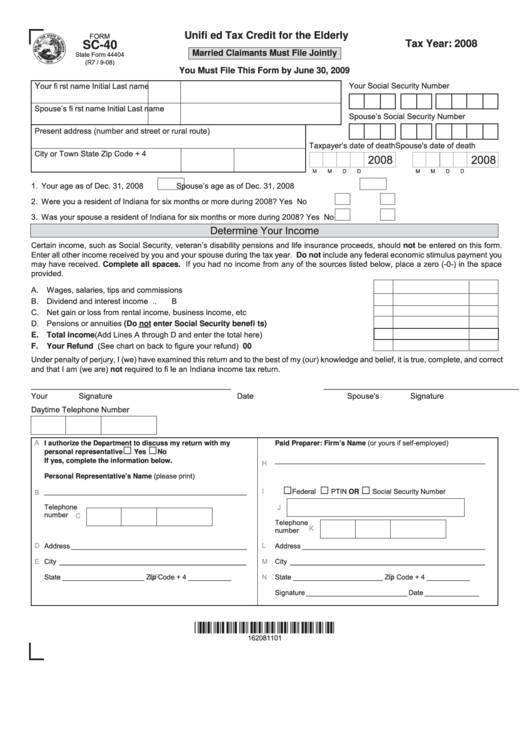

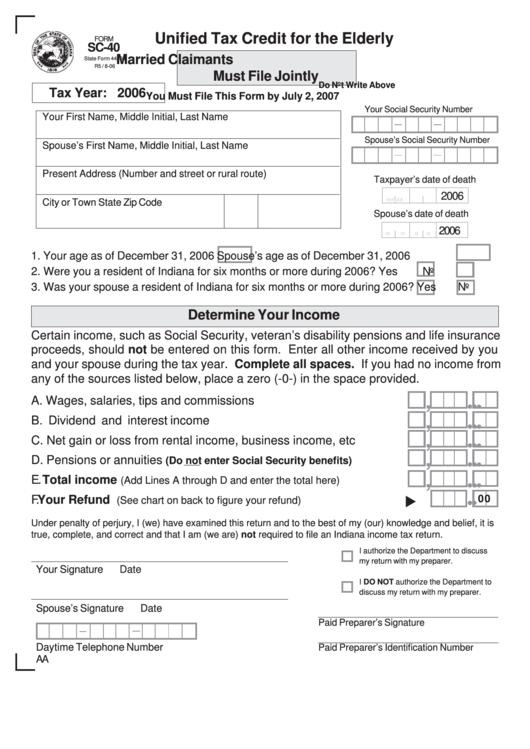

Sc-40 Form

Sc-40 Form - Web sc fillable forms does not store your information from previous tax years. Most taxpayers claim this credit by filing. 31, 2009 spouse’s age as of dec. FI le either form it. Web 68 rows form code form name ; Web the due date for filing your 2021 south carolina individual income tax return is april 18, 2022. Unified tax credit for the elderly. No need to install software, just go to dochub, and sign up instantly and for free. Web up to $40 cash back filling out the sc 1040 form, or the south carolina individual income tax return, requires attention to detail and accurate information. Web issued unless the entire form is completed.

Check box if you were age 65 or. Web edit, sign, and share sc 40 tax form 2021 online. Web dor individual income taxes filing my taxes tax credits learn what tax credits you can claim on your indiana individual income tax return you can find all available credits listed. FI le either form it. Your age as of dec. If you do not qualify for free filing using one of. Previous logins no longer provide access to the program. Web issued unless the entire form is completed. If you have not received your refund within 12 weeks of filing, you may call our. Unified tax credit for the elderly:

Web up to $40 cash back filling out the sc 1040 form, or the south carolina individual income tax return, requires attention to detail and accurate information. If you do not qualify for free filing using one of. You can print other indiana tax forms here. Web issued unless the entire form is completed. No need to install software, just go to dochub, and sign up instantly and for free. Unified tax credit for the elderly. 31, 2009 spouse’s age as of dec. File this form by june 30, 2006, to be eligible for this credit. Check box if you were age 65 or. Web form name agricultural exemption certificate.

c278 Fill out & sign online DocHub

Web 68 rows form code form name ; Unified tax credit for the elderly: Web in the circuit court of _____ county, missouri judge or division: Web dor individual income taxes filing my taxes tax credits learn what tax credits you can claim on your indiana individual income tax return you can find all available credits listed. If you have.

