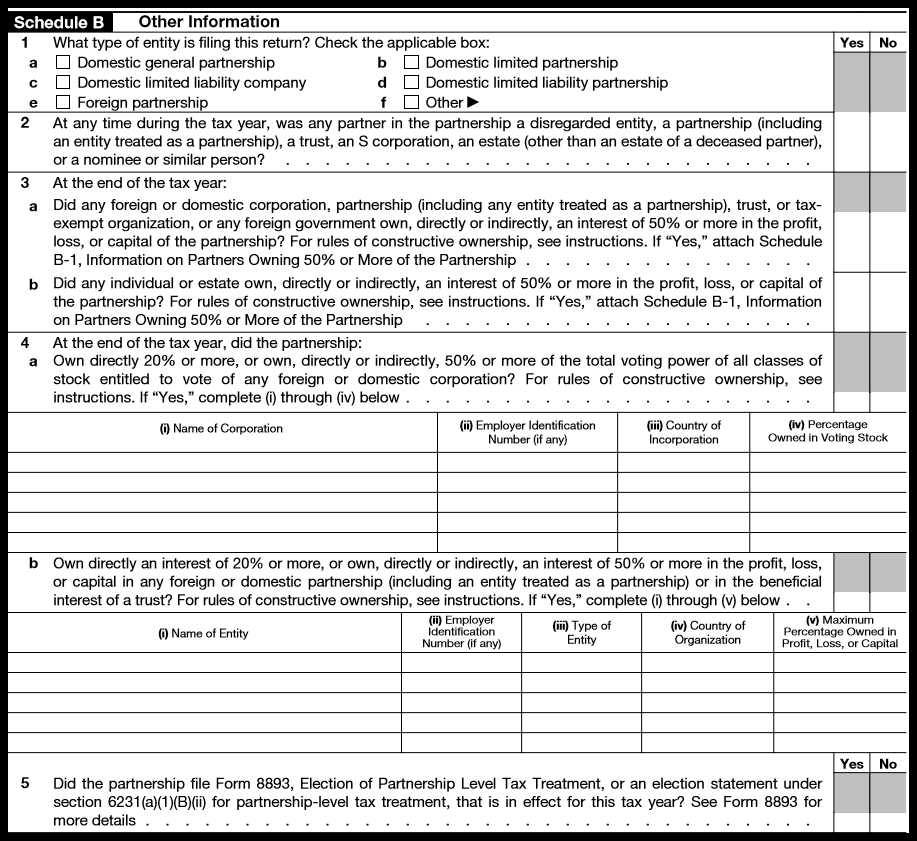

Schedule B Form 1065

Schedule B Form 1065 - Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. If yes, the partnership isn't. The new audit regime applies to all partnerships. To what extent is a. Web to meet the requirements for form 1065, schedule b, question 4, the client must answer yes to all four of the following conditions: Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). The schedule b screen in the 1065 package has been enhanced. Web a 1065 form is the annual us tax return filed by partnerships. Web input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries on. Web schedule b reports the interest and dividend income you receive during the tax year.

Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. To what extent is a. To which partners does section 267a apply? The schedule b screen in the 1065 package has been enhanced. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. To which payments does section 267a apply? Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. Web a 1065 form is the annual us tax return filed by partnerships. Web to meet the requirements for form 1065, schedule b, question 4, the client must answer yes to all four of the following conditions: Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based.

Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based. If yes, the partnership isn't. The schedule b screen in the 1065 package has been enhanced. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). Web input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries on. Web to meet the requirements for form 1065, schedule b, question 4, the client must answer yes to all four of the following conditions: However, you don’t need to attach a schedule b every year you earn interest or. Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. To which partners does section 267a apply? Web a 1065 form is the annual us tax return filed by partnerships.

