Schedule A Form 990

Schedule A Form 990 - The organization is not a private foundation because it is: (for lines 1 through 12, check only one box.) a church, convention of churches, or association of churches described in a school described in (attach schedule e (form 990).) Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Note that all organizations filing form 990 must file schedule o. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations). Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Some months may have more than one entry due to the size of the download. Instructions for these schedules are combined with the schedules. The download files are organized by month. “yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional :

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status, indicated in part i. Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. Note that all organizations filing form 990 must file schedule o. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations). The organization is not a private foundation because it is: Open to public go to www.irs.gov/form990 On this page you may download the 990 series filings on record for 2021.

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. On this page you may download the 990 series filings on record for 2021. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Open to public go to www.irs.gov/form990 The organization is not a private foundation because it is: Instructions for these schedules are combined with the schedules. “yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional : (for lines 1 through 12, check only one box.) a church, convention of churches, or association of churches described in a school described in (attach schedule e (form 990).) Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations). Note that all organizations filing form 990 must file schedule o.

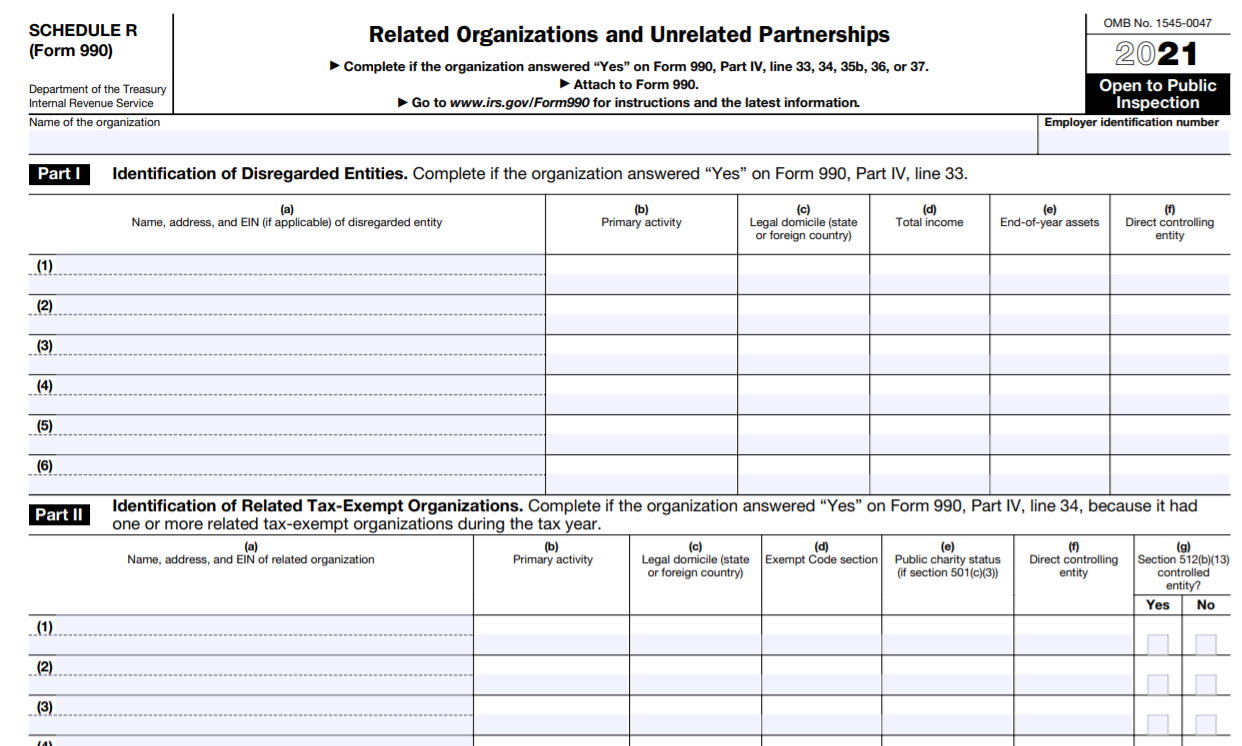

IRS Form 990 Schedule R Instructions Related Organizations and

Some months may have more than one entry due to the size of the download. Open to public go to www.irs.gov/form990 Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. On this page you may.

Form 990 (Schedule J) Compensation Information Form (2015) Free Download

“yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional : Instructions for these schedules are combined with the schedules. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form.