2014 Form KS DoR K40 Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns due in april. Web 68 rows form code form name ; Unified tax credit for the elderly: Your age as of dec. Web dor individual income taxes filing my taxes tax credits learn what tax credits you can claim on your indiana individual income tax return you.

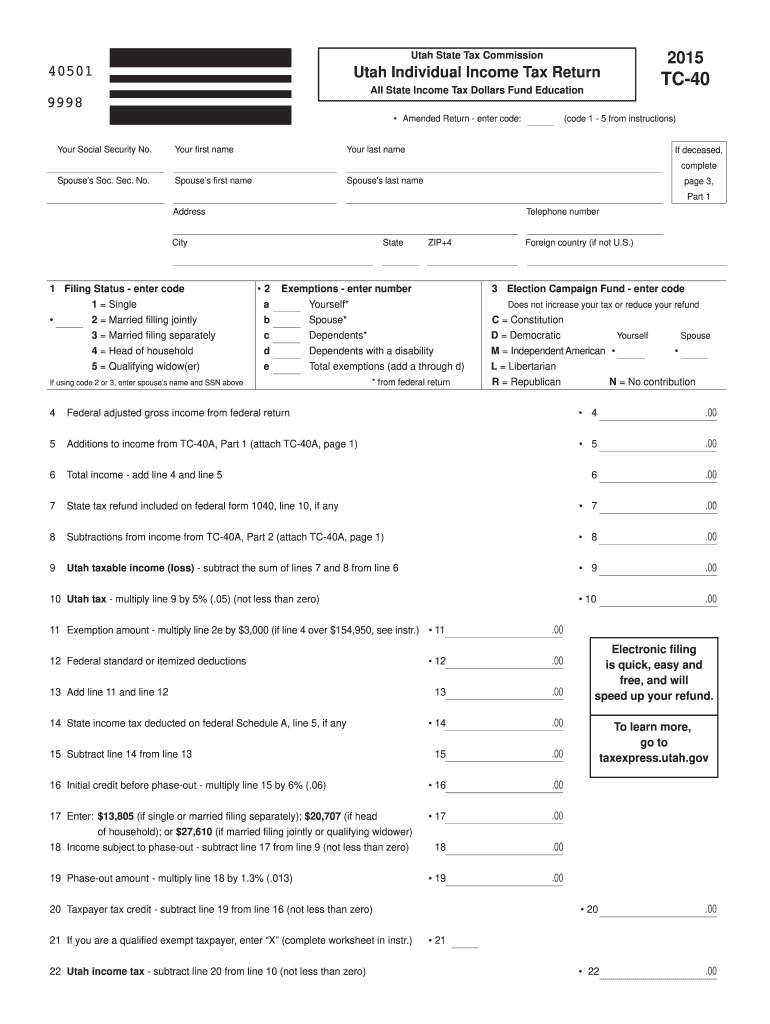

Tc 40 Form Fill Out and Sign Printable PDF Template signNow

31, 2009 spouse’s age as of dec. No need to install software, just go to dochub, and sign up instantly and for free. Most taxpayers claim this credit by filing. Web issued unless the entire form is completed. Web 68 rows form code form name ;

Form 40 Alveus

Web dor individual income taxes filing my taxes tax credits learn what tax credits you can claim on your indiana individual income tax return you can find all available credits listed. Web form name agricultural exemption certificate. Web sc fillable forms does not store your information from previous tax years. No need to install software, just go to dochub, and.

Form Sc40 Unified Tax Credit For The Elderly 2008 printable pdf

FI le either form it. Web edit, sign, and share sc 40 tax form 2021 online. Your age as of dec. Check box if you were age 65 or. You can print other indiana tax forms here.

