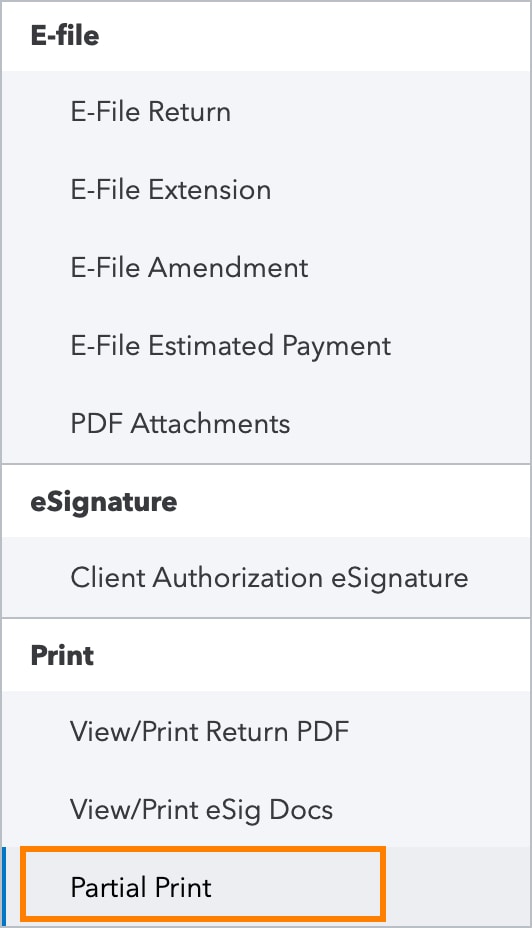

Schedule B Form 1116

Schedule B Form 1116 - Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Web there appears to be a change in line 10 for 2021 on irs form 1116. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with. 1116, schedules b and schedule c. Entire form 1116 may not be required. Form 1116 schedule b will be available on 03/31 and you can file your amended return. Form 1116, schedules b and schedule c are used by individuals (including nonresident aliens),. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. Previously, line 10 was labeled as follows: Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10.

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web there appears to be a change in line 10 for 2021 on irs form 1116. 1116, schedules b and schedule c. Form 1116 schedule b will be available on 03/31 and you can file your amended return. Although form 1116 sch b is not supported. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. Although form 1116 sch b is not. Web schedule b draft as of (form 1116) (rev.

Web schedule b draft as of (form 1116) (rev. 1116, schedules b and schedule c. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Taxpayers are therefore reporting running balances of. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. December 2022) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Web form 1116, foreign tax credit. Expat should learn to love, because it’s one of two ways americans working overseas can lower their u.s.

How to enter Form 1116 Schedule B in ProConnect (ref 56669)

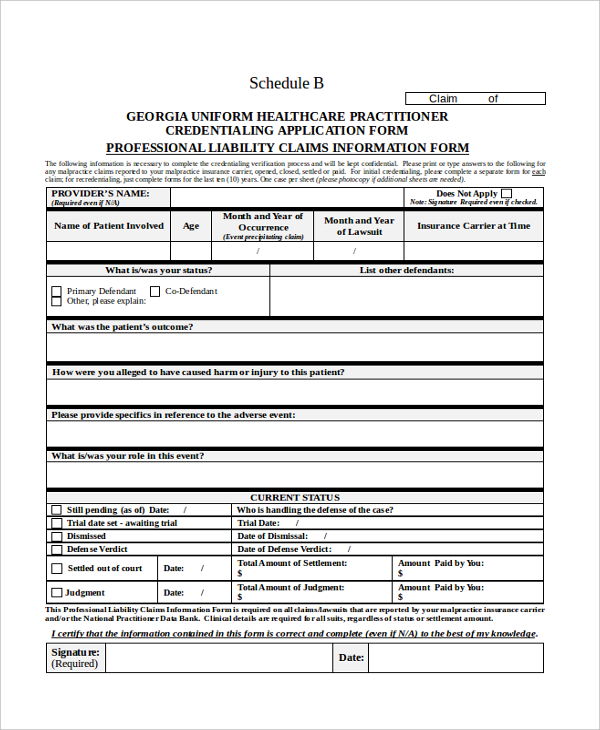

Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Although form 1116 sch b is not. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Form 1116, schedules b and.

U.S. Expatriates Can Claim Foreign Tax Credit Filing Form 1116

Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web these two new schedules are additions starting in tax year 2021. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Web schedule b draft as of (form 1116) (rev. Form 1116 schedule.

Form 1116Foreign Tax Credit

Entire form 1116 may not be required. Taxpayers are therefore reporting running balances of. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Web form 1116, foreign tax credit.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with. Web form 1116 is one tax form every u.s. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Taxpayers are therefore reporting running balances of. Form 1116, schedules b and schedule c are used by.

This will require Form 1116, Schedule B, which will be available in a

Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Entire form 1116 may not be required. Form 1116 sch.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Web form 1116 is one tax form every u.s. Taxpayers are therefore reporting running balances of. December 2022) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax.

2019 Form IRS 1040 Schedule B Fill Online, Printable, Fillable, Blank

Although form 1116 sch b is not supported. Web schedule b draft as of (form 1116) (rev. Form 1116, schedules b and schedule c are used by individuals (including nonresident aliens),. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. Web there appears to be a change in line 10 for 2021 on.

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Web form 1116, foreign tax credit. Web these two new schedules are additions starting in tax year 2021. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax.

How to File Schedule B for Form 941

Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Although form 1116 sch b is not supported. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your.

Publication 514 Foreign Tax Credit for Individuals; Simple Example

Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. Previously, line 10 was labeled as follows: Form 1116 schedule b will be available on 03/31.

Form 1116 Sch B, Foreign Tax Carryover Reconciliation Schedule Is Now Estimated To Be Ready For Print On 3/10.

Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now.

Previously, Line 10 Was Labeled As Follows:

Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Entire form 1116 may not be required. Taxpayers are therefore reporting running balances of.

Web Form 1116 Is One Tax Form Every U.s.

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. See schedule b (form 1116) and its. Form 1116, schedules b and schedule c are used by individuals (including nonresident aliens),. Web there appears to be a change in line 10 for 2021 on irs form 1116.

1116, Schedules B And Schedule C.

December 2022) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see. Web these two new schedules are additions starting in tax year 2021. Web schedule b draft as of (form 1116) (rev. Although form 1116 sch b is not.