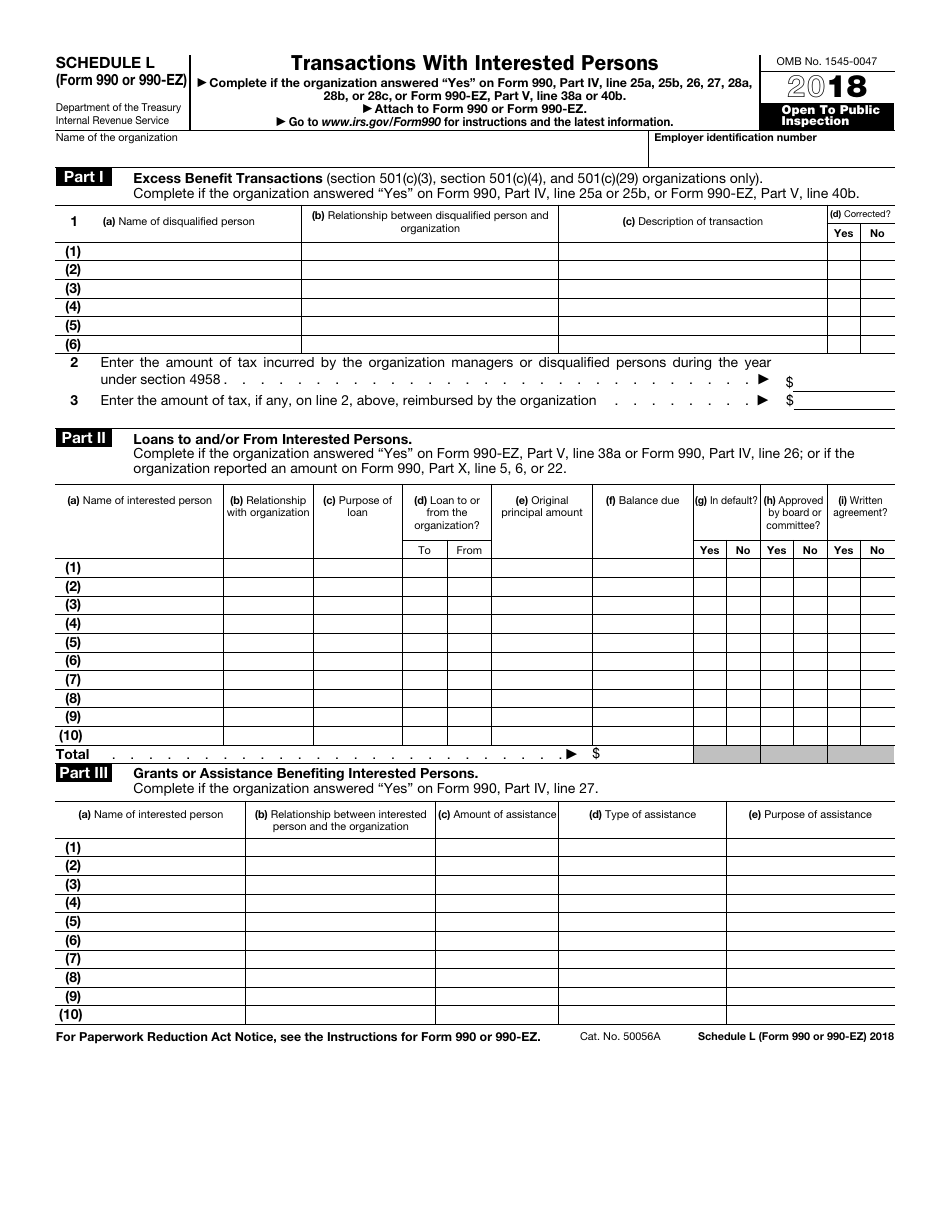

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. The download files are organized by month. Instructions for these schedules are combined with the schedules. “yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional : Web schedule a (form.

