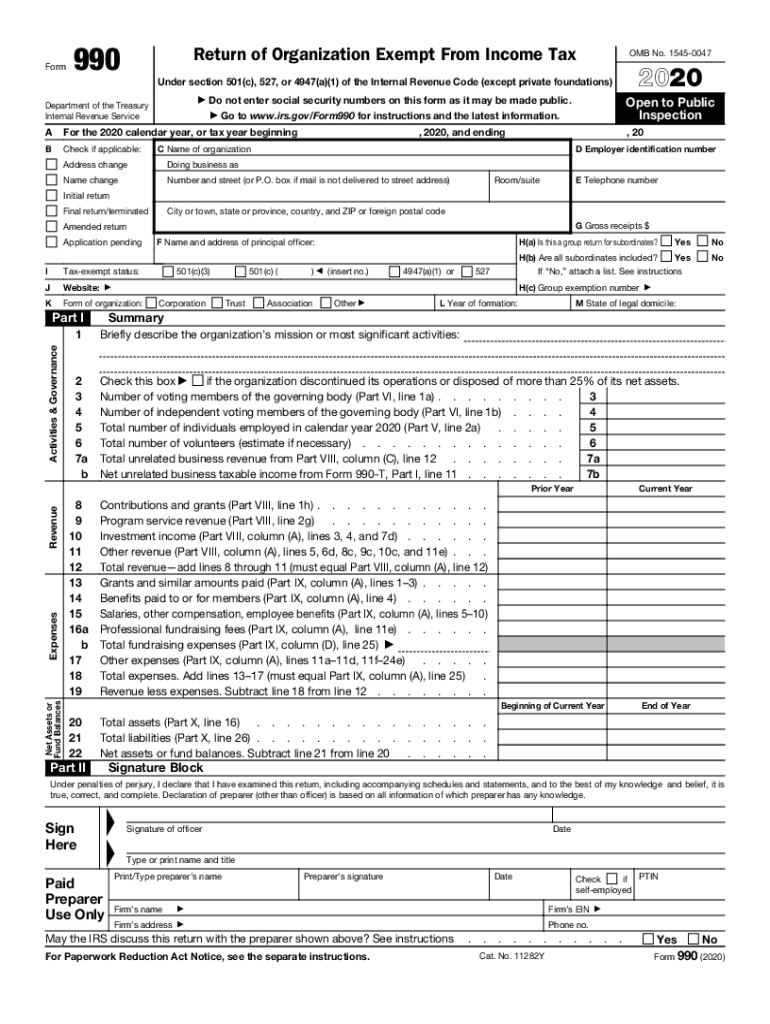

Schedule B Form 990

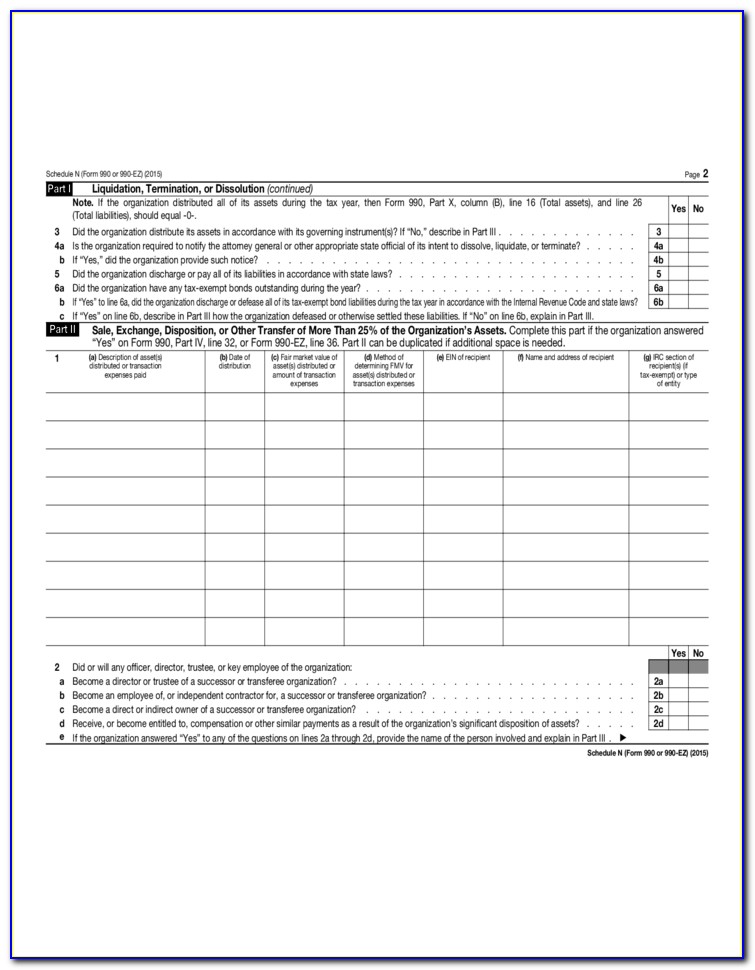

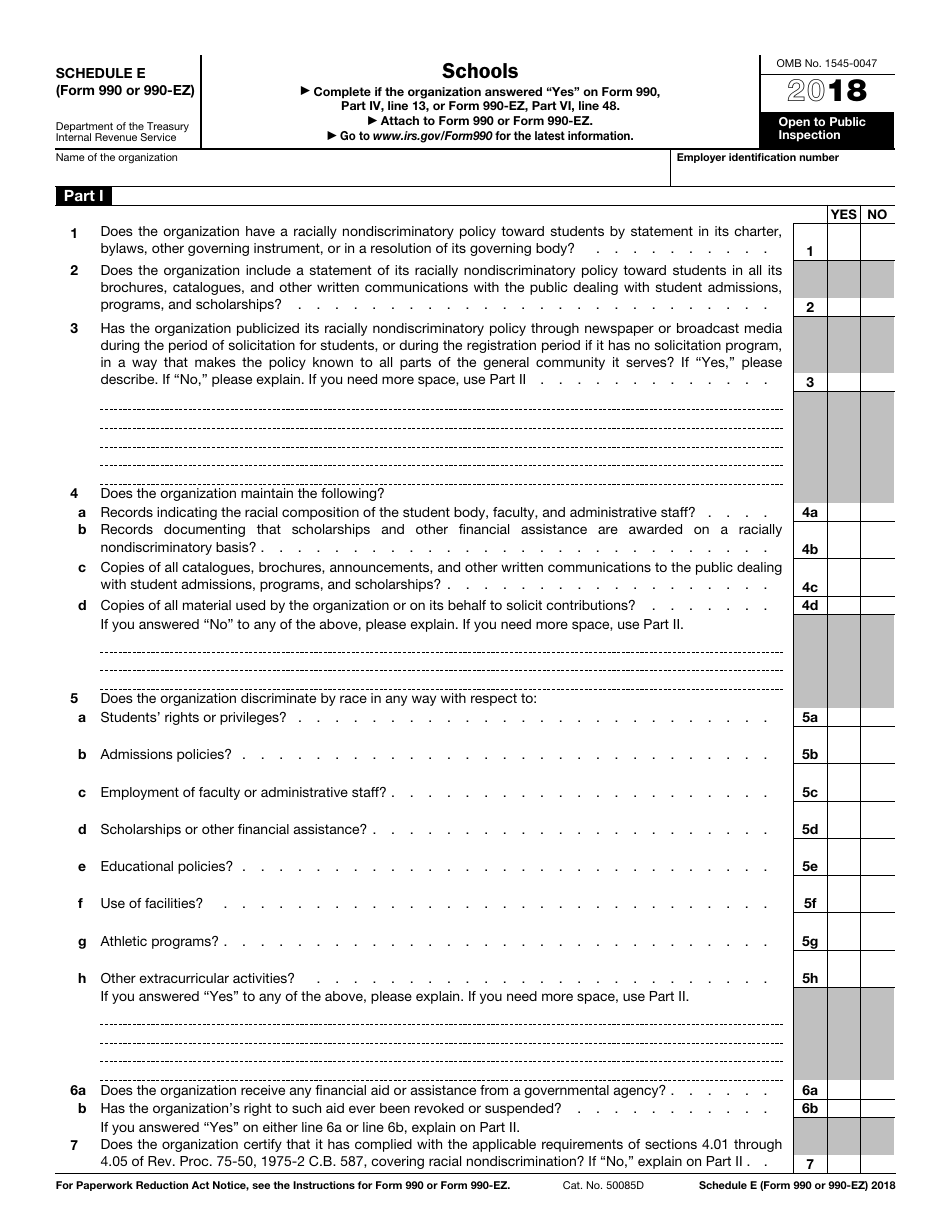

Schedule B Form 990 - This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule b donor. Ad download or email form 990 sb & more fillable forms, register and subscribe now! See the schedule b instructions to determine the requirements for filing. Web every private foundation must attach schedule b if a person contributes more than the greater of $5000 or 2% of $700,000 ($14,000) during the tax year. A nonprofit is required to file. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web the answer should be no, for now. Web wednesday, june 3, 2020. Web these differing state rules, which are likely to increase, are a trap for the unwary. On this page you may download the 990 series filings on record for 2021.

