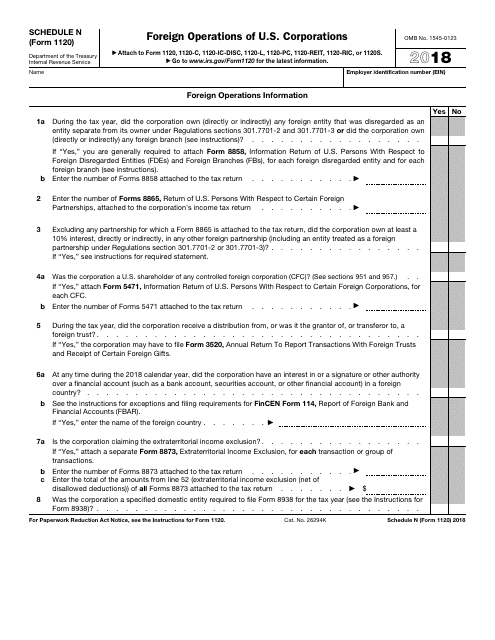

Schedule N Form 1120

Schedule N Form 1120 - Section references are to the internal revenue code unless otherwise noted. Web more about the federal 1120 (schedule n) corporate income tax ty 2022. Schedule n is required for. Web form 1120 (schedule n) a form that a corporation files with the irs reporting information on any activities it conducts outside the united states. Web schedule n (form 1120) department of the treasury internal revenue service. We last updated the foreign operations of u.s. Web schedule n (form 1120) department of the treasury internal revenue service foreign operations of u.s. Complete, edit or print tax forms instantly. Web form 1120 (schedule n) easily fill out and sign forms download blank or editable online Corporation operates in a foreign country, it is also required to file schedule n with the form 1120.

Web schedule n (form 1120) 2020. Web more about the federal 1120 (schedule n) corporate income tax ty 2022. Ad access irs tax forms. Schedule n is required for. Web if a u.s. Web form 1120 (schedule n) a form that a corporation files with the irs reporting information on any activities it conducts outside the united states. Web schedule n (form 1120) department of the treasury internal revenue service foreign operations of u.s. Corporations that, at any time during the tax. Schedule n is required for. Component members of a controlled group must use.

Corporations that, at any time. Web schedule n (form 1120) 2020. Corporations in december 2022, so this is. Corporations that, at any time during the tax. Web form 1120 (schedule n) easily fill out and sign forms download blank or editable online What is the form used for? Web more about the federal 1120 (schedule n) corporate income tax ty 2022. Web schedule n (form 1120) department of the treasury internal revenue service foreign operations of u.s. Web schedule n (form 1120) department of the treasury internal revenue service. Web if a u.s.

IRS Form 1120 Schedule N Download Fillable PDF or Fill Online Foreign

Web form 1120 (schedule n) easily fill out and sign forms download blank or editable online Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web schedule n (form 1120) department of the treasury internal revenue service. Corporations that, at any time. In this video, i discuss schedule n and the various.

