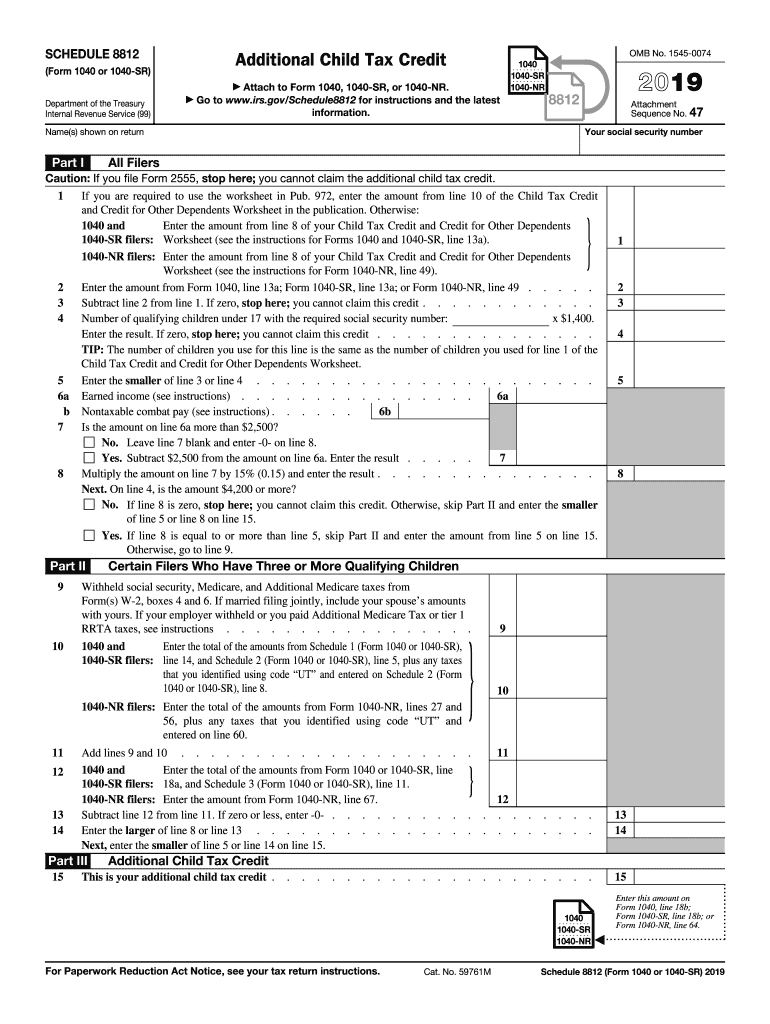

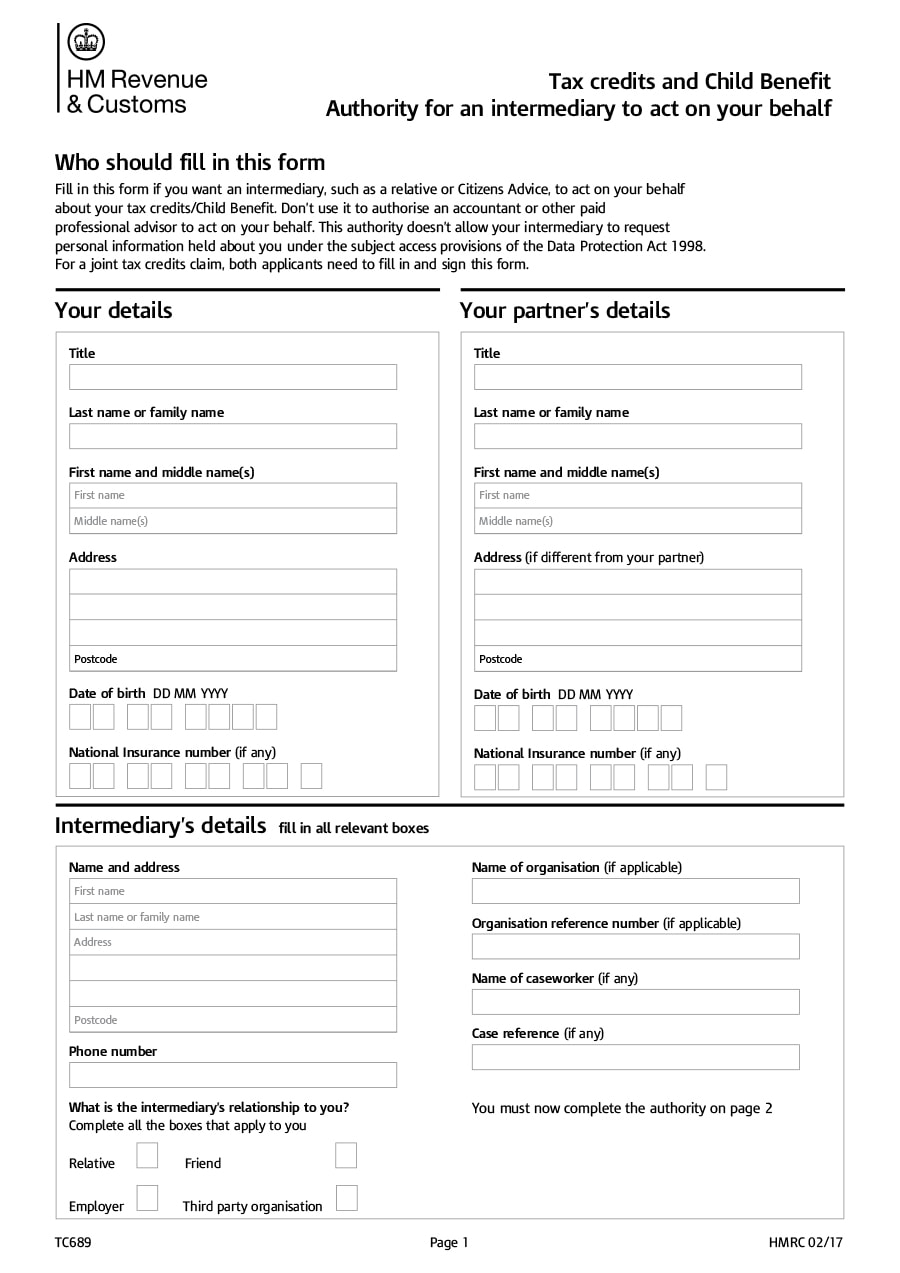

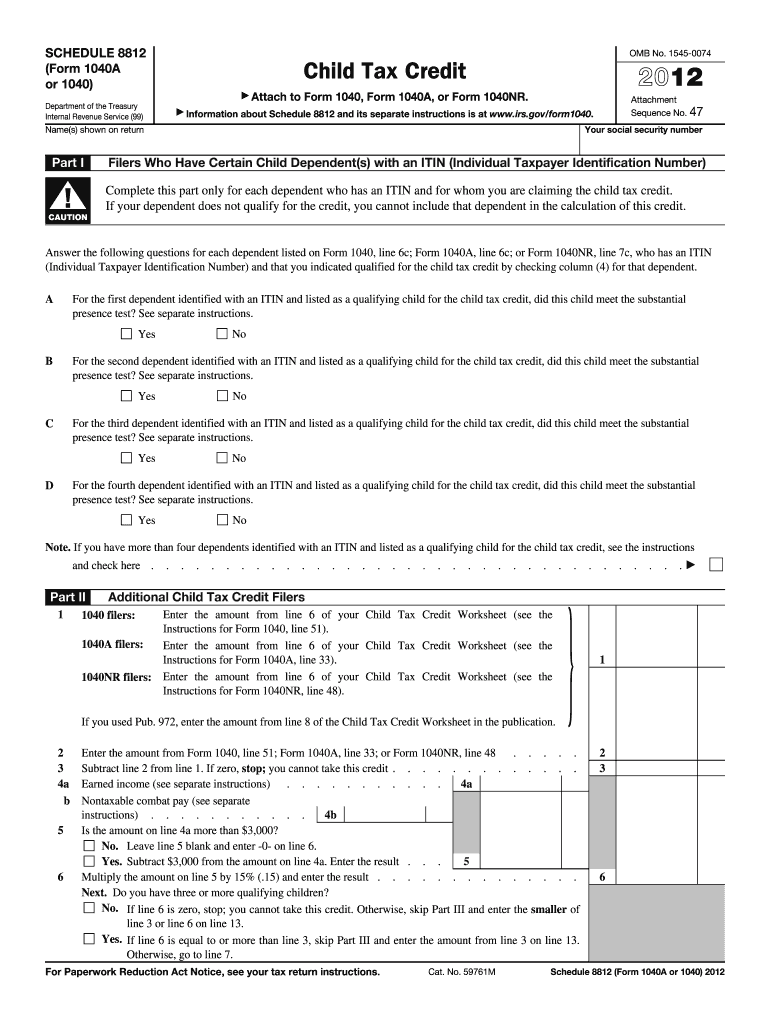

Schedule 8812 Form 2020

Schedule 8812 Form 2020 - The ctc and odc are. Search by form number, name or organization. Web if you qualify, the worksheet will direct you to fill out schedule 8812 to claim the additional child tax credit. Web follow the simple instructions below: Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Web how to file form 8812. Register and subscribe now to work on your irs 1040 sched 8812 instr & more fillable forms I discuss the 3,600 and 3,000 child tax credit amo. When the tax period started unexpectedly or maybe you just forgot about it, it could probably create problems for you. Schedule 8812 is automatically generated in.

Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Lacerte will automatically generate schedule 8812 to compute the additional child tax credit (ctc) based on your entries. The additional child tax credit may. Web get a 1040 schedule 8812 (2020) here. I discuss the 3,600 and 3,000 child tax credit amo. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. Ad access irs tax forms. Search by form number, name or organization. Web schedule 8812 (form 1040). Ad access irs tax forms.

The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web schedule 8812 (form 1040). Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. The ctc and odc are. Available in mobile app only. Web search irs and state income tax forms to efile or complete, download online and back taxes. Go to www.irs.gov/schedule8812 for instructions and the latest information. Lacerte will automatically generate schedule 8812 to compute the additional child tax credit (ctc) based on your entries. Web how to file form 8812.

2015 Child Tax Credit Worksheet worksheet

Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The article below outlines the rules for the child tax credit for tax years beyond 2021. Schedule 8812 is automatically generated in. Web child tax credit. Go to www.irs.gov/schedule8812 for instructions and the latest information.

Fillable Schedule 8812 (Form 1040a Or 1040) Child Tax Credit 2016

I discuss the 3,600 and 3,000 child tax credit amo. Web how to file form 8812. Web enter the information for the tax return. The ctc and odc are. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and.

8812 Worksheet

Web child tax credit. Go to www.irs.gov/schedule8812 for instructions and the latest information. Complete, edit or print tax forms instantly. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Web schedule 8812 (form 1040).

Schedule 8812 Credit Limit Worksheet A

The ctc and odc are. The article below outlines the rules for the child tax credit for tax years beyond 2021. Complete, edit or print tax forms instantly. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. For example, if the amount.

Irs Child Tax Credit Form 2020 Trending US

Ad access irs tax forms. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Available in mobile app only. Ad access irs tax forms. Web search irs and state income tax forms to efile or complete, download online and back taxes.

Credit Limit Worksheet 2020

Search by form number, name or organization. Web if you qualify, the worksheet will direct you to fill out schedule 8812 to claim the additional child tax credit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. The ctc and odc are. Web the.

2019 Form IRS 1040 Schedule 8812 Fill Online, Printable, Fillable

Web how to file form 8812. Complete, edit or print tax forms instantly. Available in mobile app only. Web file now with turbotax related federal individual income tax forms: The ctc and odc are.

Child Tax Credit Worksheet Qualified Business Deduction Tom

Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Taxformfinder has an additional 774 federal income tax forms that you may need, plus all federal income. The additional child tax credit may. Web get a 1040 schedule 8812 (2020) here. You will first.

8812 Schedule Form Fill Out and Sign Printable PDF Template signNow

Register and subscribe now to work on your irs 1040 sched 8812 instr & more fillable forms Schedule 8812 is automatically generated in. Web irs form 1040 schedule 8812 (2020) is used to report additional child tax creditthe form_type parameter a_1040_schedule_8812_2020 for the upload pdf to book is. Search by form number, name or organization. Web get a 1040 schedule.

Form 8812 Credit Limit Worksheet A

For example, if the amount. Web get a 1040 schedule 8812 (2020) here. Lacerte will automatically generate schedule 8812 to compute the additional child tax credit (ctc) based on your entries. Available in mobile app only. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040.

Web Follow The Simple Instructions Below:

Web if you qualify, the worksheet will direct you to fill out schedule 8812 to claim the additional child tax credit. Ad access irs tax forms. Register and subscribe now to work on your irs 1040 sched 8812 instr & more fillable forms Web get a 1040 schedule 8812 (2020) here.

Search By Form Number, Name Or Organization.

For example, if the amount. The ctc and odc are. Complete, edit or print tax forms instantly. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040.

Taxformfinder Has An Additional 774 Federal Income Tax Forms That You May Need, Plus All Federal Income.

Web how to file form 8812. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Web irs form 1040 schedule 8812 (2020) is used to report additional child tax creditthe form_type parameter a_1040_schedule_8812_2020 for the upload pdf to book is. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and.

The Additional Child Tax Credit May.

Available in mobile app only. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Web enter the information for the tax return.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png)