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Nonprofits active nationally (other than 501(c)(3) and 527 organizations) may well now have to. This schedule is designed to report information about. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Instructions for these schedules are. Ad download or email form 990 sb & more fillable forms, register and subscribe now! For other organizations that file. See the schedule b instructions to determine the requirements for filing. This provides the irs with a detailed. Web these differing state rules, which are likely to increase, are a trap for the unwary.

If the return is not. Go to www.irs.gov/form990 for the. For other organizations that file. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. (column (b) must equal form 990, part x, col. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one. This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule b donor. Web b c schedule c (form 990) 2022 for each yes response on lines 1a through 1i below, provide in part iv a detailed description of the lobbying activity. Web wednesday, june 3, 2020.

Form 990 (Schedule D) Supplemental Financial Statements (2015) Free

See the schedule b instructions to determine the requirements for filing. Web these differing state rules, which are likely to increase, are a trap for the unwary. Instructions for these schedules are. Web wednesday, june 3, 2020. Nonprofits active nationally (other than 501(c)(3) and 527 organizations) may well now have to.

2018 Form IRS 990 Schedule D Fill Online, Printable, Fillable, Blank

The download files are organized by month. Ad download or email form 990 sb & more fillable forms, register and subscribe now! Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. See the schedule b instructions to determine the requirements for filing. Web currently, charitable organizations are required to disclose the names of their major donors.

Form 990 Fill Out and Sign Printable PDF Template signNow

Instructions for these schedules are. A nonprofit is required to file. Nonprofits active nationally (other than 501(c)(3) and 527 organizations) may well now have to. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one. Web b c schedule c.

990 schedule b requirements

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web the answer should be no, for now. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

Web wednesday, june 3, 2020. Web these differing state rules, which are likely to increase, are a trap for the unwary. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. See the schedule b instructions to determine the requirements for filing. If the return is not.

Form 990 (Schedule D) Supplemental Financial Statements (2015) Free

Web b c schedule c (form 990) 2022 for each yes response on lines 1a through 1i below, provide in part iv a detailed description of the lobbying activity. Web currently, charitable organizations are required to disclose the names of their major donors to the irs on schedule b of their form 990. (column (b) must equal form 990, part.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. (column (b) must equal form 990, part x, col. Instructions for these schedules are. Web these differing state rules, which are likely to increase, are a trap for the unwary. Effective may 28, 2020, the internal revenue service (irs).

Irs Form 990 Ez 2015 Schedule O Form Resume Examples qQ5M9wJ5Xg

Web wednesday, june 3, 2020. Instructions for these schedules are. If the return is not. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one. This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule.

IRS Form 990 (990EZ) Schedule E Download Fillable PDF or Fill Online

Go to www.irs.gov/form990 for the. A nonprofit is required to file. This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule b donor. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web b c schedule c (form 990) 2022 for each yes response on.

IRS Form 990 Schedule B 2018 2019 Printable & Fillable Sample in PDF

Web b c schedule c (form 990) 2022 for each yes response on lines 1a through 1i below, provide in part iv a detailed description of the lobbying activity. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor disclosure. This schedule is designed to report information about. For other organizations that file. This provides.

Go To Www.irs.gov/Form990 For The.

For other organizations that file. Web currently, charitable organizations are required to disclose the names of their major donors to the irs on schedule b of their form 990. This provides the irs with a detailed. Ad download or email form 990 sb & more fillable forms, register and subscribe now!

Web Schedule B Is Used By Nonprofit Organizations To Report Details Regarding The Contributions They Received During The Corresponding Tax Year.

Instructions for these schedules are. The download files are organized by month. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor disclosure. See the schedule b instructions to determine the requirements for filing.

This Past Summer, The Supreme Court Invalidated California’s Requirement To Include Unredacted Form 990, Schedule B Donor.

A nonprofit is required to file. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web the answer should be no, for now. Web every private foundation must attach schedule b if a person contributes more than the greater of $5000 or 2% of $700,000 ($14,000) during the tax year.

Web These Differing State Rules, Which Are Likely To Increase, Are A Trap For The Unwary.

Web wednesday, june 3, 2020. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. If the return is not.