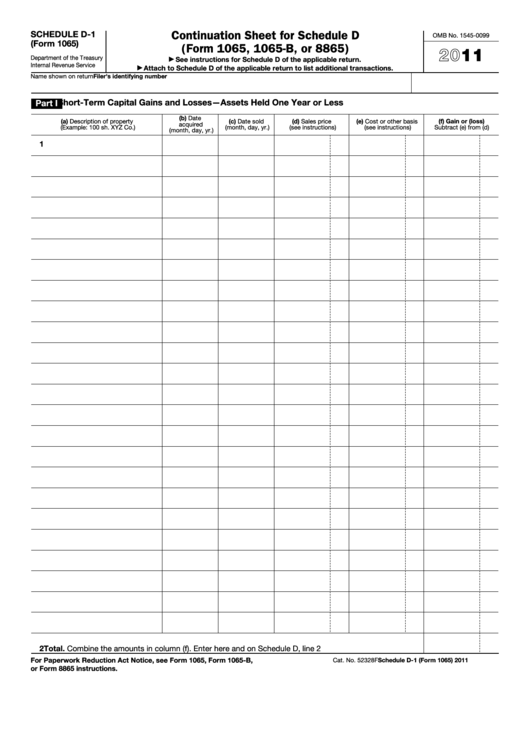

Fillable Schedule D1 (Form 1065) Continuation Sheet For Schedule D

Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based. The new audit regime applies to all partnerships. Web schedule b reports the interest and dividend income you receive during the tax year. However, you don’t need.

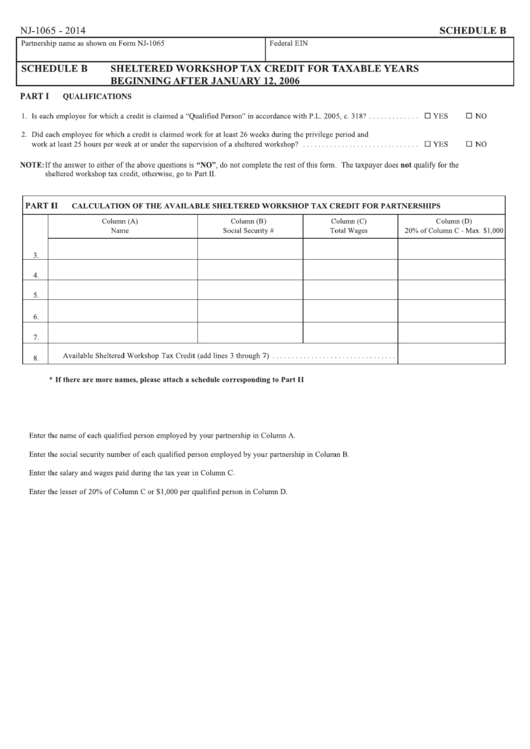

Fillable Form Nj1065 Schedule B Sheltered Tax Credit For

Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. However, you don’t need to attach a schedule b every year you earn interest or. Web what should a partnership report? To which payments does section 267a apply? Web entering form 1065, schedule b in.

