshmark and state sale taxes.

For Any Sales You Make Under $15, A Flat Commission Fee Of $2.95 Goes To The Platform.

Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward. For new sellers, however, tax season can come with a lot of questions. Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. For anything above $15, 20% goes to.

Web How To Submit An Exemption Certificate Poshmark Is Responsible For Collecting And Remitting Sales Tax, As Applicable, Per State Laws And Local Tax Laws Or Where Poshmark Is Otherwise Obligated To Do So.

If you have an exemption and would like to submit your certificate for review, you may do so here. Web sales tax exemption form. Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. Do you have to pay taxes on your online sales?

If You Are Unsure What Your Tax Obligations May Be, We Encourage You To Consult An Accountant Or Other Expert In Your Area.

5mb file in pdf, jpg or png format) Seller chooses a selling price and lists item. Poshmark allows buyer to purchase at listed price and charges a shipping fee (unknown to seller).