Schedule O Form 990 Ez 2020

Schedule O Form 990 Ez 2020 - Web change on schedule o. Public charity status and public support. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Download or email irs 990ez & more fillable forms, register and subscribe now! At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. A schedule or part will be automatically added to your return depending on your answers to questions. See instructions 34 v 35a old the organization have unrelated business gross income of $1,000 or more during the year from business activities. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.

At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Get ready for tax season deadlines by completing any required tax forms today. Download or email irs 990ez & more fillable forms, register and subscribe now! Instructions for these schedules are. See instructions 34 v 35a old the organization have unrelated business gross income of $1,000 or more during the year from business activities. Ad access irs tax forms. Web we last updated federal 990 (schedule o) in december 2022 from the federal internal revenue service. Ad download or email irs 990ez & more fillable forms, try for free now! At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.

Ad download or email irs 990ez & more fillable forms, try for free now! Web change on schedule o. Public charity status and public support. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. See instructions 34 v 35a old the organization have unrelated business gross income of $1,000 or more during the year from business activities. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Instructions for these schedules are. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. This form is for income earned in tax year 2022, with tax returns due. Web we last updated federal 990 (schedule o) in december 2022 from the federal internal revenue service.

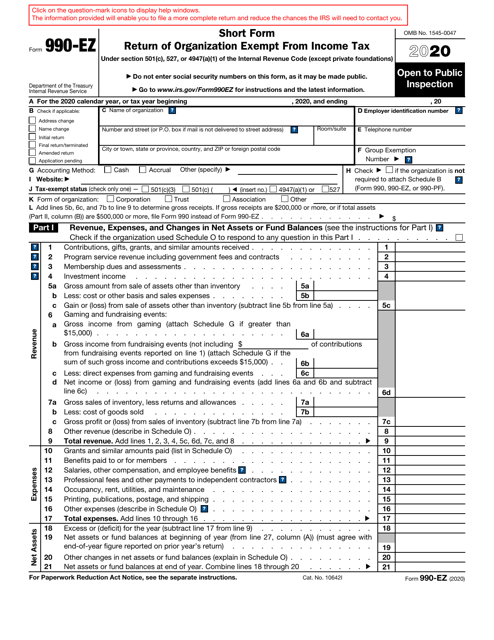

Fill Free fillable Form 2020 990EZ Short Form Return of

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 990ez & more fillable forms,.

IRS Form 990EZ Download Fillable PDF or Fill Online Short Form Return

Complete, edit or print tax forms instantly. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Download or email irs 990ez & more fillable forms, register and subscribe now! A schedule or part will be automatically added to your return depending on your answers to questions. This form is for income.

How To Fill Out Form 990 Ez 2020 Blank Sample to Fill out Online in PDF

At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Get ready for tax season deadlines by completing any required tax forms today. Public charity status and public support. Short form return of organization exempt from income tax. See instructions 34 v 35a old the organization have unrelated business gross income of.