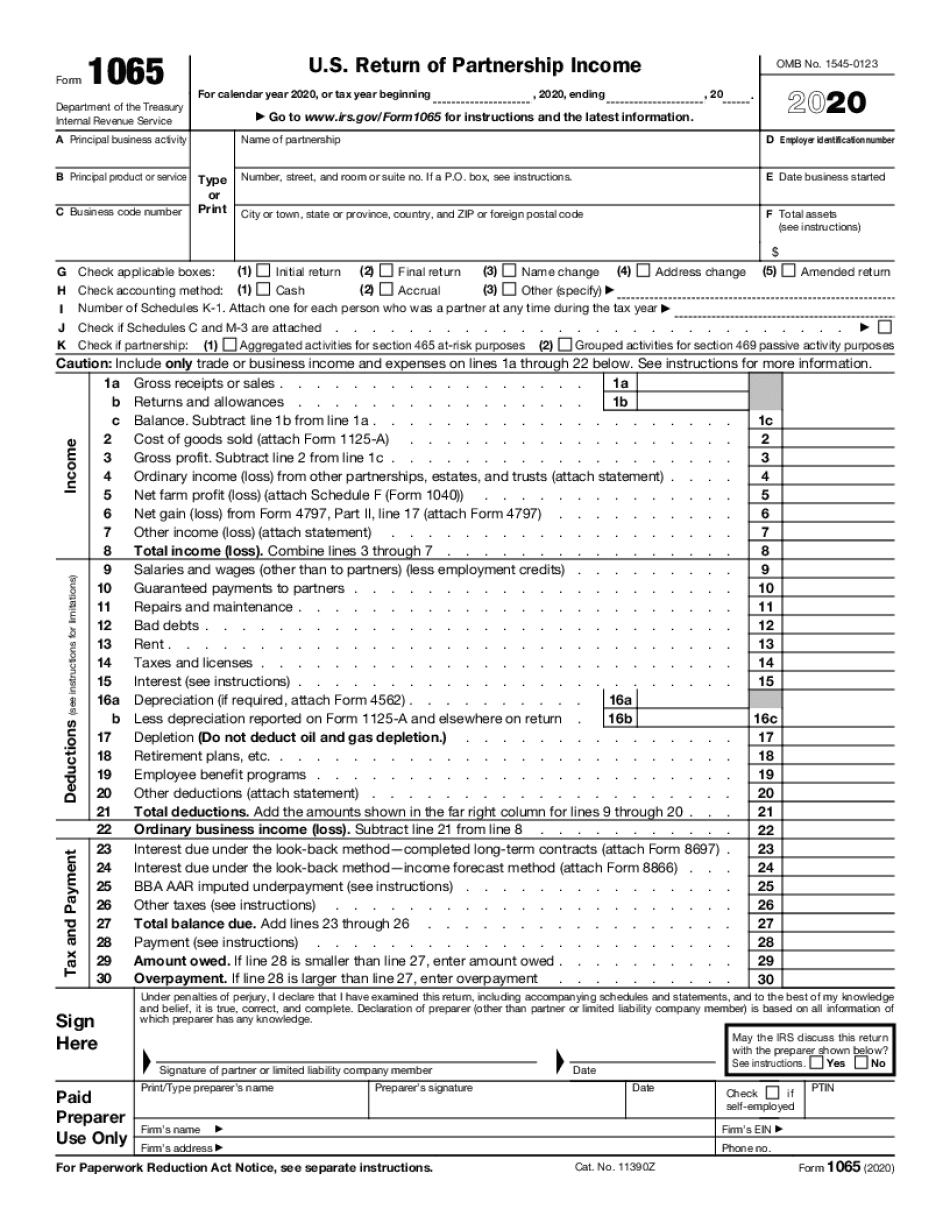

How to fill out an LLC 1065 IRS Tax form

Web input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries on. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). The schedule b screen in the 1065 package has been enhanced. Web.

Form 1065 Blank Sample to Fill out Online in PDF

Web schedule b reports the interest and dividend income you receive during the tax year. Web input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries on. To what extent is a. The new audit regime applies to all partnerships. To which partners.

How To Complete Form 1065 US Return of Partnership

Web input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries on. To which payments does section 267a apply? If yes, the partnership isn't. Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to.

Fill out Schedule B Form 1065 When to Answer Yes to Question 4 Are

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. The new audit regime applies to all partnerships. If yes, the partnership isn't. To what extent is a. The schedule b screen in the 1065 package has been enhanced.

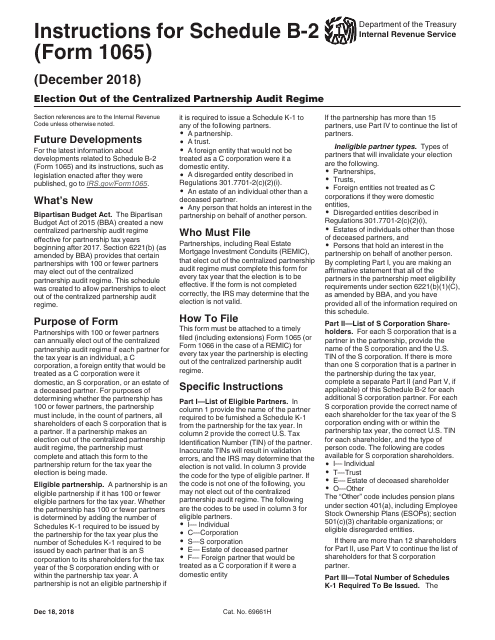

Download Instructions for IRS Form 1065 Schedule B2 Election out of

To what extent is a. Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule.