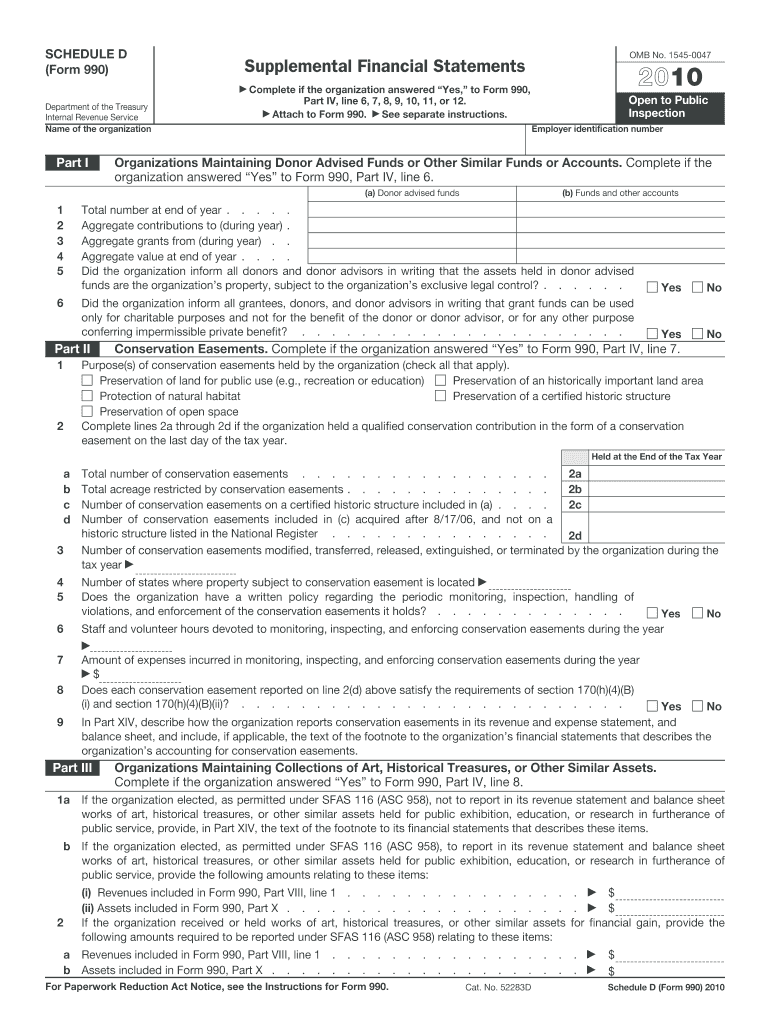

Form 990 Schedule D Fill Out and Sign Printable PDF Template signNow

(for lines 1 through 12, check only one box.) a church, convention of churches, or association of churches described in a school described in (attach schedule e (form 990).) Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations)..

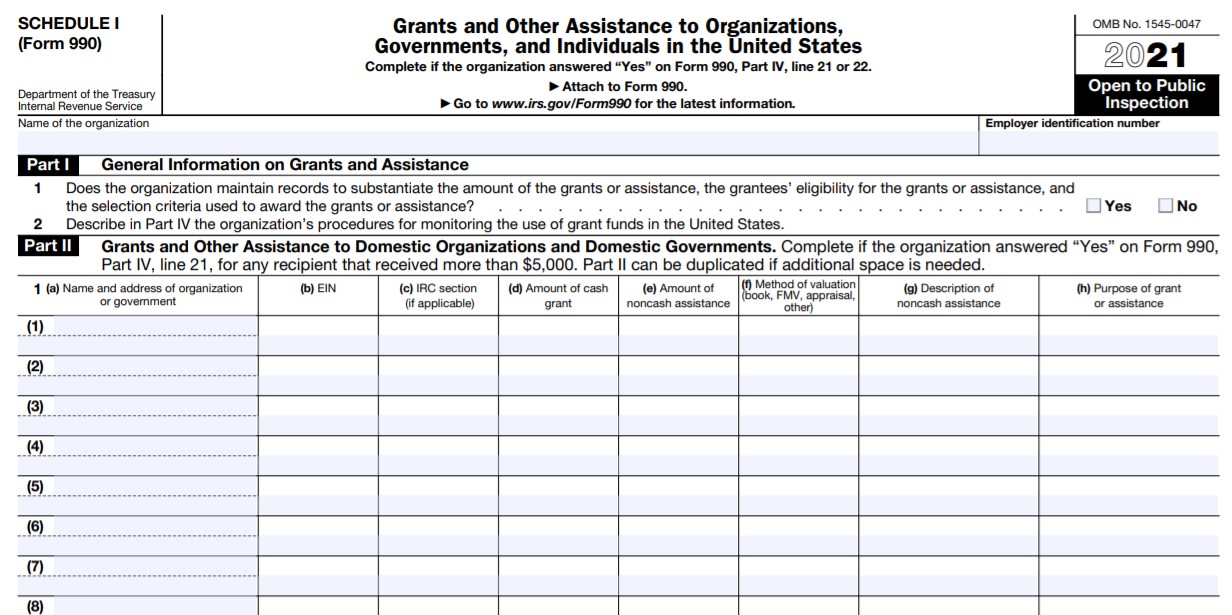

Online IRS Form 990 (Schedule I) 2018 2019 Fillable and Editable

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. (for lines 1 through 12, check only one box.) a church, convention of churches, or association of churches described in a school described in (attach schedule e (form 990).) Some months may have more than one entry due to the size.