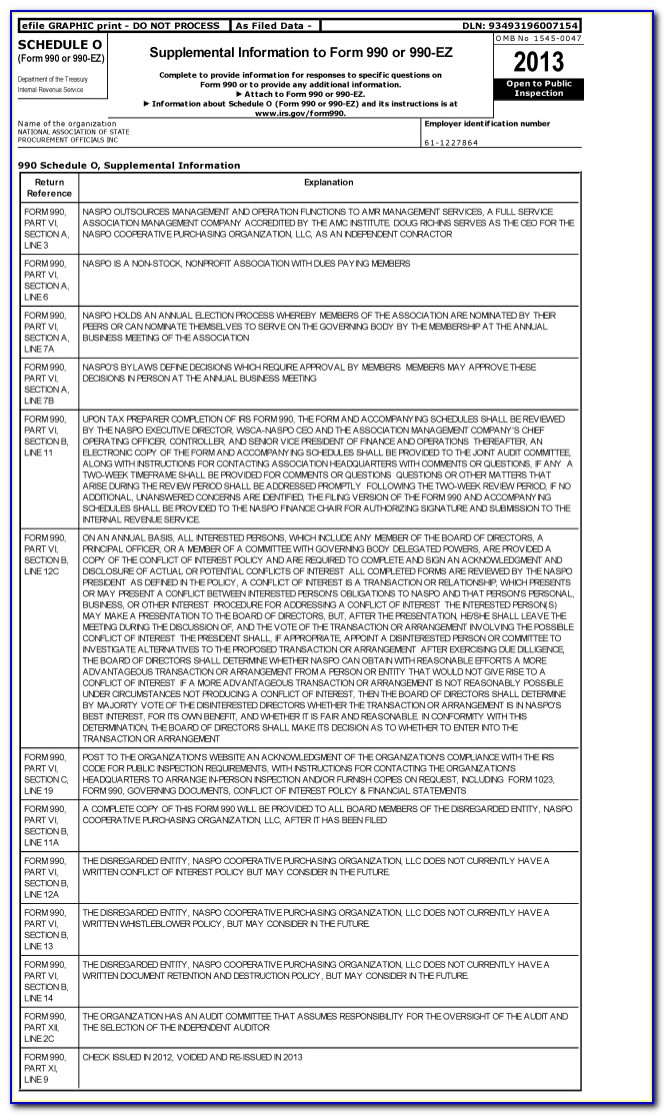

2018 Form IRS 990 Schedule O Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2022, with tax returns due. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Public charity status and public support. Short form return of organization exempt from income tax. Download or email irs 990ez & more fillable forms, register and subscribe now!

Form 990 Schedule O Edit, Fill, Sign Online Handypdf

Ad access irs tax forms. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19..

Form 990 Ez 2013 Schedule O Form Resume Examples B8DVlAnOmb

Organizations that file form 990 or form 990. Ad access irs tax forms. Web change on schedule o. Download or email irs 990ez & more fillable forms, register and subscribe now! At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.

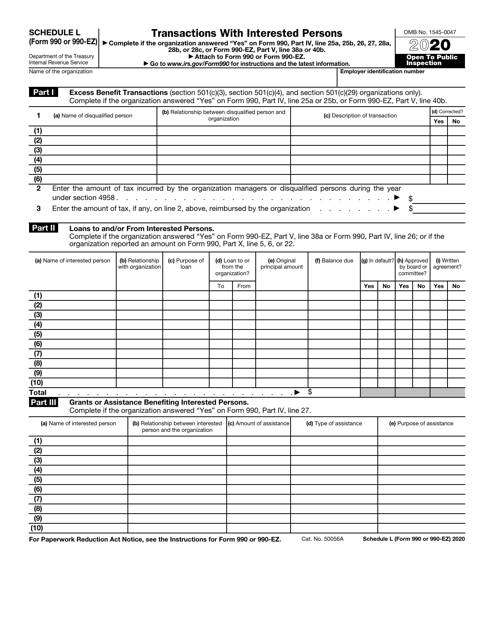

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Download or email irs 990ez & more fillable forms, register and subscribe now! Ad download or email irs 990ez & more fillable forms, try for free now! Web we last updated federal 990 (schedule o) in december 2022 from the federal internal revenue service. A schedule or part will be automatically added to your return depending on your answers to.

Schedule F Form 990 instructions Fill online, Printable, Fillable Blank

Download or email irs 990ez & more fillable forms, register and subscribe now! See instructions 34 v 35a old the organization have unrelated business gross income of $1,000 or more during the year from business activities. Get ready for tax season deadlines by completing any required tax forms today. A schedule or part will be automatically added to your return.

990 ez Fill Online, Printable, Fillable Blank form990or990ez

Ad access irs tax forms. This form is for income earned in tax year 2022, with tax returns due. Download or email irs 990ez & more fillable forms, register and subscribe now! Web we last updated federal 990 (schedule o) in december 2022 from the federal internal revenue service. Complete, edit or print tax forms instantly.

Form990 (20192020) by OutreachWorks Issuu

A schedule or part will be automatically added to your return depending on your answers to questions. Complete, edit or print tax forms instantly. Download or email irs 990ez & more fillable forms, register and subscribe now! Ad download or email irs 990ez & more fillable forms, try for free now! See instructions 34 v 35a old the organization have.

At A Minimum, The Schedule Must Be Used To Answer Form 990, Part Vi, Lines 11B And 19.

Download or email irs 990ez & more fillable forms, register and subscribe now! At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Organizations that file form 990 or form 990. Public charity status and public support.

Web The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

Web we last updated federal 990 (schedule o) in december 2022 from the federal internal revenue service. Web change on schedule o. Get ready for tax season deadlines by completing any required tax forms today. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due.

Ad access irs tax forms. Complete, edit or print tax forms instantly. Short form return of organization exempt from income tax. See instructions 34 v 35a old the organization have unrelated business gross income of $1,000 or more during the year from business activities.

A Schedule Or Part Will Be Automatically Added To Your Return Depending On Your Answers To Questions.

Instructions for these schedules are. Ad download or email irs 990ez & more fillable forms, try for free now!