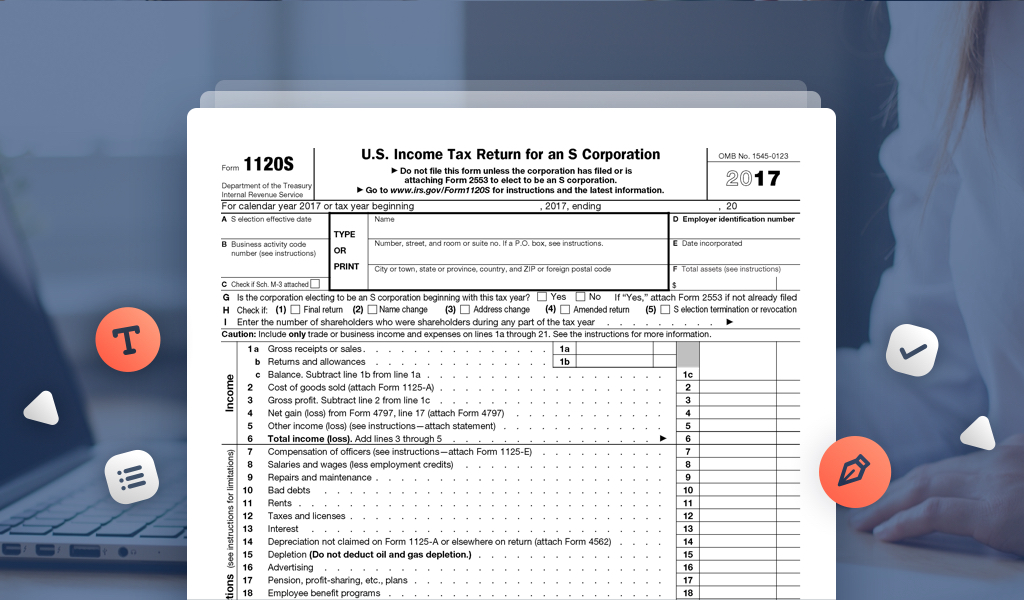

2016 Form 1120 S (Schedule K1) Edit, Fill, Sign Online Handypdf

Web form 1120 (schedule n) a form that a corporation files with the irs reporting information on any activities it conducts outside the united states. Web schedule n (form 1120) department of the treasury internal revenue service foreign operations of u.s. Web schedule n (form 1120) department of the treasury internal revenue service foreign operations of u.s. Corporations that, at.