Free Aia Schedule Of Values Form Form Resume Examples 7mk90WmOGY

(for lines 1 through 12, check only one box.) a church, convention of churches, or association of churches described in a school described in (attach schedule e (form 990).) Some months may have more than one entry due to the size of the download. Note that all organizations filing form 990 must file schedule o. On this page you may.

Form 990 (Schedule H) Hospitals (2014) Free Download

Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Some months may have more than one entry due to the size of the download. Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. The organization is not a private foundation because it is: Instructions for these schedules.

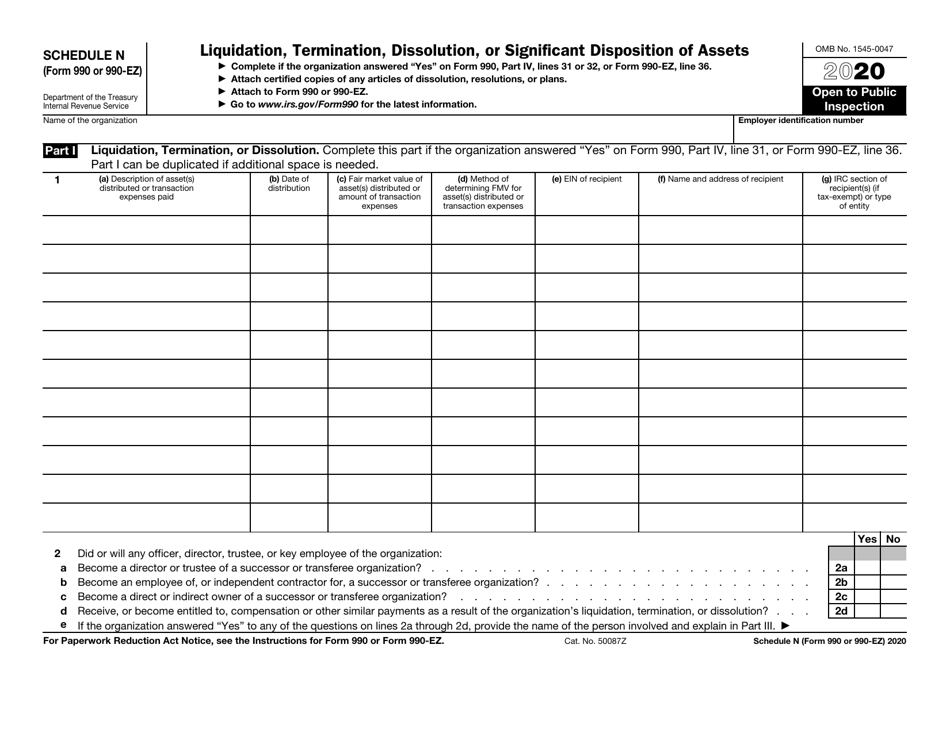

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations). Open to public go to www.irs.gov/form990 Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. “yes,” and if the.

form 990 schedule o Fill Online, Printable, Fillable Blank form990

Some months may have more than one entry due to the size of the download. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations)..

IRS Form 990 Schedule I Instructions Grants & Other Assistance

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. Instructions for these schedules are combined with the schedules..

Web The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status, indicated in part i. Open to public go to www.irs.gov/form990 The organization is not a private foundation because it is: Some months may have more than one entry due to the size of the download.

On This Page You May Download The 990 Series Filings On Record For 2021.

Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. Note that all organizations filing form 990 must file schedule o. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf.

“Yes,” And If The Organization Answered “No” To Line 12A, Then Completing Schedule D, Parts Xi And Xii Is Optional :

(for lines 1 through 12, check only one box.) a church, convention of churches, or association of churches described in a school described in (attach schedule e (form 990).) Instructions for these schedules are combined with the schedules. The download files are organized by month. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations).