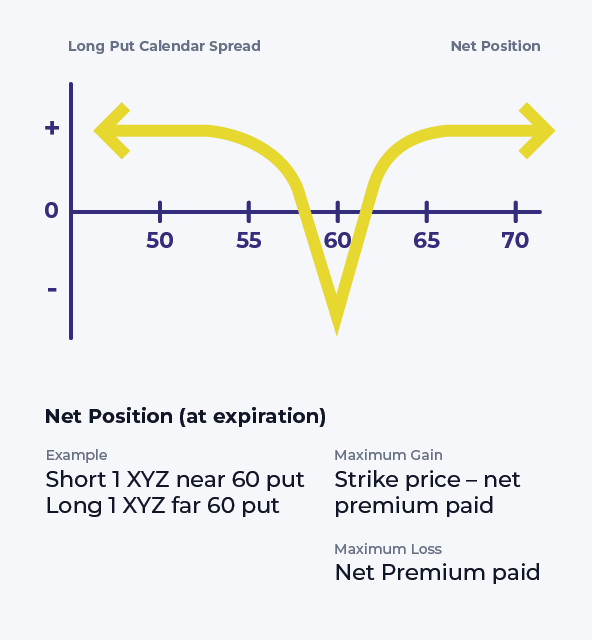

Put Calendar Spread

Put Calendar Spread - Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web what is a calendar spread? A calendar spread typically involves buying and selling the same type of option (calls. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put.

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. A calendar spread typically involves buying and selling the same type of option (calls. Web what is a calendar spread?

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. A calendar spread typically involves buying and selling the same type of option (calls. Web what is a calendar spread? Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying.

Long Calendar Spread with Puts Strategy With Example

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web what is a calendar spread? A calendar spread typically involves buying and selling the same type of option (calls. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price.

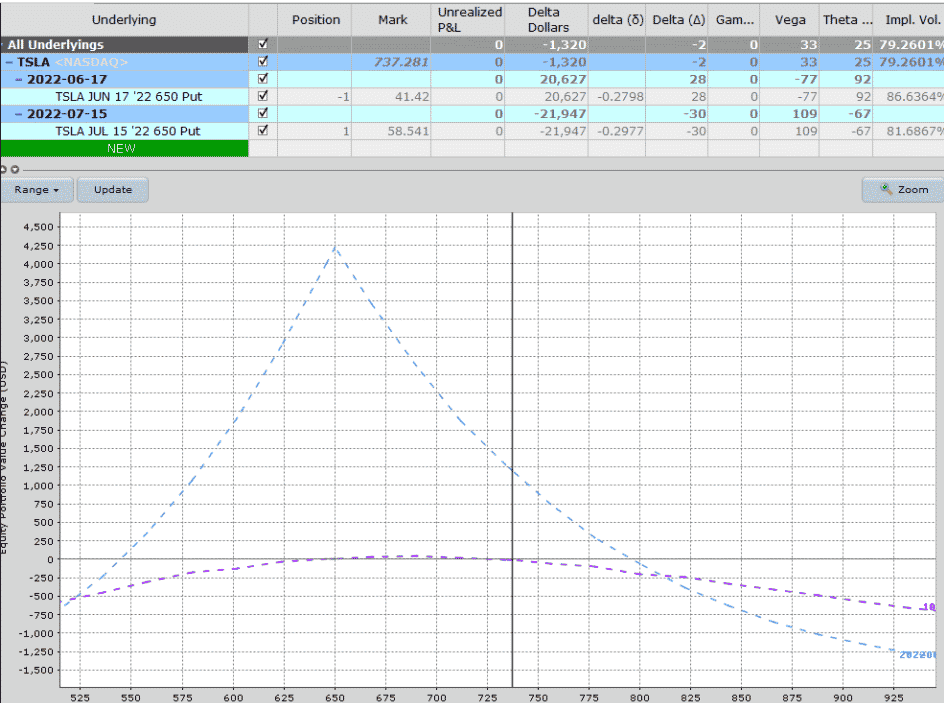

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. A calendar spread typically involves buying and selling the same type of option (calls. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long calendar put spread.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web what is a calendar spread? Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a calendar spread is an options or futures.

Calendar Put Spread Options Edge

A calendar spread typically involves buying and selling the same type of option (calls. Web what is a calendar spread? Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying..

Long Put Calendar Spread (Put Horizontal) Options Strategy

A calendar spread typically involves buying and selling the same type of option (calls. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web what is a calendar.