3.11.15 Return of Partnership Internal Revenue Service

To what extent is a. Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based. Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. To.

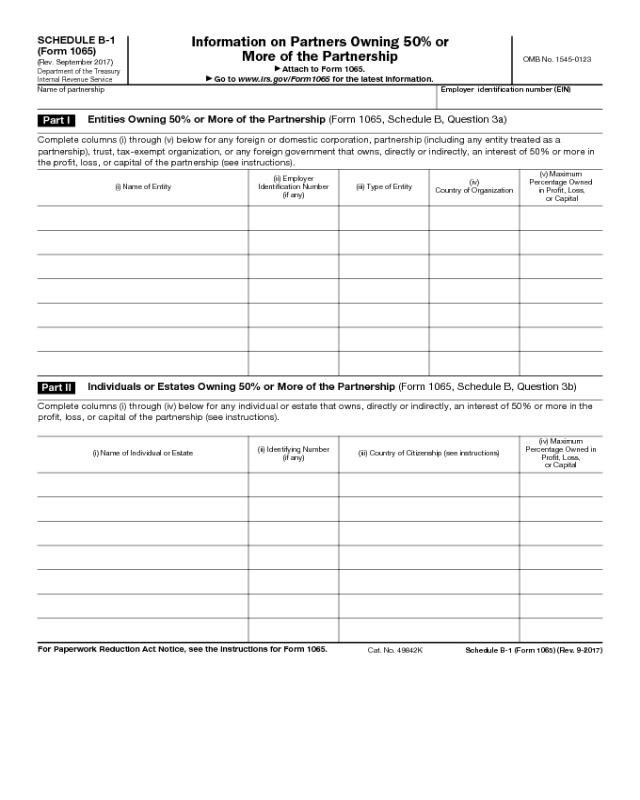

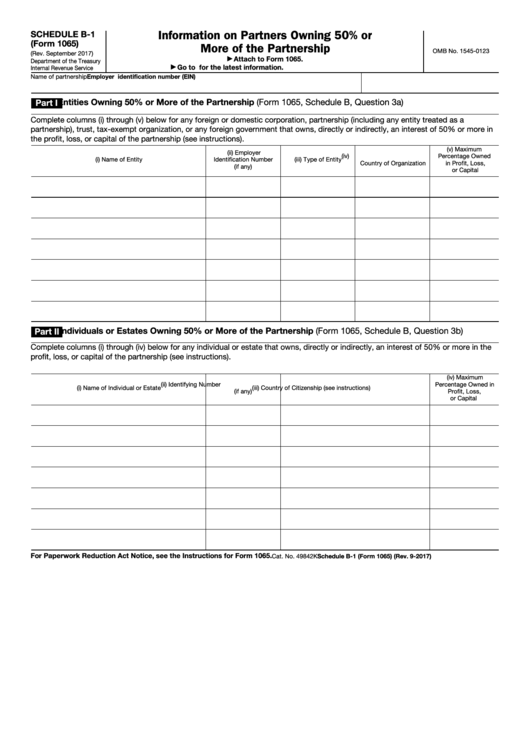

Form 1065 Schedule B1 Edit, Fill, Sign Online Handypdf

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. The schedule b screen in the 1065 package has been enhanced. The new audit regime applies to all partnerships. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). To which partners does section 267a.

Fillable Schedule B1 (Form 1065) Information On Partners Owning 50

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). To which payments does section 267a apply? Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions.

However, You Don’t Need To Attach A Schedule B Every Year You Earn Interest Or.

To what extent is a. Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. Web a 1065 form is the annual us tax return filed by partnerships. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

To Which Partners Does Section 267A Apply?

Web what should a partnership report? To which payments does section 267a apply? Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). Web input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries on.

Web To Meet The Requirements For Form 1065, Schedule B, Question 4, The Client Must Answer Yes To All Four Of The Following Conditions:

Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based. The new audit regime applies to all partnerships. Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. The schedule b screen in the 1065 package has been enhanced.

Web Schedule B Reports The Interest And Dividend Income You Receive During The Tax Year.

If yes, the partnership isn't.