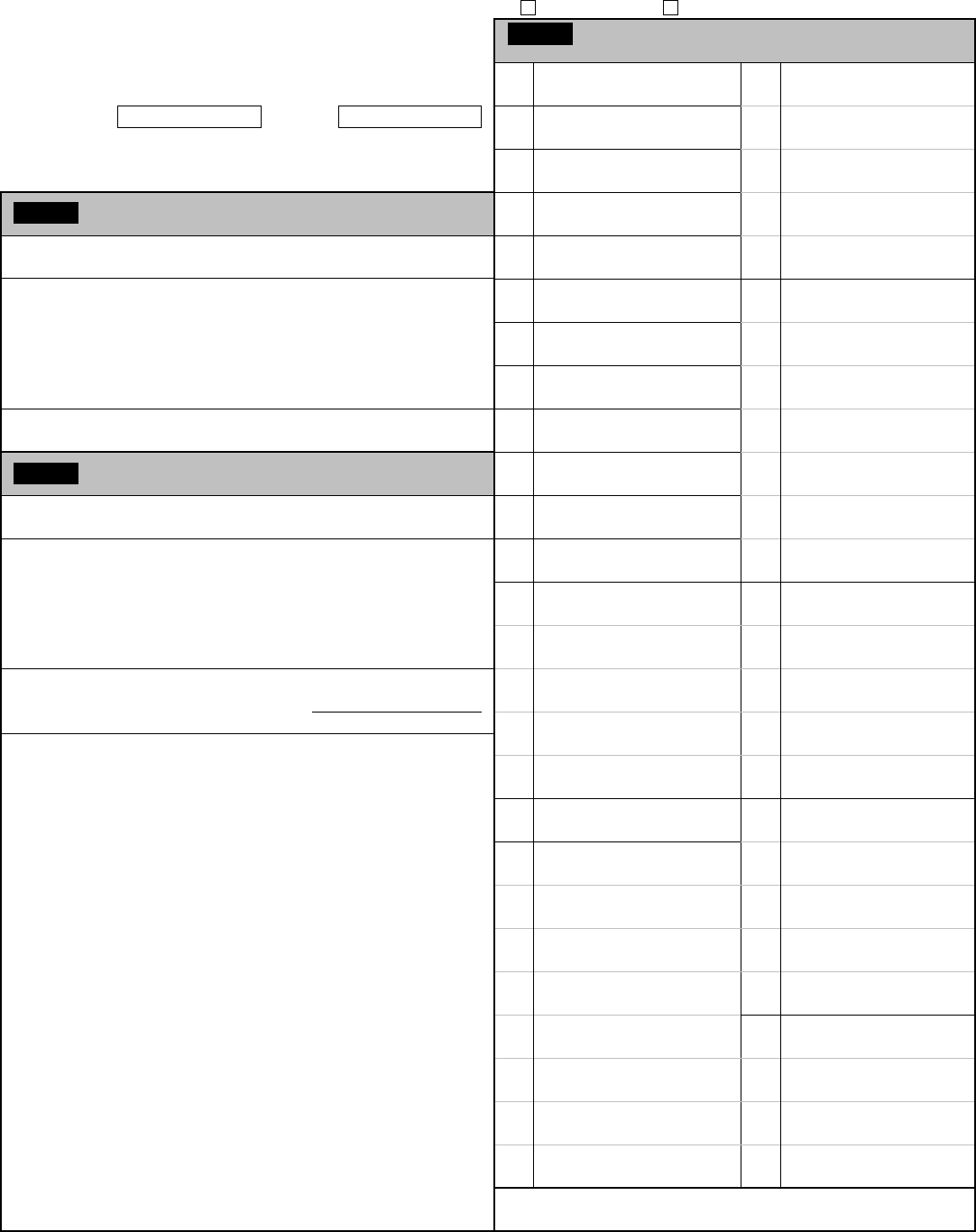

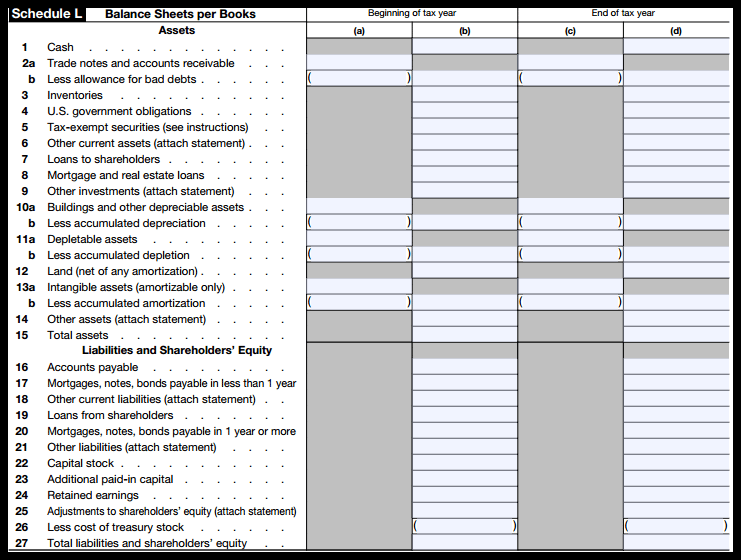

Form 1120 Template With Only Page 1, Page 2 (Sched...