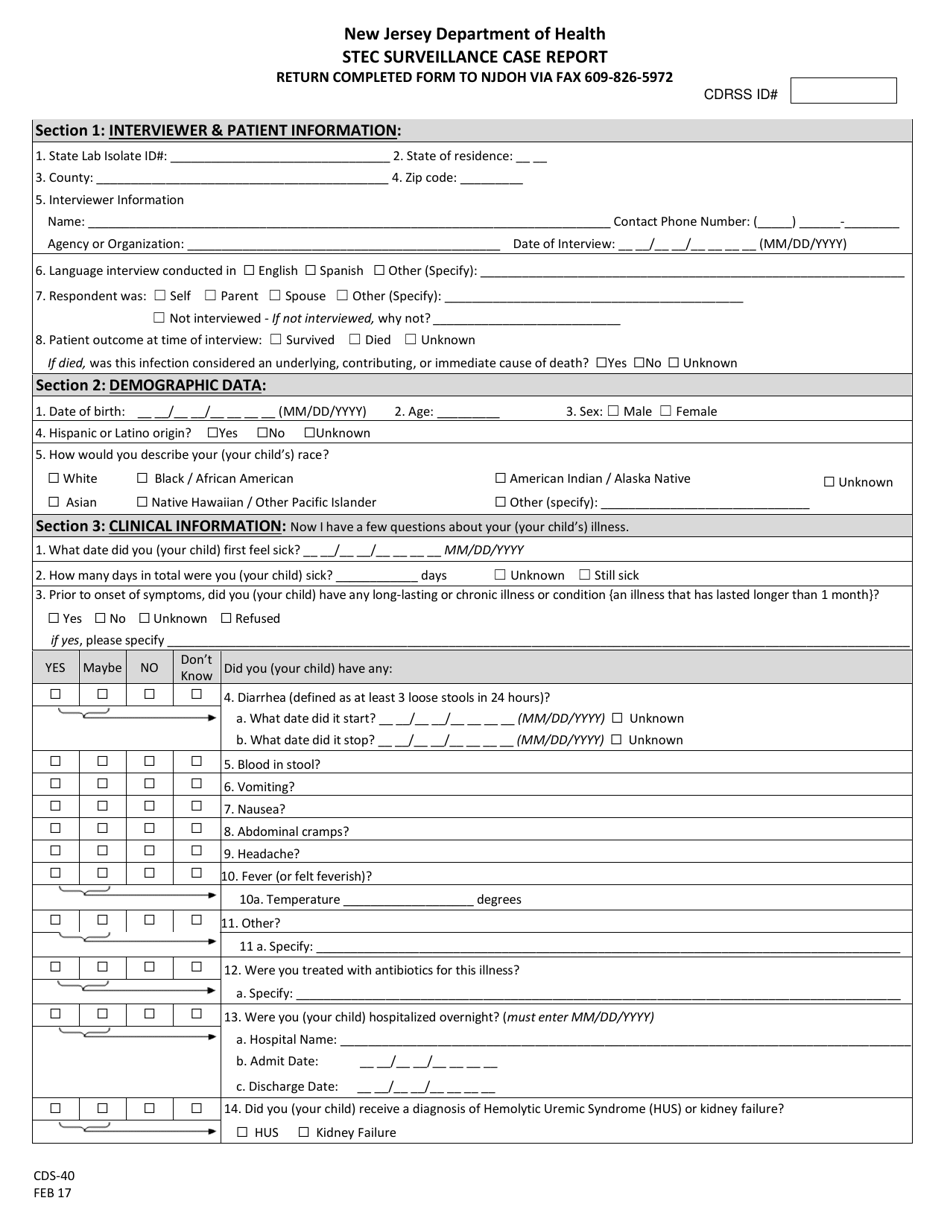

Form CDS40 Download Printable PDF or Fill Online Stec Surveillance

Web 68 rows form code form name ; Your age as of dec. If you do not qualify for free filing using one of. FI le either form it. Web issued unless the entire form is completed.

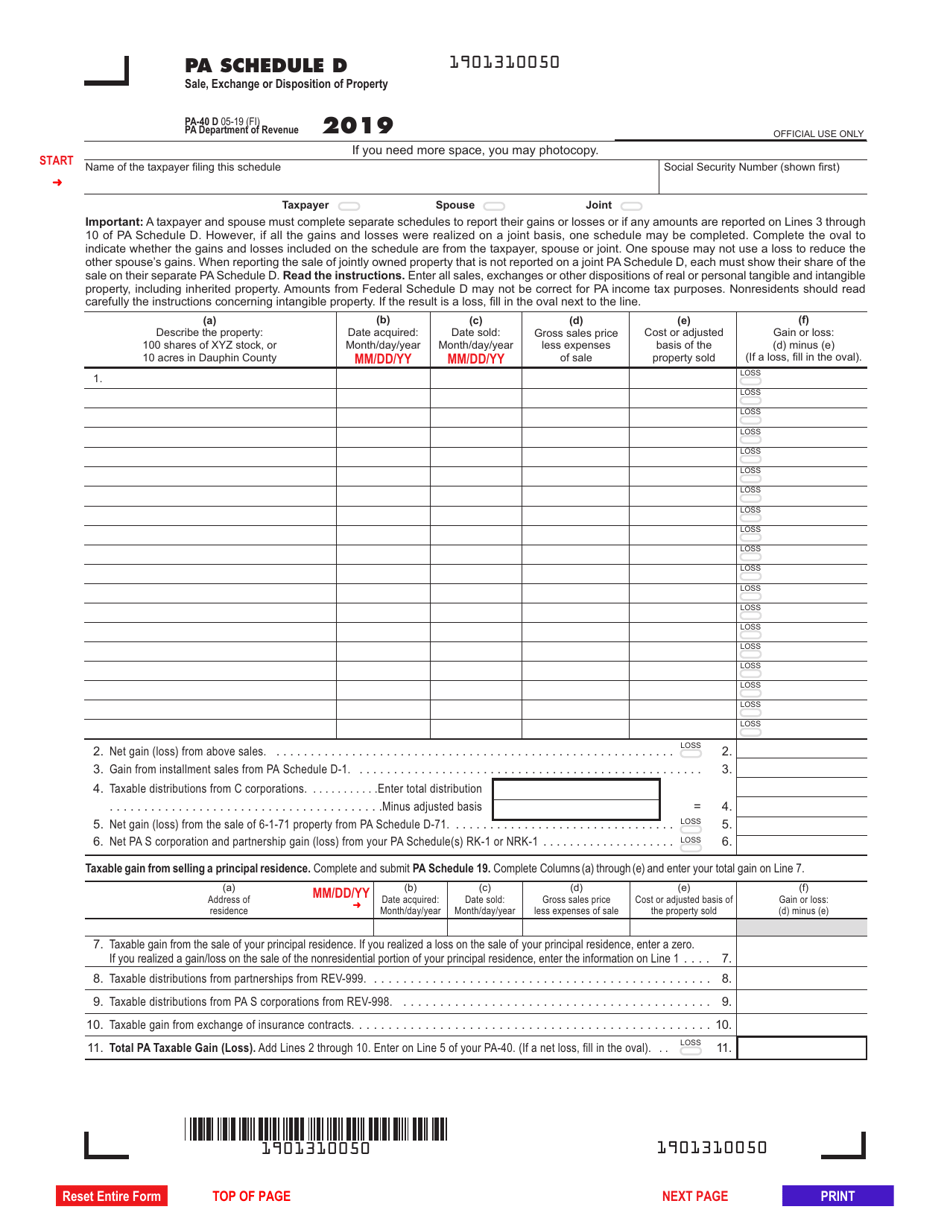

Form PA40 Schedule D Download Fillable PDF or Fill Online Sale

Web up to $40 cash back filling out the sc 1040 form, or the south carolina individual income tax return, requires attention to detail and accurate information. Check box if you were age 65 or. Web dor individual income taxes filing my taxes tax credits learn what tax credits you can claim on your indiana individual income tax return you.