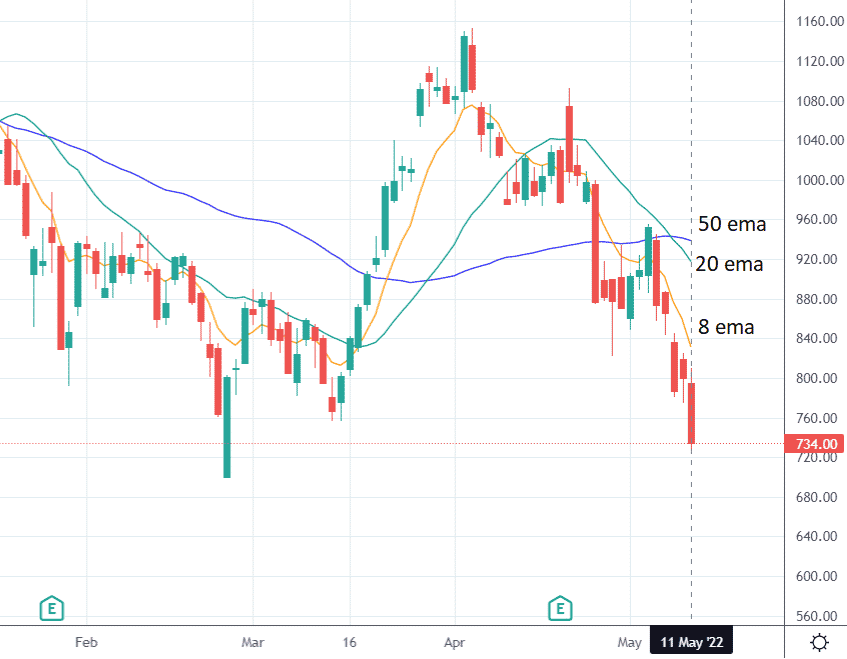

Bearish Put Calendar Spread Option Strategy Guide

Web what is a calendar spread? Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. A calendar spread typically involves buying and selling the.

Bearish Put Calendar Spread Option Strategy Guide

Web what is a calendar spread? Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. A calendar spread typically involves buying and selling the.

Put Calendar Spread

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. A calendar spread typically involves buying and selling the same type of option (calls. Web.

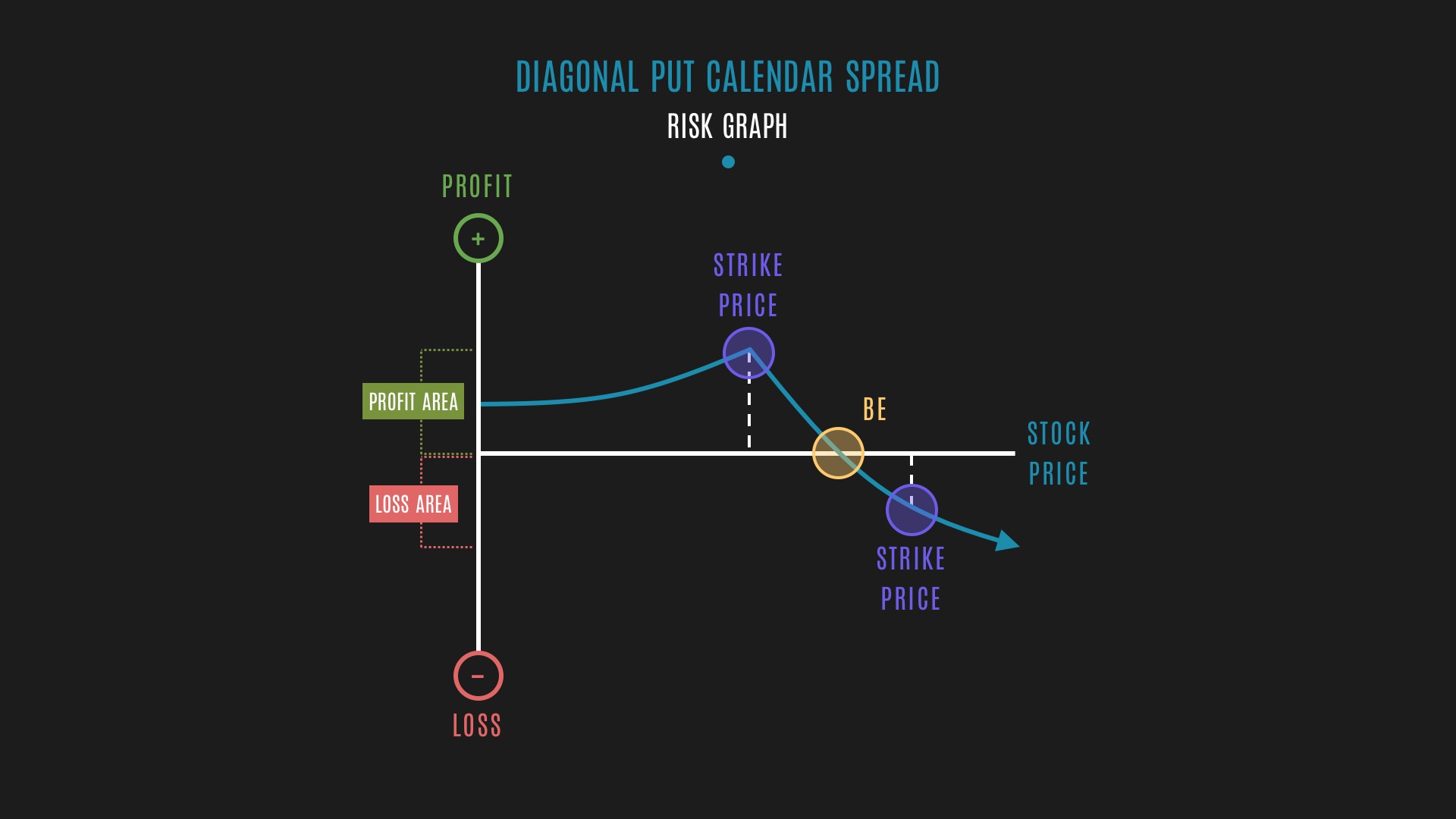

Credit Spread Options Strategies (Visuals and Examples) projectfinance

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. A calendar spread typically involves buying and selling the same type of option (calls. Web what is a calendar.

Glossary Diagonal Put Calendar Spread example Tackle Trading

Web what is a calendar spread? Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. A calendar spread typically involves buying and selling the same type of option (calls..

Web What Is A Calendar Spread?

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. A calendar spread typically involves buying and selling the same type of option (calls.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)