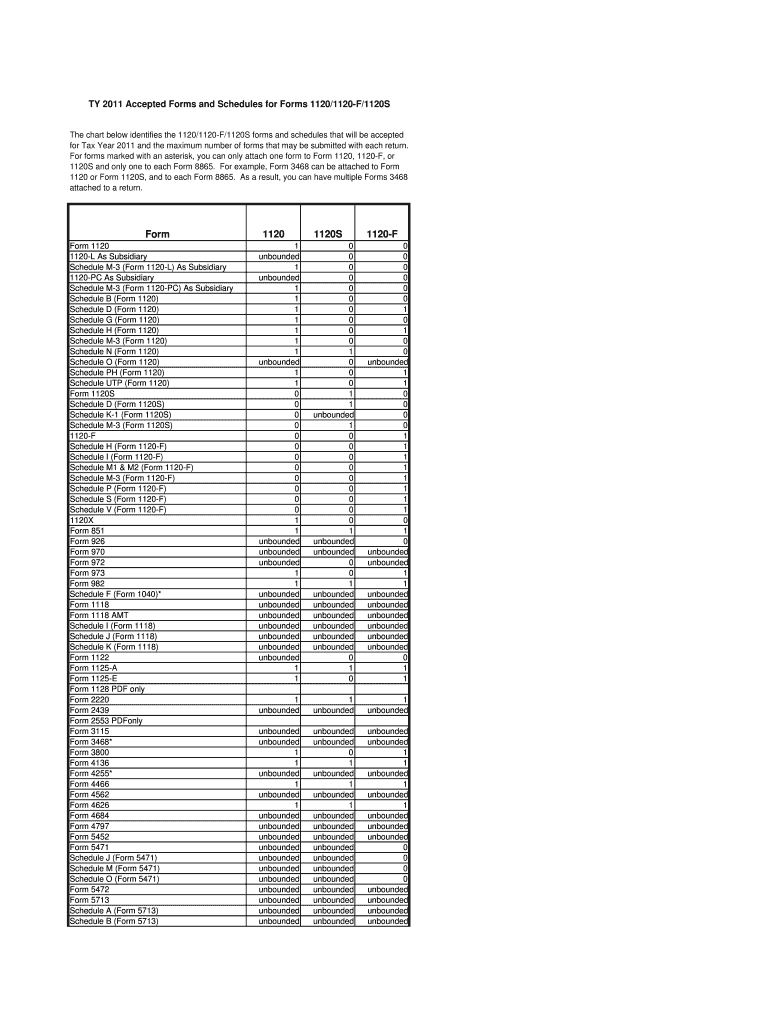

Web schedule n (form 1120) department of the treasury internal revenue service foreign operations of u.s. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! See form limitations for 1120 electronic filing for a list of form limitations that apply to 1120 electronic returns. We last updated the foreign operations of u.s. Ad access irs.