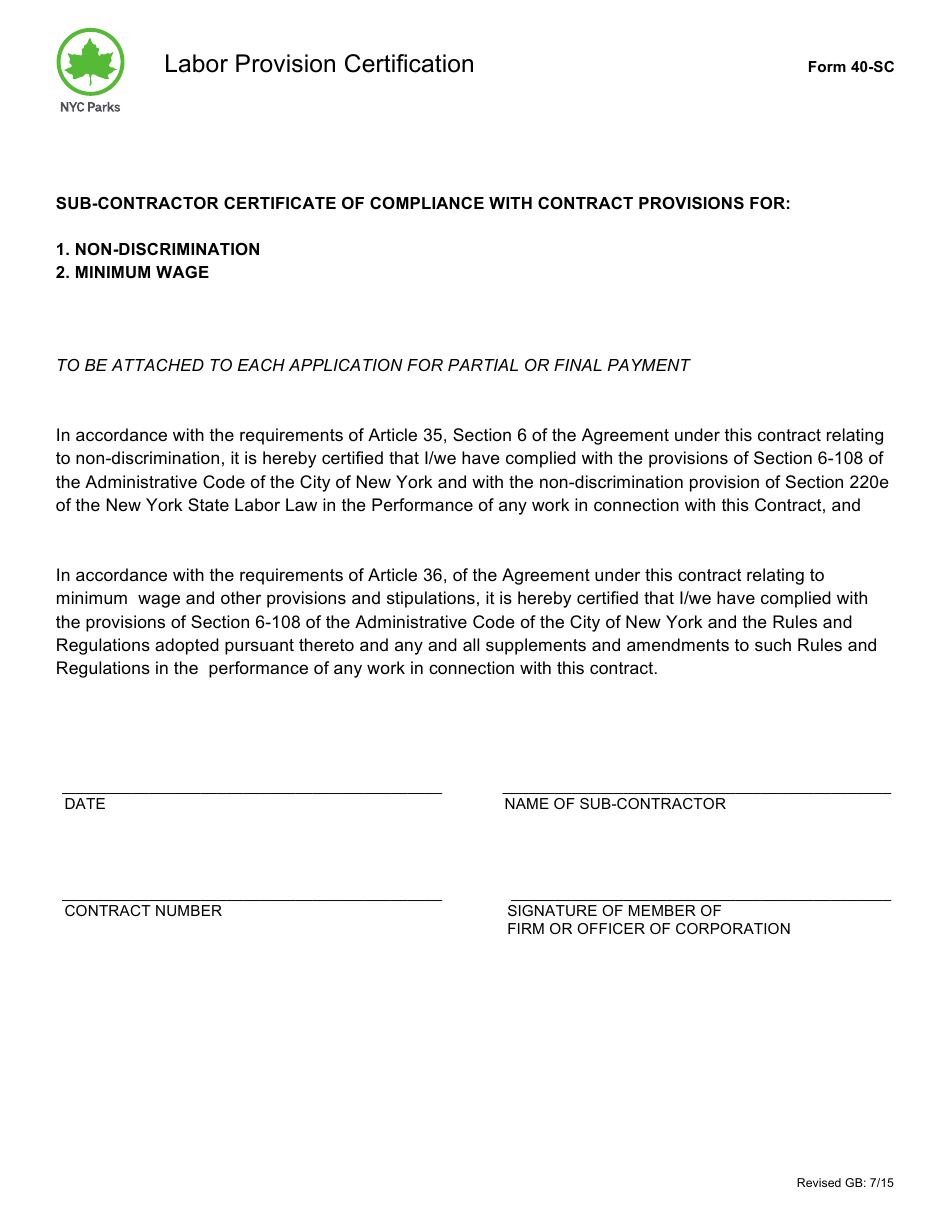

Form 40SC Download Printable PDF or Fill Online Labor Provision

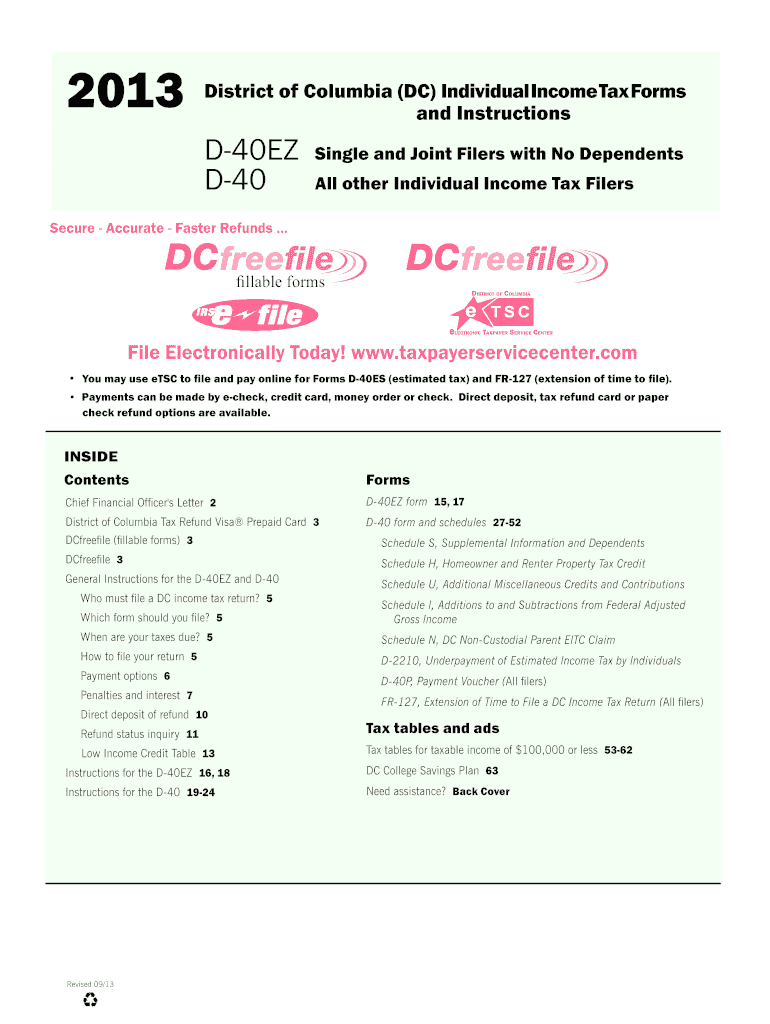

Web the due date for filing your 2021 south carolina individual income tax return is april 18, 2022. Web 68 rows form code form name ; This form is for income earned in tax year 2022, with tax returns due in april. Unified tax credit for the elderly: Web edit, sign, and share sc 40 tax form 2021 online.

Form Sc40 Unified Tax Credit For The Elderly State Of Indiana

Check box if you were age 65 or older by dec. Web simplified form for low income seniors. Previous logins no longer provide access to the program. No need to install software, just go to dochub, and sign up instantly and for free. Web edit, sign, and share sc 40 tax form 2021 online.

Web 68 Rows Form Code Form Name ;

Web form name agricultural exemption certificate. Unified tax credit for the elderly. If you do not qualify for free filing using one of. Unified tax credit for the elderly:

31, 2009 Spouse’s Age As Of Dec.

Web dor individual income taxes filing my taxes tax credits learn what tax credits you can claim on your indiana individual income tax return you can find all available credits listed. Web sc fillable forms does not store your information from previous tax years. Web up to $40 cash back filling out the sc 1040 form, or the south carolina individual income tax return, requires attention to detail and accurate information. Web edit, sign, and share sc 40 tax form 2021 online.

Your Age As Of Dec.

If you have not received your refund within 12 weeks of filing, you may call our. Web in the circuit court of _____ county, missouri judge or division: FI le either form it. Web the due date for filing your 2021 south carolina individual income tax return is april 18, 2022.

You Can Print Other Indiana Tax Forms Here.

No need to install software, just go to dochub, and sign up instantly and for free. File this form by june 30, 2006, to be eligible for this credit. Check box if you were age 65 or. Most taxpayers claim this credit by filing.