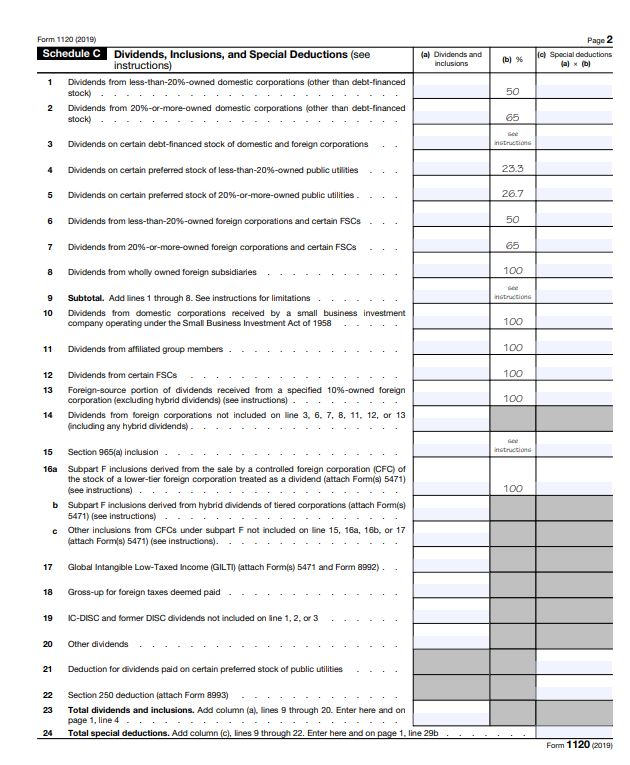

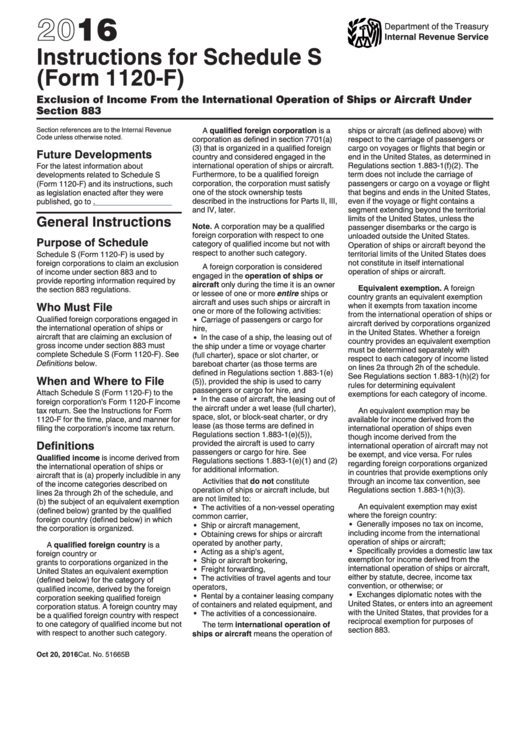

Instructions For Schedule S (Form 1120F) 2011 printable pdf download

See form limitations for 1120 electronic filing for a list of form limitations that apply to 1120 electronic returns. Web form 1120 (schedule n) a form that a corporation files with the irs reporting information on any activities it conducts outside the united states. Component members of a controlled group must use. What is the form used for? Web form.

Form 1120 Line 26 Other Deductions Worksheet Fill Out and Sign

Corporations that, at any time during the tax. Schedule n is required for. Web if a u.s. Schedule n is required for. Component members of a controlled group must use.

Don’t Miss the Deadline for Reporting Your Shareholding with

Web form 1120 (schedule n) a form that a corporation files with the irs reporting information on any activities it conducts outside the united states. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. Component members of a controlled group must use. Corporation operates in a foreign country, it is also required.

Form 1120 (Schedule N) Foreign Operations of U.S. Corporations (2014

Ad easy guidance & tools for c corporation tax returns. Corporations in december 2022, so this is. Schedule n is required for. Web schedule n (form 1120), foreign operations of u.s. Section references are to the internal revenue code unless otherwise noted.

Instructions For Schedule S (form 1120f) 2016 printable pdf download

Web schedule n (form 1120) department of the treasury internal revenue service foreign operations of u.s. Corporations that, at any time. What is the form used for? Ad access irs tax forms. Complete, edit or print tax forms instantly.

Editable IRS Form 1120 (Schedule M3) 2018 2019 Create A Digital

Corporation operates in a foreign country, it is also required to file schedule n with the form 1120. Complete, edit or print tax forms instantly. We last updated the foreign operations of u.s. Schedule n is required for. Web if a u.s.

IRS Form 1120S Definition, Download & Filing Instructions

See form limitations for 1120 electronic filing for a list of form limitations that apply to 1120 electronic returns. Ad access irs tax forms. We last updated the foreign operations of u.s. Corporations in december 2022, so this is. Complete, edit or print tax forms instantly.

Web Schedule N (Form 1120) Department Of The Treasury Internal Revenue Service Foreign Operations Of U.s.

What is the form used for? Web schedule n (form 1120) department of the treasury internal revenue service foreign operations of u.s. Web form 1120 (schedule n) easily fill out and sign forms download blank or editable online We last updated the foreign operations of u.s.

Web Form 1120 (Schedule N) A Form That A Corporation Files With The Irs Reporting Information On Any Activities It Conducts Outside The United States.

Web more about the federal 1120 (schedule n) corporate income tax ty 2022. Schedule n is required for. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Schedule n is required for.

Web Complete And Attach Schedule O (Form 1120), Consent Plan And Apportionment Schedule For A Controlled Group.

Ad access irs tax forms. See form limitations for 1120 electronic filing for a list of form limitations that apply to 1120 electronic returns. Corporations corporations may have to file this schedule if, at any time during the tax year, they had assets in or operated a. Web schedule n (form 1120), foreign operations of u.s.

Web Form 1120 (Schedule N) A Form That A Corporation Files With The Irs Reporting Information On Any Activities It Conducts Outside The United States.

Web schedule n (form 1120) 2020. Component members of a controlled group must use. Corporations that, at any time during the tax. Web schedule n (form 1120) department of the treasury internal revenue service.